The United States has a patchwork of safety net programs designed to protect workers against job loss. These include both means-tested programs that target low-income individuals and households, and social insurance programs that workers pay into and from which they can claim benefit. These programs often prove invaluable given that the median displaced worker doesn’t have enough savings to cover even one month’s worth of expenses — an evergreen truth that’s only now become more widely recognized given the broad-based economic fallout from the COVID-19 pandemic.

Yet of all the myriad programs that are out there, which matter most for displaced workers? In a new National Bureau of Economic Research (NBER) Working Paper, coauthor David Simon and I study the efficacy of the U.S. safety net at insuring workers against the loss in resources experienced following a job loss. We take a comprehensive view of all the major federal safety net programs and ask:

- Which programs provide the most buffering against job loss?

- How does this vary by pre-job-loss characteristics? and,

- What does that tell us about the important gaps in our current safety net?

To answer these questions, we use the Survey of Income and Program Participation (SIPP) from 1996-2013, which allows us to implement event study and different style models with individual fixed effects to compare changes in individuals’ income before and after a job loss.

The Importance of Unemployment Insurance

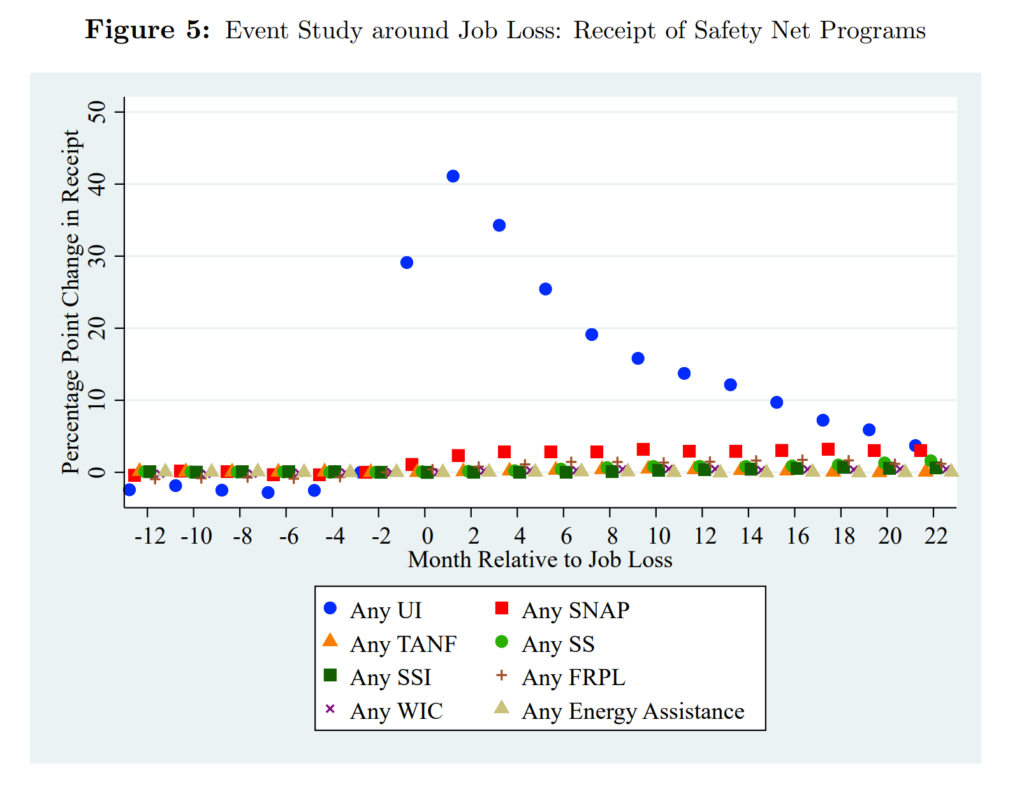

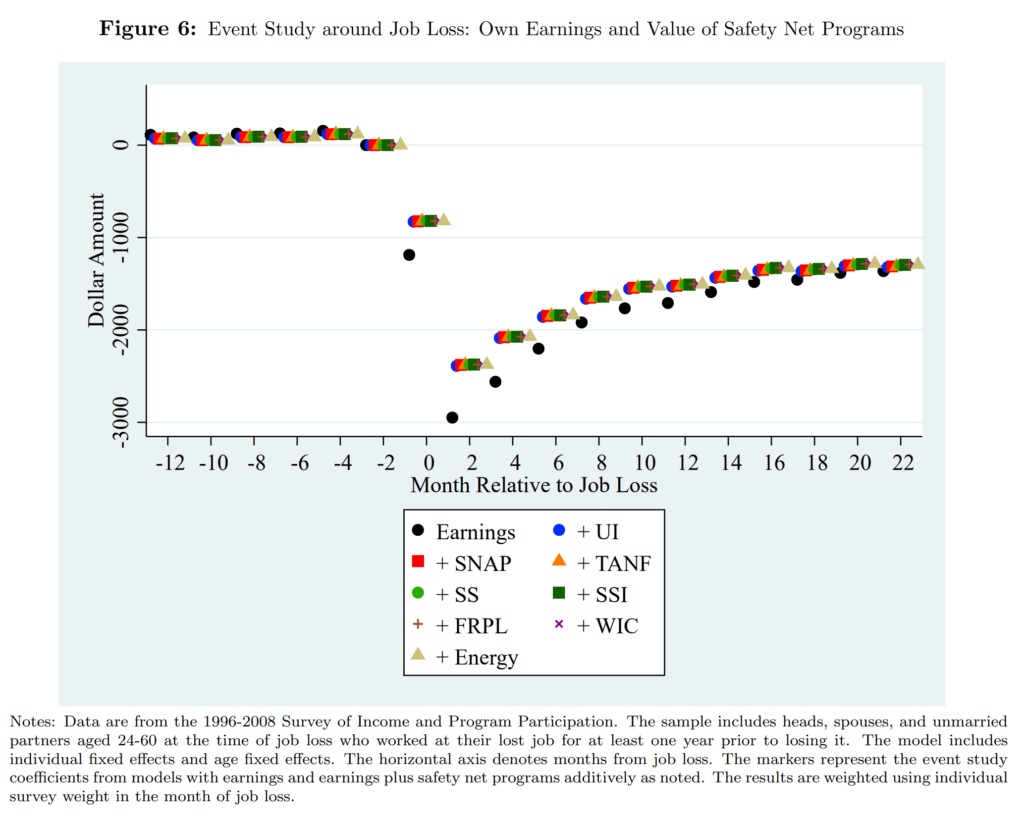

Of all the major safety net programs we considered, we find that Unemployment Insurance (UI) is by far the most important program at insuring the average job loser against lost income. However, the entire safety net replaces only 22 percent of lost income on average, and the percent replaced is actually lower for the neediest compared to middle-income displaced workers. This turns out to be due to important gaps in eligibility for UI for lower-income individuals. In particular, UI does not cover self-employed or gig-workers, and workers must meet minimum earnings and work history requirements (which vary by state) to qualify. These exclusions leave many low-income workers without any insurance from UI whatsoever. Moreover, income support from UI often runs out well before individuals’ earnings have rebounded, given the time-limited nature of the benefit.

