Today, Senator Mike Lee and Senator Marco Rubio plan to file an amendment to make the Senate tax bill’s $2000 Child Tax Credit fully refundable against payroll taxes and indexed to inflation. The policy idea is nothing new; Lee and Rubio have been agitating for this exact reform for years. And, from my perspective, the policy is a big step in the right direction and completely in line with the arguments presented in the coalition statement the Niskanen Center helped organize at www.ExpandTheChildTaxCredit.com.

The far more interesting news stems from how Lee and Rubio plan to pay for their reform: A 22 percent corporate tax rate, rather than the 20 percent rate that passed through committee. As a result, two prominent Republican Senators have given their colleagues a stark choice, one which they will have to live with when they return home to face their constituents.What is more valuable: a substantial payroll tax cut for millions of working-class families, or a marginally larger corporate tax cut?

Of course, the usual suspects are already apoplectic, with claims that this represents a betrayal of the conservative movement:

The amendment by @marcorubio to increase the corporate rate to 22 percent in order to spend more money on the ACTC is a disaster for pro-family tax policy and is a betrayal of reform conservatism. #TRIH https://t.co/L5DIwMm3IH

— Ryan Ellis (@RyanLEllis) November 29, 2017

The idea is that the amendment pits the priorities of pro-family and pro-growth conservatives against one another, ensuring the relationship between the two centrals pillars of the Republican Party’s traditional coalition will be forever damaged. And yet, Rubio and Lee are hardly the first-movers in this game of chicken. For years, the Wall Street Journal editorial board has portrayed pro-family conservative’s desire to enhance the Child Tax Credit as directly at odds with their push for lower taxes on corporations, up to and including running a piece mocking the CTC as no different than a boutique tax credit for dog owners. At one level, this is Lee and Rubio simply taking the WSJ’s premise for granted, after years of trying and failing to work in tandem with their zombie supply-sider bedfellows.

But at higher level, it’s clear that folks like Ellis are simply being hyperbolic, while hanging on to a theory of the Republican coalition that is woefully obsolete. For starters, a 22 percent U.S. corporate tax rate will still be 2 points below the OECD average, and 6 points below the G20 average. A “mere” 13 point tax cut for corporations is thus hardly a betrayal of conservative pro-growth tax policy, and is more than enough to ensure the U.S. economy remains competitive on the world stage. Besides, as Ernie Tedeschi points out, a 22 percent corporate rate is about what market participants expected:

https://twitter.com/ernietedeschi/status/935938086948818945

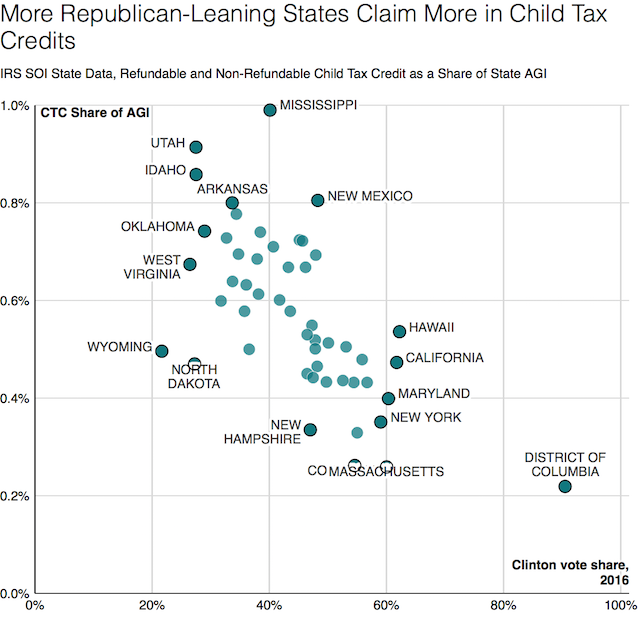

In contrast, the positive strategic case for using the CTC to refund payroll taxes is powerful and straightforward. As a new article from Lyman Stone shows, the CTC was disproportionately claimed by Republican-voting households in the 2016 election:

With the election of Donald Trump, the traditional Republican Party coalition is clearly in transition. But instead of adapting to that fact, Congress has been legislating a kind of pre-2016 conservatism’s Greatest Hits, from healthcare block grants, to marginal tax cuts, to a so-called “welfare reform” legislative push slated for 2018. As such, the base has turned against leadership, and in a big way.

Meanwhile, the successful rhetoric of Trump and surrogates like Steve Bannon has revealed an intense appetite to transform the GOP into the party of workers. A payroll tax refund to working families is an incredibly salient way to give substance to that aspiration. Doing so in a way that angers the traditional donor-class is simply icing on the cake.