Social insurance programs are at the center of American politics. In fiscal terms, Medicare and the Social Security Administration’s programs for retirement, disability, worker’s compensation, and worker’s life insurance amount to roughly 41 percent of the federal budget. This fiscal centrality, however, does not rest on anything like a broader, public understanding of what makes social insurance social — and thus why such programs are so important in American political life. On the contrary, over the years our vocabulary of social insurance has become increasingly replaced with a vocabulary of welfare and redistribution, creating a fundamentally misleading impression about most of what the federal government does.

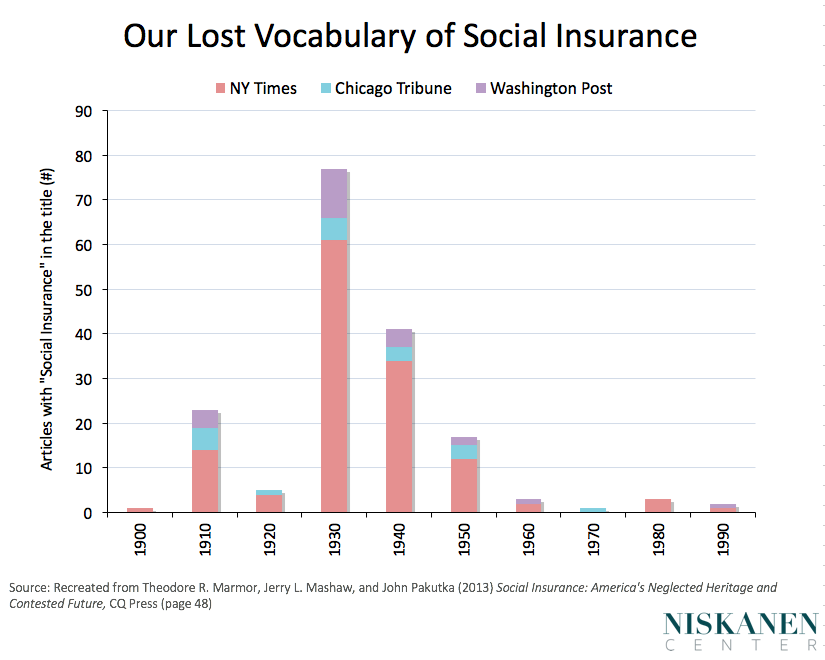

In the mid-1930s, when the retirement and survivors insurance programs had their legislative start, university-educated Americans had every reason to be clear about what distinguished social insurance from its commercial counterpart. Indeed, most undergraduate programs in the social sciences took up social insurance’s rationale and history. But note the data measuring the historical use of the expression in three of America’s most important daily newspapers. The changes recorded are startling. By the end of the 20th century, the category of social insurance had seemingly lost its place in the vocabulary of American politics.

This is particularly unsettling because of the enormous importance of social insurance programs in American history. The Great Depression, which wiped out the savings of most American families, caused multiple bank failures, and saw an unemployment rate of some 25 percent, prompted demands for substantially increased government protection against economic disaster. “Welfare” was the term used for programs that made poverty status the precondition for financial aid, and President Roosevelt acknowledged that immediate aid to poor families was required. But his case for increasing the footprint of American social policy was based on the principles of social insurance, not merely poor-relief narrowly construed.

By the 1970s, social insurance programs had become major components of the federal government, but also the targets of ideological and budgetary attack. Social Security retirement, Medicare, disability, and unemployment insurance were increasingly labeled as simply “entitlements,” and charged with contributing to out of control spending via unaffordable benefits. This allowed critics to advocate for a much smaller social policy commitment, urging a less costly “safety net” for the deserving among America’s poor citizens. The semantic bait-and-switch can be seen with Google’s Ngram viewer, which tracks word frequencies across the American English corpus.

Yet the principles and judgments incorporated in the concept of social insurance remain central to the major policy debates of our time, most dramatically in the debates over health care reform and the affordability of Social Security retirement benefits. They are relevant to the backlash against the Affordable Care Act and to the debate, rekindled recently, between the advocates of “Medicare for All” and advocates of Medicaid expansion as the next step toward universal health coverage. More generally, they are crucial to addressing the broader conservative critique of government’s role in American social policy.

So, What is Social about Social Insurance?

