Despite its lackluster reputation, the Internal Revenue Service (IRS) is one of the United States’ most important organizations, processing approximately $4 trillion in revenue and tax expenditures annually. Because of this, the agency was historically spared from partisan fighting, with public officials largely supporting the agency’s apolitical mission throughout most of the 20th century. “Taxes are the lifeblood of government,” as the Supreme Court put it in Bull v. United States.

Nevertheless, over the past three decades the IRS has had its own lifeblood drained by budget cuts and mounting bureaucratic hurdles. As the need for IRS reform has increased, so too has political polarization, with the service becoming the target of scorn by many elected officials on Capitol Hill. The IRS’s resources have become stretched thin by an increasingly complex tax code, including growing responsibilities that the agency wasn’t designed for, from administering social benefit programs (such as the recently expanded Child Tax Credit), to implementing intricate federal regulations. As lawmakers delegate more and more to the IRS, the time is right for policymakers to approach the agency with fresh eyes, and consider how it can be revamped to better achieve its missions, past, present and future.

The IRS Nears Its Breaking Point

Despite a growing reliance on the IRS to administer policies tangential to revenue collection, public officials have too-often preferred to scorn the IRS rather than nurture it. This isn’t to say that the IRS hasn’t made any internal mistakes over their nearly 160-year history — in fact, the IRS has a chronic history of cost over-runs and project mismanagement. It is nonetheless important to understand the watershed period that transformed how the IRS operates in its current form.

Congress has frequently ignored the IRS’s request to fund modernization while it attempts to update their information systems infrastructure dating from the 1960s. This has led to technological failures that contribute to a vicious cycle of visible dysfunction and angry constituents, thus souring lawmakers against the IRS all the more. The mismanagement of past funding influxes have only added to Congress’s skepticism. When the IRS finally began receiving the money for the Tax Systems Modernization (TSM) program in 1986, for example, they experienced a “famine-to-feast infusion of resources” that they were unprepared for. As a General Accounting Office report noted in the early 1990s, the IRS lacked a clear explanation of their plan for TSM while also failing to clarify the mission and scope of the program.

The IRS was unprepared for the TSM because their organizational culture and management structure was ill-suited for technology mega-projects. They acted as a more insular organization that was averse to working with outside contractors and newer employees, despite their lack of in-house technical skills to implement the modernization program. As Barry Bozeman notes, given the political scapegoating of those at the IRS and negative portrayal of the service by news media, “It is not difficult to understand how such an environment can foment distrust and insularity.” The plans the organization developed before funding was allocated thus gave “more attention to the wish list than to the specifications and functionality.”

The TSM program included many projects, from developing electronic tax filing to digitizing paper returns. However, IRS management failed to recognize that even the latest technology at the time was incapable of meeting those promises, so many of the initiatives simply failed. TSM turned from a modernization effort into an organizational learning experience. Following various reports from the General Accounting Office and National Research criticizing the program, Congress increasingly scrutinized the TSM. By 1996, the IRS received $300 million less than requested for continued funding of the TSM. “It’s never too late to stop a hemorrhage” said a GAO chief scientist before the Senate Governmental Affairs Committee in May of 1996. A month later, Congress created the National Commission on Restructuring the Internal Revenue Service to scrutinize the IRS and evaluate its future.

In 1997, the Commission released their final report, calling to “overhaul the IRS and transform it into an efficient, modern, and responsive agency.” As Joseph T. Thorndike noted, the commission noted three issues for the agency: dealing with accountability among management, chronic short-sightedness of agency goals, and missing expertise around technical systems modernization. To address these problems, some key recommendations from the Committee included:

- Establishing an executive Board of Directors to fill the leadership vacuum at the agency by guiding the IRS on the specific implementation of policy initiatives;

- Setting the IRS Commissioner’s term length to five years and with more managerial flexibility to promote consistent project management to see programs to completion;

- And creating a congressional committee to coordinate oversight of the IRS so they could assess overall performance of the agency, rather than have Congress confront them sporadically over narrow flaws that miss the bigger picture.

