Key takeaways

- Contributory programs, which rely on payroll taxes to fund benefits based on workers’ previous wages, are an enduringly popular way to structure benefits for retirement, disability, unemployment, and, most recently, paid parental leave.

- One downside of contributory paid parental leave programs is that their work eligibility requirements end up excluding a sizable portion of potential new parents who have not accumulated enough earnings, hours, or tenure with an employer to draw the benefit when their child is born.

- In a new analysis, we estimate that between 18 and 26 percent of residents aged 18-45 would be ineligible for paid parental leave in six states that offer it, even though many are in school or working.

- Policymakers can build on America’s tradition of complementing contributory programs with less generous noncontributory programs to ensure support for all families in need. We offer a menu of options from current policy proposals.

Introduction

The weeks and months following the birth of a new child are a truly special time for parents. For first-time parents, in particular, it is an opportunity to bond with their baby, improve their caregiving skills, and develop a foundation for healthy attachment.1 Recognizing the significance of this short window, it is essential that parents and babies have time to bond without sacrificing the family’s economic security. Most countries have addressed this need by establishing paid parental leave programs. These policies not only guarantee job-protected leave but also provide partial wage replacement to new parents so they can afford to spend time with their newborn. Paid parental leave is a vital program that mothers and fathers rely on during a delicate period in their child’s life.

The United States remains the only OECD country that does not have nationwide paid family leave coverage, prompting efforts by state lawmakers to fill the void.2 Thirteen states have implemented their own programs, extending benefits to parents for anywhere from 6 to 12 weeks. One important aspect of the state programs is that the benefits paid out are tied to parents’ earnings and work history. That is, they are contributory parental leave policies, requiring parents to pay into the system to receive program benefits. This structure provides coverage to most families but also leaves new parents with limited earnings or work history with meager or no benefits.

These parents are then left without meaningful support during a critical time. This paper offers a menu of options for complementing contributory paid leave programs with secondary, noncontributory programs that would be more inclusive.

The case for contributory parental leave

Historically, U.S. social policy has been based on a mix of contributory and non-contributory programs. Contributory programs, such as Old Age Security and Disability Insurance (OASDI, known colloquially as “Social Security”) and Unemployment Insurance (UI), are funded by dedicated payroll taxes. Workers who meet certain basic eligibility requirements are entitled to benefits from these programs when they leave the workforce through retirement, disability, or temporary unemployment. Their benefit amount, called their replacement rate, is set as a proportion of previous wages to partially reflect their previous contributions.

Payroll taxes have been a popular funding mechanism for parental leave programs at the state level in the U.S. and in other countries. As of 2023, 13 states have introduced paid family leave programs that all rely on a standard funding model using employee-side and/or employer-side payroll taxes to fund benefits set as replacement rates.3 Most countries similarly use employee-side and/or employer-side payroll taxes to fund their paid leave programs.4

Several features of these programs help explain their enduring popularity in social policy.5 Their broad-based structure spreads the cost across all wage-earners, enabling these programs to generate substantial and relatively stable revenues to pay out benefits. Tying benefit levels to past contributions also gives workers the sense that they have earned those benefits.6 Most importantly, it constrains unbridled growth in benefits by requiring proportional increases in taxes on workers to fund them.7

Structuring paid family leave as a contributory program, whether at a federal, state, or joint level, makes economic and political sense, but it is not without limitations.

The shortcomings of contributory programs

Contributory programs usually have minimum work and/or tenure requirements for participants to be eligible for benefits.8 Work requirements are usually set in terms of hours worked or earnings subject to payroll taxes (sometimes called insurable earnings). Tenure requirements are typically set in terms of employment with the current employer. In most of Canada, for example, parents must have worked at least 600 hours in the previous year to be eligible for paid parental leave. The Canadian province of Quebec has its own program, which instead requires parents to have earned at least C$2,000 in the previous year to be eligible for paid parental leave.9 Employment tenure requirements vary across the provinces. Alberta, for example, requires 90 days with the same employer. About half of all countries in the European Union have minimum tenure or work history requirements for payouts from their paid parental leave programs.10

