In simple economic models, workers disrupted by trade or automation are instantly reallocated from declining industries to ones on the rise. Yet that is rarely if ever the case in the real world. Labor markets are highly complex institutions, riddled with frictions created by geography, social networks, discrimination, and regulations that vary from place to place.

In a world where nothing ever changes, this wouldn’t be a big problem. Yet in a dynamic, growing economy, change is the rule, particularly with increased foreign trade and major breakthroughs in AI and robotics on the horizon. This demands that the United States finally get around to constructing a truly national labor market — one with robust employment, training, and relocation supports that follow workers wherever they go.

The “Economic Ladders to End Volatility and Advance Training and Employment” or ELEVATE Act is a big first step in that direction. It provisions include:

- A new title to the Social Security Act for states to fund and implement subsidized employment programs;

- Guardrails that ensure states pursue re-employment and retraining programs with a strong evidence base and low overhead;

- Funding conditioned on states’ quarterly unemployment rates to create aggressive and fast-acting “automatic stabilizers”;

- A demonstration project to identify “pro-worker employers” to ensure subsidized job placements don’t erode job quality;

- A national self-employment benefit for recently unemployed workers to pursue entrepreneurship;

- And a national relocation assistance program to reimburse eligible individuals for the expenses associated with “moving to opportunity.”

Inspired by over 40 years of research into employment subsidies, including about a dozen controlled pilot programs, the ELEVATE Act is the most carefully constructed and evidence-driven proposal for strengthening labor markets in a generation. And as discussed below, while there are several areas for improvement, it has the potential to appeal across partisan lines by tying employment security to a vision of an even more free and dynamic market economy.

How the ELEVATE Act Works

The ELEVATE Act adds a new title to the Social Security Act (Title XIII, “Reemployment and Other Job-Related Assistance and Benefits”) to create a dedicated federal funding stream for states to provide eligible individuals with employment, training, and supportive services. Eligible individuals include:

- the long-term unemployed;

- current and former recipients of public assistance programs like SNAP and TANF;

- those who are eligible for public assistance but not enrolled;

- noncustodial parents under a child support order;

- adults who were in foster care;

- and the formerly incarcerated.

To begin accepting payments, states must submit a detailed plan explaining, among other things, the employment strategies they intend to follow, how they fit within (but don’t crowd out) the state’s existing workforce development programs, and how they intend to evaluate their success. A minimum of 70 percent of funds paid to each state must be used directly on employment costs (wage costs, employers’ share of payroll tax, on-the-job training expenses, etc.), and a maximum of 15 percent of funds can be spent on administrative overhead.

The Act further sets out three tiers of evidence standards for the types of programs that are eligible, requiring 50 percent of total state expenditures go to the strongest, Tier-2 and Tier-3 evidence-based practices. The Tier-3 designation refers to programs that have been previously implemented by states or have been positively evaluated by a pilot program with a random-assignment design. This pushes states to put most of the emphasis on proven subsidized-employment programs that get individuals into transitional job placements quickly and have reliably passed cost-benefit tests, and less emphasis on things like classroom-based training programs of dubious effectiveness.

Yet ELEVATE doesn’t preclude states from using funds for training, readiness, and job search programs with a smaller evidence base, provided states marshal evidence of their effectiveness. States willing to foot at least 25 percent of the total cost can even submit proposals for genuinely untested program designs. Giving states the flexibility to design programs that fit their unique labor market needs is crucial. But as the Niskanen Center has argued in the past, America’s “laboratories of democracy” model works best when state flexibility operates within the context of high-level programmatic goals that provide a benchmark for rigorous evaluation, and guardrails that prevent federal dollars from becoming a blank check.

What is Subsidized Employment?

Subsidized employment is a grant-based model for supporting re-employment, whether the worker is out of a job due to an economic shock or because of discrimination in the labor market. A typical employment subsidy works by directly compensating an eligible employer for the costs associated with hiring an eligible worker, potentially allowing all of the wages and even some benefits to be temporarily covered.

Under the ELEVATE Act, subsidies for a particular job placement cannot exceed 120 percent of total wages, are withdrawn after a maximum of six months (with allowances for a training period), and obligate employers to make a good faith effort to retain the employee if they performed satisfactorily. The Act also creates an Employee Retention Credit equal to 40 percent of the worker’s second-year wages up to a cap of $6,000 for employers that retain workers for two years. If an eligible individual is let go after a transitional job placement, the individual may apply for a new subsidized job placement with a different employer after six weeks.

