Platforms are unique businesses — their purpose is more often to bring customers together to interact or make exchanges with each other than it is to sell something directly to the customers. The service being provided is that of a matchmaker, finding two people who could profitably trade or communicate but haven’t done so yet because transaction costs were too high without a trusted intermediary.

The platform business model also leverages one of the more powerful forces in the economy — network effects — to scale quickly and maintain momentum behind the entire ecosystem. Network effects mean the product or service increases in value with the total number of customers. The classic example is the telephone: The more people who have one, the more useful each phone is.

Platforms that serve multiple customer groups can also have indirect network effects, meaning that when one user group grows, the platform becomes more valuable to a complementary user group. Operating systems are a case in point: Developers’ demand for adopting a particular operating system depends on the number of users, and users’ demand depends on the number of developers creating applications.

If an operating system can reach critical mass — the point at which the value of the platform exceeds its cost for a large number of customers — it can engage a powerful flywheel effect where more users create more value for developers and vice versa. Research has shown that the social benefit from someone buying a new computer can exceed the private benefit due to these indirect network effects.

A successful platform can decrease search costs and reduce deadweight loss by brokering exchanges that never would have happened without it. But before a platform reaches that point, it must overcome a chicken-and-egg problem caused by the interdependence of demand between the customer groups. Who wants to join a two-sided market with no one on the other side? One way to solve this problem is for the platform operator to subsidize one side (usually the one with the higher elasticity of demand or the one that creates more value for the platform) by raising prices on what’s known as the “money side.”