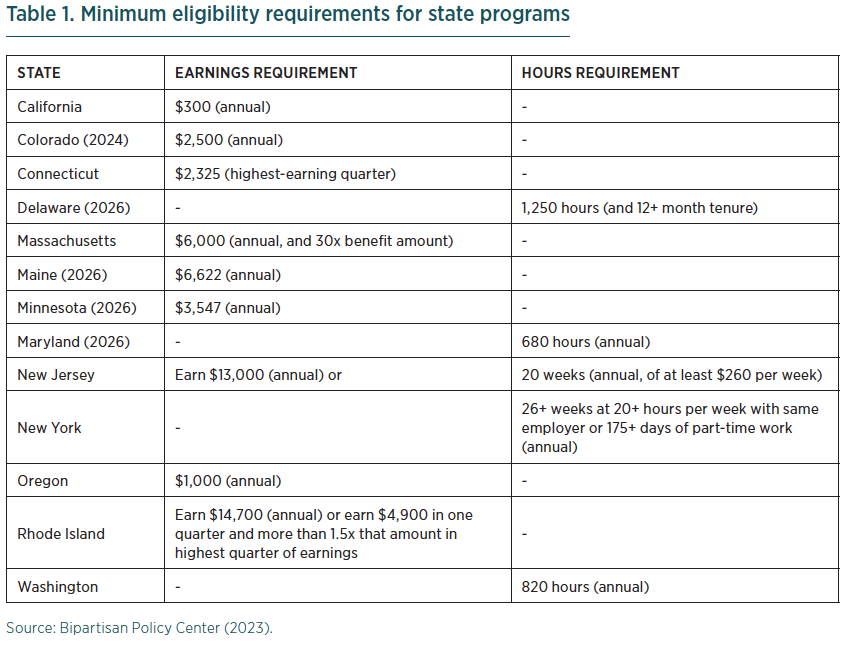

The 13 programs operating in American states likewise require new parents to meet an income threshold, work a certain number of hours, or a combination of the two during a relevant base period. Table 1 shows the specific requirements for active or pending programs in these states.

Statistics on what proportion of new parents are ineligible for these paid family leave benefits because they do not meet work requirements are not readily available. Generic participation rates may not explain why new parents did or did not participate in a program. In California, for example, the Governor’s Paid Family Leave Task Force found that about half of all eligible mothers participated in the program, but this tells us little about who did not qualify and why. Similarly, data showing about three-quarters of new mothers in California do not participate sheds little light on the role of work eligibility requirements relative to other factors like insufficiently attractive replacement rates, exemptions under collective-bargaining agreements for government workers, or immigration status.11

Determining how many parents potentially lack access to paid leave because of work requirements is vital to understanding the scale of exclusion from these contributory programs.

Estimating the potential impact of work-related eligibility requirements

Matt Bruenig of the People’s Policy Project has developed a simple way to estimate the percentage of women who would be ineligible for their state’s contributory parental leave program because they do not meet work requirements (both women and men are eligible but women are much more likely to take leave).12 He used data from the 2021 American Community Survey (ACS) to examine the incomes of women in their primary childbearing years (18-45 years old). He found the proportion of women who would not meet the income or hours requirements for their state program ranged from 25 percent in Colorado to 51 percent in Rhode Island.

