The latest news from the Intergovernmental Panel on Climate Change is not encouraging. A recent release of documents gives a preview of its forthcoming Sixth Assessment Report on the state of the global climate. Among the items released are a summary for policymakers based on the findings of a working group on the physical-science basis of climate change and a draft version of more detailed scientific analyses.

The findings include estimates of carbon budgets – the additional cumulative emissions that can be allowed until warming reaches specified temperature thresholds above the preindustrial global average. The estimate likely to get the most attention is that keeping emissions within 500 billion tons (500 Gt) of CO2, or the equivalent in other greenhouse gasses, would give a 50-50 chance of staying at or below the 1.5o C threshold relative to preindustrial temperatures (p. SPM-38, Table SPM-2). That 500 Gt is less than 15 years’ worth of emissions at current rates.

Although estimates such as those given by the IPCC are stated probabilistically, they serve as cautionary benchmarks. If worrisome outcomes are to be avoided, net emissions of CO2 and other greenhouse gasses would have to cease entirely before the critical carbon budget is exceeded. The goal of achieving net-zero emissions goes by the name of deep decarbonization.

Carbon pricing can play an important role in achieving deep decarbonization. Although critics have often dismissed carbon pricing as having only incremental impacts on emissions, this commentary challenges that view. However, doing so will require carbon taxes or emissions trading to be implemented in radically different forms than policies that have been enacted to date.

Conventional carbon pricing and its critics

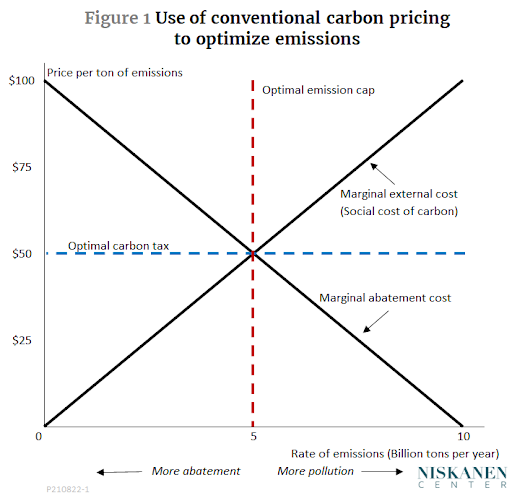

The idea that making polluters pay for the harm they cause will result in less harm is far from new. It goes back at least 100 years to the pioneering work on negative externalities of Arthur Cecil Pigou. Textbook explanations of the use of prices to control pollution typically begin with some variant of a diagram like Figure 1:

In Figure 1, the intersection of the negatively sloped marginal-abatement cost curve with the horizontal axis shows that in the absence of any penalties for pollution, 10 Gt of CO2 or equivalents would be emitted each year. Moving upward from right to left along that curve, we see that pollution can be reduced at a cost per ton that rises as pollution decreases, until the cost of abatement reaches $100 for the last ton of emissions to be eliminated. The marginal external cost curve shows the harm done by each added ton of emissions. The positive slope of the curve indicates that each additional ton of pollution causes greater harm than the ton before. In discussions of climate policy, the external costs of greenhouse gas emissions are often referred to as the social cost of carbon.

Pigou, however, was not thinking of climate change when he developed his theory of externalities, but rather, of more localized air or water pollution. With that in mind, he reasoned that the intersection of the two curves in Figure 1 represented an optimum abatement effort. The costs of reducing pollution below that level would, at the margin, exceed the benefits. His policy recommendation would have been to impose a tax of $50 per ton. Beyond 5 million tons of emissions, it would be cheaper for polluters to clean up than to pay the tax, so the annual rate of pollution would be limited to that amount. Alternatively, the same result could be achieved by establishing an emissions cap of 5 million tons per year, enforced by a system of tradable permits.

Today, Pigouvian carbon pricing is widely supported by economists as a tool of climate policy. They see carbon pricing as inherently efficient. They argue that resources needed to build clean energy infrastructure and clean up industrial processes are scarce, and a price incentive directs those resources toward the points where a given investment yields the greatest reduction in emissions. The efficiency-enhancing properties of carbon pricing are seen as especially advantageous in situations where the cost of abatement differs widely among sources of emissions. Economists also like the way carbon prices close loopholes in the incentives created by regulations that are intended to limit carbon pollution. For example, in the United States, regulations called CAFE standards are designed to induce automakers to build fuel-efficient cars and trucks. However, once the vehicles are sold, those regulations do nothing to discourage their buyers from driving them as much as they like. By raising the price of gasoline, a carbon tax would close that incentive gap.

But carbon pricing is far less popular among green activists than among economists. There are many reasons for that, some political, some ethical, some ideological. But sticking just to economics, the most common objection is that Pigouvian carbon pricing is inconsistent with the goal of deep decarbonization.