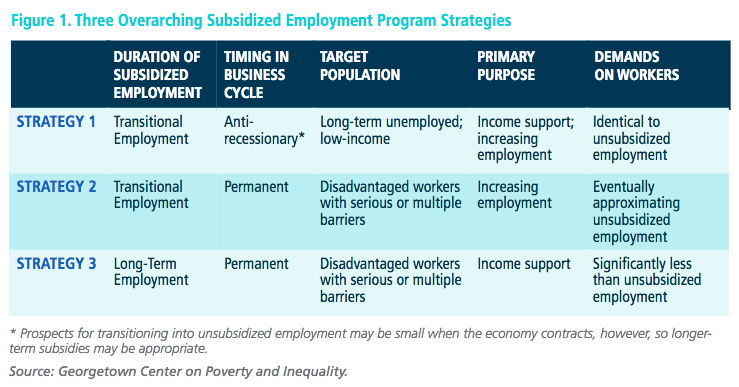

This simply describes the high-level structure of employment subsidies. As the Georgetown Center on Poverty and Inequality has detailed, the variety of potential subsidy designs is immense. The successful employment subsidy programs launched under American Recovery and Reinvestment Act further shows that states have the capabilities to implement them quickly and effectively.

Promoting High Quality Jobs

Employment subsidies are easily confused with wage subsidies, but as the description above shows, they are actually quite different approaches. By directly compensating employers’ hiring costs and promoting worker retention, employment subsidies increase labor demand. The Earned Income Tax Credit (EITC), in contrast, is closer to a classical wage subsidy because it adds a bonus to workers’ reported earnings. The prospect of higher post-tax earnings encourages people to enter the labor force, increasing labor supply. In some cases, employment subsidies can be structured to increase labor demand and supply simultaneously.

The EITC is an incredibly effective tool for reducing poverty and promoting work, and deserves to be expanded independently of the ELEVATE Act. Nonetheless, wage subsidies have some notable drawbacks when used on their own. If employers are unwilling to hire a worker with a criminal record, for example, raising post-tax earnings does nothing to help. The wage subsidy may increase the individual’s willingness to offer work, but it leaves the employer’s willingness to offer them a job unchanged.

Wage subsidies can also have the unintended effect of depressing wages. Knowing their post-tax earnings will get a boost allows employers to capture some of the benefit through lower wages, which in turn biases new business formation towards lower-productivity industries. To combat this effect, the ELEVATE Act authorizes states and local governments to run demonstration projects identifying “Pro-Worker Employers” that offer job placements with predictable schedules, family-friendly benefits, adequate pay, and access to career pathways. These jobs would then presumably be given preference in agency job banks, which would also be responsible for screening out abusive or fraudulent employers. Of course, the precise implementation details would left up to each state.

Building Shock Absorbers into the Labor Market

By design, payments to states under the ELEVATE Act would escalate in response to both cyclical and structural employment shocks, building strong “automatic stabilizers” into the economy. For example, if the state unemployment rate in a given quarter is below 6.5 percent, federal matching funds are limited to the usual federal medical assistance percentage (FMAP) formula. But as the unemployment rate ticks up, the federal share increases rapidly until reaching FMAP+50 percentage points or 100 percent federal funding (whichever is greater) in quarters where unemployment is equal to or greater than 8 percent.

This ramping mechanism ensures state-level aggregate demand stays high even if a recession causes a drop in state revenues. The aggressiveness of this matching system might even eliminate the need for a discretionary fiscal stimulus in the event that monetary policy fails and we have another Great Recession. Instead, federal re-employment spending would begin to ramp up in the first quarter of rising unemployment, and in a way that directly buoys private-sector wages and employment in the states where demand is most needed.

The ELEVATE Act would also respond to local labor market shocks in a much more targeted and predictable way than is possible with conventional monetary and fiscal policies. If an entire regional industry is disrupted by trade or automation, say, state-level workforce development agencies would automatically see an influx of funding to begin constructing retraining pathways with employers, helping divert skilled workers away from public assistance or early retirement and into new productive opportunities.

Given the complex nature of the ELEVATE Act, the modeling required to score its budgetary impact is still being developed by the Congressional Budget Office. While an earlier proposal for a national subsidized employment program estimated total costs of $16 billion a year, this only provides a sense of magnitude. The ELEVATE Act is more ambitious in several ways and contains mechanisms that would lead outlays to vary dramatically depending on the state of the business cycle. Yet, as discussed above, this turns out to be one of the most valuable features of its design.

