Renewable energy is ascendant. In energy markets in the U.S. and abroad, wind and solar are gaining ground and competing against traditional fossil fuel energy sources for market share. This momentum has been seized upon by proponents of the renewable energy transition, and climate advocates, to argue that the age of fossil fuel dominance is coming to an end.

In response to these claims, Mark Mills, of the Manhattan Institute, argues in his piece “The ‘New Energy Economy’: An Exercise in Magical Thinking,” that renewable energy faces practical constraints in terms of resource intensity and cost. He argues that when those are considered carefully, renewables will not be able to supplant the convenience of fossil fuels in the near future.

There are real economic and physical challenges to transitioning our hydrocarbon-based energy system to one dominated by renewables in a timely manner. We cannot underestimate the role hydrocarbons play and will continue to play in our global economy. However, Mills’ claim that the physical limitations of renewables, compared to those of hydrocarbons, make the transition to a new energy economy impossible mischaracterizes the material challenges associated with creating a renewables-based grid and the significant progress being made in the renewable energy industry.

Putting the challenge of scale into perspective

Mills begins his piece by considering the “moonshot” required to ramp up renewables to the point where they could replace hydrocarbons on a global scale. Completely replacing hydrocarbons over the next 20 years would take an unprecedented scaling up of renewable energy production and infrastructure and would be exorbitantly expensive. Fortunately for climate advocates, limiting global warming to 2 ̊C does not require that renewables completely replace hydrocarbons over the next two decades, even if we will be using a lot more than today.

A recent report from the International Renewable Energy Agency finds that limiting global temperatures to 2 ̊C requires that renewables’ share of total final energy consumption would only have to reach 65 percent by 2050, an increase of 47 percentage points against today. Similarly, deep decarbonization in the U.S. does not require the complete phaseout of fossil fuels. A 2014 report from the Deep Decarbonization project modeled different pathways to achieving an 80 percent reduction in greenhouse gas emissions by 2050, and none of its decarbonization pathways involve completely replacing fossil fuel capacity. Even the report’s most ambitious renewables case, where wind and solar make up roughly 80 percent of electricity generation, still includes fossil fuel electricity generation without any carbon capture technologies.

Of course, the transition to a renewables-dominated energy system will take a significant amount of investment and will certainly entail systemwide costs (more on this later). However, the realization that limiting global temperature rise to 2° C and decarbonizing the U.S. economy does not require eliminating hydrocarbons from our energy mix helps put the challenge into perspective, and makes this target much more manageable.

Much of Mills’ piece focuses on the power sector, where renewable resources are taking big bites out of fossil fuel generation. The most pressing material concern of any power system is ensuring energy availability. And Mills is correct that fossil fuels, particularly oil and gas, are flexible and convenient when it comes to energy storage. Because hydrocarbons can be easily stored, conventional power plants can be dispatched fairly easily to follow cyclical demand for electricity. The intermittency of wind and solar resources makes matching fluctuating supply with demand much more complex and will require a build-out of new transmission and energy storage infrastructure to ensure power availability.

Mills argues that modern battery technology is too inefficient and expensive to backstop a renewables-based energy grid. And that may be true, but Mills’ analysis overemphasizes the role that batteries will have to play in order for a renewables-dominated grid to meet U.S. electricity demand. He stipulates that it would take Tesla’s Gigafactory 1,000 years of production to store two days’ worth of U.S. electricity demand. The basic arithmetic is correct, but the figures he is using are arbitrarily selected and go far beyond what experts say is necessary for renewables to meet U.S. electricity demand and decarbonization goals.

A 2018 study published in the journal Energy & Environmental Science analyzed 36 years of hourly U.S. weather data to understand the geophysical constraints to supplying electricity with only wind and solar power, and found that 80 percent of the U.S. grid could be powered by the combination of the two. This level of renewable energy penetration must be accompanied by either a network of high-voltage transmission lines or by the construction of enough storage capacity to meet 12 hours of U.S. energy demand. The U.S. currently uses 4,200 terawatt-hours (TWh) of electricity per year, and back of the envelope calculations suggest that a 12-hour chunk of that would be roughly 5.8 TWh. At a battery-pack price of $176 per kilowatt hour, that would cost roughly $1 trillion — a substantial, but not inconceivable investment, especially since battery prices are still experiencing significant cost reductions.

