The tax bill pending before Congress has raised the hopes of many people, like myself, who favor sweeping tax reform. It includes imperfect but recognizable versions of several measures long advocated as steps toward greater tax efficiency and fairness. These include cuts in corporate tax rates, increases in the standard deduction linked to a scaling back of itemized deductions, and a gesture toward reform of income support policy in the form of a modest expansion of child tax credits.

Although it is now clear that none of these will be implemented in a way that is fully satisfactory, some reformers declare themselves willing to at least grudgingly support the bill as a whole. Before doing so, however, I suggest taking a clear-eyed look at some of the possible less pleasant consequences of the bill. These consequences arise, directly and indirectly, from the decision to combine needed reforms with a recklessly deep tax cut at a time when the economy is already running at or near full capacity. One does not need to be a deficit hawk to understand that the timing is altogether inappropriate. The resulting fiscal pressures will make it harder to achieve hoped-for reforms to policies for health care, the social safety net, and infrastructure. Are the modest tax reforms in the pending bill worth the price?

A quick tour of recent fiscal history

Fiscal policy, whether in the form of changes in taxes or in spending, can either stimulate the economy or cool it off. Appropriately timed changes in the structural balance can help smooth the business cycle. If policymakers add fiscal stimulus when the economy enters a recession, they can shorten the downturn and speed the recovery. If they apply fiscal restraint during a boom, they can reduce the risk of overheating, inflation, and speculative bubbles. Economists refer to such policies as countercyclical. Responsible countercyclical policy is fully consistent with prudent management of the national debt over the long term.

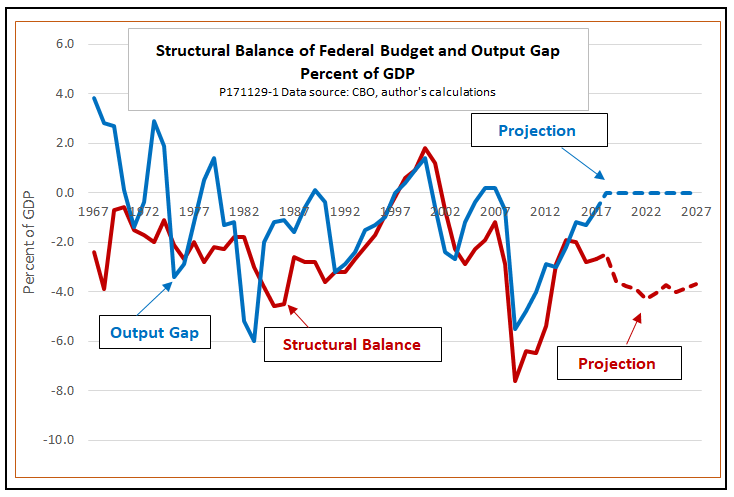

If, instead, the government adds stimulus when the economy is already running hot, or tightens during a recession, fiscal policy is said to be procyclical. The pending tax cut is procyclical to a degree unprecedented in the past half-century, as the following chart makes clear:

The chart shows two key numbers. The structural balance of the federal budget is the surplus or deficit adjusted to remove the temporary effects of the business cycle in order to isolate the effects of policy changes. The output gap is the difference between the real GDP that the economy is producing now and potential GDP, that is, the level of output, popularly known as “full employment,” that the economy can sustain over time without excessive inflation. The output gap is negative when the economy is operating below potential GDP and becomes positive when output temporarily rises above that level, as it sometimes does.

To gauge the appropriate timing of fiscal stimulus or restraint, we simply compare the structural budget balance to changes in the output gap. Fiscal stimulus is called for when the output gap falls below its full employment level. Restraint is appropriate when the output gap approaches or exceeds the level set by potential real GDP. Here is a quick tour of a half-century of U.S. fiscal policy, as shown in our chart.

The 1960s, ’70s, and ’80s were a turbulent period for the U.S. economy. Undisciplined monetary policy bore a large part of the blame. Business cycle peaks in 1969, 1973, and 1980, shown by spikes in the blue line measuring the output gap, were accompanied by peak inflation rates of 7, 11, and 14 percent—unthinkable by 21st century standards. During the run-up to the 1967 peak, the cyclical budget balance remained far in deficit. Perversely, it moved toward restraint just as the economy fell into recession. During the 1970s, steady fiscal stimulus—with a structural deficit averaging 2 percent of GDP —did nothing to moderate the inflation that increased from one cycle to the next.

In the late 1970s, tight monetary policy finally brought inflation under control, but it also triggered back-to-back recessions in 1980 and 1981. As the second of these recessions took hold, the newly installed administration of Ronald Reagan reacted with a multi-year program of phased tax cuts. That fiscal stimulus strengthened the subsequent recovery. While the structural budget balance moved from a deficit of 1.8 percent of GDP to 4.6 percent, the output gap improved from -6 percent to -1.1 percent.