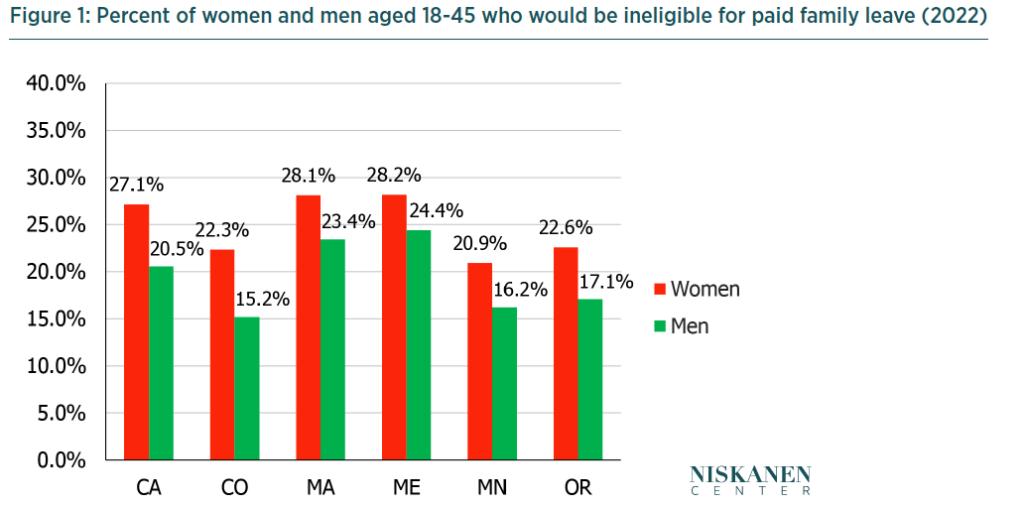

Our analysis replicates his estimates for six states with annual earning requirements — California, Colorado, Massachusetts, Maine, Minnesota and Oregon — using recently released ACS data for 2022.13 The update is important because the unemployment rate was still relatively high in 2021 but has since returned to pre-pandemic levels.14 We also examine the impact of these eligibility requirements on men in the same 18-45 year-old age range because of the importance of paternity leave to building father-child relationships.15

Figure 1 illustrates the proportions of women and men aged 18-45 who would be ineligible for their state’s parental leave benefits because they do not meet the program’s minimum income requirements. They range from 20.9 percent in Minnesota to 28.2 percent in Maine (two states that passed new laws but have not yet implemented them). The proportion of potentially ineligible women is slightly lower in 2022 relative to 2021, likely due to the return to a pre-pandemic labor market. The proportion of potentially ineligible men is much lower than women but still ranges from a low of 15.2 percent in Colorado to a high of 24.4 percent in Maine.

The evidence suggests that, even in a strong labor market, a sizable portion of new parents would not meet their state program’s eligibility requirements. Based on Bruenig’s analysis, it appears that minimum hour requirements tend to disqualify more parents than minimum earnings requirements.

Parental leave in Canada provides suggestive evidence about the limits of liberalizing eligibility requirements. Canada’s federal program requires workers to accrue at least 600 hours in the previous year to be eligible for parental leave. As often happens in Canada, the province of Quebec exited the federal program in 2006 to start its own provincial-run program. Instead of a minimum hours requirement, Quebec opted for a minimum C$2,000 earnings requirement. In the years that followed, the proportion of mothers receiving parental leave benefits outside of Quebec hovered around 65 percent; in Quebec, it rose from 65 percent to 90 percent.16 According to the most recent pre-pandemic data, two-thirds of new Canadian mothers (nationwide) received benefits. Furthermore, a quarter of new mothers were ineligible for parental leave benefits because they did not meet work requirements.17

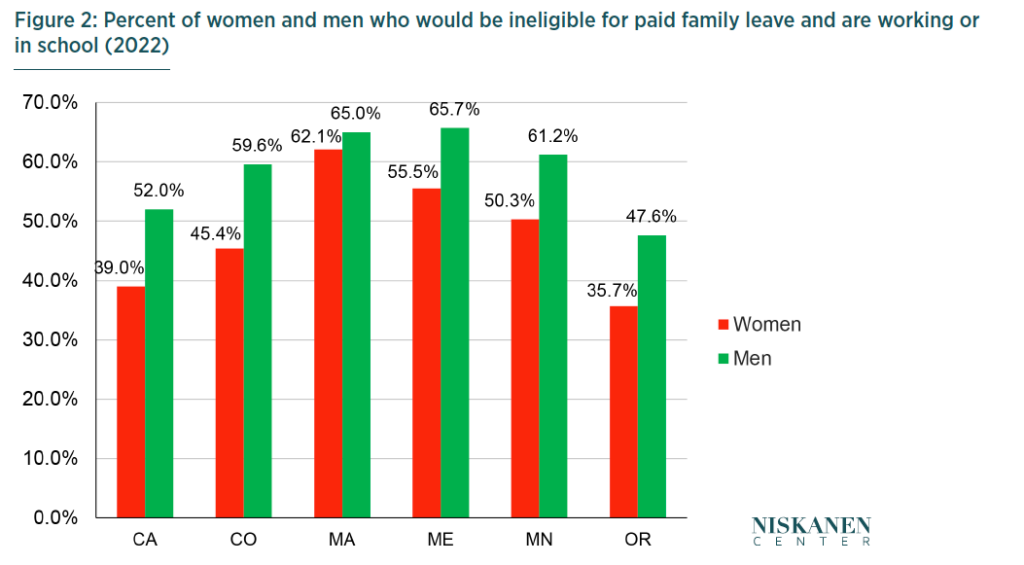

New parents may not have accumulated the requisite earnings for several reasons. Using the same ACS data, Figure 2 looks at whether those ineligible were working or in school (or both) at the time. It suggests that a significant proportion of those ineligible — in many cases, the majority — are employed at least part-time or completing their education in preparation for joining the workforce.