Even though the U.S. is on track to build 2,500 MW of energy storage by 2023, building enough batteries to store 12 hours of electricity demand is still a massive infrastructural challenge. For example, it would take 165 years of Tesla Gigafactory production (35 GWh per year) to produce 12 hours of storage capacity. While this will require a significant investment, putting the amount needed into perspective will help provide clarity and certainty to utilities and investors and mobilize the resources necessary to achieve decarbonization targets. It is important to note, moreover, that the study mentioned above analyzed the build-out of energy storage necessary to handle high levels of renewable energy penetration without considering other mechanisms to improve energy availability.

In reality, a renewables-dominated power grid will not depend solely on battery storage to meet cyclical surges in demand. Instead it should include a broad portfolio of supply- and demand-side flexibility measures: Improving demand-side interruptible loads, increasing energy efficiency, transmitting greater amounts of power over long distances, and using natural gas power plants for on-demand generation will all lessen the burden on battery technology. A 2012 National Renewable Energy Laboratory study envisioned a more flexible approach to a high-renewable electricity future in the U.S. by 2050. The authors found that renewable generation sources could adequately supply 80 percent of total U.S. electricity generation in 2050 while meeting electricity demand at the hourly level. 50 percent of renewable energy capacity would come from variable wind and solar photovoltaic sources. Storage capacity would have to increase to roughly 100 to 152 GW in 2050, which does not seem unlikely. Bloomberg’s latest “Long-Term Energy Storage Outlook” expects the cumulative global energy storage business to grow to 942 GW by 2040, with the U.S. being one of the leading markets. The report estimates that by 2040, the U.S. will have over 100 GW of cumulative storage capacity deployed.

Mills is justified in his concern that a transition to a grid dominated by renewable energy will entail complex material and infrastructural challenges, but the 100 percent renewables vision he is outlining is not what experts say is necessary. The goal is to decarbonize our electricity systems, which will require a wide variety of energy generation technologies including biomass, advanced nuclear, and even fossil fuels equipped with carbon capture technology, as well as renewables. Additionally, we should not dismiss the role of energy efficiency measures in achieving this goal. In fact, half of the carbon dioxide emission reductions in the electric power sector since 2005 have come from slowing growth in demand for electricity. While the 2008 recession played its role in reducing electricity demand, since 1990, energy efficiency has become the third largest electricity resource in the United States.

The scale of the challenge is surmountable when put into the context of what is necessary to achieve a decarbonized power grid. Exploring the recent economic trends occurring within the renewable energy industry reveals promising signs that the material challenges associated with this transition are not economically out of reach.

Price concerns are outdated

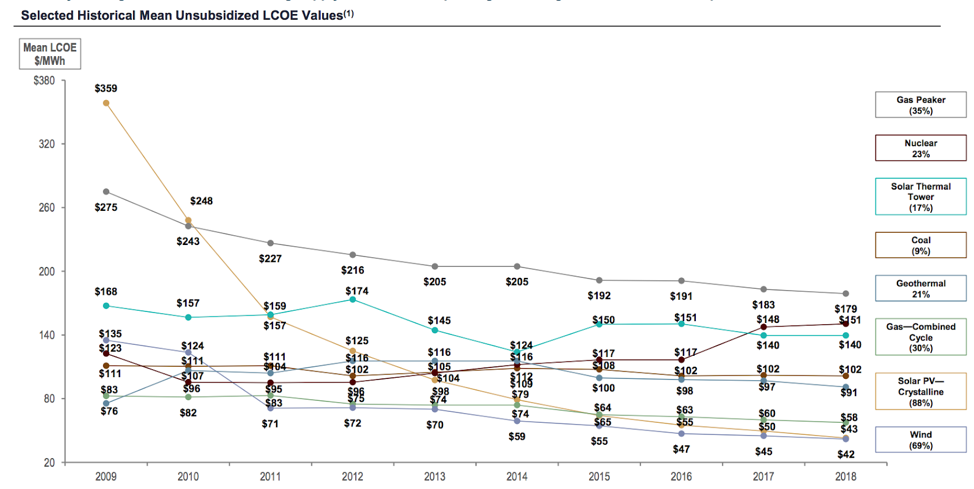

The transition to a new energy economy does not rely on “magical thinking,” as Mills would argue, but instead relies on attractive economics. Fortunately, significant cost reductions are driving unprecedented growth in the renewable energy industry. Levelized Cost of Energy analysis from Lazard finds unsubsidized wind and solar to be cheaper on the margin than coal, and even cheaper than natural gas in some cases:

However, Mills attacks the credibility of such LCOE analysis for making renewables-biased assumptions about natural gas prices and about capacity factors — the amount of power a plant actually produces in a given period compared to its maximum capacity. He argues that natural gas prices have decreased over the past decade and that assumed capacity factors are higher than actual capacity factors for renewables.