Whatever its final score, many of the parameters within the ELEVATE Act can be adjusted without forfeiting its intelligent overall structure. For instance, the final budget estimate of the ELEVATE Act will likely be extremely sensitive to the matching scheme. In turn, it could be tweaked to escalate more gradually in response to normal labor market variability, and by allowing the FMAP matching rate to go below the 50 percent minimum in states with extremely low unemployment or high fiscal capacity.

The Act could be further improved by substituting the unemployment rate with a superior measure of labor market tightness, such as the prime-age employment-to-population ratio, or “prime-age EPOP.” This would make the matching formula more sensitive to declines in labor force participation that can reduce the unemployment rate but don’t necessarily indicate a healthy economy.

Promoting Entrepreneurship and Geographical Mobility

For cases where temporary shocks turn into permanent economic distress, sometimes the best option for a worker is to move or start their own business. The ELEVATE Act considers both. Under the Act, anyone eligible for unemployment insurance or who recently became unemployed through no fault of their own can apply for self-employment benefits, allowing them to work full time on starting their own business. In essence, this creates a national version of the Self-Employment Assistance programs that are already available in many states.

In addition, the Act creates a relocation assistance program letting dislocated, unemployed, and underemployed workers apply for $2,000 in tax-free grants (adjusted upwards with family size) to offset up to 90 percent of the costs associated with relocation, including transportation. Successful applications require demonstrating either an offer of employment or a reasonable expectation of finding a form of employment that’s not available in the commuting area in which they currently reside.

Consider this: When economist Lyman Stone dug into why coal workers in declining regions of Appalachia haven’t moved to find work, he realized Kentucky coal country contained 27 of the 71 counties where cash benefits exceed 40% of individual income. As he notes,

Programs that discourage saving by stringently asset-testing benefits or by prohibiting hoarding (such as TANF or SNAP) trap beneficiaries in place, because migration has steep fixed costs in the form of transportation costs, lease deposits, and income to cover time spent looking for work.

While in an ideal world these perverse incentives wouldn’t exist in the first place, a relocation assistance program could prove to be a powerful tool for helping workers find jobs that match their skills and overcome place-specific poverty traps. A 2015 study of Germany’s relocation assistance program, for example, found participants in the program “earn significantly higher wages and find more stable jobs compared to non-participants.” The program also cost considerably less than alternative programs like vocational training.

A similar scheme in Australia, known as the “Relocation Assistance to Take Up a Job” program, was evaluated last year by the Australian Department of Jobs and Small Business. The program reimburses eligible long-term job seekers $3,000 to $6,000 AUD to relocate to a new city or region with a lower unemployment rate than the city or region they’re leaving. The evaluation found a majority of participants remained off income supports 12 months after relocating, and although the sample size was small, the report’s authors concluded the program was “successful, useful and important for those job seekers who participated.” One program participant interviewed for the evaluation summarized his experience by saying “I can’t thank the government, the people that have helped me… enough.”

Identifying the Problem

Having looked at the core programs contained in the ELEVATE Act, it’s worth reviewing the full scope of the problem it seeks to address. While recent unemployment numbers look strong, they hide systemic problems like declining labor force participation and large variations in unemployment by region and demographic group. Consider the following:

- Employment in the U.S. manufacturing sector experienced a large and swift decline in the years immediately following China’s 2001 entry to the World Trade Organization. While a mild recession and strong dollar likely played a role as well, estimates suggest as much as half of the subsequent loss of manufacturing jobs can be attributed directly to Chinese import competition (the “China Shock”). Most affected workers moved into lower-paying service jobs, although some dropped out of the labor force entirely.

- Ten years after the Great Recession, the age-adjusted employment-to-population ratio (a more reliable measure than the unemployment rate) has only just returned to prerecession levels. Even so, employment levels are well below their peak in the late 1990s, suggesting substantial progress is still left to be made.

- Between 1980 and 2010 the number of Americans with a felony conviction or prison time in their past quadrupled to 20 million adults — the product of an incarceration rate that dwarfs those of all other developed countries. A criminal record poses a significant barrier to employment, and is believed to be among the biggest factors behind America’s unusually low labor-force participation rate.

These three examples represent the problem of adjustment costs, labor market slack, and discrimination respectively, and in turn correspond to the three main categories of unemployment:

- Frictional

- Cyclical

- Structural

However, the three types of unemployment aren’t entirely separable. Frictional and cyclical unemployment can transform into structural unemployment when adjustment and stabilization policies are inadequate. In the case of the China Shock, many older workers responded by retiring early or turning to disability insurance in lieu of other income supports. In the case of the Great Recession, the slow labor market recovery (or “hysteresis”) likely caused workers’ skills to atrophy. Put differently, the demand- and supply-sides of the labor market can easily become entangled over the medium to long run.