Young adults often find themselves in periods of transition, including school and employment, during the same years in which they are getting married and having children. A badly timed break from the labor market or delayed start because of schooling could disqualify them from the benefits of paid parental leave in the years that follow. Once they meaningfully (re)join the workforce, their earnings are subjected to the employee/employer-side payroll tax, making them pay into a program they never got to use.

The shortcomings of contributory programs — that their minimum eligibility requirements end up excluding some households — are significant but not insurmountable. Whether policymakers decide to build on the momentum of state paid parental leave programs or replace them with a national paid parental leave program, they have several models for complementing primary contributory programs with secondary, noncontributory programs.

America’s history with secondary programs

The tradition of pairing generous contributory programs and less generous secondary, noncontributory programs dates back to the Social Security Act of 1935. The architects of what would become Old Age, Survivors, and Disability Insurance (OASDI) and Unemployment Insurance (UI) believed these new contributory programs funded by payroll taxes would be the backbone of American social policy, but they also recognized that the programs would take time to get off the ground, leaving many workers ineligible in the short run. They also acknowledged that some workers would remain ineligible even when OASDI and UI were fully operational.

To compensate for the gaps in coverage, Congress created supplementary federal programs that provide states with funding to help run several existing social assistance schemes aimed at the same populations. The names and structures of these programs have evolved over time, but we still have them today. Those not eligible for Old Age, Survivors, and Disability Insurance (OASDI) can receive Supplemental Security Income (SSI). Those not eligible for UI are able to receive Temporary Assistance for Needy Families (TANF) or General Assistance (GA) in some cases. SSI, TANF, and GA have more liberal eligibility requirements relative to OASI, DI, and UI regarding work history, paired with more restrictive income requirements to ensure benefits are targeted to those most in need.

Building on this tradition, there are several options for designing secondary programs to complement state contributory and employer-provided paid family leave programs. They fall into two broad approaches — using federal tax credits or block grants.

Menu of options

Tax credit approaches

“Baby bonus” programs typically provide new parents with a lump sum cash benefit or payout in regular intervals in the weeks following a child’s birth. In Australia, for example, new parents who do not meet the eligibility requirements for the more generous Parental Leave program are eligible for the less generous Newborn Supplement.18

In the United States, there have been several federal baby bonus proposals building on the changes to the federal Child Tax Credit in 2017 and 2021.

The Child Tax Credit for Pregnant Moms Act was introduced in 2018 and has been reintroduced in each subsequent session.19 The bill would expand the definition of “qualifying child” to include unborn children as eligible for a child tax credit worth up to $2,000. This allows parents to qualify for the credit based on their income in the tax year before a child is born. However, because qualifying children must have a valid Social Security number, parents cannot claim the credit until after the child is born. The bill effectively creates an immediate baby bonus for children born before April 15th and a delayed one for those born later in the year.

The child tax credit’s phase-in structure means an unmarried new parent would need almost $25,000 in (previous-year) household earnings, and a married new parent would need nearly $32,000 in (previous-year) household earnings to receive the full credit. Those with additional children would need to earn more for the full credit. Those earning less would still receive a partial credit.

Minimum income eligibility requirements are higher for the child tax credit than for state contributory paid family leave programs. However, one advantage is that eligibility is based on household rather than individual earnings, likely expanding the pool of eligible parents. The federal expansion would also provide additional economic support to many new parents who do not have access to employer-provided parental leave or live in states without a contributory program. Those who already have access would still receive the federal support as a top-off to their other benefits.

Similar proposals using this design but providing more generous benefits that phase in quicker include the Providing for Life Act and the Family Security Act 2.0.20

A recent House version of the American Family Act adds a baby bonus program to the child tax credit reforms already proposed in previous iterations.21 Like earlier bills, the latest American Family Act increases the value of the current $2,000 child tax credit to $3,000 for children six and over and $3,600 for children under six years old. It also eliminates the credit’s phase-in, making it “fully refundable,” and pays out the credit monthly, as was the case with the pandemic program of 2021. What’s new is a provision providing parents of newborn children with a $2,000 benefit in the baby’s first month. Because this is in lieu of the $300 they would receive that first month, it essentially acts as a $1,700 baby bonus.