According to data from the Energy Information Administration, natural gas prices have in fact been increasing since 2016, and although they will remain relatively low, they are estimated to continue rising into the future. Lazard’s 2018 LCOE analysis used a natural gas price of $3.45, and at the time of its publication in November the Henry Hub spot price for natural gas was at $4.68. This spike in the price of natural gas was driven by forecasts for extremely cold weather across the U.S. and indicates how volatile natural gas prices can be. Given these trends, natural gas prices used in LCOEs do not always bias calculations away from gas.

Capacity factors used in LCOE analysis are arbitrarily assumed and are usually inflated, as Mills points out, but that is true for all generation technologies, not just renewables. Lazard’s LCOE uses capacity factors that are based on upper limits, most likely coming from newer plants. The analysis uses capacity factors for wind and solar of 55 percent and 34 percent respectively, and 93 percent and 80 percent for coal and gas combined-cycle plants respectively. Capacity factors recorded in 2018 by EIA found wind and solar to operate at 37 percent and 26 percent respectively. Capacity factors for coal and natural gas were found to be 54 percent and 58 percent respectively. Thus, comparing assumed capacity factors in Lazard’s LCOE analysis with EIA data, the capacity factors for fossil fuel plants are more inflated than those for renewable energy generation technologies.

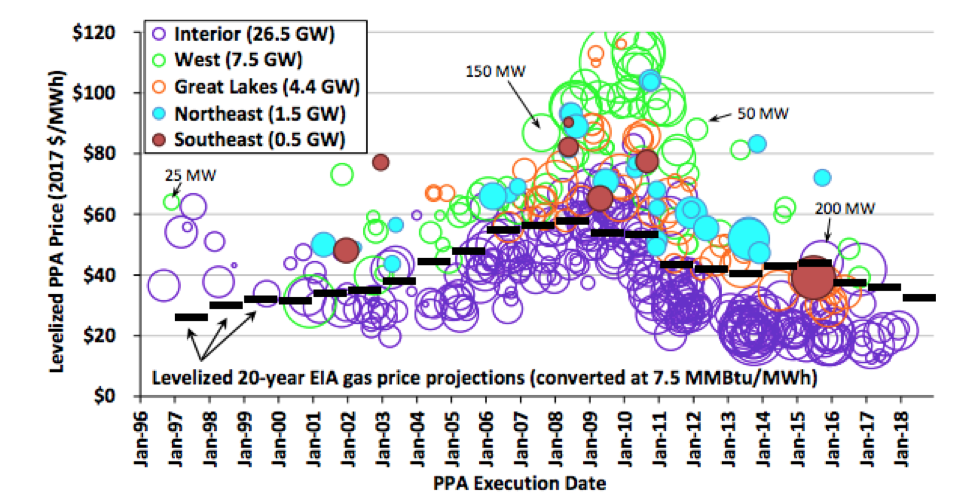

There is certainly room for improvement in LCOE analysis, but these studies do provide a relatively accurate picture of the cost trends in the power sector. In fact, recent data on purchase power agreements (PPAs) are consistent with Lazard’s estimates. In June 2018, NV Energy asked regulators to approve six solar PPAs, all of which netted contracts under $30 per MWh, which is right on par with Lazard’s cost estimates for subsidized solar power. The utility even set a new low-cost record when it entered into a 300 MW PPA at $23.76 per MWh for 25 years. A Department of Energy report published last year found that the average PPA price for wind projects in 2017 fell to $20 per MWh, also in line with Lazard’s estimates of subsidized wind prices of $14 to $47 per MWh. PPA prices do vary by location, and a majority of these projects were found in wind belts in the U.S. But the overall trends are in line with estimates coming from LCOE analysis, and are further evidence that wind and solar energy technologies are experiencing dramatic cost reductions that are making them competitive and cost-effective sources of electricity.

