(Alternative Title: How Ezra Klein Caused Income Inequality)

We’ve all heard that median wages are stagnating, but that’s not all that is happening. Wages are also becoming increasingly segregated by firm—meaning, high wage employees are increasingly working in high wage firms and low wage employees work in low wage firms, rather than in firms with a mix of both.

At least that’s what Song, Price, Guvenen, Bloom, and von Wachter find in their paper “Firming Up Inequality.” Using a massive U.S. dataset that matches employees with employers, they show that “over two-thirds of the increase in earnings inequality from 1981 to 2013 can be accounted for by the rising variance of earnings between firms and only one-third by the rising variance within firms.”

Why this is happening, no one really knows. In fact, it’s what economists Claudia Sahm and Adam Ozimek agree is one of the “Big Open Questions” in economics. But I have theory.

It goes back to “Equilibrium in Competitive Insurance Markets,” a pioneering 1976 paper by Joseph Stiglitz & Michael Rothschild that demonstrated the theoretical instability of private, competitive insurance markets. It’s work that, despite thousands of citations, remains underrated for the generality of its conclusions.

Separation Anxiety

Here’s the basic idea: Imagine an insurance scheme with two types of people: either high risk or low risk. If the risk type of any particular individual is not observable to the insurer (i.e. if there is asymmetric information) the insurer must nonetheless set a premium that will cover its expected average costs. This could be based on the population average, for instance. Think of this as a kind of “naive” pricing strategy.

Yet for the low risk type, this premium will seem far too high. And conversely, for the high risk type, the premium will be a deal (so much so that they over-demand it, a phenomena known as adverse selection).

Put differently, when high risk types are pooled with low risk types, the latter subsidizes the former, which for the low risk type represents a negative externality. It’s a situation that is often hard to find in the real world precisely because, given the choice, the low risk type will simply refuse to purchase the naively priced insurance in the first place (adverse selection strikes again).

This often manifests in the form of different insurance companies swooping in with some screening mechanism to help identify the lowest risk types and “skim” them from the common risk pool. The classic example is in auto-insurance, where elderly drivers with clean records are offered substantially lower rates drawing them out of the common pool. Just like in Song et al., this situation leads to increases in between-firm premium (and risk) inequality, while the median premium necessarily goes up.

