Key Takeaways

- Modernizing the defense industrial base will require streamlining the acquisitions process and removing perverse incentives that discourage innovation.

- In a recent report, Anduril Industries, a defense tech startup, outlines various policy recommendations.

- Suggestions include modernizing the procurement system and attracting top software talent.

- Enabling DoD to manage a nimble, innovative defense-industrial base is critical to restoring American state capacity more broadly.

Introduction

The history of industrial policy in the United States is inseparable from the history of the U.S. defense budget. From GPS and the internet to the interstate highway system, innumerable technologies and infrastructure projects that reshaped the American economy can trace their origins to defense-related investments.

Unfortunately, the era of dynamic and farsighted defense procurement seems increasingly far behind us. The decline of defense innovation is bad for U.S. national security and military readiness. More generally, it does not bode well for our industrial prowess and state capacity.

In a recent report, Rebooting the Arsenal, Anduril Industries, a defense tech startup, calls for a renewal of the defense industrial base. Anduril is known for manufacturing unmanned vehicles and developing operating systems for military technology. That experience with hardware and software contracting provides the firm with unique insight into the military acquisitions process. Citing the Pentagon’s historic role in funding R&D and commercialization, the report outlines deficiencies in the federal innovation and acquisitions process and proposes several structural reforms. Anduril elevates several strategies to eliminate bureaucracy, attract top talent, and incentivize innovation. While the devil is always in the details, it is encouraging to see private industry commit to restoring state capacity.

The decline of the startup ethic

As Anduril’s report notes, the U.S. Department of Defense once worked at the pace of a startup:

The Pentagon was built in only 16 months (1941-1943), the Manhattan project ran for just over 3 years (1942-1946), and the Apollo Program put a man on the moon in under a decade (1961-1969). In the 1950s alone, the United States built five generations of fighter jets, three generations of manned bombers, two classes of aircraft carriers, submarine-launched ballistic missiles, and nuclear-powered attack submarines.

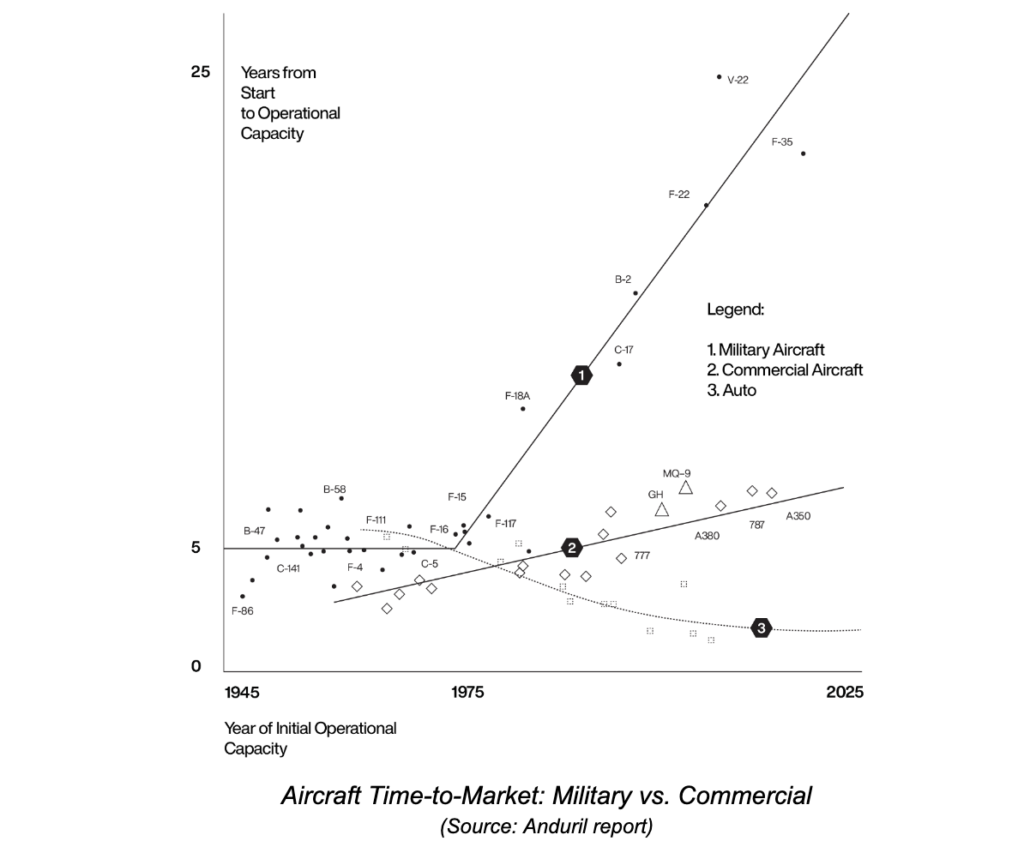

Military innovation yielded benefits for consumers as well. By 1960, the DoD alone accounted for 36 percent of all the research and development in the world. As the graph below illustrates, military aircraft (one) experienced an exponential increase in time from start to operational capacity after 1975. In contrast, commercial aircraft (two) development time increased linearly, while car development time dropped steeply (three). So what changed?

