A rising tide lifts all boats, does it not? That cliché of economic policy is meant to highlight the ways in which economic growth, as a substitute for targeted social policies, can make life better not just for the privileged, but for the disadvantaged, as well. However, the cliché is misleading in that the causation is not all one way. A better social safety net can contribute to a stronger economy and faster growth of both actual and potential GDP.

A new report from the Congressional Budget Office provides some insights into one of the mechanisms linking social policy to growth, namely, labor force participation (LFP). Recent LFP trends in the United States have not been favorable to growth, but a close examination of the data suggests that better social policy, especially in the areas of income support, healthcare, and disability, could significantly improve participation. Increased LFP, in turn, would boost both actual and potential GDP, making room for additional monetary and fiscal stimulus.

Recent trends in Labor Force Participation

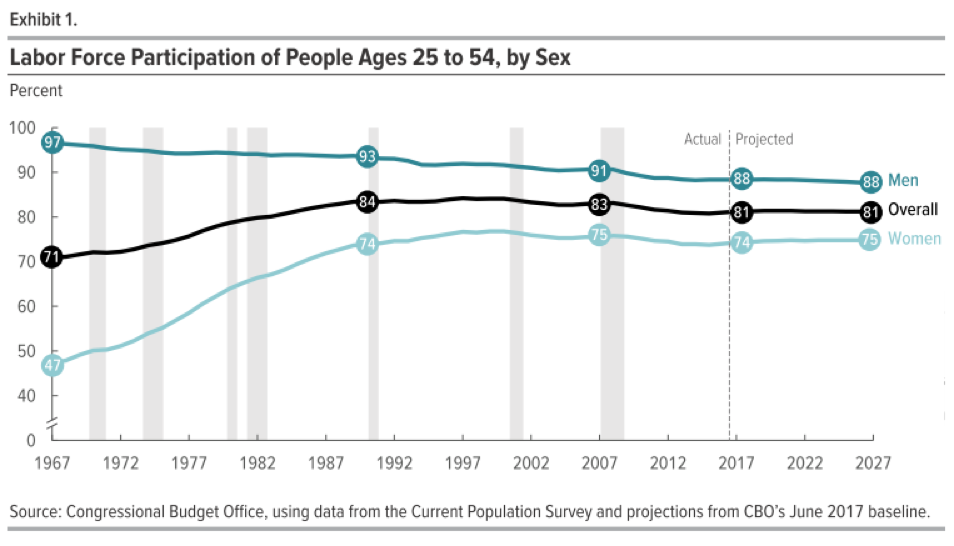

Let’s look at some of the key findings of the CBO report. First, we find that labor force participation as a whole has declined since its peak in the early 1990s. As the following chart shows, LFP rates are expected to stabilize for men and increase slightly for women over the next decade, but not to return to their former peak values. (Gray bars denote recessions.)

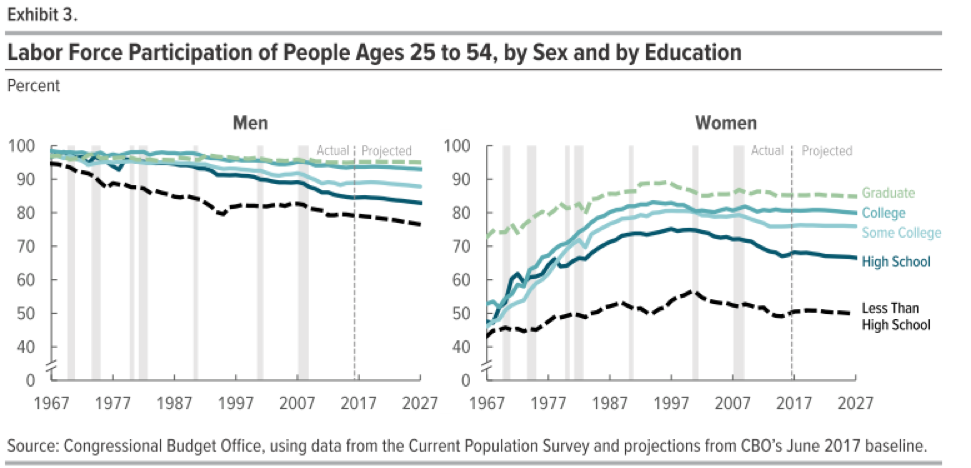

Second, we find that decreases in participation have not been uniform. As the next chart shows, declines in LFP have been especially sharp for less educated men and women. In contrast, the report notes that gender and ethnicity have had little effect on the overall trend. Although LFP rates are lower for minority groups and women, they have actually recovered slightly more for those groups than for white men since the trough of the recession.