Where the Network Effects Are: A Taxonomy

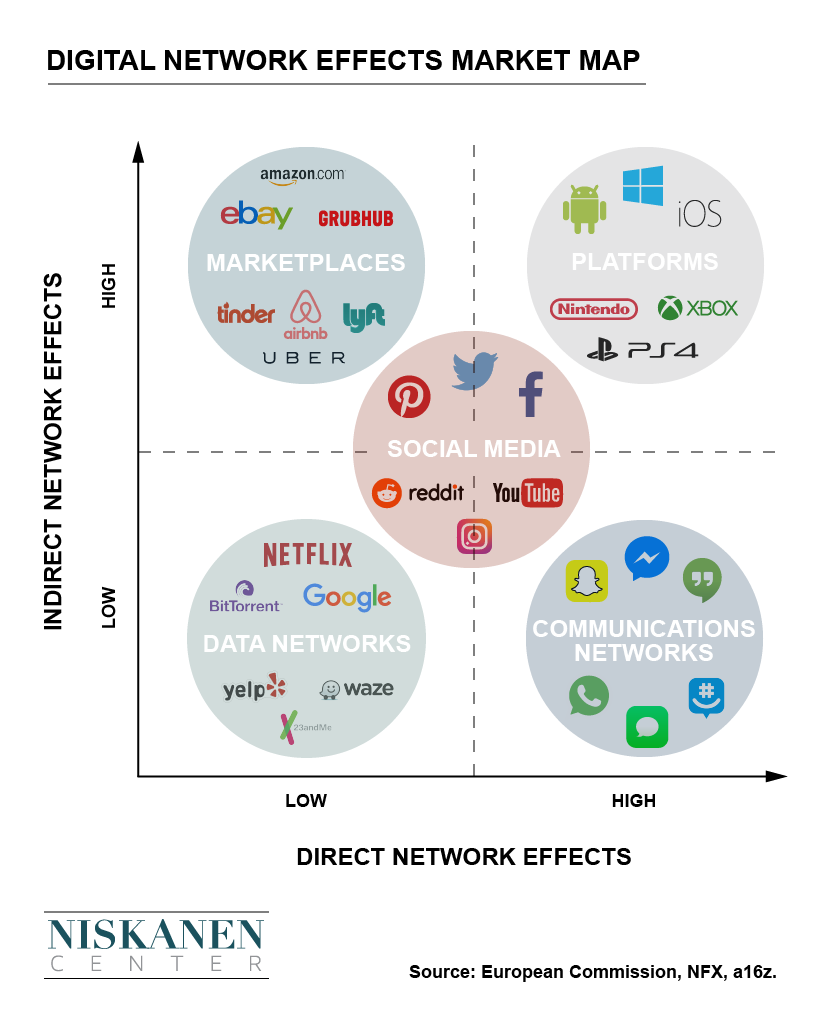

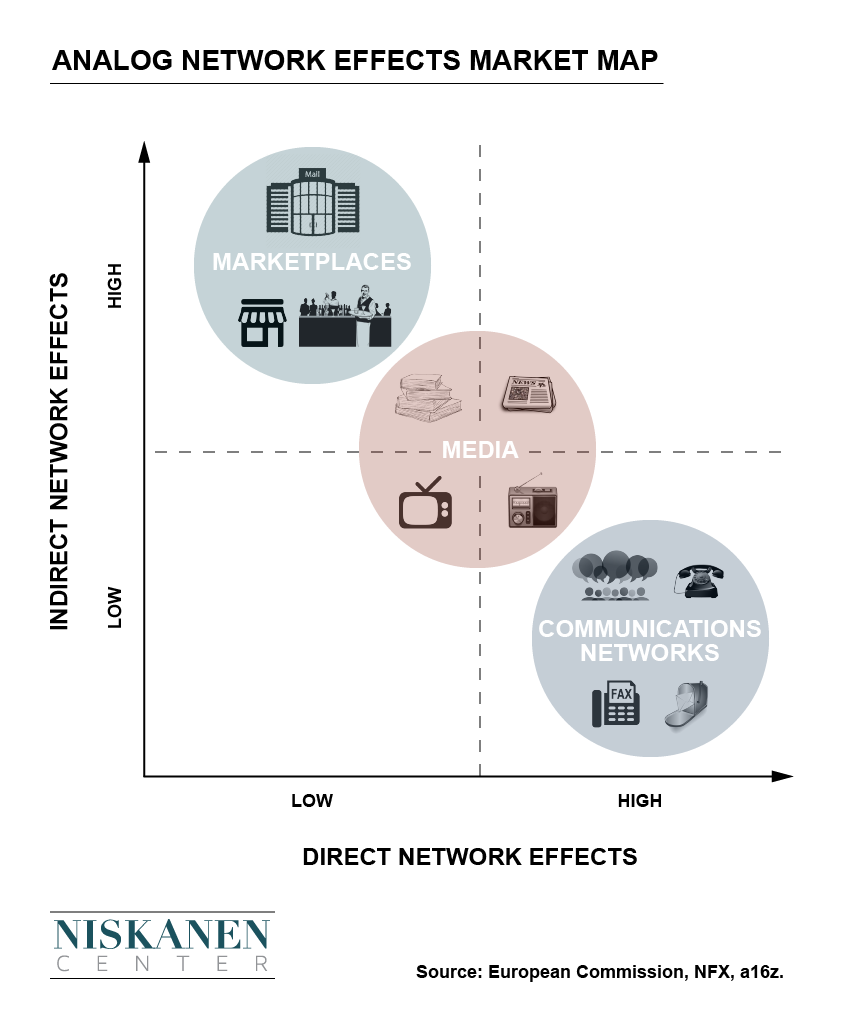

The charts below map the digital and analog markets with significant network effects. The vertical axis measures how strong their indirect network effects are, and the horizontal axis measures how strong their direct network effects are.

Communications networks have the strongest direct network effects — in which each user benefits when a similar user joins — of any platforms. Their raison d’être is to enable people to interact with others. WhatsApp, Facebook Messenger, Slack, iMessage, and Snapchat all serve this purpose, and collectively they have billions of users. In the pre-Internet age, the phone and fax machines were communications networks that also grew in value with their size.

Marketplaces facilitate transactions between two or more distinct groups and help minimize transaction costs, which results in more exchanges and an increase in social welfare. From the analog era, we have shopping malls that match retailers and shoppers; flea markets that match buyers and sellers; and nightclubs that match singles (n.b.: ladies’ night means that women are the subsidy side of the market and men are the money side). In the digital economy, there are eBay, Craigslist, and Amazon Marketplace for matching merchants and customers; Uber and Lyft for matching drivers and riders; Postmates and GrubHub for restaurants and eaters; and Airbnb for hosts and guests.

Social media networks like Facebook, Instagram, Twitter, Pinterest, Reddit, YouTube, and LinkedIn combine the direct network effects of communications networks (the “social” part of the name) with the matchmaking of marketplaces. Social media networks aggregate attention and then sell pieces of it to advertisers for targeted campaigns. Newspapers, magazines, television, and radio used to be the primary platforms for this latter function in the pre-Digital Era.

Platforms, such as operating systems and video game consoles, are ecosystems of users and developers and demonstrate both strong direct network effects (many apps that involve communication and collaboration become more useful with more users) and indirect network effects (app developers want more users and users want more apps), with the result that these markets tend toward oligopoly. Today, there are only three big personal computing platforms: Windows, which leads the desktop OS market with more than 88 percent market share, and Android and iOS, which together have almost 97 percent of the mobile and tablet OS market. Sony, Microsoft, and Nintendo control almost the entire video game console market.

Data networks are a new type of network that did not exist before the Internet made collecting, analyzing, and applying large datasets economical. Waze uses a driver’s speed and location to improve routing and navigation for other users of the app. Yelp and Netflix collect data and ratings to improve recommendations for users. AncestryDNA and 23andMe create databases of their customers’ genetic data, which are then used to improve genetic analysis for those same customers. All of these data networks have direct network effects, i.e., after each user’s data is added to the network, the value of the service provided by the network increases to every user.

Network Effects Aren’t What They Used To Be

Last century, all the action revolved around the desktop computer. This century, the multiplicity of devices and ease of direct communication means platforms can quickly find themselves cut out or replaced. Here are a few reasons why network effects may not be as strong in the 21st century as they were in the 20th century:

-

The proliferation of physical devices and digital platforms lowers switching costs.

-

Network effects have become highly localized, diminishing the advantage large networks have over small networks.

-

Network effects can be negative due to congestion, competition, advertising, and spam.

-

Users have an incentive to go off-platform for repeat business or high-value transactions.

In light of the empirical evidence, antitrust regulators should proceed on a case-by-case basis in markets with platform business models, identifying negative and positive network effects and determining if they are diminishing, increasing, or constant before making conclusions about market power.

Read the full comment we submitted to the FTC here.