In its report, Anduril notes several key factors, including new leadership, changing priorities, and consolidation.

In the 1960s, Robert McNamara, a one-time Ford executive, became secretary of defense just as postwar innovation slowed and costs began to rise. He believed that American technology was sufficiently advanced to win the Cold War. As a result, he prioritized the quantity, not quality, of military systems. His mindset was informed by the circumstances of the era, when a majority of federally funded R&D was still conducted in-house, and often involved large, capital-intensive military systems.

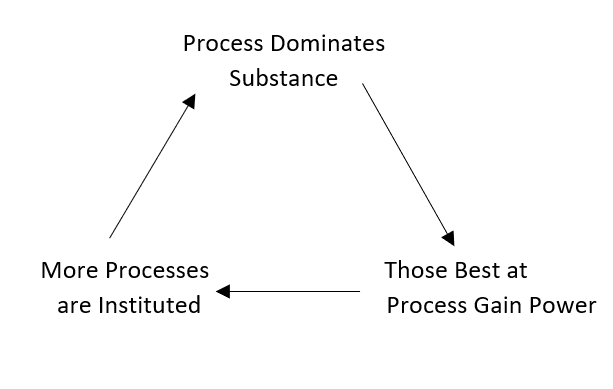

Given the seemingly predictable pace of Soviet military R&D and the dearth of U.S. firms with the capital or expertise to build military technology, McNamara implemented the Planning, Programming, and Execution System (PPES). PPES established a years-long bureaucratic process to develop and award contracts. R&D began to outsource to private firms, with technology developing according to highly detailed specifications. Duplicative programs were cut, resulting in one major contract per project. Under the previous system, multiple teams competed, using different methods to solve a single problem. That competition encouraged teams to work fast and innovate. Under PPES, only one team would work on each project, slowing outcomes. The chart below, from the Anduril report, illustrates how PPES prioritized process over outcomes.

(Source: Anduril Report)

Six decades later, it is evident that the PPES approach has long outlived its usefulness. McNamara’s reforms were designed for the specific challenges of his era. Their application to a post-Cold War context, especially in the 21st-century information age, has become disastrous. The PPES’ original purpose of cost containment is largely forgotten. Defense contracts routinely run over budget and behind schedule. Cutting in-house R&D and eliminating duplicative development efforts while adding red tape has resulted in relative stagnation. Deviations from contract specifications are punished, deterring creativity. The contract structure incentivizes firms to focus on lobbying for contracts instead of building functional technology. Virtually every product is also built-to-order, making it extremely difficult to bootstrap new technologies whose applications are, by definition, not possible to foresee in advance.