As the output gap improved, enthusiasm for large budget deficits diminished. Several adjustments were made to tax policy that brought in additional revenue, not by raising marginal tax rates, but instead, by closing loopholes and broadening the tax base. The rising red line in the chart shows how those adjustments significantly narrowed the structural deficit by the late 1980s, a timely shift that helped keep peak inflation to 5.4 percent. The decade ended with a recession that began in mid-1990, but turned out much more moderate than those of 1980 and 1981.

The period that followed, from 1991 to 2014, might well be called the era of fiscal sanity. The most prominent feature of the chart in those years is the close fit between the red and blue lines. As the long expansion of the 1990s carried the output gap well into positive territory, a combination of tax increases and spending restraint raised the structural balance. That kept the dot-com boom from getting completely out of control, so that the subsequent recession at the turn of the century was even milder than that of 1990.

The fit of the two lines was not quite so good during the next business cycle, which peaked during the administration of George W. Bush. Tax cuts and rising military spending in the early Bush years have been criticized for providing excessive fiscal stimulus too long into the recovery. However, from 2004 to 2007, a certain amount of fiscal restraint was applied, as shown by the upturn in the red line of structural balance. Earlier and greater tightening might have done more to moderate the subsequent crash, but there was at least some movement in the right direction.

The Bush administration acted promptly when the downturn did come. The Great Recession (later declared to have begun in December 2007) was barely underway when Congress passed the Economic Stimulus Act of 2008, authorizing tax rebates later that spring. In February 2009, the newly installed Obama administration followed with the much larger stimulus of the American Recovery and Reinvestment Act. Together, these fiscal moves sent the red structural balance line plunging. Without the combined fiscal stimulus packages of the Bush and Obama administrations, the recession might have gone on to rival the Great Depression of the 1930s.

As the economy recovered, fiscal policy was again tightened. Critics argue that the degree of budget restraint, especially from 2011 to 2013, was too aggressive, given the depth of the recession and the hesitant recovery. Even so, as late as 2013, the structural balance remained in deficit by 2.9 percent of GDP, providing as great a degree of fiscal stimulus as at any point during the preceding 20 years.

In short, from 1991 to 2014, the fiscal sanity largely prevailed. Yes, there were mistakes of timing, including excessive stimulus in the mid-2000s and premature tightening in the middle of the recovery from the Great Recession. However, the key principles of countercyclical fiscal policy were generally observed—loosen fiscal policy when the economy enters a recession and tighten again as it approaches full employment or temporarily surpasses it.

Unprecedented procyclical effects of the pending tax bill

Let’s look ahead now to the projected effects of the pending tax bill, which would greatly amplify a procyclical trend in fiscal policy that, on a smaller scale, is already underway. As the chart shows, fiscal policy began to slip out of line as early as 2015. Even without major changes in tax policy, spending increases over the past two years have been sufficient to move the structural balance back toward greater deficits, as the output gap has continued to close. In a more cautious era, the increasing structural deficit would have called either for spending restraint or tax increases, but recently, it seems, fiscal sanity has gone out of fashion.

The result is the tax cut now pending in Congress. The chart projects the likely results of the cut, if passed in something approximating either the current House or Senate versions, using the following assumptions:

- Begin with the Congressional Budget Office baseline projections of the structural deficit, adjusted for the latest CBO estimates of the effects of the proposed tax cuts.

- Assume that the stimulus of the tax cuts will close the output gap by 2018 and leave it at zero thereafter.

- Assume that the incentive effects of the tax cuts will add approximately 0.3 percentage points to the annual growth of real GDP over the next 10 years, compared with CBO baseline projections.

- Further adjust CBO projections on the assumption that each percentage point added to GDP will move the structural deficit toward surplus by 0.35 percentage points, in line with recent estimates of the effects of automatic stabilizers and assuming no policy changes on the expenditure side of the budget.

The projections shown in the chart are dynamic, that is, they take into account the possibility that the tax cuts will improve economic growth and thus increase tax collections. In that regard, they are somewhat more optimistic than either the static projections of the CBO or the dynamic estimates of the Joint Committee on Taxation. The 0.3 percentage point increment to growth on which the projections are based comes from an open letter from nine prominent conservative economists to Treasury Secretary Steven Mnuchin, recently published in the Wall Street Journal.

The extent of procyclicality over the next 10 years, as portrayed in the chart, would be entirely unprecedented. The past half-century saw comparable prolonged periods of high structural deficits only during periods when the economy was operating well below its potential level (as in the 1980s or during the Great Recession), or in times of high and unstable inflation (as during the late 1960s and 1970s).

How will it play out?

If the pending tax bill does become law, it is unlikely that things will actually play out as shown in our chart. At least one of two things is likely to happen to disrupt the projected scenario, and quite possibly both.