The United States has nevertheless historically attempted to address each type of unemployment with distinct policies: Trade Adjustment Assistance (TAA) to target compensation and retraining on individuals impacted by foreign trade; Unemployment Insurance (UI) to reduce income losses between jobs or in a recession, providing a modest “automatic stabilizer”; and anti-discrimination regulations like the “Ban the Box” initiative designed to reduce employers’ ability to discriminate against individuals with criminal records. And in case after case, the status quo leaves much to be desired: TAA benefits are notoriously inefficient and hard to access; the eroding UI tax base left state programs inadequately funded in the last recession; and “Ban the Box” initiatives appear to merely shift the target of discrimination onto broader racial categories, harming more than they help.

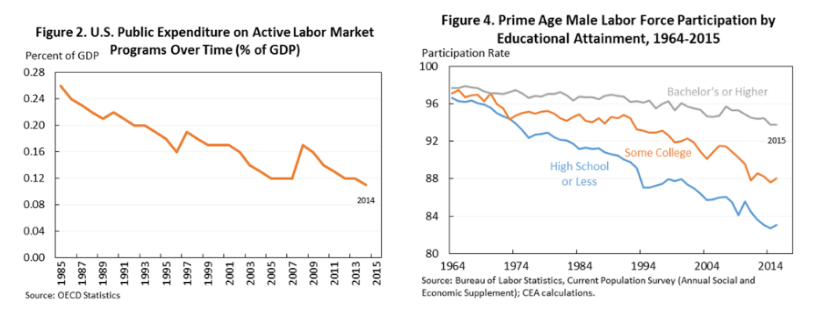

Meanwhile, according to OECD statistics cited in a 2016 CEA report, the U.S. only spends about 0.11 percent of GDP on programs that actively encourage labor force participation, down from 0.25 percent of GDP in 1985. This is the lowest expenditure on active labor market policy (ALMP) of any OECD country besides Mexico and Chile. The United States would need to increase its expenditure on ALMPs by about $24 billion a year to catch up with other Anglo-American countries like Canada and Australia — a gap the ELEVATE Act could realistically close all on its own.

Contrast employment subsidies with the growing enthusiasm for a public sector “job guarantee.” As we’ve argued in the past, job guarantees modeled on the New Deal-era Work Progress Administration (WPA) are unworkable in the modern context, would risk politicizing the labor market, and misallocate labor to the detriment of long-run productivity. Subsidized private-sector employment, on the other hand, ensure the last-mile of hard-to-employ workers gain experience in sectors that are genuinely in demand, and within firms that are ultimately subject to a market-test. Versions of employment subsidy proposals have thus been endorsed by anti-poverty progressives and pro-work conservatives alike, perhaps most famously by the economics Nobel laureate Edmund Phelps. Put differently, the ELEVATE Act would achieve the goals of a job guarantee but in a way that can actually works.

Congressional Republicans have even showed implicit support for subsidized employment, most recently in their push for an (inadequately funded and misconceived) expansion of employment and training programs within the Farm Bill. While a national subsidized employment program has the potential to divert low income workers away from traditional public assistance, treating it as a substitute for income supports like SNAP in which the typical recipient is already employed is inappropriate and a political non-starter.

Conclusion

At the core of the Niskanen Center’s social policy vision is the belief that robust systems of insurance against trade, technology and business-cycle shocks are critical to sustaining the long-run openness and dynamism of the U.S. economy. The ELEVATE Act would achieve all this and more, including the creation of a national relocation assistance program to help dislocated workers move to opportunity and a self-employment benefit to support entrepreneurship in lieu of regular unemployment insurance.

The ELEVATE Act is thus three programs rolled into one. In good times, it would help bridge the last mile of unemployment by making hard-to-employ populations more attractive for job placements. In bad times, it would turn into an automatic fiscal stabilizer par excellence. And when particular regions are hit by labor-demand shocks that require economic reorganization, it would provide a flexible basis for states and employers to train and transition workers into new jobs. In short, the ELEVATE Act presents a comprehensive, evidence-based approach to closing America’s massive gap in active labor market policy, with benefits that would redound across the entire economy through tighter, better-matched, and more inclusive labor markets.

Samuel Hammond (@hamandcheese) is the Director of Poverty and Welfare Policy at the Niskanen Center.