The unveiling of Representative Carlos Curbelo’s Market Choice Act (MCA) has ended the decade long hiatus of a Republican sponsored carbon-pricing bill. The introduction of the MCA bill has been praised by environmental and energy groups, economists, and has even been commended by industry leaders. But the bill has also been deemed by some as a measure that will harm the economy without noticeable environmental benefit.

Curbelo’s carbon pricing proposal is unique in its design, so understanding what its practical impacts might be is an important part of the discussion. Here,we want to keep an updated summary of the best analysis we can find on the environmental and economic effects of the MARKET CHOICE Act.

Reducing Emissions

Multiple studies have recently been published that model the impact the MCA will have on greenhouse gas emissions. A recent RFF study examined the impacts of the MCA’s proposed tax-gasoline swap on energy related US emissions of (CO2) using a Computable General Equilibrium (CGE) model that accounted for international trade, capital dynamics, and tax interaction effects. The results of this model found that the MCA’s tax-gasoline swap will reduce energy-related CO2 emissions to 27% below 2005 levels in 2025, and 29% below 2005 levels in 2030.

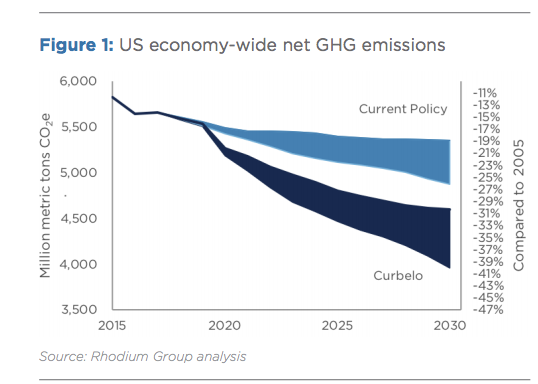

An analysis by Columbia’s SIPA Center on Global Energy Policy results in an even more optimistic view of the emissions performance of Curbelo’s carbon tax proposal. That research used the Rhodium Analysis Group’s version of the NEMS model and found that the MCA will achieve 27-32 percent reductions by 2025 and 30-40 percent reductions in 2030, also compared to 2005 levels, with more than two thirds of the emission reductions occurring in the electric power sector.

Figure 1: Economy-wide emissions reductions from the Columbia SIPA study

Both these studies demonstrate that the MCA will put the U.S. on course to achieve the 26%-28% GHG emission reductions below 2005 levels agreed in Paris at COP 21 and demonstrate a higher level of practical ambition than the regulatory approaches forwarded by the Obama Administration.

Economic Effects

Opponents of any climate change legislation do not hesitate to emphasize the costs that carbon pricing will have on economic performance. Of course, any carbon pricing legislation will increase the costs of fuel and electricity, ultimately increasing total energy expenditures. But measuring them quantitatively is essential.

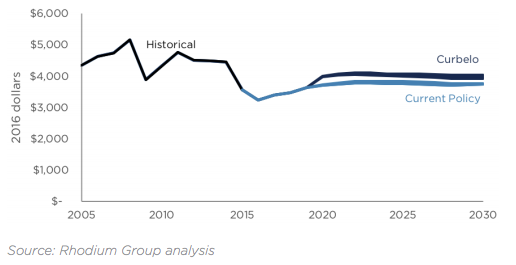

Fortunately, such analysis is available. The Columbia report also investigates the impact the MCA will have on energy price and expenditures and found that the proposal does increase energy expenditures by approximately $275 in 2020 and by $186-$278 in 2030. Although the MCA does result in increase in energy expenditures, they are extremely modest and remain more than $1,000 lower than the recent historical peak of $5,165 experienced in 2008.

Figure 2: US per capita energy expenditures from Columbia SIPA Analysis

A carbon tax essentially creates a new revenue stream for the federal government. The MCA creates the Rebuilding Infrastructure and Solutions for the Environment (RISE) Trust Fund, which will receive and disburse the revenue from the new carbon price. After accounting for the 25% haircut, as an approximation of the Congressional Budget Office practice for new excise taxes, the revenues into the RISE Trust Fund would be nearly $1 trillion over the first 10 years of operation under the MCA. The MCA sets how the RISE Trust Fund will appropriate the revenues for infrastructure funding (70%), energy assistance for low-income households (10%), energy transition assistance, climate adaptation, and advanced energy R&D.

Investments in infrastructure, energy R&D, and the overall shift of an economy from carbon-intensive to low-carbon production structures will undoubtedly have macroeconomic consequences. However, Columbia’s SIPA study used a Diamond-Zodrow CGE model to assess the MCA’s impact on macroeconomic indicators and found that the proposals impact on GDP is quite insignificant. The model predicted that annual GDP is 0.1% and 0.2% lower under the proposal when compared to GDP under the current policy scenario. Although GDP under the MCA proposal shrinks “the effects are close to zero, indicating that the drag on economic growth caused by the increase in prices is roughly offset by the positive effects of revenue use.”

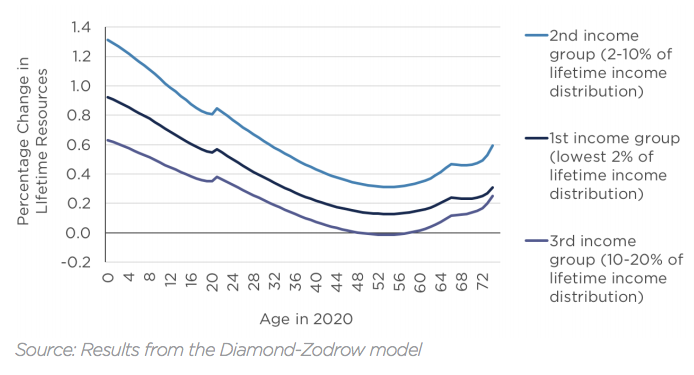

Perhaps the most important and debated issue concerning any tax legislation, especially carbon taxes, is their impact on low-income households. Carbon pricing is often criticized for being regressive, implying that low-income households will pay an undue cost compared to the rest of society. However, analysts have known for some time that the regressivity (or proregressivity) of a carbon tax relative to current policy is a matter of policy design.

As noted earlier, a portion of the revenues raised by the MCA will be used as transfers to assist low-income households faced with higher energy expenditures. The question is whether the positive effects of the transfers will be enough to mitigate the negative impacts of the increased in energy prices, and Columbia SIPA’s report demonstrates that the transfers do in fact increase the welfare of most low-income households. The transfer design in the MCA ensures positive welfare effects for all representative households in the lowest two income groups and for most households in the third income group. The age groups that benefit the most are young workers and retirees.

Figure 3: Impact of the Curbelo proposal on welfare of low-income households

The design and implementation of the Market Choice Act set it apart from previous attempts at carbon pricing legislation, and are fundamental to its unique ability to address environmental challenges without having to sacrifice economic output. Although the usual suspects will not hesitate to criticize a carbon tax, it is quite clear that a deeper analysis of Carlos Curbelo’s proposed legislation reveals that the costs of the MCA are smaller than many appreciate, and that they will be heavily outweighed by environmental benefits.