Social insurance, like commercial insurance, is about protection against financial risk. It is “insurance” in the sense that people contribute to a fund to protect themselves against unpredictable financial risks. These include outliving one’s savings in old age, the early death of a breadwinner, the onset of a disability that makes work difficult if not impossible, the high costs of acute illness, involuntary unemployment, and work-related injury. Yet unlike with commercial insurance, contributions are not prices in a market and thus do not depend on the contributor’s risk profile (unless commercial regulations say otherwise, in essence creating “social” insurance through the backdoor). Instead of a contract between an enrollee and an insurer, social insurance is a system of shared protection among the insured, most comparable to mutual insurance in the commercial realm, with contributions made in proportion to one’s market income. In social insurance, the “insurer”—whether a government agency or a corporate body with a joint labor-management board—is the agent of the contributing enrollees. And unlike commercial insurance, the social insurance “contract” mandates participation by law, since otherwise adverse selection would cause its unraveling.

Social insurance spreads the costs of coverage according to a different logic than that of commercial insurers. The same risk in commercial insurance carries the same premium price. The greater the risk, the higher the price of coverage. Social insurance, by contrast, operates on the premise that contributions are calculated according to one’s income and benefits according to one’s needs. But the central political feature of social insurance is that the contributors are also beneficiaries. This is not the case with social assistance programs with means-tested eligibility standards. As important as such programs are for those who experience poverty, taxpayers do not in general identify with welfare beneficiaries.

How much difference does it make that most contemporary reporting on social insurance programs, and much social science scholarship, ignores their conceptual underpinning and distinctive operational features? Should popular voices in American social policy be criticized for using proper names to describe programs without explaining their distinctiveness from means-tested welfare programs? I would not be writing this essay if I did not believe, as one of three co-authors, that the title of our 2014 book — Social Insurance: America’s Neglected Heritage and Contested Future — identified an important problem.

“Entitlement”-talk

Words make a difference to all thinking about public policy, but this is especially the case where conflicts are over fundamental values. Consider, for example, the common use of “safety net” as a collective description of programs as diverse as Medicare and Medicaid, old age Social Security, food stamps, disability insurance, and homeless shelters. This expression collapses the distinction between means-tested welfare and social insurance programs into a metaphor suggesting that recipients have to “fall” into poverty to warrant help. This is the opposite of social insurance, which represents a platform on which one can stand before economic risks arise. The term “safety net” is even more ambiguous, particularly when modified by terms like high or low, porous or tightly knit, threadbare or generous, or applied in situations when one’s financial resources are largely “spent.”

The use of public finance terms like “income transfers” further blurs the differences between cash benefits that one receives only after income and asset tests are applied and insurance payments that kick in without such tests. Then there is the term “entitlement,” which was meant to refer to the nondiscretionary nature of the spending, but now connotes an adolescent sense of entitlement among the beneficiaries. Neither term helps us understand the robust public approval of our major social insurance programs, and indeed, are often employed by opponents of social insurance in order to obfuscate an otherwise popular concept.

The negative connotation of “entitlements” is especially misleading. When one legitimately claims some social insurance benefit, the implication is that there is a corresponding duty to provide that benefit. That is the basis of the common sentiment among recipients of retirement income Social Security that they have earned their pensions. That widely shared sentiment largely explains the political fear that any substantial reduction in those benefits is a “third rail.” Few if any critics of the program criticize the appropriateness — or desirability — of OASI, the old age retirement and survivors insurance programs, on its own terms. Instead, they concentrate on claims that the programs are unaffordable. As a result, a large proportion of the public fears for their future despite the obvious political vulnerability of such critiques.

Understood as a technical budgetary category, entitlements in American fiscal policy are simply those programs whose benefits and beneficiaries cannot be adjusted without statutory changes. Administrations cannot simply reduce a program’s benefits or change its eligibility rules on their own. That entails constraints on administrative flexibility, reflecting the idea of stable governmental commitment to social insurance protections over long periods.

Using the entitlement category in two senses is confusing and in that respect harmful. What citizens believe about the appropriateness of a program is a distinct concept from the budgetary rules about changing its provisions. Both are important, but when was the last time you, the reader, saw this distinction explained when the entitlement term was used? Instead, “entitlement” is used like a four-letter word in diatribes about the supposedly troubled future of social insurance programs.

