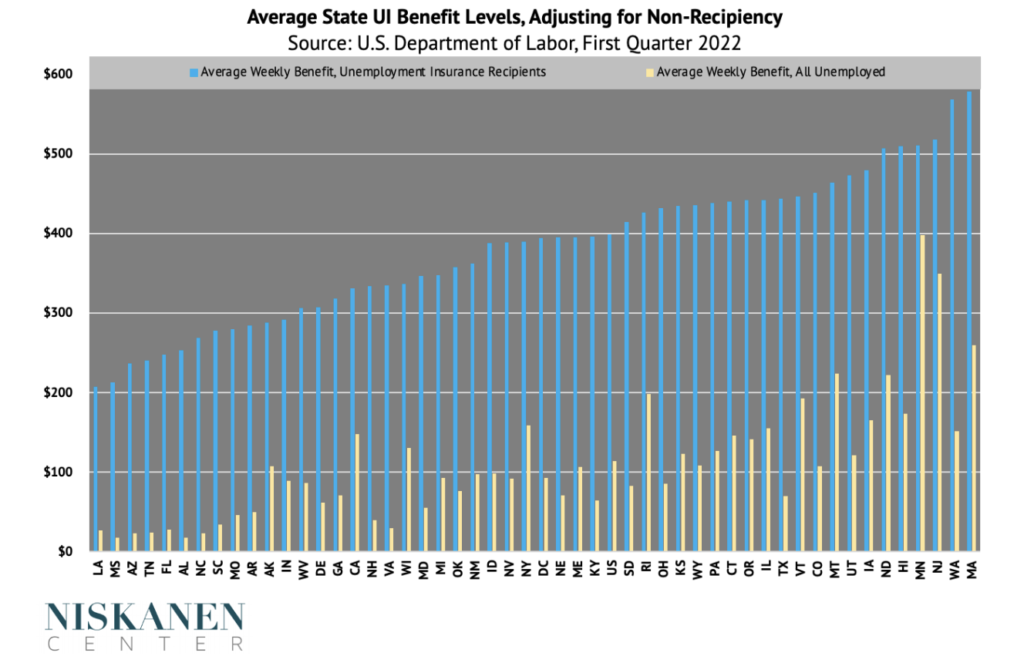

In most states, unemployed workers receive an average UI benefit of under $100/week.

Serious misconceptions surround unemployment and unemployment insurance (UI). The extent to which unemployment occurs across the nation in all economic conditions is underestimated. Policymakers emphasize UI reforms during recessions and then erroneously disregard them afterward, despite the need for better benefits in good labor markets too. The lack of legislative urgency can also be attributed to another illusion: states’ average benefit sizes are worse than they appear. Working families have shakier financial stability due to the stingy benefit levels.

On average, UI benefits replace 40 percent of recipients’ prior wages (with variation among states), which is not enough to remain secure between jobs. This low rate of wage replacement still paints an overly optimistic picture, though. When the Department of Labor tabulates average benefit levels, it only includes unemployed people who are receiving UI. However, just around a quarter of unemployed workers receive UI (a much lower rate than a few decades ago).

Many unemployed workers miss out on UI benefits by design. Strict rules often limit program eligibility, while administrative burdens make it harder for eligible people to navigate the system, causing many to give up on applying altogether. Individuals might not even realize they qualify and aren’t informed otherwise. As a result, the average state UI payments received by all unemployed workers are dismal.

The figure below helps to visualize the generosity of every state UI program during the first calendar quarter of 2022. The lines in blue represent the average weekly benefit amounts for UI recipients, while the yellow lines represent the average weekly benefit amounts for all unemployed workers (both UI recipients and unemployed non-recipients).

In every state, UI recipients received an average benefit of at least $200/week. In contrast, unemployed workers in only five states had average benefits in excess of $200/week. Twenty-eight states had average benefit sizes under $100/week when including non-recipients in the calculations. New Jersey and Minnesota were the only states where the average benefit size for all unemployed workers kept individuals above the poverty line. In addition, New Jersey and Minnesota were the only two states where the median UI benefit was greater than $0 for all unemployed workers. Average benefit amounts for recipients can be a mirage when few manage to qualify and overcome program hurdles.

These inadequate benefits directly hurt unemployed workers’ financial wellbeing, compel employed workers to stay in bad work conditions, and lead to lower salary levels and worse quality matches between employees and employers. When the alternative to a substandard job is poverty, it is harder for people to make independent choices. Workers can utilize unemployment insurance as a bargaining tool and a set of protections, but only if benefit eligibility and sizes are both improved. These UI reforms warrant immediate Congressional attention.