With Congressional COVID-19 relief negotiations at a stand-still, a bipartisan group of Senators has prepared a $908 billion package of its own. As the Washington Post reports:

Among those involved in the latest effort include Democratic Sens. Manchin, Jeanne Shaheen (N.H.), Maggie Hassan (N.H.) and Mark R. Warner (Va.), as well as Angus King (I-Maine), who caucuses with Democrats. Sen. Richard J. Durbin (D-Ill.), the second-ranking Democrat in the Senate, has also been involved in the discussions but won’t appear at a news conference later Tuesday unveiling the plan. Among the Republicans involved are Sens. Lisa Murkowski (Alaska) and Bill Cassidy (La.), in addition to Romney and Collins.

The proposal includes $240 billion in funding for state and local governments, a renewal of the enhanced Unemployment Insurance benefits at $300 per week, a $300 billion extension of small business relief through the Paycheck Protection Program, and money for vaccine distribution and contact tracing.

Conspicuously absent, however, is any mention of a 2nd round of stimulus checks. Stimulus payments were likely excluded from the package to keep costs down. Fortunately, there are cheaper and better-targeted options on the table. Relief payments to households with children would be particularly valuable, given the unique costs and challenges facing families amid the pandemic — challenges that will have both short and long-term repercussions for the U.S. economy as a whole.

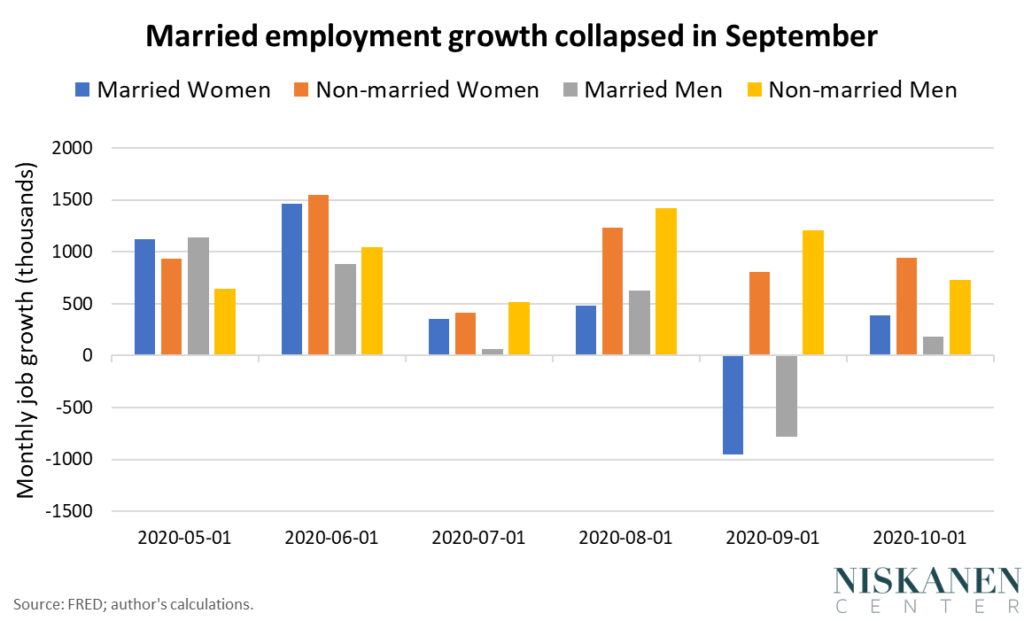

In the short-run, childcare and school closures have straddled families with the Herculean burden of working while being a full-time parent — if parents are able to work at all. Indeed, the beginning of the school year coincided not only with a slowing labor market recovery, but with dramatic job losses among married men and women (a proxy for households with children). At nearly one million lost jobs in September alone, mothers have clearly faced the brunt of school closures, sacrificing their career and income to act as “child care provider of last resort.”

The long-run effects of school and childcare closures on families and children aren’t yet known, but have the potential to be devastating. School-age kids in lower-income households already show signs of falling behind academically, with direct implications for their earnings as adults. Household instability and income volatility, meanwhile, can themselves contribute to domestic strife and even divorce.

Direct payments to households with children would help lean against these forces, while providing parents with flexible resources to acquire childcare in whichever way works best for them. The HEROES Act proposed to do just that, by making the Child Tax Credit fully refundable with a maximum credit of $3,600 for each child under 6, and $3,000 for each child ages 6 to 17. According to the Joint Committee on Taxation, this expansion would cost just under $109 billion in fiscal year 2021 — just above one-third of the cost of the payments within the CARES Act. It would also cut child poverty by at least 40 percent.

If that proves too expensive, Congress could instead simply make the existing $2,000 Child Tax Credit fully refundable, while directing the IRS to advance the refunds to parents as quickly as possible. According to the Tax Policy Center, full refundability by itself would lower the cost to only $24 billion, while efficiently targeting the poorest quintile of families. This idea was even endorsed over the summer by a group of leading conservative intellectuals.

An even cheaper (though not mutually exclusive) option would be adding a “look-back” provision to give taxpayers the option to use their earnings from 2019 when determining their CTC and EITC refund for tax year 2020, as the Center on Budget has proposed. Given the hit family incomes have taken over the past year, this should be a no-brainer.

Whichever option Congress goes with, the next relief package — if we get one at all — must make support for families and children a top priority. Failure to do so may seem like it saves some money in the short-run, but only by making families pay dearly now and into the future.