Mills’ main concern with LCOE analysis is that these studies consider the costs of producing electricity on each source’s own terms while ignoring the real-world imperative of supplying 24/7 power, a concern Mills shares with many. While renewable energy plants have zero fuel costs, they rely on sources that are inherently variable.

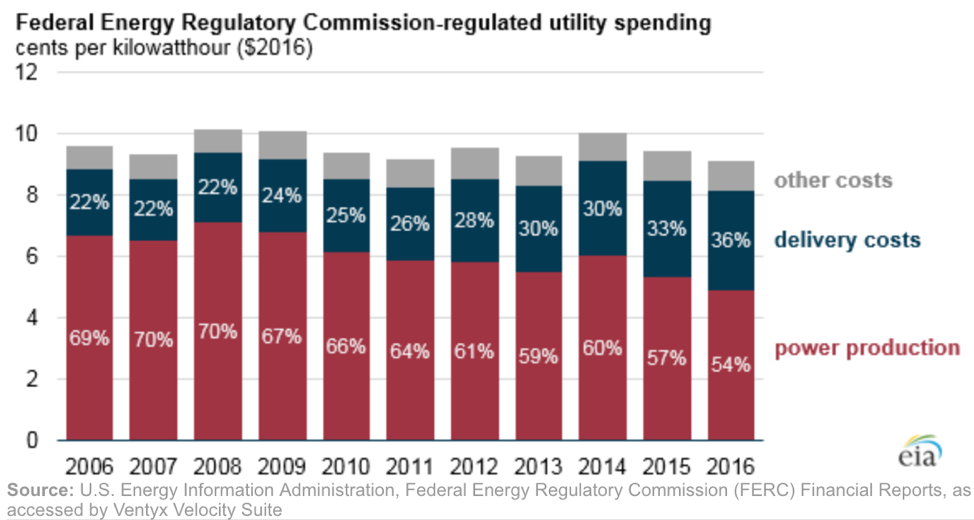

As noted above, at high levels of renewable energy penetration, this variability will require systemwide improvements in storage and transmission infrastructure. Mills and many others are concerned that increased levels of renewable energy penetration into the grid will thus result in higher electricity prices for consumers. As evidence, Mills claims that declining fuel costs for coal and natural gas over the last 15 years should have resulted in declining retail electricity prices, but that instead, average U.S. residential electric costs have risen by 20 percent over the same period. However, this is a misleading depiction: The figures that Mills uses as evidence of price increases are nominal values, meaning they have not been adjusted for inflation. Federal data shows that the inflation-adjusted price of electricity has actually fallen over the last decade.

The overall price decline was driven by a fall in generation prices, which was largely due to the nation’s burgeoning supply of natural gas. But over the same decade electricity generation from renewables grew significantly, and further growth could lead to generation costs falling even more. A study from the Lawrence Berkeley National Laboratory found that in a power grid where solar and wind make up 40-50 percent of generation, wholesale energy prices could drop by as much as $16 per MWh.

However, wholesale electricity prices are only half the picture — the prices consumers pay for electricity account for transmission and distribution costs, as well as the reliability costs associated with maintaining a stable energy grid.