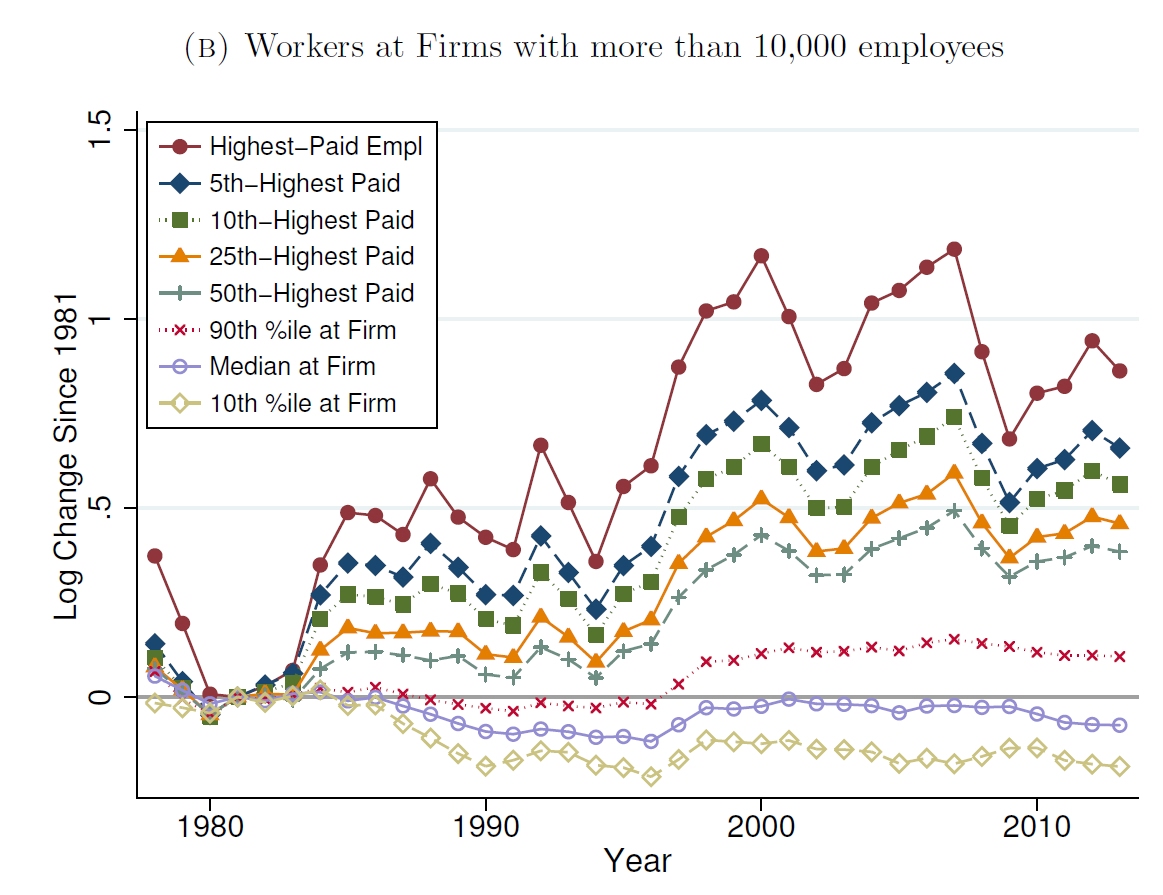

From Song, Price, Guvenen and Bloom (2016), “Firming Up Inequality”

The upshot of Stiglitz & Rothschild is that in a competitive market, insurers can always improve on the “naive” price by charging a price that causes different risk types to reveal themselves. That is, “pooling equilibrium” in competitive markets have a natural tendency to unravel into “separating equilibrium” over time and as a function of available screening devices. Something like this happened in the 1800s, when the discovery of actuarial science led to a boom in commercial insurance that drove “flat rate” Friendly Societies into extinction, leading to the rise of nationalized insurance and the welfare state.

The End of Asymmetric Information

How does this apply to technological change, wages, and inequality?

Think back to the naive insurer attempting to “pool” high and low risk types under one premium. Now substitute insurer with employer, and high and low risk types with low and high productivity workers, and the flat premium with a relatively flat wage structure.

Our nostalgic vision of the mid-20th century’s strong middle class is a memory of a wage pooling equilibrium that eventually unraveled. Behemoth corporate employers priced labor in a relatively naive way, given an inability to observe the heterogeneity of individual productivity moment by moment, and the role of labor unions in negotiating wages as a collective. While there was still a premium on things like seniority and higher education, wages were nevertheless fairly compressed.

For workers who contributed substantially more value to the company than they were being paid for, this was a raw deal. Conversely, it was great deal for workers whose productivity lagged. In other words, high productivity workers bore a negative externality by having to partially subsidize low productivity workers due to the inherent opacity of who-contributes-what within team production.

That has changed with information technology that makes it easier than ever to observe and measure individual worker productivity and screen for it accordingly (which may be why the premium from working at larger firms has also diminished). The best evidence for this comes from a 2015 paper, “Firms and skills: the evolution of worker sorting,” by Christina Hakanson, Erik Lindqvistz, Jonas Vlachos:

In this paper we study how the sorting of workers to firms has changed over time. We do so by using detailed and direct measures of worker’s cognitive and non-cognitive skills linked to firm level data covering the entire Swedish private sector. Our main finding is that there has been a substantial increase in the sorting of workers by skill between 1986 and 2008, with larger skill differences between firms and smaller differences within firms. The main driving force behind the increase in sorting is the expansion of the ICT sector.

Tyler Cowen and Alex Tabarrok’s essay “The End of Asymmetric Information” gives a ton of supporting qualitative examples of how ICT has made efficient sorting easier. Note that this sorting does not necessarily have to increase matching efficiency or create new synergies (something Song et al. find little evidence for). The main reason high productivity workers enjoy pooling together is simply because it lets them escape the negative externality of having to subsidize low productivity peers.

