If the economic viability of the coal industry was not already in question before the outbreak of COVID-19, the ensuing economic downturn has really laid bare the precariousness of its position. U.S. coal plants were already shutting down at near unprecedented levels, and almost half of the operating fleet was selling power at a loss.

The lockdown on economic activity in the U.S. has already begun to erode electricity demand, and fossil fuel sources with high marginal costs, i.e. coal, will be hit the hardest. The Energy Information Administration estimates coal generation will fall 20 percent in 2020, and the Institute for Energy Economics and Financial Analysis (IEEFA) predicts coal could fall to 10 percent of U.S. electricity generation as early as 2024. This is truly a remarkable estimate, given that coal provided 23.5 percent of generation last year. It also presents a daunting future for coal. Such a decline will surely increase calls to protect it as reliable baseload electricity. However, a recent analysis of electric system reliability has thrown cold water on the idea that coal is essential to grid reliability.

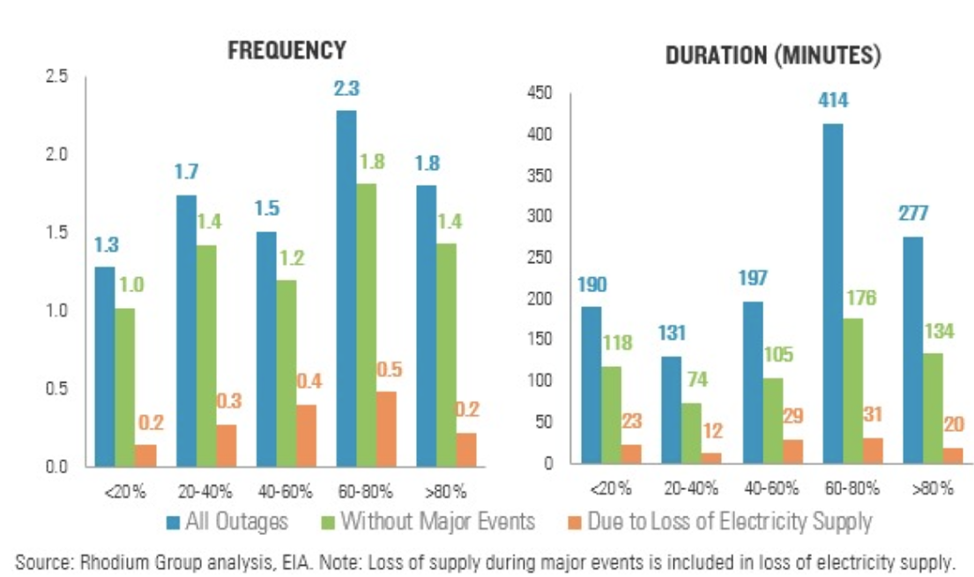

A study from the Rhodium Group examined the link between reliability and fuel secure generation–specifically coal and nuclear power–and found that there is no relationship between greater levels of these resources and grid reliability. The study combines shares of coal and nuclear generation in each balancing authority (BA)–entities that are responsible for managing electricity supply and demand in a designated area. It groups them into five bins from <20 percent coal and nuclear–up to >80 percent of coal and nuclear–and examines the frequency and duration of outages in each BA.

The figure above shows that there is no clear relationship between shares of coal and nuclear generation and the frequency/duration of outages. If anything, greater shares of coal and nuclear electricity generation are associated with a slight increase in the frequency of power outages. The results demonstrate that coal retirements alone would not lead to greater or longer electric service outages. The need for coal generation to reliably supply power is even more questionable when you consider the amount of natural gas capacity coming online in the next few years.

IEEFA’s Coal Outlook 2019 estimated that roughly 28,442 megawatts (MW) of coal capacity will be retired or converted to natural gas between 2019 and 2024. This amount of coal capacity would produce roughly 117,000,000 MWh of electricity using today’s capacity factors. Using data from EPA’s eGRID database, there is roughly 30,000 MW of natural gas capacity planned or already under construction in the U.S., and expected to come online by 2021, which could supply approximately 150,080,612 Mwh per year. In the next two years, planned new natural gas would easily provide more generation than the IEEFA thinks we will lose from coal–and this isn’t taking into account the ample renewable energy capacity expected to come online.

From a nationwide perspective, there is no evidence that retiring large amounts of coal capacity in the coming years will negatively impact grid operators’ ability to supply reliable electricity. At least for the time being, the transition to a cleaner electricity system should not be hampered by fears of losing grid reliability.

Photo by Loïc Manegarium from Pexels