The Child Tax Credit (CTC) and Earned Income Tax Credit (EITC) are among the most powerful anti-poverty programs in the United States today, lifting over 10 million adults and children out of poverty every year. To build on this success, proposals to expand or reform both credits abound, from increasing the EITC for childless workers, to making the CTC “fully refundable” to reach children in households with low or no income in a given year.

To better understand these and other reform options, the Niskanen Center has developed a benefit calculator for policymakers and the general public to design and test different tax credit proposals, study their interactions, and quickly estimate their net-impact on different household types. The calculator’s presets are based upon the Family Security Act, released by Senator Mitt Romney in 2021, which proposes replacing the CTC with a flat child allowance while converting the EITC into a simplified worker credit. An alternative preset illustrates the Biden administration’s CTC expansion included in the Biden administration’s COVID-19 relief package.

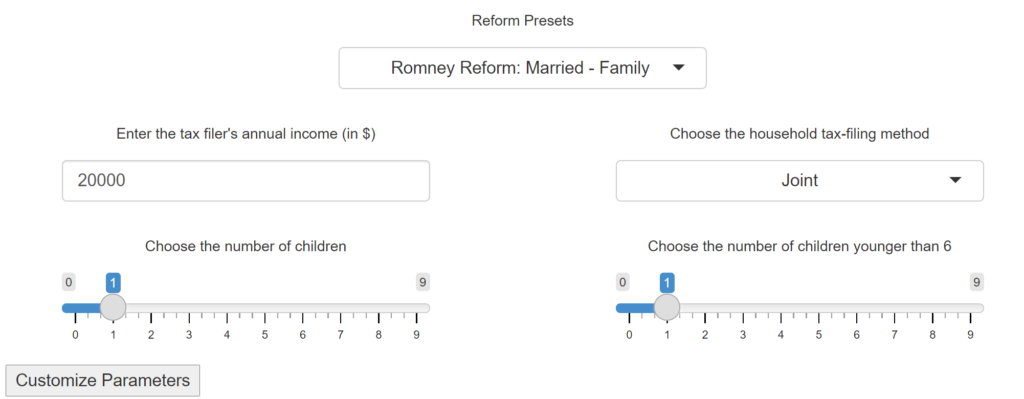

Customizable Parameters

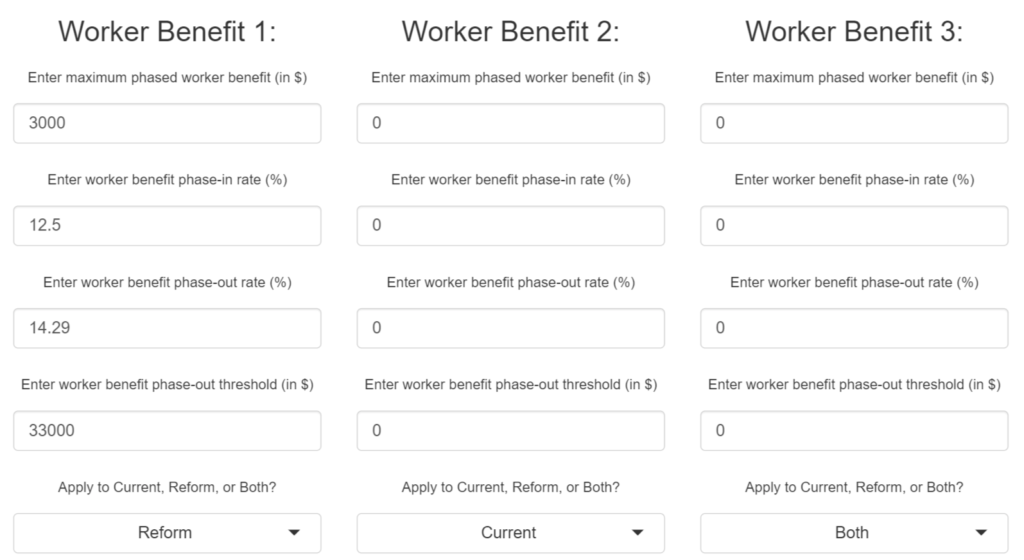

By clicking ‘customize parameters,’ users can design and test proposals for reforming either credit, or replacing them altogether, while automatically generating charts that illustrate the net-effect of the reform on household incomes and Effective Marginal Tax Rates (EMTRs).

The three “worker benefit” parameters are flexible enough for users to examine complementary reforms and see how they interact with other programs. This includes state-level EITCs and in-kind programs like Medicaid, provided the eligibility criteria can be construed in terms of income thresholds with a given phase-in and phase-out rate.