Because the American Family Act’s child tax credit is fully refundable, so is the $1,700 baby bonus. Parents with low or no earnings in the previous or current year can still receive the full credit/bonus. This distinguishes it from the other baby bonus proposals discussed above. The overwhelming majority of parents who might be ineligible for their state paid family leave program because of work history requirements would qualify for the baby bonus, ensuring they at least receive some support after having a child.

In both cases, the maximum credit amount ($2,000 and $1,700) is substantially less generous than those found in state paid leave programs, which range from a maximum of $900/week to $1,620/week over six to 12 weeks.

Block grant approaches

A second set of options involves altering how states can spend their share of certain federal block grant funds, including the Temporary Assistance for Needy Families (TANF) block grant and the Child Care and Development Block Grant (CCDBG).

A few states have piloted At-Home Infant Care (AHIC) programs where new parents who would otherwise be eligible for state child care subsidies while they work could instead opt to receive cash assistance to stay home with their infant child. States cannot use federal funds for these programs but may count state spending toward their maintenance of effort (MOE) requirements under the TANF block grant.

Two states pioneered AHIC programs. Under Minnesota’s program, low-income parents could receive cash assistance equal to 90 percent of the cost of infant child care subsidies for up to one year. Montana has a similar program but with cash assistance equal to 100 percent of the cost of infant child care subsidies for up to two years.22 In both cases, program funding has been subject to appropriations, which have waxed and waned over the years. There have been several congressional proposals to build on the concept by adding more robust federal support. For example, the proposed Choices in Child Care Act of 2006 would have awarded grants to five to seven states to conduct AHIC pilot programs using CCDBG funds.23

Most recently, the Protecting Worker Paychecks and Family Choice Act would allow states to use Child Care Entitlement to States (CCES) funding to create the sort of AHIC programs described above.24 The amount would be equal to or greater than the state’s average subsidy payment for infant care. Like many state paid leave programs, the duration is limited to 12 weeks. Eligibility is explicitly tied to nonparticipation in any other state contributory and employer-provided paid family leave programs. There are work history requirements, but they are more flexible and left to the discretion of states, which must demonstrate that the “applicant was working or attending a job training or educational program, as defined by the State, for at least four consecutive quarters ending on the date of application.”

As Figure 2 indicated, a significant proportion of those ineligible for state contributory paid leave programs are employed at least part-time or engaged in educational programs, suggesting they would be eligible for the AHIC provisions under the Protecting Worker Paychecks and Family Choice Act.

Conclusion

Universal access to paid family leave is an important public policy goal. Like the architects of America’s social policy in the past, today’s policymakers should recognize that tried and tested contributory programs are a step in the right direction but have important limitations. New parents with limited work history are, by design, left out of these programs, but their need for economic security while they bond with their newborn remains the same. Strong labor markets can only do so much to reduce the problem.

Just as those architects built secondary noncontributory programs for retirement, unemployment, and disability, today’s policymakers need to consider what such a program might look like for paid parental leave. By outlining several promising approaches using federal tax credits and block grants, we hope to spur those discussions and help policymakers build a system that works for all families.

- Prenatal-to-3 Policy Impact Center, Prenatal-to-3 Policy Clearinghouse Evidence Review: Paid Family Leave (Nashville: Peabody College of Education and Human Development, Vanderbilt University, 2023). https://pn3policy.org/policy-clearinghouse/paid-family-leave ↩︎

- Bipartisan Policy Center, Paid Family Leave Across OECD Countries (Washington, D.C.: Bipartisan Policy Center, 2023). https://bipartisanpolicy.org/explainer/paid-family-leave-across-oecd-countries/ ↩︎

- Joshua McCabe, Supporting Families, Supporting States: A Framework for Expanding Paid Family Leave (Washington, D.C.: Niskanen Center, 2022). https://www.niskanencenter.org/supporting-families-supporting-states-a-framework-for-expanding-paid-family-leave/ ↩︎

- Amy Raub et al., Paid Parental Leave: A Detailed Look at Approaches Across OECD Countries (Los Angeles: WORLD Policy Analysis Center, 2018). ↩︎

- Greg Shaw, “Changes in Public Opinion and the American Welfare State,” Political Science Quarterly 124, no. 4 (Winter 2009-10). https://www.jstor.org/stable/25655741 ↩︎

- Larry DeWitt, “Luther Gulick Memorandum re: Famous FDR Quotes,” SSA Historian’s Office Research Notes, (Social Security Administration, 2005). https://www.ssa.gov/history/Gulick.html ↩︎

