Yesterday was the 20th anniversary of welfare reform, a law that profoundly changed the nature of public assistance in America. While its liberal critics worst predictions may not have come true, the reform’s legacy has nonetheless diminished after decades of careful study. There are even good reasons for conservatives to feel ambivalent.

On the one hand, welfare reform eliminated an entitlement (AFDC) and replaced it with TANF, a block grant to states that added work requirements to cash welfare and caused caseloads to plummet. It represented an unprecedented entitlement reform, and forever endeared the reform to fiscal conservatives.

On the other hand, the reform’s work and asset requirements created perverse incentives that locked-in rather than cured dependency. Its block grant structure, an apparent win for fiscal federalists, was quickly turned into a state slush fund. And in hindsight, the reform appears to have contributed to a steep rise in deep poverty among single mothers and their children.

In other words, welfare reform may have been a political success, but TANF remains a fundamentally flawed program on conservative’s own terms. Here are three reasons conservatives should give the reform a second thought.

Work Requirements Didn’t Work

There’s an older adage: the best anti-poverty program is a good job. Conservatives go a step further and see work as inherently virtuous, a source of fulfillment and self-reliance. That may all be true in principle—however, work requirements have worked much differently in practice.

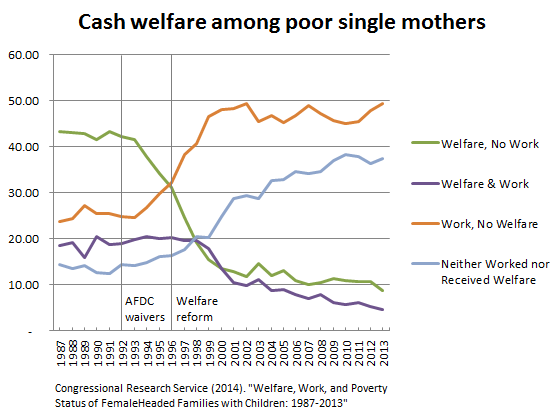

It’s true that in the early years TANF did push many AFDC recipients into work. But focusing on single mothers (a core demographic within AFDC), all of the improvements were over by 2000. As time limits ran out and recipients were kicked off the rolls, the number of single mothers with neither work nor welfare climbed steadily.

Many single mothers lost welfare but did not find work.

Among the recipients made to work, TANF work requirements limits job search to six weeks in a twelve-month period, and discourages vocational training. Thus rather than being a tool for climbing out of poverty, TANF recipients tend to take the first job they encounter. These tend to be low paying, low skill jobs with little opportunity for advancement, and which don’t pay enough to move the individual out of eligibility for low-income entitlement.

Under TANF, for example, a single adult parent with a child under six is barred from counting attendance in a GED program toward their 20 hours of average weekly work. In general, TANF caps vocation training at twelve months over a lifetime. Conservatives have rightfully opposed occupational licensing for creating artificial barriers to employment, but as long as they exist, they necessitate greater provisions for job skills training.

Block Grants Are Pseudo-Federalism

Block grants provide states maximum flexibility to spend federal dollars where they need them most. But in practice the rules and conditions designed to keep TANF funds focused on pulling the poor into work have failed miserably, and have instead been gamed by savvy governors to fill budget holes in areas with nothing to do with workfare or poverty reduction.

The block grant structure has also compromised work requirements. In theory, they are enforced through a work participation threshold that requires states to engage at least 50% of their welfare recipients in a work activity. However, states can earn credits toward meeting the threshold by reducing caseloads outright, and by counting recipients in unsubsidized work (that is, people who are already working). These gimmicks effectively allow states to reduce their required work participation rate to 0, meaning TANF work requirements—broken in and of themselves—don’t even apply to much of the country.

The conservative ideal of federalism is noble, driven by the belief in the states as fifty laboratories of democracy. But block grants are not necessarily the best means to that end. Indeed, the workfare ideas that led up to the 1996 welfare reform emerged out of state policy experiments conducted under the highly successful AFDC waiver programs, that allowed states freedom to experiment while retaining rigorous evaluation and performance standards. Those evaluations baked “evidence based policy” directly into policy, and proved essential for tracking outcomes to spur states to compete along the desired dimensions.

Waivers tend to be narrow, but can be broadened given thoughtful design. Rhode Island, for example, accepted budget caps in exchange for a “global waiver” on a host of federal Medicaid rules and reporting requirements in order to restructure its program. Finding the right balance is hard, but as TANF shows, without outcome-based performance measures and carefully worded rules, block grants run the risk of merely creating fifty laboratories of rent seeking.

Asset Limits Warp Markets, Undermine Prudence

Asset limits have a reasonable enough purpose. Someone who is “property rich but cash poor,” say, probably shouldn’t qualify for cash assistance when they could secure a loan or sell their house. And yet most Americans have less than $1,000 in savings, so asset verification turns out to be more like searching for a needle in a haystack. Under TANF states are allowed to waive asset tests and so far eight have. The rest have limits that average between $2,000-$3,000, excluding a vehicle. This is incredibly meager.

That wouldn’t be a problem if asset limits were benign. Unfortunately, they create a perverse set of incentives that encourage poor household to “spend down” their limited savings when it’s exceeded by the present value of welfare payments, or dissuade them from accruing savings in the first place. This is the opposite of what a conservative welfare policy should be doing: namely setting the poor up with bank accounts and teaching them the virtue of prudence.

Consider this: When economist Lyman Stone dug into why coal workers in declining regions of Appalachia haven’t moved to find work, he realized Kentucky coal country contained 27 of the 71 counties where cash benefits exceed 40% of individual income. As he notes,

“Programs that discourage saving by stringently asset-testing benefits or by prohibiting hoarding (such as TANF or SNAP) trap beneficiaries in place, because migration has steep fixed costs in the form of transportation costs, lease deposits, and income to cover time spent looking for work.

There are obviously many factors that go into a household’s decision to move. Asset tests which would deny half the income of a family should they attempt to save enough to move to economic opportunity doesn’t have to be one of them.

Conclusion

In 2006, Robert Rector of The Heritage Foundation, a key conservative author of the 1996 reform, wrote: “It isn’t enough to get the technical details of a policy right. Words and symbols matter, too.”

But as conservative welfare scholar Peter Germanis noted in response, “failure to pay attention to ‘words’ and ‘details’” has transformed TANF from a bi-partisan symbol of the importance of work into a partisan symbol of policy carelessness. Conservatives can do better.

Indeed, welfare reform—TANF—is a failed policy even on conservative’s own terms:

- It gutted effective work requirements, and where they do bind, do so in a way that penalizes acquiring the skills needed for self-sufficiency.

- Block granting up-ending a more authentic waiver-based form of competitive federalism, creating new opportunities for wasteful spending.

- And asset tests have harmed geographic mobility while undermining the conservative virtue of prudence.

And this is without stressing its more fundamental failure of not reducing poverty. Going forward, conservative policy makers must think carefully about the details of TANF’s design. Here are some goals to keep in mind:

- Welfare programs that encourage work should take better account of job availability.

- Training and education provisions under TANF should be broadened.

- States should be made to target funds on the truly poor.

- And asset limits should be relaxed to encourage saving and mobility.