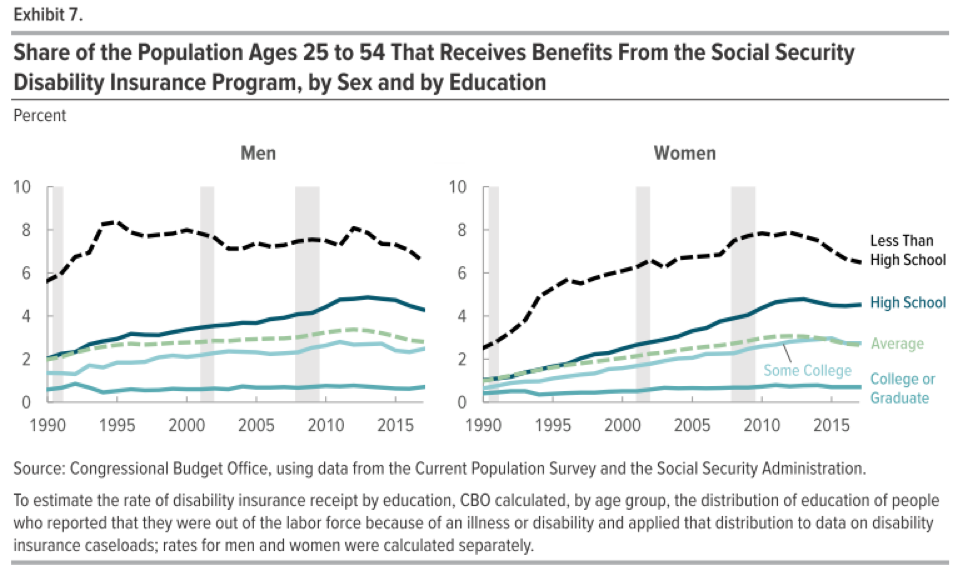

Third, the next chart from the CBO report shows that disability contributed significantly to the decline in LFP, especially for those with less education. Lower LFP due to disability is a result, in part, of an actual decrease in the average health of the working-age population, but that is not the whole story. Participation also falls because lower-income workers turn to Social Security Disability Insurance (SSDI) as a substitute form of long-term unemployment insurance. But once they are enrolled in SSDI, their incentives to rejoin the labor force are greatly reduced. As a result, the disability rate falls only slowly during economic recoveries—an example of hysteresis in labor markets.

