Senator Rubio and Senator Lee’s proposed amendment to tie the Child Tax Credit (CTC) to payroll tax liability, in exchange for a slightly higher corporate tax rate (22 instead of 20 percent) was met yesterday with acclaim from social and reform conservatives. It even received praise from some moderate Democrats, like Senator Michael Bennet, who praised its nod to bipartisanship last night on the Senate floor.

Meanwhile, the Wall Street Journal editorial board more or less went off the deep end, penning an editorial that was 50 percent snark and 50 percent just plain bad economics.

First, they argue that a CTC payroll tax refund would discourage work. It wouldn’t: allowing workers with children to keep their first dollar in earnings would lower the implicit marginal tax on labor, and induce greater work.

And second, they argue the 20 percent corporate tax rate is the most pro-growth part of the tax plan. It isn’t: The expert consensus is that greater expensing of capital investment is the more directly pro-growth element of the tax plan. The more important factor for the corporate rate is that it be made competitive with the OECD and G20 averages of ~24 and ~28 percent, respectively. There is simply nothing magical about 20 percent rather than 22 percent.

Ironically, as John Ricco noted on Twitter, the Journal‘s criticism isn’t even internally consistent. File this under “marginalism for me but not for thee.”

Lmao, at least make your bad-faith backfilling internally consistent. Corporate rate cuts are good because it lowers marginal rates, but CTC is bad because it….lowers marginal rates? https://t.co/vhoENT994f

— Ricco (@riccoja) November 30, 2017

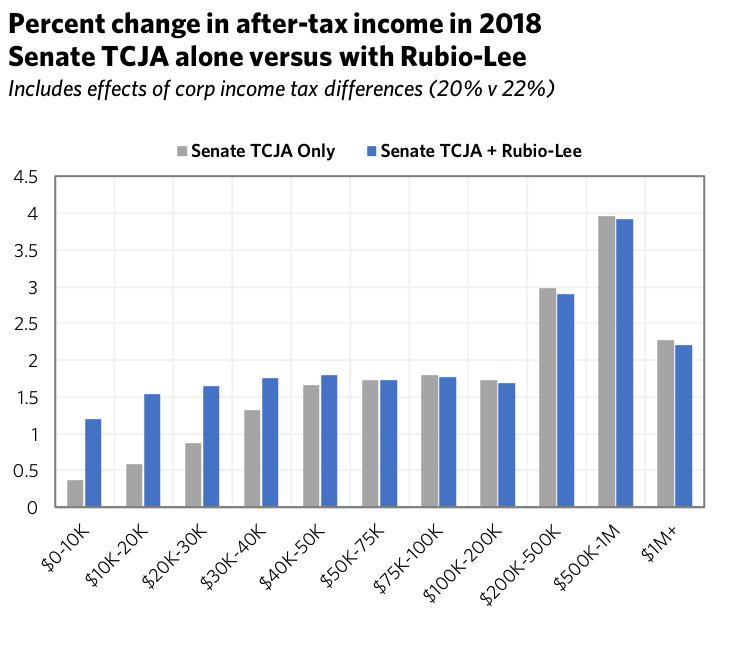

So what is the big hub-bub all about, anyway? The indispensable Ernie Tedeschi ran a simulation of the Rubio-Lee amendment, relative to the base tax plan, to find out. Here are his results:

In essence, for a modestly smaller net gain in the after tax income of upper-income households, the Rubio-Lee amendment adds over 18 million new net-beneficiaries of the tax plan, and substantially increases the tax cut for the middle class. That seems like a winning trade to me. Not just for Republicans, who won an unprecedented election in 2016 with the help of working-class voters, but also for Democrats and the country as a whole.

https://twitter.com/ernietedeschi/status/935991380987600897

Now, with Senator Susan Collins expressing support for the amendment, unanimous support from Senate Democrats is all that is required to make Rubio-Lee a reality. This is their chance to have a bipartisan, and wholly positive impact on a piece of legislation that will almost surely pass with or without them. It is completely normal to support an amendment while planning to vote against a bill as a whole. Apparently, even Trump is against it. So how can they possibly say no?

https://twitter.com/jbarro/status/935975814868488192

Think about what a “No” vote from Democrats would look like: It would give ambivalent R’s, like Senator Rob Portman, a chance to vote “Yes,” giving Ohio Republicans ammunition against Senator Sherrod Brown in 2018. Indeed, it would make this tweet from the GOP twitter account go from being rather stupid, to, well… prescient:

Senate Democrats Then: We must expand the child tax credit!

Senate Democrats Now: Nevermind.— GOP (@GOP) November 27, 2017