Notably, the congressional commission also blamed Congress’s tax legislation for some of the IRS’s overall issues, stating that the complexity of the tax code put a significant burden on the administration, and that “Reducing taxpayer burden by simplifying the tax laws and administration must start with the Congress and the President.” While several of their recommendations went ignored, the general desire for increased oversight and a tighter leash on IRS behavior were prioritized and acted on. This was in part due to multiple scandals that arose during this period, which drastically derailed the focus of IRS reform efforts.

There is an additional political context that shaped how the IRS would be reformed: the 1994 Republican Revolution. While the Congressional Commission was bipartisan, that didn’t stop politicians from using IRS reform efforts as a political cudgel. Although the problems with the TSM program made the need to address the agency’s broader issues practically inevitable, Democrats losing their House majority for the first time since 1952 left Congress with fewer taxation supporters and a new group of anti-tax antagonists. Some members of Congress used the 1994 elections as a justification for roasting the IRS, with Senator Chuck Grassley stating that restructuring the IRS was “keeping with what many saw as the mandate given to the Congress in 1994—moving power from government to the people.” As congressional investigations continued in 1997, Republican pollster Frank Luntz reminded candidates that “nothing guarantees more applause and more support than the call to abolish the Internal Revenue Service.”

As legislation based off congressional hearings went through the House smoothly in the fall of 1997, concurrent political activities altered the tone around the reform’s purpose. In both chambers of Congress, committees held hearings on “horror stories” from taxpayers on alleged IRS abuses. Then Chair of the House Republican Conference, John Boehner, declared “This Halloween, the Republican Congress is unmasking the IRS for what it really is: a bureaucratic monster stalking the American taxpayer,” in tandem with the launch of a GOP website to solicit such claims. Another scandal erupted with claims that the IRS was targeting conservative non-profit organizations, leading to further Congressional hearings and scorn towards the agency. While both scandals greatly affected the 1998 IRS Restructuring and Reform Act, over the two years following its passage, government investigations found that both sets of allegations were generally unfounded and that the IRS had been operating within the law. As the Restructuring Commission noted in their initial report, there were “very few examples of IRS personnel abusing power.” The report recommended that taxpayers should have greater protection from undue IRS enforcement regardless.

An effort that originally sought to improve the IRS’s ability to implement modernization projects quickly transformed into legislation that, as political scientist David C. Johnston puts it, “handcuffed the tax police.” As tax law professor Leandra Lederman notes in her article, “IRS: Politics as Usual?,” shaping the reform bill around alleged crises was not conducive to deliberation and led to overreaction. Instead of legislating reforms to help the agency adequately administer the tax code, the backlash to various scandals led to the IRS Reform Act placing the service under even more bureaucratic burdens, further hindering the agency’s ability to collect revenue much less address systems modernization. With the IRS’s organizational incompetence left unimproved, the agency’s core IT systems remain trapped in the 1960s to this day.

The reforms in late 1990s would go on to have drastic effects on the IRS’s ability to do its most basic function: collect taxes. Following its passage, the agency faced dramatic pressure to defer action on tax collection activities. Individual income tax audit rates declined by almost 66 percent from 1996–2002, while the audits that did occur defaulted to inaction in a third of the cases. In Fiscal Year 1997, the IRS performed 10,090 seizures in response to unpaid taxes. By 2000, total annual seizures dropped to just 74. As of 2017, that number was 323, down 58 percent from 2011. Lederman identifies three key reasons for these downturns:

- First, the restructuring of the IRS consumed many organizational resources that had to be directed away from regular activities;

- Second, the IRS Reform Act forced the agency to reallocate individual employees from enforcement to service responsibilities, such as helping taxpayers navigating filings;

- Third, statutes in the legislation established agency rules with strict penalties for what was deemed wrongful activity by IRS personnel. The “Ten Deadly Sins,” for example, included “Providing a false statement under oath with respect to a material matter involving a taxpayer or taxpayer representative.” This led employees to avoid acting on valid collection cases over fears of being fired.

In the wake of the aforementioned scandals, Charles Rossotti was appointed as a commissioner to reform the IRS. Sharing some of the mindset around the Reform Act, he sought to make the service more efficient and “think about its job from the taxpayers’ point of view.” Drawing from the Restructuring Commission’s original report, Rossotti initiated a fundamental overhaul of the IRS’s structure from regionally-based operations to four centralized divisions that each served different segments of taxpayers; the basic structure that remains to this day. The Commissioner also understood the modernization challenges the IRS had been facing, describing the agency’s information systems capabilities as “like being a bank and not knowing how much money is in your customer’s account.” While he did partner with the private sector to bring more expertise into the modernization project, by 2004 Congressional testimony suggested that the efforts still faced “significant delays and cost over-runs.”