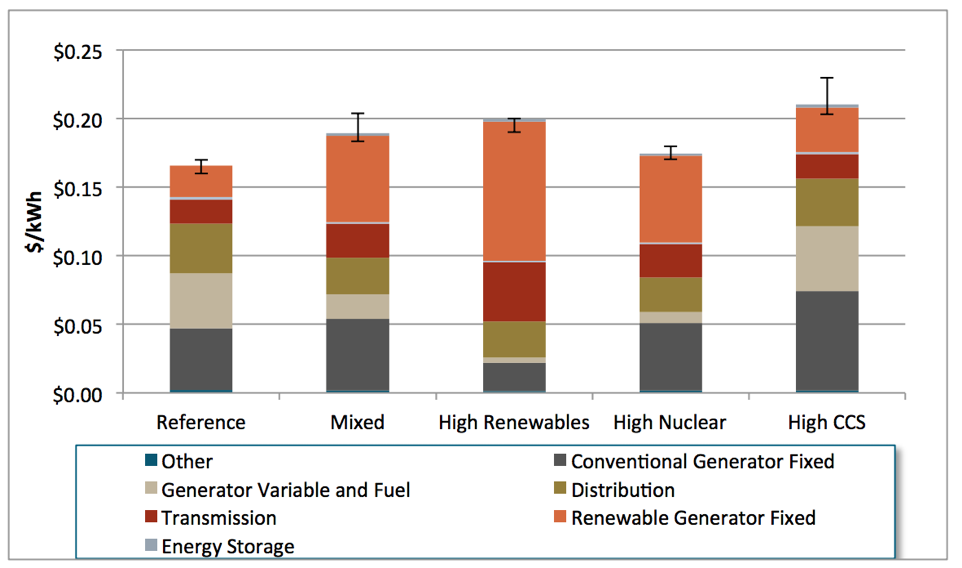

Careful analysis that includes all those factors suggests that the higher systemwide costs associated with renewables generation will be manageable. The 2014 Deep Decarbonization report found that the cost of a high-renewables future, where wind and solar provide more than 50 percent of the energy supply, is roughly $.04 per KWh higher than the baseline. The result is a total electricity cost of $.20 per KWh (the average cost right now is $.13 per KWh). Well over half of the baseline costs are a result of the fixed costs of renewable generation, which are primarily made up of the capital costs of this technology.

Close to a third of the estimated $.20/KWh price comes from storage, transmission, and distribution to handle the intermittency of renewables — at a cost 25 percent higher than in the baseline case. But there is reason to believe the 25 percent increase in the Deep Decarbonization report is high. The report took a conservative approach and assumed technology costs would remain relatively flat for many technologies till 2050. This has certainly not been the case so far, as wind, solar, and battery technology costs have dropped significantly and are predicted to keep falling, which will in turn reduce the system costs of a high-renewables future.

Mills, however, points to Europe as a prime example of greater renewables penetration resulting in higher electricity prices. This is not surprising, considering that these countries were subsidizing expensive, early-stage technology. The European experience with renewable energy and its impacts on electricity prices is markedly different than the U.S. experience. The design of these programs in Europe, and Germany in particular, was such that customers were paying a renewable energy surcharge, whereas in the U.S., part of our renewable-energy subsidies go through the tax system (by lowering investors’ tax liabilities) and bypass consumer electricity prices.

Ultimately, greater levels of renewables will require a new way of operating the power system, and there are very real costs to handling the intermittency of renewables. But painting the relationship between increased renewable energy generation and higher electricity prices as causal is overly simplistic. If the capital costs for renewables keep falling, as expected, then the increased systemwide costs of a high-renewables future could be greatly reduced. Continuing to deploy these technologies will lead to further cost reduction and will make a high-renewables future much more affordable.

That being said, all industries are subject to the law of diminishing marginal returns, where every incremental gain yields less progress than in the past, and as Mills points out, the renewable energy industry is no exception. He argues that the gains in the renewable energy industry “are now all measured in single-digit percentage gains,” and that we should not expect any revolutionary improvements that could make a new energy economy possible. But he goes astray once more when he argues the reason we should not expect any more massive gains in these technologies is that we are reaching their physically-imposed energy limits.

Although the renewable energy industry will certainly experience diminishing marginal returns, the potential cost reductions for both solar and wind technology could go well beyond single-digit percentages. A 2016 report from the International Renewable Energy Agency concluded that wind and solar costs could fall by as much as 35 percent and 59 percent, respectively, between 2015 and 2025. However, these cost reductions are heavily dependent on ensuring that a virtuous cycle of policy support driving increased deployment, technological improvements, and cost reductions remains in place.

Focusing on the conversion of photons to electrons to demonstrate that cost reductions in the renewable energy industry will be limited is smoke and mirrors. Based on EIA data, coal, natural gas, and petroleum power plants have an efficiency of 33, 44, and 31 percent respectively. As Mills points out, the efficiency of solar PV panels currently sits around 26 percent, while the efficiency of wind turbines is roughly 45 percent. Clearly, it is difficult to convert energy into electricity for all sources. The main point, however, is that the efficiency rates of wind and solar technologies do not need to improve by much (or in the case of wind, at all) to make them as efficient as fossil fuel sources.

