The idea of a Universal Basic Income—an unconditional cash stipend from the government that could, in principle, greatly simplify the existing system of means-tested programs—has come under fire for being antithetical to one of America’s strongest values: Work.

The argument, most recently articulated by Josh Barro at Business Insider, states that while a cash transfer may be able to provide subsistence, it cannot provide the sense of purpose and dignity that only a job can. This echoes an argument made frequently by AEI president Arthur Brooks that, more than money, the poor lack a feeling of being needed, and for most people only work can provide that feeling.

The problem with these arguments is that they simply assume a UBI would significantly undermine the incentive to work, shifting the debate to the red-herring of work’s relationship with purpose. Noah Smith, for instance, responded to Barro by pondering the difficulties of empirically measuring an abstract sense of dignity, while Matt Bruenig responded by pointing out all the ways the rich receive vastly more “passive income” than the poor (like from interest and capital gains) without an apparent loss of purpose. Both these points are secondary to the most basic point: UBI is simply not a threat to work.

UBI and Work in Theory

The effect of a Universal Basic Income on work effort is theoretically ambiguous without specifying the means-tested programs that would be replaced. The economist Ed Dolan wrote what is perhaps the definitive piece on the subject here, walking through various scenarios in detail.

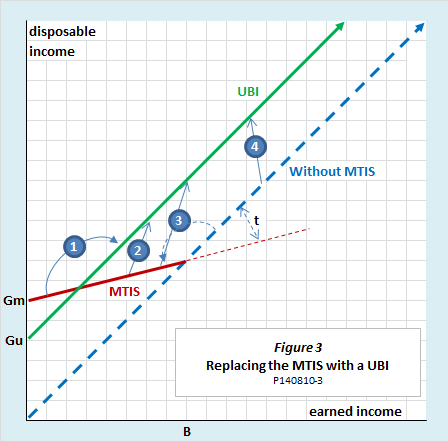

Means-tested programs, conversely, unambiguously reduce work effort. When a benefit decreases with every additional dollar in earnings, it imposes an effective marginal tax on work. If a UBI was set at less than the combined value of current means-tested programs it would therefore be unambiguously pro-work for the lowest earners (income and substitution effects both point towards working more), up to the point where the value of the UBI net of earnings crosses the value of the former means-test program net of earnings. Beyond that point, the effect is technically ambiguous, but probably still pro-work, as the elimination of marginal tax rates has a powerful substitution effect in favor of work. This is illustrated by points (1) and (2) in a graphic created by Dolan comparing a UBI with a generic means-tested income support (MTIS).

The key assumption here is that the UBI must be financed by something other than higher taxes on middle and lower income households. Were that the case, UBI and its cousin, the Negative Income Tax, would be essentially equivalent, and create the same implicit tax on work as conventional means-tested programs. This highlights the strange contradiction of conservatives who, on the one hand, extol the virtues of work, and on the other, push for greater means-testing within entitlement programs. Indeed, if you truly care about promoting a culture of work—particularly among lower income households—economic theory clearly points to a universal program like UBI.

UBI and Work in Practice

The fear of a modest UBI creating widespread idleness is refuted by a quick review of the literature estimating labor supply elasticities, which the CBO has summarized here. With respect to elasticity for unearned income, a study using EITC expansions estimates that “a $1,000 increase in net unearned income reduces the participation of wives by 0.1 percentage points and of husbands by 0.5 percentage points, implying income elasticities of -0.04 and -0.01, respectively.” That’s an incredibly modest effect—a reduction in work effort equivalent to earning one to four cents less with every dollar of UBI.

This is consistent with the research I highlight in my paper calling for a Universal Child Benefit (a kind of UBI for kids). The evidence from Canada’s existing child benefit shows essentially no effect on the father’s work, and a differential but still modest effect on the labor supply of mother’s: some mothers use the benefit to compensate their homework, while others use it to afford childcare and enter the labor force.

Like the theoretical analysis in previous section, this highlights how the work incentives of an unconditional cash transfer are unlikely to be the same for every group. The alternative—trying to characterize the effect on “work in general” either from intuition or a simple regression—is intellectually lazy. Any reported measure of an “average effect” obscures a great deal of potentially relevant heterogeneity. For instance, suppose a UBI induces the poorest workers to work a bit more and middle income workers to work a bit less, for an average measured effect of zero. Is that better or worse than a program that causes lower income workers to work less and middle income workers to work more, with the same average effect? Getting answers to these questions is precisely why countries like Canada and Finland are planning to run rigorous basic income pilot programs.

Other critics of UBI question the utility of new experiments by invoking the Income Maintenance Experiments from the 1970s. The experiments tested a variety of Negative Income Tax structures on different groups over 3 to 5 years, and found evidence that recipients substantially reduced their work hours: an average of 119 fewer hours per year for husbands, and 93 fewer hours per year for wives. More surprisingly, a recent follow-up study suggests that the effects were persistent, with former recipients earning an average of $1,800 less than expected forty years hence.

What the critics fail to point out are the numerous shortcomings of the 1970 experiment that make interpreting their results treacherous, particularly in comparison to UBI. Three main problems stand out. First, the experiments used NIT schemes that phased-out at a rates ranging from 30% to 80%. An 80% claw back is a very steep implicit marginal tax on earnings so it’s not surprising that it discouraged work. Second, some experimental groups were given an NIT that started at 130% of the poverty line—hardly a modest income floor. And finally, the experiment had infamously bad study design and methodological flaws, including rampant under-reporting of work effort by recipients attempting to claim a higher benefit.

In many ways, the NIT schemes that were piloted in the 1970s bear more resemblance to conventional means-tested programs, only they were cash based. Indeed, a UBI is attractive precisely because it avoids implicit marginal taxes on work, provides a modest minimum income guarantee for those who fall through the cracks, and can’t be easily gamed by misreporting earnings or work hours.

The ultimate irony for conservative critics of UBI is that Finland’s upcoming UBI experiment is based on the hypothesis that it will encourage the jobless to find work, since it does away with the conditionality of conventional unemployment insurance. In other words, a UBI is not just superior from the perspective of work disincentives, but it may also help to reduce moral hazard more generally.

The Danger of Bad Arguments

A wise tweeter once said it’s dangerous to make bad arguments for a good idea. In the case of UBI, the worst argument of all is the notion that it can spare us from the drudgery of work, and usher in an era of post-scarcity. Fortunately, only a fringe element of UBI supporters actually suggest using it in this way. Much more common is the idea that Artificial Intelligence and automation are about to eliminate most forms of work anyway, leaving UBI as an insurance policy of last resort.

This futurist focus has unfortunately given UBI an anti-work association, making it the perfect foil for champions of a culture of work to signal their virtuosity. But in lieu of the technological singularity, a UBI is still far and away a superior way of arranging the social safety-net compared to the status quo. UBI’s critics should stop attacking what they think UBI represents and instead begin to grapple with its substance.