The 1998 law created two bodies to increase oversight of the IRS: the IRS Oversight Board and the office of the Treasury Inspector General for Tax Administration (TIGTA). It was a later report from TIGTA that triggered the 2013 scandal involving alleged targeting of conservative 501(c)(4) nonprofit organizations. Investigations from multiple institutions later concluded that this was in all likelihood a result of bureaucratic mismanagement of a markedly complex tax code. Indeed, far from engaging in overzealous enforcement, the IRS developed an organizational culture of risk aversion, with employees afraid to carry out normal enforcement activities in fear of violating regulations on their behavior. As Rossotti put it in 2002, “We live in a fishbowl. It is difficult to make even a small mistake because it immediately gets magnified. A small mistake is quickly interpreted as “now the whole thing is falling apart.” The attacks levied against the IRS have also worn-down employee morale over time. As Commissioner John Koskinen testified to Congress in June 2014 about the targeting controversy, “When they then are subject to depositions and recorded interviews, it sends… a deleterious effect on morale because they thought they were actually doing what they were asked to do…” In response to this one scandal, Koskinen stated that 250 IRS employees were forced to dedicate approximately 120,000 hours of work in order to meet congressional demands.

At the time, the perception of a moral crisis within the IRS was enough to trigger passage of the Protecting Americans From Tax Hikes (PATH) Act in 2015. One component of the legislation sought to deepen IRS personnel’s fear of punishment by indicating that “performing, delaying, or failing to perform… any official action (including any audit) with respect to a taxpayer for purpose of extracting personal gain or benefit or for a political purpose” will result in an employee’s termination. The same year this legislation passed, IRS funding levels fell to levels comparable to their 1998 budget adjusted for inflation. Since then, funding for the IRS was only marginally increased for one year following the PATH Act reforms.

These developments proved important not just for the IRS’s functioning as a revenue agency, but for its ability to properly fulfill its growing non-revenue responsibilities. Over the past few decades, Congress has delegated more regulatory and social welfare tasks to the service. However, instead of ensuring that the IRS has the proper organizational structure and resources to smoothly meet these expanding roles, Congress has instead passed legislation to micromanage the agency’s resources towards processing tax returns and servicing customers. The strains from these agency design choices have made themselves apparent over the last 18 months, with the IRS struggling to quickly implement a host of COVID-19 relief programs, from tax credits for paid sick leave to economic impact payments.