For example, using a popular metaphor, Anthony Patt and Johan Lilliestam, writing in Joule, argue that “carbon taxes stimulate a search for low-hanging fruit. That ceases to matter when we know we must eventually pick all of the apples on the tree.” In their book Making Climate Policy Work, Danny Cullenward and David Victor maintain that carbon pricing is useful only in situations of “commercially mature technologies competing in stable environments,” such as switching electric power plants from coal to natural gas. Endre Tvinnereim and Michael Mehling, in an article for Energy Policy, write that conventional carbon pricing made good sense for earlier environmental problems, such as acid rain, where the challenge was simply to reduce annual emissions below a dangerous threshold. However, they say, climate policy today cannot limit itself to reducing emissions incrementally. Emissions have to cease entirely.

The critics have a valid point here. Since CO2 persists in the atmosphere for centuries, unlike other, shorter-lived pollutants, there is no positive, optimal level of new emissions that is consistent with an acceptable global temperature target. But the critics go too far in rejecting carbon pricing altogether. It may be true that conventional carbon taxes and emissions trading only go after the “low-hanging fruit,” in the sense that they aim only to eliminate emissions for which abatement costs are low while leaving total emissions at a reduced, but still dangerous, level. However, there are other ways to implement carbon pricing that are fully consistent with deep decarbonization. The next sections show how that can be done, first using carbon taxes, or alternatively, by emissions trading.

Deep decarbonization with a carbon tax

In an article for Nature Climate Change, Noah Kaufman and four colleagues describe a way to achieve deep decarbonization with a carbon tax. Departing from the conventional approach, they forgo any attempt to set the tax equal to the social cost of carbon. Noting that plausible values of the social cost of carbon range from zero into the thousands of dollars per ton, they conclude that they are “of little practical value to policymakers.” Instead, their proposal, which they call “near-term to net zero” (NT2NZ), proceeds in four steps, as follows:

- Set a target date. The first step is to set a date for net-zero emissions by balancing the risks of higher global temperatures against the higher costs of faster emissions reduction. This step is inherently political, involving compromises among people’s widely differing preferences and attitudes toward intangible costs and benefits.

- Identify a preferred emissions pathway. An infinite number of pathways could be consistent with any given net-zero date. There is no reason the pathway would have to be a straight line. It could emphasize fast, early reductions, a choice that would prioritize immediate deployment of off-the-shelf abatement technologies. Alternatively, the preferred pathway could backload emission reductions to take advantage of technological advances that are likely to reduce future abatement costs. For any given target date, earlier reductions would reduce total cumulative emissions, whereas later reductions would reduce the total cost of attaining net zero.

- Calculate carbon prices. Carbon taxes would be set to be consistent with the preferred emissions pathway in the near term. Calculations would be based on models of market dynamics that included estimated parameters for supply and demand elasticities, behavioral reactions, and so on. Kaufman et al. caution that beyond a decade or so, exact calculations of prices would be impractical.

- Update steps 1-3 on a regular basis. Such “adaptive management” would make it possible to stay close to the desired emissions pathway without locking in assumptions about highly uncertain future variables.

Clearly, NT2NZ, which ensures zero emissions no later than its target date, overcomes the objection that carbon pricing can harvest only the low-hanging fruit. However, although NT2NZ avoids the difficult task of calculating an explicit social cost of carbon, it still puts a very substantial informational burden on central authorities.

As noted, key parameters required to implement NT2NZ include supply and demand elasticities for multiple carbon-intensive inputs and outputs and estimates of future technological progress. In addition, in order to set the target date and calculate an optimal emissions pathway, the central authorities would, implicitly or explicitly, need to apply a discount rate, which, as Kaufman et al. emphasize, has long been a vexing issue for pricing policies based on the social cost of carbon. Finally, the choice of a target date for full decarbonization would require implicit judgements regarding risk aversion, since any chosen date would be associated with a substantial range of temperatures and associated damages.

A cap-and-trade approach to deep decarbonization

In my view, the heavy informational demands that NT2NZ places on central authorities could be substantially mitigated if price-based deep decarbonization were implemented using emissions trading rather than a carbon tax. Just to have a name, I’ll call this alternative emissions trading for deep decarbonization (ET4DD). The required steps would look something like this:

- Set a temperature target. The logical starting point for ET4DD would be to set a maximum tolerable global temperature target, such as a 1.5o C above the preindustrial average, rather than setting a date for achieving net zero. Although the resulting net-zero date would not be known in advance, the date itself is unimportant if the temperature target holds. Although this first step would be informed by economic considerations and climate science, it, like the choice of a date in NT2NZ, would be a fundamentally political decision.

- Calculate a carbon budget. Starting from the chosen temperature target, calculate a corresponding global carbon budget. Since climate-science models yield a range of possible budgets associated with any given temperature target, this step would require political judgement regarding risk aversion. For example, according to the models used in the latest IPCC report, a global budget of 500 Gt would give a 50 percent chance of keeping the average world temperature below 1.5o C. If that were considered too much risk, lowering the budget to 300 Gt would improve the chance of staying below the target temperature to 83 percent.

- Determine the U.S. share of the budget. The current U.S. share of global carbon emissions is about 15 percent. If the global budget specified in Step 2 were 500 Gt, the U.S. share of the budget could simply be set pro rata at 75 Gt, equivalent to about 12, plus or minus, at the 2019 rate. Political and diplomatic considerations might lead to the choice of a larger or smaller national budget.