In fact, the incremental cost reductions in the renewable energy and battery storage industries have brought them to a point where they are already cheaper than coal and could soon be competitive with natural gas. Just last year, a utility company in Colorado decided to retire two coal plants and replace them with 1,800 MW of solar, wind, and battery storage technology, a move that could save ratepayers $213 million to $375 million. The decision is due to the fact that the utility company has solicited record-low clean energy prices, with wind pricing at $11 to $18 per MWh and solar-plus-storage coming in at $30 to $32 per MWh. This shift is being mirrored by utilities across the country. PacifiCorp utility recently proposed a plan to retire four coal units in Wyoming and replace them with a portfolio of wind, solar, and storage technologies, a move it says will save customers $248 million over the next 20 years.

Although natural gas plants made up most of the power sector’s 2018 capacity additions, utility-scale renewables had made up the majority of capacity additions since 2014, and now proposals to build new natural gas plants are drawing increasing scrutiny from state regulators. In April, Indiana regulators rejected a proposal by Vectren, an electric and gas utility, to replace a baseload coal plant with a new, 850 MW natural gas plant because of concerns about stranding a $900 million energy asset in the face of declining renewable prices. The regulators argued that the utility company had overestimated the costs of renewable energy and screened out multiple less expensive alternatives. California utility Southern California Edison recently selected a portfolio of energy storage projects totaling 195 MW instead of a 262 MW natural gas peaker plant to supply local capacity needs, while Arizona recently extended its moratorium on new gas plants over 150 MW to allow the state more time to consider renewable alternatives.

Of course, part of the explanation for this increased skepticism of new natural gas plants is that states have adopted policies that support the build-out of renewable energy, such as Renewable Portfolio Standards and clean energy mandates. However, the economics of renewables has also been a significant factor behind this trend.

The figure above, from the Department of Energy report mentioned earlier, demonstrates that the price of wind PPAs in the U.S. Interior region, but also in some other regions, has become competitive with the projected fuel costs of gas-fired combined-cycle generators over time. These PPAs do benefit from the tax credits that the wind industry receives, and cost reductions will likely slow when the credit expires. However, McKinsey’s Global Energy Perspective finds that by 2030, new-build renewables will outcompete both coal and gas in most regions of the world, conclusions that are also echoed in Bloomberg’s New Energy Outlook for 2019.

Focusing on the conversion limits of renewables is a distraction from the current economics of renewable energy technologies. The economic trends of different generation sources, and the significant gains still to come, demonstrate that revolutionary and massive improvements in the costs of renewable energy technologies are no longer necessary to make them cost-competitive. We are entering a period where utilities are forgoing running costly coal plants and are skeptical of building natural gas plants and are instead opting to build new, clean energy portfolios.

The transition to a new energy economy is worth it

The concerns that Mills raises in his piece should be taken seriously. There are very complex physical and economic challenges associated with the transition to a renewables-heavy power system, but they are not as insurmountable as Mills claims. There is a reason why solar and wind will account for 64 percent of utility-scale additions in 2019, and why renewables will be the fastest growing source of electricity generation in the U.S. for the next two years, while fossil fuel capacity will only increase about 1 percent by 2022. It is because the transition to a decarbonized energy grid is worth it, especially when you consider the very real and substantial social costs of using fossil fuels.