A Service Underserved

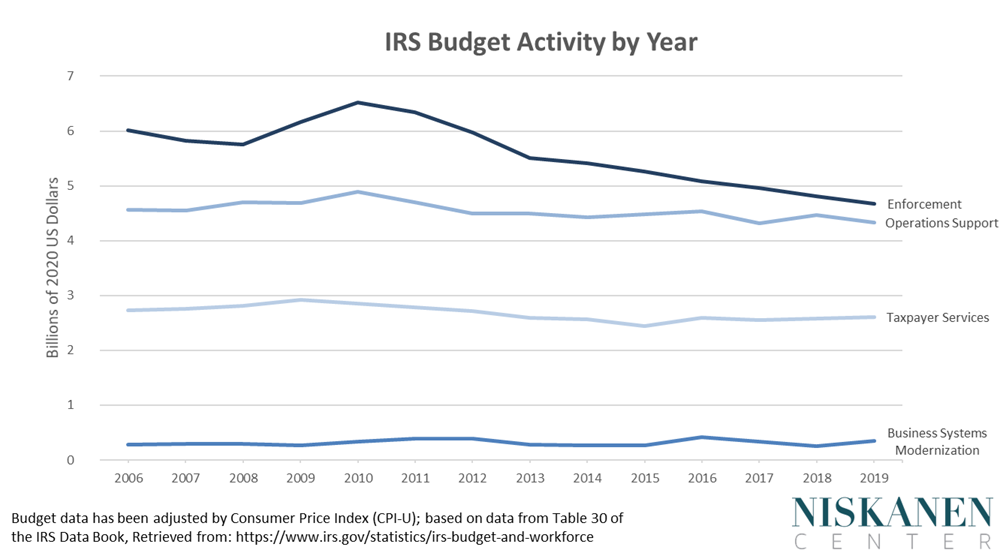

While enforcement rates were able to recover somewhat during the 2000s, the last decade of scorn for the IRS has only exacerbated their struggles. Passage of the Affordable Care Act gave the IRS various responsibilities for administering provisions of the extensive legislation, such as premium tax credits. As a consequence, the Republican House majority that emerged from the 2010 midterms repeatedly pushed to slash the IRS’s budget, with a member of the House Appropriations Committee saying in a 2013 hearing that any significant funding increase “was going to be a challenge for some very basic reasons. There are a lot of objections to the Affordable Health Care Act, a lot of objections to ObamaCare.” The IRS Advisory Council nonetheless stated in 2014 that the agency was “in the midst of an existential funding crisis.”

Despite the starve-the-beast treatment it has received, a 2015 OECD report found that the IRS has become one of the most efficient tax administrations in the developed world, yielding one of the lowest costs of tax collection ratios even with its byzantine tax code to administer. But as tax professor Steve Johnson notes, no organization is ever going to achieve perfect efficiency. Changes to the tax system have occurred almost every year, and placed an increasing burden on the IRS’s workforce, requiring repeated training among IRS employees.

Following budget cuts throughout the early 2010s, IRS Commissioner John Korskinen said, “We continue to find efficiencies wherever we can and are presently saving $200 million a year… But we have reached the point of having to make very critical performance tradeoffs.” With a shrinking scope for bona fide efficiencies, 75 percent of cuts instead went to go to personnel and staff training. As seven former IRS commissioners acknowledged in 2015, these cuts to appropriations created a crisis for the IRS workforce, with only 4 percent of employees under the age of 30 and an estimated 38 percent of employees eligible to retire in 2018. While the political argument was to punish the IRS for scandals by withholding funding, budget cuts for staff and training did nothing to help improve the agency’s “vast bureaucratic bumbling,” as one Senator described it. On the contrary, they made matter worse.

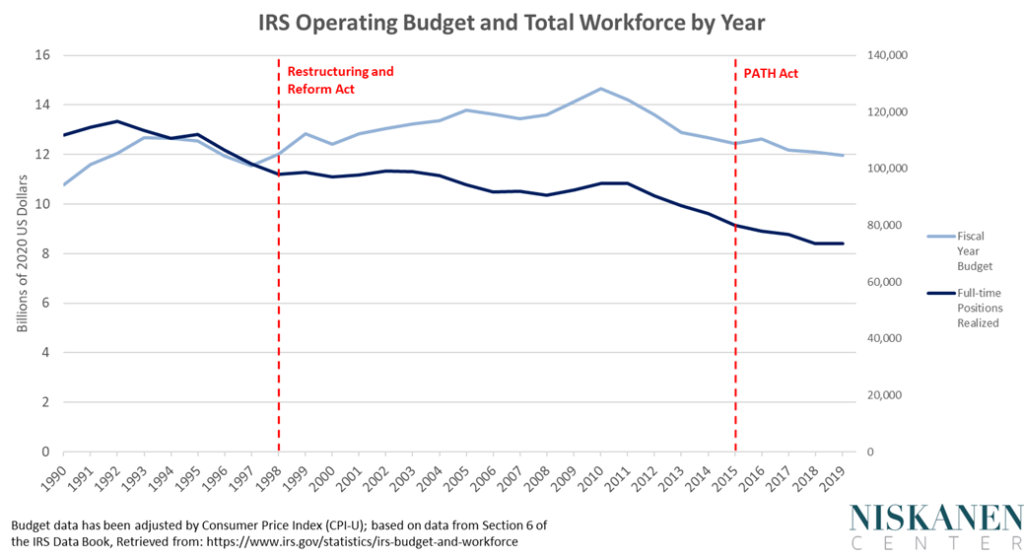

There are numerous metrics that capture the IRS’s dire resource struggles. The wear-down of the IRS has been well documented, from the delays it faced distributing economic relief payments, to its backlog in processing last year’s tax returns. The IRS receives funding comparable to its constant-dollar appropriations from 30 years ago while needing to process 56 million more tax returns and twice the number of business tax returns.