- Julian Zelizer, Taxing America: Wilbur D. Mills, Congress, and the State, 1945-1975 (Cambridge University Press, 1999). https://catdir.loc.gov/catdir/samples/cam032/98021974.pdf ↩︎

- Raub et al., Paid Parental Leave. ↩︎

- Lindsey McKay et al., “Parental-Leave Rich and Parental-Leave Poor: Inequality in Canadian Labour Market Based Leave Policies,” Journal of Industrial Relations 58, no. 4 (September 2016). https://doi.org/10.1177/0022185616643558 ↩︎

- Who Is Eligible for Parental Leave in the EU-28? (European Institute for Gender Equality, 2021). https://eige.europa.eu/sites/default/files/documents/20210524_mh0121038enn_pdf.pdf ↩︎

- Christine Pal Chee and Joe Nation, Evaluation of the California Paid Family Leave Program (Bay Area Council Economic Institute, 2020). http://www.bayareaeconomy.org/files/pdf/BACEI_PFL_6192020.pdf ↩︎

- Matt Bruenig, “All Twelve State Parental Leave Programs Are Awful” (People’s Policy Project, 2023). https://www.peoplespolicyproject.org/2023/02/06/all-twelve-state-parental-leave-programs-are-awful/ ↩︎

- A note on limitations: ACS does not have longitudinal data that can track new parents’ previous year’s earnings. Looking at birth year would overestimate the proportion of parents ineligible because parents’ income usually diminishes the year they give birth to a child. Additionally, there is evidence that some individuals with a small income misreport they had no earnings in ACS. This would also overestimate the proportion of ineligible parents. Despite these limitations, our estimates are similar to estimates for Canada’s paid parental leave programs. ↩︎

- Bureau of Labor Statistics, Civilian Unemployment Rate. https://www.bls.gov/charts/employment-situation/civilian-unemployment-rate.htm ↩︎

- Kevin Shafer, So Close Yet So Far: Fathering in Canada and the United States (University of Toronto Press, 2023); Molly Dickens and Kate Mangino, “How Paternity Leave Helps Dads’ Brains Adapt to Parenting,” Harvard Business Review, Nov. 15, 2023. https://hbr.org/2023/11/how-paternity-leave-helps-dads-brains-adapt-to-parenting ↩︎

- McKay, Mathieu, Doucet (2018). ↩︎

- Statistics Canada. Table 5: Mothers and Maternity/Parental Benefits, Canada, 2018. https://www150.statcan.gc.ca/n1/daily-quotidien/191114/t005a-eng.htm ↩︎

- Services Australia, Work Requirements for Parental Leave. https://www.servicesaustralia.gov.au/work-requirements-for-parental-leave-pay-for-child-born-or-adopted-from-1-july-2023?context=64479; Services Australia, Newborn Upfront Payment and Newborn Supplement. https://www.servicesaustralia.gov.au/newborn-upfront-payment-and-newborn-supplement ↩︎

- Child Tax Credit for Pregnant Moms Act of 2023, H.R. 4258, 118th Congress. (2023). https://www.congress.gov/118/bills/hr4258/BILLS-118hr4258ih.pdf ↩︎

- Providing for Life Act of 2023, S. 74, 118th Congress. (2023). https://www.congress.gov/118/bills/s74/BILLS-118s74is.pdf; The Family Security Act 2.0. https://www.romney.senate.gov/wp-content/uploads/2022/06/updated_family-security-act-2.0_one-pager_appendix.pdf ↩︎

- American Family Act of 2023, H.R. 3899, 118th Congress (2023). https://www.congress.gov/118/bills/hr3899/BILLS-118hr3899ih.pdf ↩︎

- At-Home Infant Child Care Program. 2023 Minnesota Statutes, Ch. 119B, Sec. 035. https://www.revisor.mn.gov/statutes/cite/119B.035/pdf; At-Home Infant Care Program. Montana Code Annotated 2023, Title 52, Ch. 2, Sec. 710. https://leg.mt.gov/bills/mca/title_0520/chapter_0020/part_0070/section_0100/0520-0020-0070-0100.html ↩︎

- Choices in Child Care Act of 2006, S. 3797, 109th Congress. https://www.congress.gov/109/bills/s3797/BILLS-109s3797is.pdf ↩︎

- Protecting Worker Paychecks and Family Choice Act (discussion draft),118th Congress (2023). https://waysandmeans.house.gov/wp-content/uploads/2021/05/OMNI_001_xml-003-FINAL.pdf ↩︎