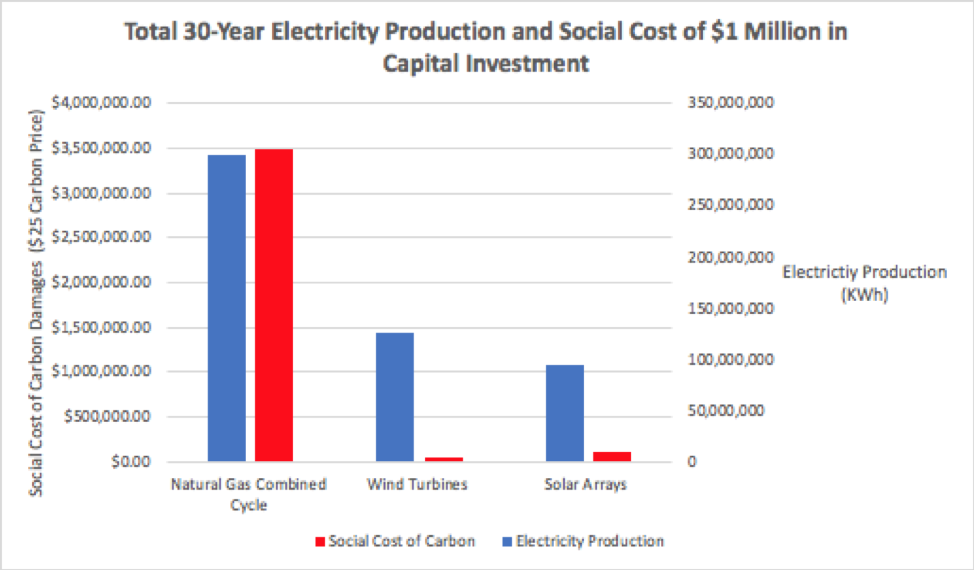

To illustrate this point, one can compare the total 30-year electricity production from $1 million in hardware among a natural gas combined-cycle plant, wind turbines, and solar arrays. Mills uses a similar comparison to argue that hydrocarbons produce more energy per dollar of capital invested than both wind and solar. He claims,

“With today’s technology, $1 million worth of utility-scale solar panels will produce 40 millon kilowatt-hours (KWh) over a 30-year operating period. A similar metric is true for wind: $1 million worth of modern wind turbine produces 55 million KWh over the same 30 years. Meanwhile, $1 million worth of hardware for a shale rig will produce enough natural gas over 30 years to generate over 300 million KWh.”

If only the upfront capital cost of energy sources dictated the decisions of investors, then we would expect fossil fuels to dominate new capacity builds and investment flows to new generation technologies, but as has been demonstrated above, this is simply not the case.

Using only the energy density and the capital cost per kilowatt of capacity to compare energy sources gives an incomplete comparison of different generation methods. All forms of power generation require capital investments that will convert the energy source into electricity, but there are a host of other costs that must be considered. For example, using hydrocarbons to produce electricity entails fuel costs. From a utility or consumer perspective, the final electricity prices of hydrocarbons are inherently volatile because they are tethered to prices of the fuel. Additionally, natural gas needs to be processed, transported, and then regasified, all of which entail further costs. Moreover, Mills’ footnotes admit that his calculations do not include the $1,000/KW of capital cost of a turbine generator for natural gas, which further skews his numbers. By contrast, renewable energy technologies have fuel costs of zero. The price of renewable energy ultimately depends on technology costs, which are only coming down. So although renewable energy technologies tend to have higher capital costs, their minimal operation and maintenance costs and zero fuel costs can easily make them cost-competitive with hydrocarbons.

Just as the real-world systemwide costs of intermittent renewable energy should be taken seriously, so too should the real-world, hidden costs of fossil fuel generation. Energy generation using hydrocarbons produces externalities in the form of greenhouse gas emissions that contribute to global warming and thus lead to environmental damage and related social costs. Although there are various difficulties in determining the exact value for the social costs of carbon, taking them into account illuminates the real costs of using hydrocarbons.

Accounting for the emissions over the entire life cycle of a power plant, 300 million KWh of electricity produced from a $1 million investment in a natural gas combined cycle plant would produce nearly $3.5 million in damages at a very modest $25-per-metric-ton carbon price. Comparatively, wind and utility-scale solar plants would produce $44,000 and $96,000 in damages, respectively. Although wind and solar plants currently produce less electricity output per dollar of capital invested, they also produce significantly less damage from greenhouse gas emissions, and these benefits can manifest themselves in reduced ecosystem, infrastructure, and even health costs. These are real economywide costs that must be considered when comparing conventional generation sources to alternative sources such as renewables. These costs can either be internalized via a carbon price, or we can continue to pay these costs in damage to our ecosystems and infrastructure.

The declining costs of renewable energy technologies, coupled with the consideration of the environmental damage caused by hydrocarbons, have swayed investors and utility companies to believe that the transition to a new energy economy is worth it, and the American public seems to be in agreement. This transition will undoubtedly be challenging, but we should not allow overblown concerns to paralyze the significant progress being made in the energy space. We must seize and sustain this momentum to ensure that near-term transition to a new energy economy remains within reach.

Image from Pixabay Stock.