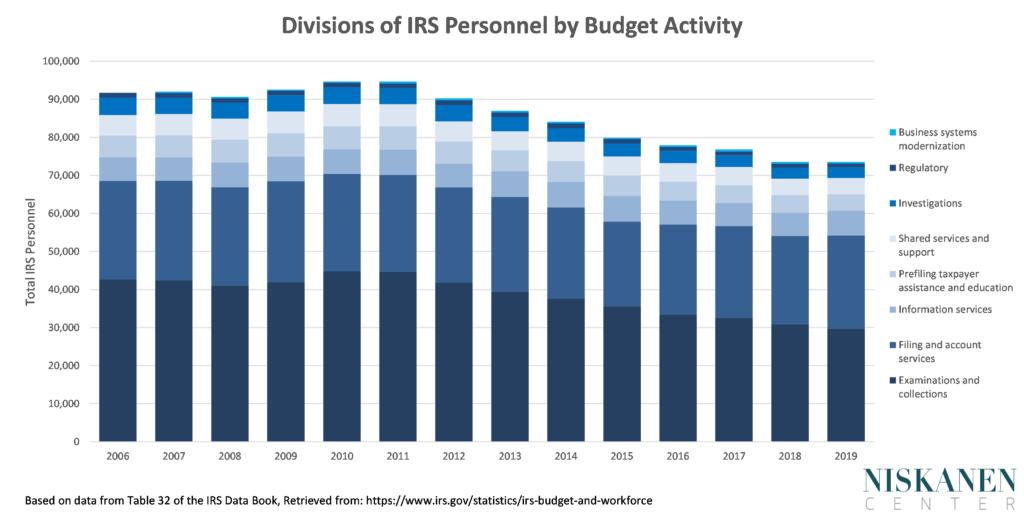

From 2010 to 2020, the number of individual income tax returns the IRS has to process rose from 142 million to 170 million. Over that same period, the IRS has cut over 33,000 positions, while the part of their budget that “funds the infrastructure necessary for processing returns and refunds” has declined by 9 percent in inflation adjusted dollars. In FY2020, the IRS was only able to answer 24 percent of the 100 million calls that were made by taxpayers, many of whom were merely seeking help complying with their tax obligations. Between 2010 and 2018, funding for the IRS fell by 20 percent in inflation-adjusted dollars and 22 percent of their staff has been removed. To call this an unsustainable trend for such a critical government agency is an understatement.

Nor were these funding cuts evenly spread out, with tax enforcement facing the largest decline. The current IRS commissioner now says the IRS is “outgunned” to address the $1 trillion gap in taxes that go uncollected. The IRS enforcement budget declined by 23 percent from 2010 to 2018 while the customer service budget only decreased by 4 percent. Further hindering their capabilities, IRS expenditures on training per-employee declined by over 80 percent from 2010 to 2014. Over half of employment cuts have been in enforcement positions, and its number of revenue agents has now dipped below 10,000 for the first time since 1953. From 2011-2013, it is estimated that over $100 billion in business income and $60 billion in nonbusiness income was underreported. From 2010–2019, the audit rate for individuals declined by almost two-thirds and the rate for businesses fell by half. As the IRS’s resources have thinned, the “core tax-collection mission” that Senator Grassley cited for the agency in the 1990s is ironically the area subsequent reforms gutted the most.

The IRS’s decades-long pleas for appropriations to remedy their technological backwater have largely gone unaddressed. Former head of the IRS’s Office of the Taxpayer Advocate, Nina Olson, described the situation like so: “The IRS has erected a 50-story office building on top of a creaky, 60-year-old foundation, and it is adding a few more floors every year.” Indeed, 231 of the IT systems used by the IRS are classified as “legacy systems,” i.e. ones that are at least 25 years old, including many core systems that run on arcane programming languages that are too old to be maintained.

