I have argued elsewhere that the revenues produced by a carbon tax-for-regulation swap should be used to pay for tax cuts or returned to taxpayers via lump-sum rebates. This is the most attractive scenario if a carbon tax emerges as part of a larger effort to reform the tax code or as a stand-alone measure to supplant EPA greenhouse gas regulation.

But what if a tax-for-regulation swap were to come up in an attempt to address budget deficits and the looming fiscal imbalance? Many conservatives fear exactly that, which is why they are reluctant to promote a tax-for-regulation swap. But even were those fears realized, conservatives should take heart: using carbon tax revenues to reduce the deficit makes good economic sense.

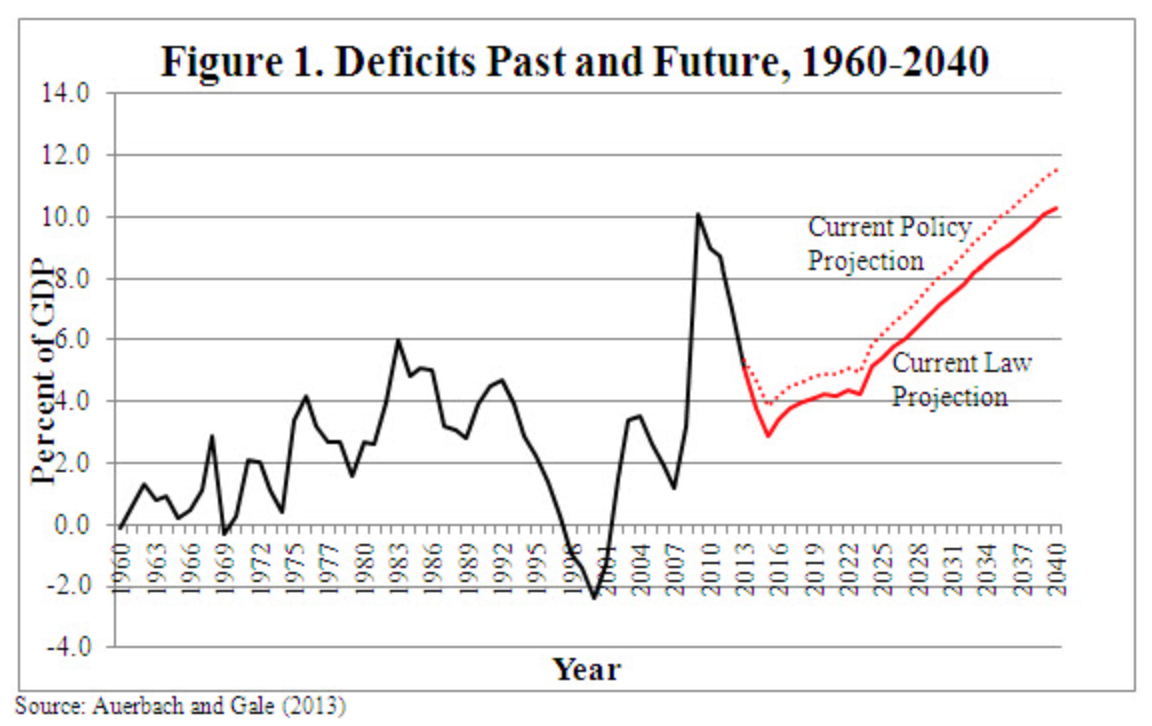

An examination of the fiscal outlook of the United States, as provided by economists William Gale, Samuel Brown, and Fernando Saltiel, sets the stage for why a carbon tax might be on the table as part of a larger deficit reduction program.

The federal debt-to-GDP ratio, after averaging 37 percent of GDP over the 50 years prior to the Great Recession, will pass its 1946 all-time high of 108.6 percent in 2035 due primarily to projected increases in health care costs associated with the Medicare and Medicaid programs. At present, net governmental debt in the United States is even higher than in the Euro area and, in fact, everywhere else in the world save for Japan. A European-style debt crisis—with all the attendant severe economic and political implications—cannot be so lightly discounted if the United States continues along its present path.

