What is likely to unfold later this year in Canada will be instructive for advocates of fair policy to reduce CO2 emissions. For those of us hoping and advocating that policy would evolve toward transparent, economy-wide, and revenue-neutral carbon taxes there is reason for hope and fear. Canada, perhaps more than other nations, needs to to embrace carbon taxes as its pre-eminent carbon policy instrument, but doing it right is will be essential to our economic future.

To meet the pledge it made in Paris last year, Canada will have to reduce its greenhouse gas (GHG) emissions by roughly 25% by 2030. Unlike in the United States, cutting coal out of the electric generation mix offers little opportunity, with coal responsible for less than 10% of current emissions. But, roughly 25% of national emissions relate to hydrocarbon production and transportation. How the government approaches this sector will give a real indication of how climate policy might progress in Canada in the long-term.

The long-standing Canadian conundrum remains seizing the opportunity to expand existing oil and gas production, via exports to both US and Asian markets, while trying to meet GHG emission reduction targets. Constructing required pipeline infrastructure is essential to fully realizing the production opportunity. Consequently, regulatory approval of such infrastructure has become a proxy war for Canadian carbon policy.

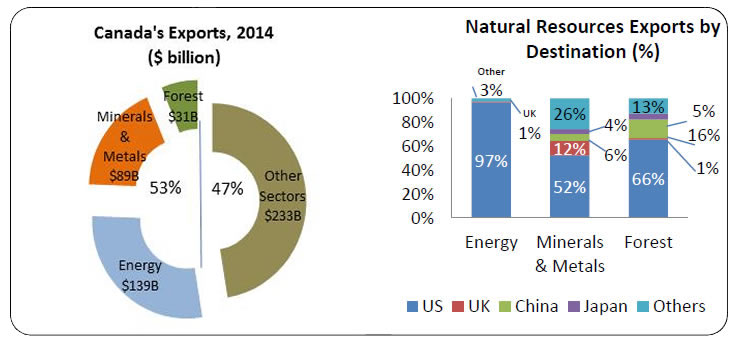

On the battlefield is a significant economic opportunity. Hydrocarbon exports currently represent nearly 30 % of Canada’s export revenues. To deny growth in this sector begs the question: where else would the Canada economy find other growing sectors?

The Trudeau government is fully committed to meeting its Paris targets. It has even mused about making them more aggressive. But at the same time, it has not yet overtly indicated that it will countenance no growth in hydrocarbon sector, let alone prohibit any required transportation infrastructure.

Two decisions loom later this year for this government that will substantially define where it actually stands. One is approval of a liquified natural gas (LNG) project at Prince Rupert, British Columbia, led by Malaysia’s Petronas. The other is an expansion of the existing TransMountain oil pipeline system, providing major tidewater access for Albertan dilbit, led by the Kinder Morgan group. The latter is an imperfect substitute for Keystone XL. If either of these projects are rejected outright on the basis of their attributed carbon impacts, then the consequences for the Canadian hydrocarbon industry will be substantial and punitive. Future prospects will be limited for any real growth in Canada’s hydrocarbon sector. One decision could come as early as September, the other in December.

Outright rejection would clearly represent a great victory for those in the North American environmental movement. Activists have long insisted that the entire oil sands resource must be contained, regardless of the actual incremental emissions generated or the foregone economic value lost. On the other hand, if approved, Canada will undoubtedly increase hydrocarbon production over the period leading up to 2030. The resulting increase in carbon emissions will challenge the government’s climate ambitions.

Of course, the Trudeau government could find an obvious and constructive synthesis of this dilemma between climate credibility and economic necessity, if it were to embrace carbon taxes as the national instrument for emissions reductions. To date, the Trudeau government has mused about the possibility a national carbon pricing standard, but not about how carbon pricing relates to compliance of Canada’s Paris commitments or infrastructure build out for the energy sector.

The province of Alberta is the country’s major emitter of carbon (both on a per capita and absolute basis). Last year the recently elected provincial government, led by Rachel Notley, implemented a 30 $CDN/tonne carbon tax on most of the province’s carbon emissions. It is intended to escalate a 2%/yr, subject to what major competitors are applying as carbon prices on their emissions. The Albertan carbon tax is thus as high or higher than most other carbon pricing regimes in the developed world.

But sadly for Albertans, the Notley regime committed itself to this policy with no conditions. A quid pro quo breakthrough on market access for its hydrocarbon resource was not demanded. To date, the Trudeau government has yet to recognize what, if anything, Alberta’s responsibility has bought it in terms of market access.

If the Trudeau government were to approve the two pipeline projects and move forward on a national carbon tax regime, that would actually represent an inspired synthesis of economic self-interest and carbon policy credibility.

Outright rejection of these infrastructure projects to meet climate ends implicitly imposes a steep and hidden carbon price on incremental hydrocarbon production. If the world had the capacity to impose carbon prices well in excess of $100/tonne then perhaps Canadian hydrocarbons may not compete on the world market and production would contract. But until the world shows such ambition, why should Canada impose higher carbon prices on itself by blocking market access? Who else is doing this? Certainly not the United States.

Simply put, how economically self-destructive the Trudeau government is willing to be, in the name of achieving its Paris targets, might just be decided over the next six months. What is the point of national carbon taxes, if certain emitters are forced to face much steeper carbon prices by virtue of having to meet absolute carbon emission reductions or infrastructure limitations? To both have carbon taxes and hard targets on certain sectors is illogical and unfair.

But Canada may yet do it, nevertheless.

Image by toptop54 from Pixabay.