Following the full display of the IRS’s technology deficit with their systems-wide failure on Tax Day in 2018, the Taxpayer Relief Act mandated changes to the IRS’s electronic abilities. The organization’s 2019 Modernization Business Plan outlined numerous goals for overhauling their systems. These include, but are not limited to:

- Modernizing the IRS Individual Master File (while neglecting the Business Master File);

- Developing web applications for assisting taxpayer issues;

- Replacing batch processing with a Real-Time Tax Processing program;

- Improving automation of business tax returns;

- Transferring workloads to cloud-based platforms and digitizing data;

- Protecting taxpayer data through cyber analytics and threat management.

This 2018 legislation was followed the year after by the Taxpayer First Act, which called for reorganizing the IRS’s leadership structure toward addressing the agency’s repeated failure to effectively implement program modernization. However, as of August 2020, TIGTA found that “specific or long-term plans have not been developed to address updating, replacing, or retiring most legacy systems.” The report points to the fact that IRS continues to receive less funding than it estimates is needed.

Due to the workforce deficit, the IRS has increasingly relied on automated processes for detecting audit targets. This comes with its own drawbacks, however, because using automated methods for auditing wealthy individuals’ taxes is more difficult given their length and complexity. Forced by their limited resources, they have instead had to focus on simpler examinations, such as low- and medium-income people who claim the Earned Income Tax Credit (EITC). Indeed, the agency’s Automated Correspondence Exam application is specifically tailored to assess EITC cases. As a result, in 2018 over a third of individual tax returns selected for examination were related to EITC refunds. This has adversely affected EITC up-take, as a 2019 NBER working paper found that taxpayers were less likely to claim the EITC in subsequent years if they were audited, despite the small share of audited individuals who are ultimately determined to be ineligible.

Workforce cuts and lack of staff training have, somewhat paradoxically, harmed automation efforts more broadly. The share of cases involving software-detected underreporting declined between 2010–2018 as the IRS’s Automated Underreporting program experienced a 40 percent cut to its workforce. As such, the IRS has steered away from enforcement activities focused on higher-income taxpayers towards simpler cases, including those involving low-income recipients of refundable tax credits. Like the drunkard who looks for their keys under the lamp post, the IRS thus increasingly subjects vulnerable populations to unnecessary and unprofitable scrutiny merely because they file the types of returns the IRS can quickly and automatically screen for audit.

Rebuilding the IRS

The administrative capacity of the IRS has now been crumbling for decades. It needs to be extensively retrofitted and renovated to carry out even its core responsibilities, much less its growing role in social and regulatory policy. At at some level, the U.S. still needs to administer the tax system it has. The general needs for increased funding, staffing, training, and technology remain clear and any reforms should include them. However, there are numerous proposals and ideas for improving the IRS’s deeper functionality. While detailing all such proposals would fill a book, some themes emerge that we’ve encapsulated in the seven following recommendations:

1. Adapt to the IRS’s dual role as a revenue and benefit administration.

The IRS has started to be more considerate about the administration of its tax expenditures, such as performing outreach to neglected communities to increase the take-up rate of tax benefits. Nonetheless, the IRS needs broader reforms to incorporate its growing role in benefit administration, including greater appropriations from Congress specifically for the benefit programs the IRS already houses, and for its efforts to increase participation rates. Beyond greater funding, the IRS should be restructured to better reflect the dual but distinct roles of tax collection / enforcement and benefit administration. For example, the Wage and Investment Division, which administers tax laws governing individual wage earners, could be reorganized to better distinguish between the division’s compliance and enforcement activities and their role in benefit outreach and customer service.

2. Return the IRS to a single mission by delegating its non-revenue responsibilities elsewhere.

While this may be a more idealistic solution, segmenting an agency by mission has precedent with other agencies. Congress has previously spun-out new organizations to take on responsibilities that a given agency was unable to administer properly, with examples ranging communications regulation to immigration policy. For instance, the Immigration and Naturalization Service struggled to build a culture around immigration enforcement while having the dual role of accepting immigrants into the United States, leading to the reorganization the separated U.S. Citizenship and Immigration Services (USCIS) from the investigatory activities of U.S. Immigration and Customs Enforcement (ICE). The immigration example may be particularly relevant given the analogous tensions between the IRS’s missions as a collections agency and benefit administrator.

