This fact sheet provides a preliminary distributional and policy analysis of the comprehensive child benefit reform proposed by Utah Senator Mitt Romney. Under the proposal, the Child Tax Credit (CTC) is replaced by a flat child allowance equal to:

- $350 per month ($4,200 per year) for children ages 0-5;

- $250 per month ($3,000 per year) for children ages 6 to 17;

— available to all children with a valid SSN, as well expecting parents within 4 months of their child’s due date. The maximum monthly payment is capped at $1,250 per family, and phases-out at a rate of $50 for every $1,000 above the current CTC income thresholds of $200,000 for single filers and $400,000 for joint-filers. Monthly payments would be administered by the Social Security Administration with any over- / under-payments reconciled through the IRS after filing year-end taxes.

A monthly child allowance enables the consolidation of duplicative policies and programs. The reform therefore proposes abolishing the Temporary Assistance for Needy Families (TANF) block grant, the Child and Dependent Care Tax Credit (CDCTC), and the “head of household” (HoH) tax filing status. The Earned Income Tax Credit (EITC) is replaced by a simplified earnings credit with a maximum value of $1,000 for single households and $2,000 for married households filing jointly, independent of the number of child dependents. The EITC for adult dependents is preserved. With the remaining revenue raised by ending the State & Local Tax (SALT) deduction, the reform is anticipated to be deficit neutral.

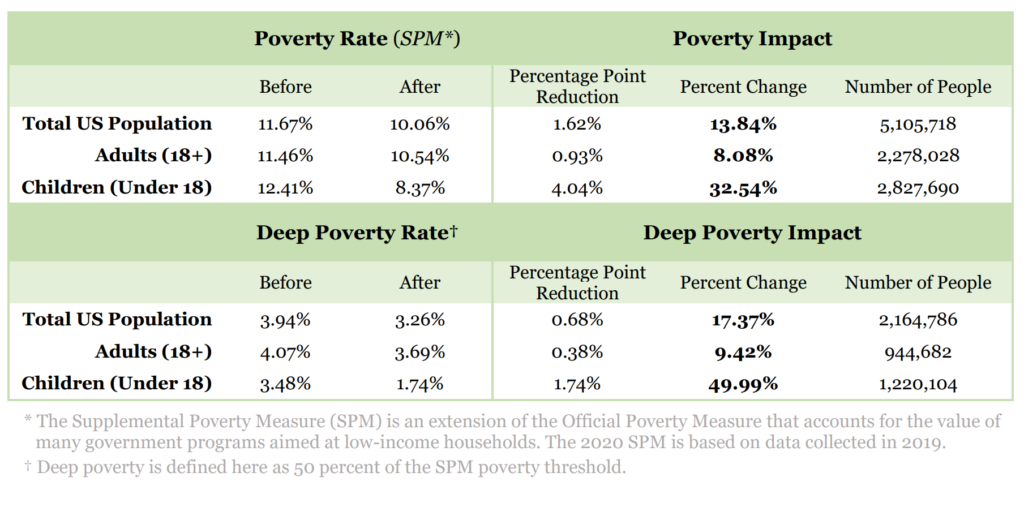

We find that the Romney child allowance would reduce U.S. child poverty by roughly one third, and deep child poverty by half. Detailed estimates by race and by state can be found in the appendix.

Our statement in support of the Family Security Act can be found at ExpandTheChildTaxCredit.com, and our new report, The Conservative Case for a Child Allowance, can be found here.