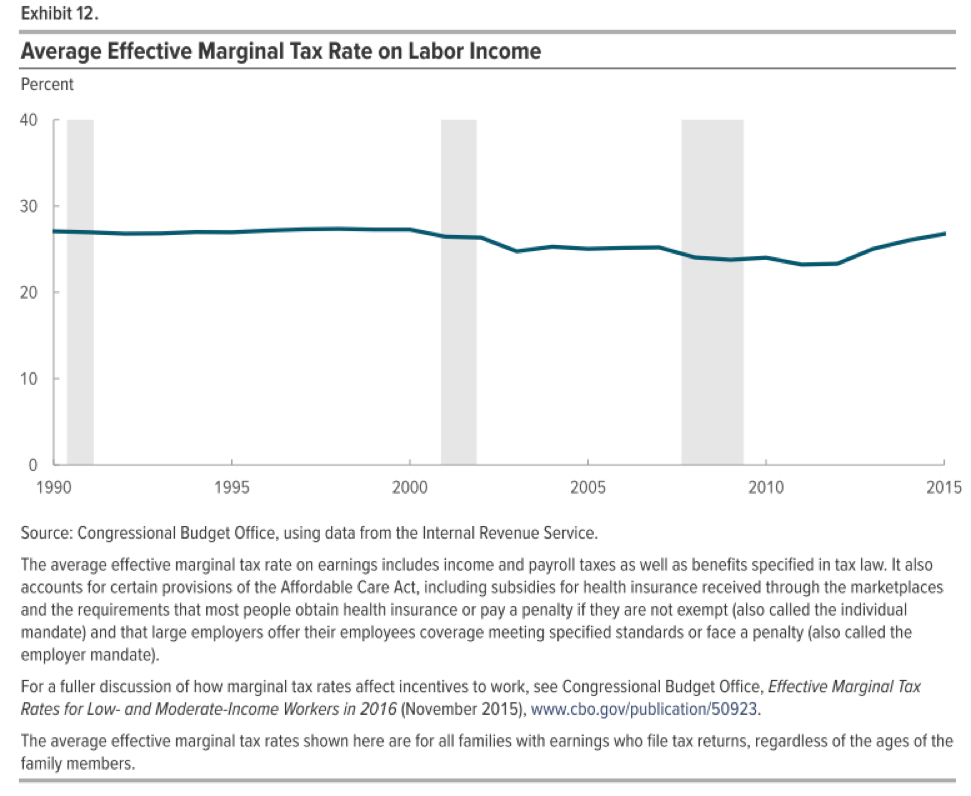

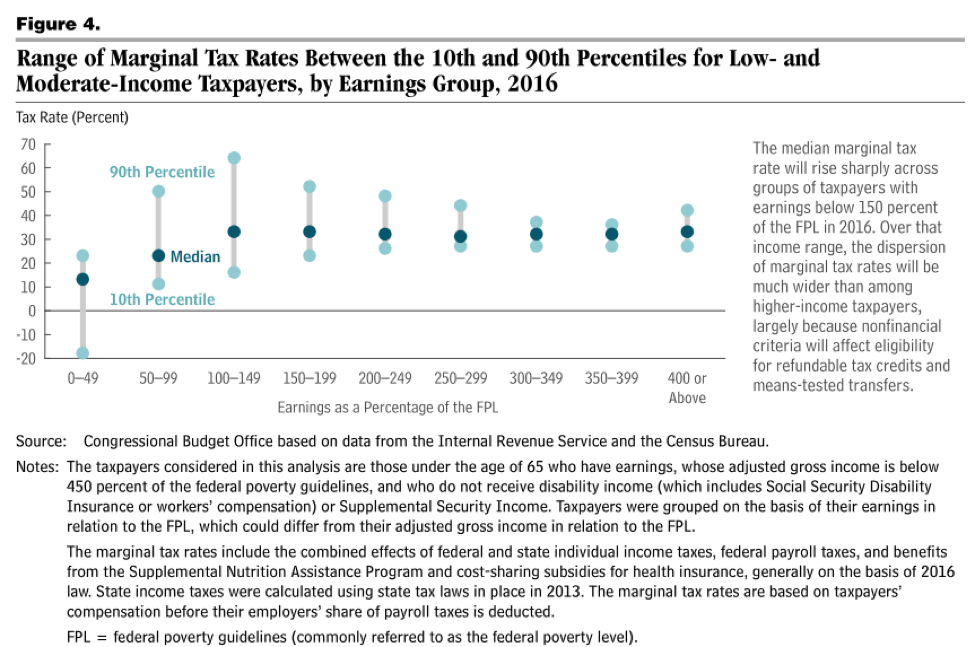

Finally, as the next chart shows, we learn that effective marginal tax rates (EMTRs), which strongly influence work behavior, have risen in recent years. A household’s EMTR includes both its explicit rates of income and payroll taxes and the implicit tax rates that arise from reductions in social benefits—income support, healthcare, food, housing, and other programs.

A chart from a different CBO report shows that EMTRs are especially high and variable for households near and just above the federal poverty line. Those households include a high proportion of the less-educated persons whose LFP is especially low. Note that the chart does not include people covered by SSDI. Implicit marginal tax rates are even higher for people on SSDI, since more than a minimal amount of work can lead to the loss, not only of cash benefits, but also of Medicaid coverage.

Implications for growth and social policy reform

These findings on labor force participation suggest that boosting GDP growth should not be viewed as an exclusively macroeconomic project. Microeconomic policy matters. Economists who work in the area of regulatory reform know that, of course, but social policy plays a role, too.

- Social safety net. Our existing policy for income support, with its maze of overlapping and poorly coordinated programs, imposes unnecessarily high effective marginal tax rates. In fact, as I have argued elsewhere, the CBO’s estimates of EMTRs, as shown in the above chart, very likely understate the magnitude of the problem. Many ways have been proposed to cash out and unify existing programs. Universal basic income, negative income tax, expanded earned income tax credits, universal and refundable child tax credits—take your choice. Any one could lead to a fairer, more rational, and more efficient social policy.

- Healthcare policy. A universal and affordable healthcare system could give a real boost to labor force participation. Such a system would, of course, help simply by improving health. That would be especially important for lower-income workers, whose access to care is now most likely to be limited, and who are most likely to be kept out of the labor force by medical conditions that fall short of full disability. Moreover, a universal healthcare system, unlike the one we have now, would not have to be stringently means tested. The high EMTRs implicit in Medicaid and ACA subsidies for individual policies would be substantially mitigated.

- Disability policy. The current SSDI disability system is obsessively concerned with making sure that people not be able to draw benefits unless they are truly unable to work. That obsession has backfired spectacularly. It is not just that the system excludes many people whose disabilities actually keep them from working but do not qualify them for SSDI. Even more to the point, SSDI, by and large, requires anyone who wants to apply for benefits, or to keep them once in the system, to prove their disability by not working. Attempted reforms, to date, have done little to change that. It remains true that returning to work can mean risking a loss of benefits far in excess of likely earnings. The disincentives in SSDI could be substantially reduced by integrating it with other sources of income support (a UBI, negative income tax, or whatever) and replacing the linkage of Medicaid eligibility to SSDI status with a system of universal health care.

In short, reforming the social safety net should not be viewed as something that would drain public resources and put a drag on economic growth. Rather, it should be viewed, along with regulatory reform and tax reform, as part of a broader project to make the economy more productive and growth-friendly.