Even so, economists generally agree that debt at these levels increase interest rates, reduce national savings, and harm future GDP growth rates. By 2022, economists Alan Auerbach and William Gale warn that the increase in the U.S. debt-to-GDP ratio from earlier in the decade through 2022 will reduce the economy’s growth rate by 0.675 percentage points.

Returning the long-term debt-to-GDP ratio to where it was in 2012 (70.1 percent) would require a permanent increase in taxes or reductions in spending equal to 4-7 percent of GDP through 2089. Spending cuts of that magnitude would be politically unprecedented. Consider the three largest deficit cutting budget deals of the past when the job of budget-cutting was politically easier to manage:

- The 1983 Social Security Reform package reduced deficits by 1 percent of GDP in the four years after its passage.

- The 1990 budget deal reduced deficits by 1.4 percent of GDP over the five years after its passage.

- The 1993 budget deal reduced deficits by 1.2 percent of GDP over the five years after its passage.

None of those deals, needless to say, relied exclusively (or even primarily) on spending cuts to reduce the deficit. And given the current political landscape, there’s little reason to think that budget cuts will be more attractive in the future. Consider a late-2013 survey, which found that 62 percent of Republicans say that protecting current levels of spending for Medicare and Social Security is more important than cutting the deficit (to say nothing of the 79 percent of Democrats or 66 percent of Independents who say the same). A 2010 survey even found that 70 percent of those who self-identify with the Tea Party movement oppose cuts to Medicare or Medicaid to help close the deficit. If significant spending cuts are hard deliver today, they will likely be even harder to deliver tomorrow as America ages and relies more heavily on the very programs that need to be addressed.

A carbon tax cannot, by itself, solve our fiscal problems. It can, however, make a significant contribution. Economist Gilbert Metcalf estimates that a $30 carbon tax that increased reasonably over time could, by the year 2050, raise 0.79 percent of GDP (0.49 percent of GDP if distributional offsets are provided to protect low income households).

Many conservatives, however, think that the best way to contain spending is to starve the government of tax revenues. Adopting a carbon tax to reduce debt, they believe, takes policy in exactly the wrong direction. But government—as we can see in the above figure—continues to spend whether tax revenues can support that spending or not. In fact, recent research suggests that tax cuts have led to increases in government spending and, subsequently, increases in taxes to offset the hit to the Treasury. This could be because:

- Political decisions about spending are made independent of political decisions about taxes;

- Tax cuts weaken the link in voters’ minds between spending and taxes and thus increases demand for more spending; and/or

- Irresponsibility regarding taxes breeds irresponsibility regarding spending.

Some conservatives, of course, will argue that increased revenues from a carbon tax—were they incorporated in a deficit reduction deal—would almost certainly fuel additional spending and thus have no impact on the debt. While that can’t be ruled out, it is worth noting that large-scale budget deals in the past have indeed reduced deficits. It takes no great leap of faith to believe that past is prologue.

Conservatives are right to worry that tax increases will have a negative impact on economic growth. But it’s unclear how much of an impact. Harms, after all, would be offset by reductions in future tax rates (taxing today to pay off debt rather than taxing tomorrow to do the same), a reduction in interest rates, and an increase in public savings, both of which would follow from a lower deficit. A recent study from economists at Resources for the Future suggests that using carbon tax revenues to reduce the deficit provides even greater economic returns than using those revenues to cut taxes now.

It is unlikely that carbon tax revenues will be used to retire debt outside of a larger budget deal. Selling one serving of political spinach (a carbon tax) is hard enough. Selling an entire plate of spinach (a carbon tax and deficit reduction) is harder still.

Such a plan might become politically attractive, however, if political leaders have already made the decision to (finally) confront America’s staggering public debt. In that case, tax revenues will likely have to be raised somehow, and raising them by taxing pollution—and thereby addressing the risks associated with climate change—is a more salable alternative than raising them by directly taxing income or labor.