The rise of industry consolidation

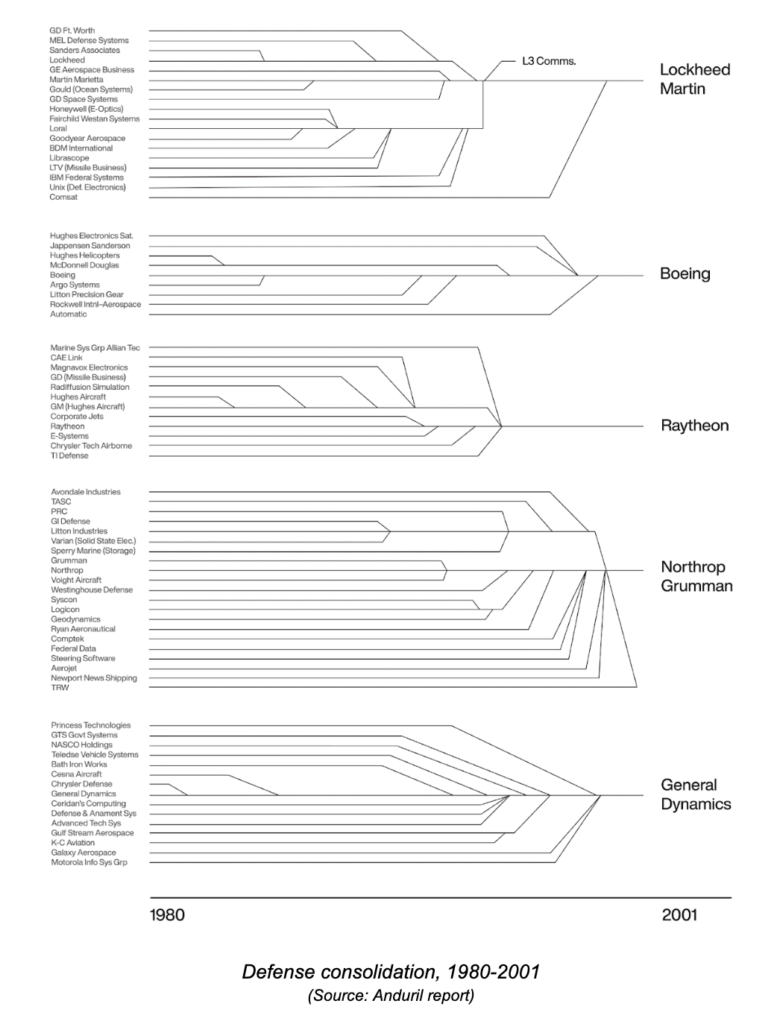

Critically, Anduril’s report highlights how the consolidation of the defense industry contributed to the stagnation of defense R&D. In 1993, as the Cold War wound down, Deputy Secretary of Defense Bill Perry warned defense CEOs that substantial defense budget cuts were coming. At the infamous “last supper,” Perry urged firms to merge to survive. As illustrated in the chart below, dozens of independent defense companies were subsequently whittled down through mergers and acquisitions to the big five defense contractors that dominate the market today.

Perry’s attempts to counterbalance the impact of consolidation by lowering the barriers to entry had negligible effects. The 10 largest defense companies account for over 80 percent of the industry’s revenue, with nearly two-thirds of major weapons systems contracts attracting only one bidder.

Bidding is often uncompetitive because only one firm has the expertise and capacity to build a certain system. A major firm’s monopoly on expertise and resources can lead to acquisition delays. For example, in 2018, Northrup Grumman’s acquisition of a rocket engine maker enabled it to exclude every other prime contractor from helping rebuild the U.S. nuclear arsenal. When bidding for the Air Force’s new ICBM contract, it even denied engines to its main rival, Boeing.

Personnel is policy

In its report, Anduril stresses that software engineering is as critical as hardware, but is undervalued. Most of DoD’s current innovation priorities, like artificial intelligence (AI), autonomous unmanned aerial vehicles (UAVs), or swarming munitions, are all software-enabled. Building great software is an engineering task on par with building a fighter jet, Anduril argues, one that requires recruiting the best and brightest engineers that Silicon Valley has to offer.

Yet financial incentives aside, the defense sector’s terminal decline and risk-averse culture conflicts with modern software-development practices. The tech sector values speed, creativity, and flexibility. Legacy contractors develop self-contained hardware systems that require little iteration beyond routine maintenance. In contrast, software products ship as soon as they are functional and continually offer updates and upgrades. A “move fast and break things” mindset of continual testing and improvement is disparaged in the defense sector. Engineering talent interested in defense knows the best place to make an impact is in defense-adjacent tech rather than the actual defense industry.

Building the future

Our broken defense acquisition process can and should be fixed. Incentivizing nimbleness, building products according to a mission instead of specifications, ramping up software investment and iteration, and fostering competition to drive down costs and increase new entrants would go a long way to address these issues. Evolving bureaucracy in response to new challenges is a critical aspect of renewing state capacity.

Ushering in a “software-first” mindset at DoD won’t be easy. To this end, Anduril suggests establishing new programs for software priorities, awarding prime contracts to software companies, and aligning acquisition policy with industry best practices.

More broadly, Anduril’s recommendations include:

- Prioritizing software: Establish large programs for key software priorities, award prime contracts to software companies, and align acquisition policies with industry best practices.

- Designing and implementing meritocratic competitions for new contracts: This drives innovation and seeds new, more dynamic companies.

- A shift from proposals-based competition to performance-based competition: Measuring outputs rather than inputs can help incentivize functional technology.

- Building to the mission, not to spec: designing products to solve problems from first principles.

- Updating outdated data rights practices: Limit federal rights to new software to specific applications so companies can use it in their commercial business, and demand adherence to technical interoperability standards.

- Increasing the percentage of contracts awarded through competitive bidding processes: Rerunning bids for large programs and loosening contracting timelines would quickly bring in fresh blood and enable more companies to cross the “valley of death.”

Conclusion

After decades of stagnation, it’s encouraging to see the private industry step up and demand reform in the defense sector. Not only does Anduril lay out the historical challenges of defense contracting, but they also plot a way forward. Our aging, top-heavy industry must adapt to modern challenges and break free from the sclerotic procurement processes created by and for a bygone era. Restoring state capacity where it matters most is critical not only for U.S. national security, but for the broader functioning and legitimacy of our democracy. Indeed, if history is any guide, reimagining how we invest in our national defense may be essential to spurring new technologies, robust productivity growth, and an America that builds again. So let’s get to it.

Photo Credit: iStock