3. Change the appropriations structure for the IRS to mandatory funding.

As IRS Commissioner Charles Retting testified in an April 2021, “mandatory, consistent, adequate multi-year funding allows us to plan appropriately.” While this is no doubt true of every government agency, stable funding is particularly vital for an administration that serves as the lifeblood for everything else the government does. Retting cites the IRS’s unstable annual appropriations as a major reason for the IRS’s hiring struggles. Establishing mandatory appropriations for the service would also make its ability to function resilient to the potential scandals, real or perceived, that anti-tax populists and pundits have incentives to latch on to. Moreover, if Congress is going to respond to agency scandals by “punishing” the IRS, mandatory funding would at least push lawmakers towards reforms that address structural bureaucratic issues rather than funding cuts.

4. Create a joint congressional committee to oversee the IRS’s broader missions.

While the original Restructuring Commission recommended this in the 1990s, there is still no congressional body to comprehensively oversee the IRS. Because of this, the agency still struggles with addressing duplicate information demands from different congressional committees. Congress has also generally failed to realize the broader problems facing the IRS and its challenges with administering the complex tax code and ancillary responsibilities they have legislated, instead favoring ad hoc scandals as they pop up. Establishing a specific committee for oversight would enable Congress to better understand the full extent of the problems facing the IRS, allowing reformers to see the forest for the trees.

5. Expand the IRS’s project management capabilities while requiring implementation frameworks for project goals.

As TIGTA found, the IRS still doesn’t seem to have sufficient plans at the ready to implement mega-technology projects if/when they receive the resources to do so. As the Biden administration aims to fund a large portion of their American Families Plan through shrinking the tax gap, the IRS needs to have detailed frameworks in place for how to follow through on expansions in the service’s capabilities. While the IRS plans on establishing a specific division in its leadership structure for organization-wide modernization, they need to focus their work on blueprinting how it would manage the projects it has outlined within their modernization wish lists. This will help avert the famine-to-feast and cost overrun problems that could lead the agency to stumble on another modernization effort, triggering another wave of backlash from Congress.

6. Separate the EITC’s child and worker benefits, while automating delivery of EITC and CTC refunds to eligible taxpayers.

This reform has two components. First, simplifying the EITC by shifting its per-child portion into the Child Tax Credit, as Senator Romney recently proposed in the Family Security Act, would clarify the EITC’s function as a work-support and reduce the complexity of its administration. Second, since employers are required to submit W-2 forms to the IRS early in the tax season, the IRS now matches W-2 wage data with tax returns before administering refunds. Because of this, the IRS now has the capability to automatically identify most eligible EITC and CTC recipients whether or not they file a claim. Allowing such refunds to be issued automatically would reduce the filing burden on low income households and thus reduce improper payments.

7. Replace the tax preparation Free File program with direct filing software on the IRS website.

Currently, the IRS contracts with private tax preparation software providers and has established an electronic filing portal for them within the IRS. The IRS subsidizes this alliance of tax software companies to give taxpayers an option for free electronic filing; applications that users have generally found unsatisfactory. The IRS also expends resources toward oversight of the program; resources that could be used for internal IRS projects. The reliance on third-party tax preparers hurts EITC recipients, in particular. As the Progressive Policy Institute notes, tax prep companies trim more than 10% off of low-income workers’ EITC refunds on average. A free, in-house filing system would also complement the online portal the IRS is developing to help deliver the new monthly Child Tax Credit, particularly if combined with pre-populated returns.

In summary, modernizing the IRS represents an untapped opportunity to improve taxpayer services and the tax enforcement simultaneously. Outside periods of vilification, the IRS is broadly well-regarded by the public. Survey data from Pew Research found it held a +25-net approval rating, with even 50 percent of Republicans having a favorable view of the agency. As the cumulative damage from years underfunding come to a head, the need for new funding and deeper reforms to the IRS’s organizational structure have become mission-critical. If such reforms aren’t forthcoming, we should not expect the IRS to live up to its growing number of responsibilities, but instead prepare for its already-broken foundation to continue to crumble.

Samuel Hammond is the director of poverty and welfare policy at the Niskanen Center.

David Koggan is a poverty and welfare policy intern at the Niskanen Center and a rising senior at Carnegie Mellon University.