“Solvency”-talk

Still another source of linguistic confusion is what I will call solvency talk. When policy discussion turns to the fiscal projections of social insurance programs, critics and defenders alike turn to the trust fund. If the old-age retirement actuaries forecast a revenue projection of X in 25 years and the projected outlays of Y equal more than X, the “trust fund” is, according to this logic, in trouble. It will no longer have enough to meet its “bills” at that date. And if that shortfall were to continue, the necessary result would, in this framing, be insolvency, even though few policy experts seriously doubt the sustainability of programs like Social Security given fairly modest reforms, nor the political catastrophe of allowing the trust fund to run dry. In this sense, solvency talk is a lot like the threat of government shutdown created by the Federal debt ceiling — a crisis manufactured from the intransigence of elements on both sides of the aisle rather than anything fundamental.

Reflect for a moment about budget forecasts of Department of Defense outlays. Nobody writes about the military department going “broke” or becoming “insolvent” no matter how fast the growth in the budget. Indeed, no sensible analyst would make 20, 30, or 40-year forecasts for defense expenditures. Some analysts, in discussions of the future of Social Security make conditional forecasts long into the future. These are said to be useful exercises, reminding the public that commitments now have long-term effects. But the very preoccupation with solvency generates unnecessary anxiety. Since DOD does not have a “trust fund” budgetary categorization, its future outlays are presumed to be ones over which future governments have some control.

The same legal control is available to the Social Security Administration and the Congress. The confusion is even worse in programs that combined different funding mechanisms. For instance, funding for Part A of Medicare comes from the social health insurance trust fund (HI) while Part B is funded from general revenues and beneficiary premiums; it cannot go broke, but it can be reduced. That prompts solvency talk about Medicare’s future without clarification of how the program differs in two of its component parts.

The background of most solvency questions is the widely reported growth of the future retiree population. The Census Bureau projects that the over-65 population will soon make up 20 percent of the population. Such projections, unaccompanied by estimates of what increases in funding social insurance programs will require, prompt concern. Dire predictions of “insolvency” or cuts in retirement benefits get reported in the media without much scrutiny. As a public speaker, I face such questions regularly. I urge my questioners to dwell for a moment on how a growing proportion of senior citizens can be politically compatible with large reductions in future Social Security benefits. Put another way, how could the “sacred cow” of Social Security — in the language of its critics — face such a fate under conditions that, if anything, only cement its political sanctity?

There is another irony here that warrants discussion. The original use of trust fund language in social insurance had more to do with trust than with funds. President Roosevelt rightly felt in the 1930s that the contributory ethos of social insurance would come to be central to its secure political status. A population believing that each contributing worker had earned their social insurance benefit would not tolerate substantial budgetary cutbacks. The idea of a trust fund, then, was to emphasize the special status of a program whose benefits would be decades after a contributor’s payments. Its design is to enforce time-consistency, and its language is meant to highlight reliability. Yet sadly this language has since been turned upside down, bringing needless fear of “running out” of funds and thus uncertainty about the future. Roosevelt’s protective rhetoric backfired as the original understandings of social insurance weakened, even while the popularity of the programs remained substantial.

Social Insurance, Our Neglected Heritage

There are at least two plausible criticisms of this essay’s argument about the importance of relearning the appeal of social insurance principles. One is that the world has changed dramatically since the birth of social insurance in the late 19th century, let alone since the 1934-35 Committee on Economic Security provided a blueprint for expanding social insurance in American public life. The other is that changes in long-standing European social insurance programs show that major adjustments in the American programs are required as well.

The claim that the world has changed does not necessarily mean that the economic risks against which social insurance programs offer protection have been fundamentally altered. Consider every one of the risks noted in this essay — outliving one’s savings, involuntary unemployment, medical costs, and disability. Not one has disappeared, and social insurance programs for each have been implemented in wealthy democracies. I doubt, in other words, whether social insurance is in any conceptual trouble.

But that does not mean social insurance programs don’t need to adapt to contemporary circumstances. The spread of contract employment has been particularly challenging for European countries where social insurance is a function of trade unions and other sector-level organizations. It is equally obvious in the US that employer-provided health insurance puts a damper on labor market flexibility. Reduced employment in regular jobs with health coverage will demand the search for other sources of provision. These and other realities of our changing economy will only bring to the fore the central claim of this essay: Social insurance programs dominate American social policy but what that means for our politics is too little understood or explained. And that criticism extends not only to harried reporters but to a significant amount of the public policy community, as well.

Theodore (Ted) Marmor is a Niskanen Center adjunct fellow and Professor Emeritus at The Yale School of Management.