- Issue emission permits. The national share of the global carbon budget determined in Step 3 would be divided into emission permits of suitable size (say, 75 million certificates of 1,000 tons each) and put into circulation, either by auction or by grandfathering. The permits could be freely bought and sold. Buyers could include sources of emissions that wanted to use the permits themselves, either immediately or later; speculators who wanted to buy them hoping to resell later at a profit; and, possibly, climate activists who wanted to buy permits and lock them away in order to hasten the approach to net zero. Everyone would be placed on notice that once the original issue of permits was used up, they would not be replaced. That would guarantee that cumulative emissions would never exceed the designated carbon budget.*

In short, in contrast to NT2NZ, in which the primary policy instrument would be a carbon tax that follows a time-path based on a fixed net-zero date, the primary policy instrument under ET4DD would be a fixed carbon budget divided into a fixed number of tradeable permits. The ET4DD approach would ease the informational burden on central authorities in several ways.

First, under NT2NZ, the time-path of the carbon price (the tax) has to be set centrally. Doing so requires complex calculations based on estimated values of supply and demand elasticities, which can never be more than only approximate. Furthermore, even though the time-path of the carbon tax would be announced in advance, it would need to be revised periodically. In contrast, under ET4DD, once a political decision is reached regarding the carbon budget (comparable to the political decision regarding the net-zero date under NT2NZ), the time-path of the carbon price is determined on a decentralized basis through buying and selling of permits. The buyers and sellers use their own judgements, which need not all be the same, about elasticities and other parameters.

Second, optimizing the time-path of the carbon tax under NT2NZ would require the central authorities to make assumptions about the rate of technological progress. Under ET4DD, such assumptions would be up to individual market participants. Technological optimists would buy permits in order to engage in high-emission activities in the near term, planning to switch to low-cost, low- or zero-carbon technologies as they became available. Technological pessimists would hoard permits for later use (or for resale at a profit) on the assumption that permit prices would rise sharply as the number of remaining permits decreased over time. The resulting time-path of the carbon price would thus be based on the dispersed knowledge of parties with financial motivation to keep up with the best available information as technologies evolved.

Third, under NT2NZ, both the original decision regarding the net-zero date and subsequent decisions regarding the time-path of the carbon tax would require central authorities to make explicit or implicit decisions about discount rates and risk aversion. Under ET4DD, the initial determination of an appropriate carbon budget would, at least implicitly, require political judgements regarding risk aversion and discounting, central authorities would not need to revisit those decisions on an ongoing basis. As a result, there would be fewer opportunities for special interests to intervene in a way that would slow the progress toward decarbonization. Instead, individual market participants would buy and sell emission permits based on their own private discount rates and degrees of risk aversion.

Conclusions

Achieving net-zero carbon emissions is not going to be an easy goal. No deep decarbonization policy yet proposed, whether price-based or otherwise, is likely to be adopted soon, either in the United States or internationally. As this is written, the Biden administration has announced plans for a “clean electricity payment program” (CEPP) that is among the most far-reaching of its kind yet proposed. However, the CEPP still faces major political hurdles and, even if fully implemented, would largely be limited to the electric power sector. Similarly, existing carbon pricing policies in Sweden, Canada, and elsewhere have incomplete sectoral coverage and fall far short of ensuring prices high enough to achieve full decarbonization by a certain date. Neither Kaufman’s near-term to net-zero approach, nor emissions trading for deep decarbonization, as proposed here, is close to ready for translation into legislative language and submission to Congress.

But this commentary has not claimed to offer a proposal ready for immediate implementation. Instead, its main point has been that the “low-hanging-fruit” critique does not constitute a compelling case against carbon pricing. Critics of existing carbon pricing schemes have identified a real problem, but the problem is one of the limited, Pigouvian version of carbon taxes and emission trading that dominates the literature. The shortcomings of the Pigouvian approach could be corrected by restating carbon pricing in some such form as NT2NZ or ET4DD.

Finally, it should be emphasized that regulation and carbon pricing are not either-or choices for deep decarbonization. If well-designed regulations or mixed regulatory and incentive-based strategies like CEPP have better near-term political prospects than carbon pricing, as seems now to be the case in the United States, then by all means we should welcome them. Even if those strategies stall out before reaching net zero, as they likely would by themselves, the progress they achieved would make it easier to design and implement future policies that would use an all-of-the above approach, including carbon pricing, to move the ball further toward net zero.

Thanks to Joseph Majkut and Logan Mitchell for their input on earlier drafts of this commentary.

* Sources that captured and permanently stored their own CO2 emissions would not require permits. Independent operators who engaged in direct air capture (if such a technology ever became economically feasible) could be rewarded by the issue of new permits, which they could then sell, without violating the predetermined carbon budget. However, the kinds of questionably additive offsets sometimes encountered under existing cap-and-trade regimes would not be allowed, nor would “uses” of CO2 in ways that resulted in eventual release of emissions into the atmosphere.

Photo by Markus Spiske on Unsplash