One of the earliest proposals for a basic income guarantee can be found in Thomas More’s 1516 book, Utopia, in which the character of Raphael Nonsenso relays a conversation with English cardinal John Morton, who believes a basic provision for livelihood would help prevent petty crime:

I forgot how the subject came up, but he was speaking with great enthusiasm about the stern measures that were then being taken against thieves. ‘We’re hanging them all over the place’, he said. ‘I’ve seen as many as twenty on a single gallows. And that’s what I find so odd. Considering how few of them get away with it, how come we are still plagued with so many robbers?’ ‘What’s odd about it?’, I asked – for I never hesitated to speak freely in front of the Cardinal. ‘This method of dealing with thieves is both unjust and undesirable. As a punishment, it’s too severe, and as a deterrent, it’s quite ineffective. Petty larceny isn’t bad enough to deserve the death penalty. And no penalty on earth will stop people from stealing, if it’s their only way of getting food. In this respect, you English, like most other nations, remind me of these incompetent schoolmasters, who prefer caning their pupils to teaching them. Instead of inflicting these horrible punishments, it would be far more to the point to provide everyone with some means of livelihood, so that nobody’s under the frightful necessity of becoming, first a thief, and then a corpse.

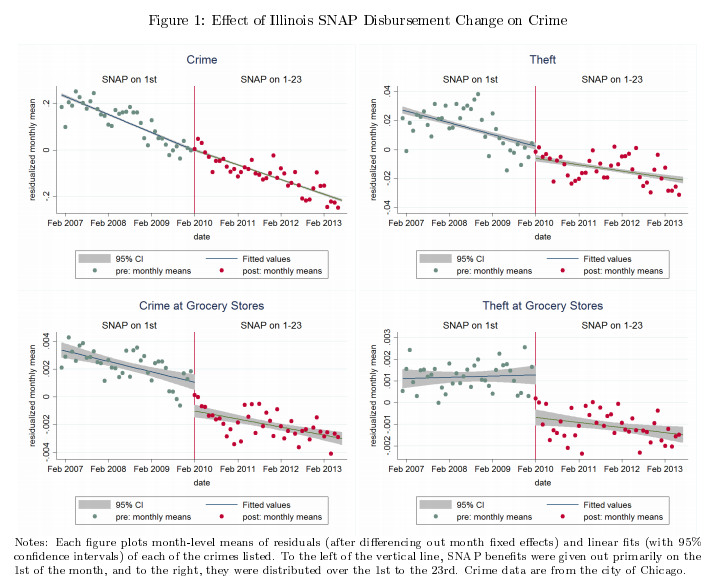

Five-hundred and one years later, and we now have robust empirical verification of the Cardinal’s hypothesis. This is from “SNAP Benefits and Crime: Evidence from Changing Disbursement Schedules,” a 2017 working paper by Analisa Packham and Jillian Carr for Miami University’s Department of Economics:

We find that staggering SNAP benefits throughout the month leads to a 32 percent decrease in grocery store theft and reduces monthly cyclicity in grocery store crimes. Moreover, we find that the relationship between time since SNAP issuance and crime is nonlinear.

Staggering SNAP benefits throughout the month decreases grocery store theft 32%

Periodic payments are powerful. To be eligible for SNAP, a household has to generally be at or below 130 percent of the poverty line. These are households that are incredibly resource-constrained, so it shouldn’t be that surprising that spreading grocery benefits across the month better matches household consumption patterns. We also know that SNAP benefits are routinely (and illegally) exchanged for cash at 50 percent of their face value. You can’t pay your phone bill with a grocery voucher, so that makes me wonder: What would happen to other forms of petty theft and missed bill payments if SNAP recipients were allowed to use their card to pay for more than just groceries? That seems like a pilot study worth running.

In general, I view the social insurance state as partly existing to address the problem of incomplete credit markets for low income folk. Due to an adverse selection problem, the poor are unable to access credit to smooth consumption both between and within months, at least without paying very high rates of interest. This is why lump-sum transfer programs like the EITC are accompanied by high-cost borrowing on the part of the recipient. Unconditional cash transfers can lessen those credit constraints and help substitute folks away from loan sharks and desperate behavior, like shoplifting. This is how I put it in a recent memo I wrote for the National Academies of Sciences on cash-based approaches to child poverty:

Some have argued against periodic payments by noting how the lump-sum nature of tax credits may be useful as a forced savings mechanism. The evidence for this view comes from expenditure surveys which show as many as 84 percent of EITC recipients use some portion of their refund to pay down debts. However, other research reveals that credit card usage by EITC recipients increases in anticipation of the refund, indicating that debt-paying behavior is largely a byproduct of credit-based consumption smoothing. Periodic payments would allow households to smooth consumption without incurring interest costs, thus relaxing credit constraints more efficiently.

Hat-tip: Alexander Berger