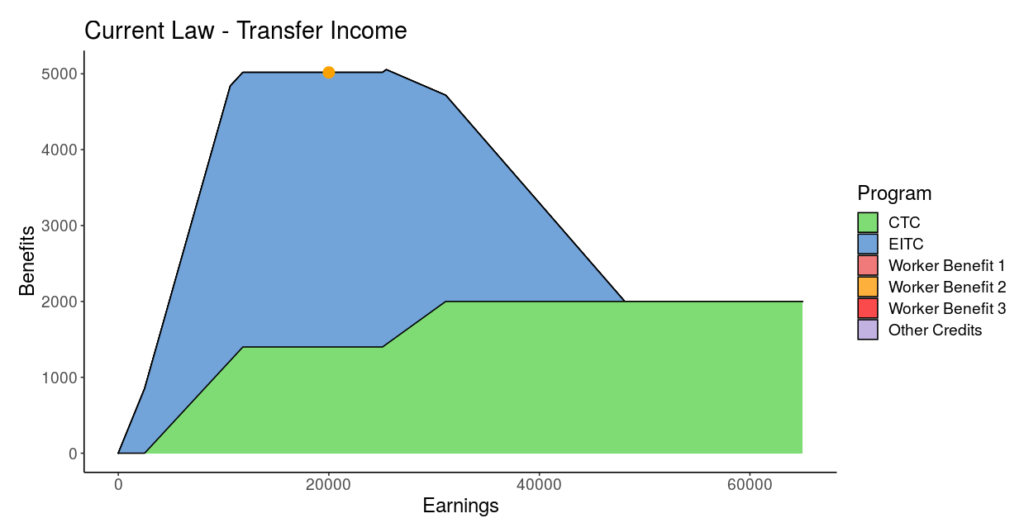

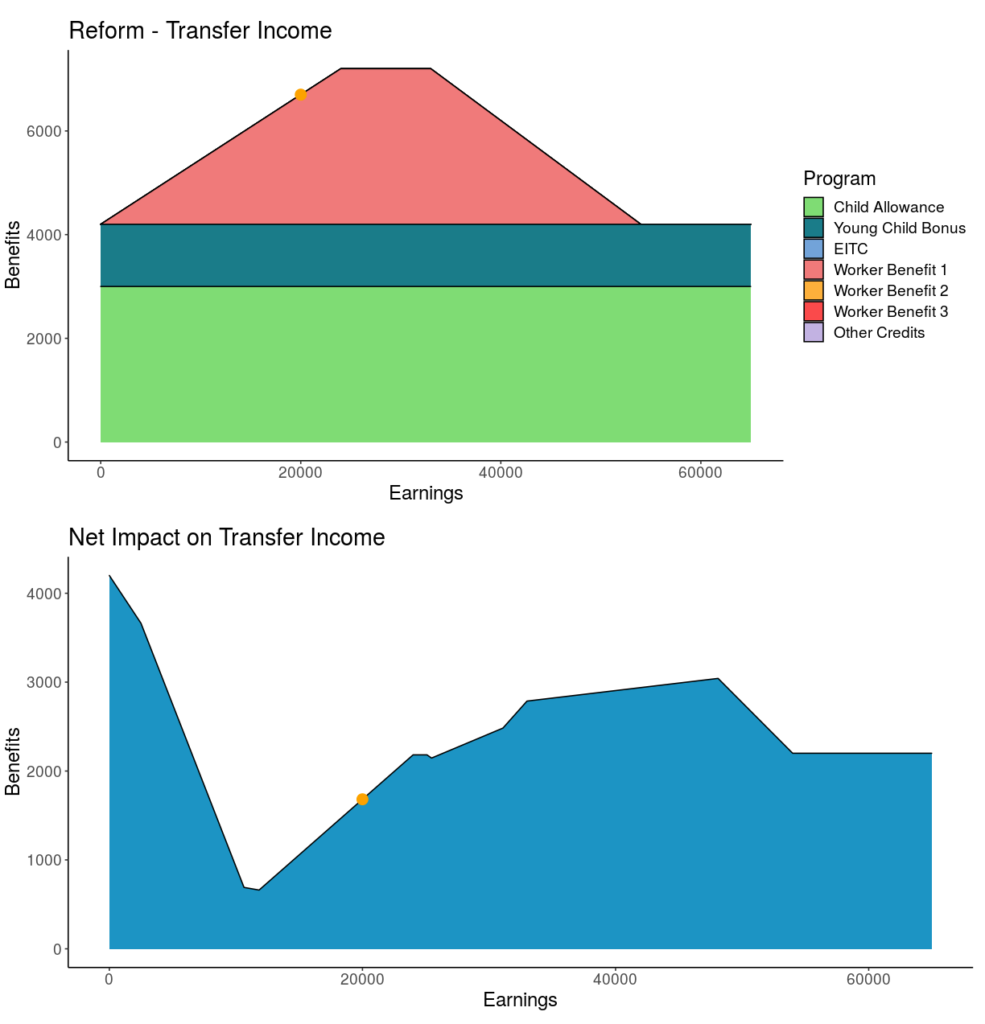

Clicking on the ‘Benefits Chart’ tab will generate graphical illustrations corresponding to the current benefit structure, the benefit structure under the user’s specified reform, and the net-impact of implementing the reform relative to the status quo. The ‘Total Benefits’ tab generates analogous charts of total distributional impact by household type.

For example, here is the current benefit structure for a married household with one child below the age of 6:

And here is the benefit structure for the same family as proposed by the Family Security Act, followed by its net-impact on transfer income relative to the status quo.

A caveat on benefits administered as tax credits

Tax credits such as the EITC and CTC suffer from low participation rates among intended recipients. For example, on average, only 78 percent of the EITC-eligible population actually receives the credit in any given year. This is due to a lack of awareness, complex eligibility rules, and the fact that low-income households making less than the standard deduction are not required to file a tax return.

As such, this calculator should only be understood as modeling the benefits a given household would be eligible for under different parameters, as actual participation rates depend on extraneous factors. The child allowance proposed in the Family Security Act, for example, would likely have significantly higher participation than the Biden child credit, owing to its implementation through the Social Security Administration and the simplifications it makes to the EITC.

Similarly, this calculator should not be relied on for estimating population-wide distributional impacts, as this requires modeling the entire distribution of households rather than considering one household type at a time. Nonetheless, this calculator enables “quick and dirty” prototyping of reform proposals in advance of a more thorough analysis.

This calculator is still in beta. Please contact rorr@niskanencenter.org regarding errors, bugs, or suggestions for features.