While UI may be incomplete in its coverage, we find that means-tested programs nonetheless provide even less buffering in comparison. Workers who have household income below 200 percent of the poverty line before job loss were frequently participating in means-tested programs (most commonly SNAP and Free and Reduced Price Lunch) before losing their job. And while these workers did get slightly larger benefits after losing their job, the benefit increase was nowhere near as large and responsive as UI.

In the months immediately following job loss, we find that workers receive on average $639 per month (2020 dollars) from all safety net programs combined, of which $624 derives from UI. In part, this because UI is a much more generous program on average—paying more than triple the amount of monthly SNAP benefits for the average recipient. While means-tested programs are important for providing baseline support for the working poor, they do little to insure them against the income shock from a job loss.

Moving forward, there are many important changes to the safety net that should be considered to make it more inclusive and targeted to the neediest. Based on our analysis, expanding UI eligibility to include more lower-income workers, including self-employed and gig-workers, deserves to be high on the list. The federal response to COVID-19 included Pandemic Unemployment Assistance (PUA), which expanded UI eligibility to many historically un-covered groups. With the appropriate financing model, these eligibility expansions could be made permanent, thereby ensuring the full spectrum of workers have access to robust and responsive income support following a job loss.

Chloe East (@chloeeast2) is an Assistant Professor at the University Of Colorado, Denver, with expertise in Public Economics, Labor Economics, and Health Economics.