Or as Sahm reports, “the rise in between-firm inequality has been driven by a shift in the mix of workers at firms (those who would earn a lot anywhere are now more likely to work together at top firms than in the past) as opposed to a shift in the wage premium from working at the very best firms.”

The Case of Journalism

Journalism and the newspaper industry provide a very clear case study of this dynamic. Traditional print journalism operated on a naive pricing model by charging a flat or pooled fee for the entire paper. The reason for this was inherent to the medium. Editors had to mostly guess about what sections were driving readership because information was asymmetric and opaque. In turn, costly features like investigative journalism or foreign bureaus were implicitly subsidized by low cost but high demand sections like style or entertainment.

As journalism moved online, the insights provided by the low transaction cost medium destroyed the information asymmetry and suddenly revealed the true drivers of traffic and readership. The pooling equilibrium of print unraveled along with willingness-to-pay, so expensive features like foreign bureaus were forced to shut down left and right. Junior writers and reporters have also jumped in relative fame and in a way that’s arguably more meritorious, now that talent is so easily validated. Meanwhile the median writer and publication has faced intense headwinds, which implies that between-firm inequality in news publishing must be increasing dramatically.

When Ezra Klein left the Washington Post to start Vox, for instance, it was directly analogous to someone with a perfect driving record launching their own auto insurance company to avoid the premiums of a high risk pool. It was made possible because online metrics and Klein’s own internal observations helped reveal fellow high-talent outliers. Thus, while Vox may be a smaller company, my guess is per-employee productivity is substantially higher than at the Post.

Inequality is a Collective Action Problem

In other words, Ezra Klein in some small way contributed to wage segregation and therefore rising income inequality, although he can’t really be blamed. Under the separating equilibrium theory of wage segregation, income inequality results from a kind of collective action problem where individually rational behavior adds up to a (potentially) socially inefficient outcome. Once a technological or organizational innovation has made it easier to screen or observe productivity difference, inter-firm competition drives the “pooling” wage equilibrium to unravel in a way that’s very hard to reverse since the separating equilibrium is self-reinforcing.

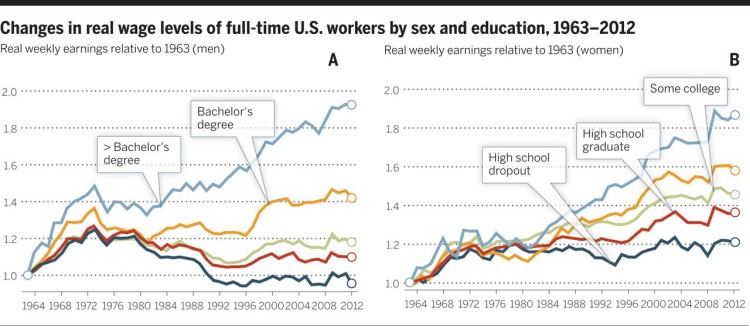

From Autor (2014), “Skills, education, and the rise of earnings inequality among the other 99 percent”

Rising premium on quality signals like educational attainment, polarizing wages, and lower social mobility / “Coming Apart” dynamics may therefore all be symptoms of the same phenomena. For better or worse, pooling equilibria promoted a degree of churn between rungs on the social ladder, and denied the ability of imperfect signals to sort one into a low wage destiny.

If this theory is right, it means reducing wage segregation is a lot harder than it looks, and comes with extremely ambiguous welfare gains. If inequality were really only a matter of elites appropriating rents, then a few tweaks to marginal tax rates and a one-time income redistribution would have a chance at being stable. In contrast, the separating wage equilibrium theory means income redistribution is continuously trying to maintain an unsteady-state. It’s like trying to pour an even level of water across a convex surface that invariably draws the water to its edges. A policy like a universal basic income could therefore be thought of as the government stepping in to enforce a socially efficient pooling equilibrium that has otherwise become competitively unstable.

The “Big Open Question” for me is whether there’s the political will to make that happen.