The first likely disrupter is that the output gap will not smoothly rise to zero and stay there. Before the tax bill was even conceived, the economy was already on course to reach potential GDP by 2019. There is every reason to expect that additional fiscal stimulus will carry it past its long-term sustainable level, as happened in the 1990s and again (although only barely) in 2006 and 2007. In the past, such episodes have been followed by higher inflation and a subsequent recession. Although recessions are notoriously hard to predict, it is worth noting that the longest uninterrupted economic expansion in U.S. history, that of the 1990s, lasted exactly 120 months. The current expansion will be 120 months old in June 2019—just 18 months from now. To expect the present expansion to continue uninterrupted until 2027 is, to say the least, highly optimistic.

The second likely disrupter is an increase in the debt ratio. Assume, optimistically, that the average interest rate on the federal debt remains close to its current historically low rate of about 1.7 percent. Assume also (as we did in drawing the chart) that the annual rate of real GDP growth increases by 0.3 percentage points above the CBO’s baseline rate. Finally, assume that inflation stays no higher than the Fed’s target of 2 percent per year. The structural deficit would have to remain at 2 percent of GDP or less to hold the debt ratio at its current level of 77 percent of GDP. (This tutorial explains the necessary calculations.)

However, even given these rosy assumptions, our projections show the structural deficit increasing from its current value of about 2.7 percent of GDP to more than 4 percent by 2022. If the output gap were to remain at zero, as projected in the chart, the actual annual deficit would be the same as the structural deficit. If there were a recession, it would be much greater. Ergo, we can be essentially certain that the debt ratio will rise steadily over the next few years.

In terms of pure economics, there is nothing especially alarming about this. As the above-linked tutorial explains, the U.S. economy is still quite far from the conditions under which positive feedbacks would take over and send the debt spiraling out of control. Furthermore, as a sovereign power that issues debt denominated in its own currency, the federal government faces absolutely zero risk of ever becoming insolvent.

Politics are another matter, however. It is highly likely that a rapid run-up of the debt would wake the deficit hawks of the Republican party from their current slumber. Once wakened, the hawks are far more likely to demand spending cuts rather than tax increases as a fix for excessive deficits.

The prospect of spending cuts is more than just a conjecture. It is, in reality, part of an explicit and long-standing conservative strategy.

As long ago as 1978, nine years before he became head of the Federal Reserve, Alan Greenspan put it this way in testimony before the Senate Finance Committee:

Let us remember that the basic purpose of any tax cut program in today’s environment is to reduce the momentum of expenditure growth by restraining the amount of revenue available and trust that there is a political limit to deficit spending.

GOP leaders have stuck doggedly to this strategy in the years since. Last month House Speaker Paul Ryan explained to a town hall audience that “you cannot get the national debt under control, you cannot get that deficit under control, unless you do both: Grow the economy, cut spending.” He further remarked that the Republican tax plan “grows the economy. We’ve got a lot of work to do in cutting spending.”

In short, no one in the Republican Party seems actually to believe that the proposed round of tax cuts will pay for itself through growth, nor do they care. The tax cuts are just the first part of a two-part strategy; the second part is to consist of sweeping spending cuts.

Is there an alternative?

Those of us who do not view the game of economic policy in zero-sum terms, with either the Republican or Democrat team as the winner, have a decision to make. Are the modest elements of true tax reform contained in the pending legislation sufficient to justify the price that is being asked?

That price is not just a matter of distributional effects—too much for the donor class, not enough for the working class. There also will be a price in terms of the macroeconomic disruptions brought on by an unprecedentedly large dose of procyclical stimulus at a time when the economy is already at or near full capacity. If we survive those, there will be a further price in terms of promised cuts to Medicare, Medicaid, Social Security, and other social safety-net programs on which tens of millions of families depend — not to mention the cuts to spending on education, a faltering health care system, and the nation’s rusting infrastructure.

Personally, I think the price is too high, especially when there is an alternative: Abandon the whole idea of cutting net taxes, and instead, pursue good old-fashioned, revenue- neutral tax reform. Such reform would have plenty of room for cuts in marginal tax rates, paid for by broadening the tax base. In particular, as I have argued elsewhere, it could include sharp cuts to the top corporate tax rate—even complete abolition of the corporate tax—paid for by taxing income from capital in other ways that would minimize distortion of investment decisions. It also could include sweeping simplification of personal income taxes, through increasing the standard deduction and eliminating itemization—progress on which the pending bill, to its credit, makes a modest start.

Done correctly, such a program would be even more pro-growth than the gimmicky package of incentives in the current bill. The resulting growth would provide enough revenue to actually reform social safety-net programs instead of just cutting them. What is more, it would raise wages by enough so that fewer families were dependent on help from the government.

I say, forget this tax bill. Go for real reform.