The U.S. government could commit to full employment by offering any willing and able person a job in public service. But should it? Known as a job guarantee, the once heterodox idea went mainstream last year with the endorsement of the Center for American Progress. While the specifics of any particular plan vary, CAP proposes “a large-scale, permanent program of public employment and infrastructure investment—similar to the Works Progress Administration during the Great Depression but modernized for the 21st century.”

Proponents argue that involuntary unemployment is a major source of social instability, and that public service employment, in particular, would help bring the country together. Nevertheless, here are three quick reasons why I don’t think a job guarantee is the way to go.

1: It’s a non-sequitur.

In policy debates, it’s always useful to specify the precise source of market failure that demands government intervention. In healthcare, for instance, single-payer proponents argue that private health insurance fails in the face of large adverse selection problems (see: “pre-existing conditions” and “death spirals”). Governments should thus step in to provide efficient universal insurance coverage, while hospitals and doctor offices continue to run in a decentralized manner as private or non-profit organizations. According to this view of the market failure in healthcare, nationalizing hospitals would be a non-sequitur.

There’s an analogy here to job guarantees. The market failure, as far as I can tell, is that recessions, and labor market frictions more generally, contribute to the phenomenon of “involuntary unemployment.” So why not attack this market failure head-on using monetary policy and employment subsidies, leaving the allocation of labor up to the market? In fact, the one thing that distinguishes proposals for a job guarantee from all other related proposals is the notion that public bureaucracies can do a better job at allocating labor than the market — a complete non-sequitur.

2: It would be easily politicized.

Notwithstanding glib remarks about “everything being political,” the market process and Congress really do operate according to different rules — one on the principle of profit and loss, and one on electoral success. Making the U.S. federal government an employer of last resort would therefore dramatically increase the politicization of the labor market.

The WPA in the New Deal era, whatever its other merits, was notorious for favoring urban, industrial states in the North over the agricultural South, and was used by the powerful Ways & Means committee to hand out political favors. Moreover, as a public employer with soft budget constraints, the WPA suffered from many of the same sort of principal-agent problems that typify non-commercialized state-owned enterprises, from shirking to misuse of funds.

While those problems are not insurmountable, proponents of job guarantees neglect the scale of this political-economic problem. FDR governed like a monarch, and thanks to a series of anti-corruption measures, the WPA was much more successful than it might have been. And yet even his job guarantee program was so beset by patronage and waste that it gave birth to the term “boondoggle.” Now imagine a job guarantee with the quality of governance under the current administration: One recession, and we’d have a permanent army of Border Patrol agents. If that sounds far fetched, don’t forget that the WPA was used to construct military facilities in America’s buildup to entering WWII, and was ultimately wound down to push public workers into military service.

3: Subsidized employment beats public employment.

Monetary policy and automatic fiscal stabilizers can support near-full employment without the political-economic problems of a job guarantee. New Zealand’s central bank, a historical leader in monetary policy innovation, recently updated its mandate to include “maximizing sustainable employment” alongside price stability. The Federal Reserve can and should interpret its dual mandate in an equally vigorous way.

“Would Active Labor Market Policies Help Combat High U.S. Unemployment?” – KansasCityFed.org

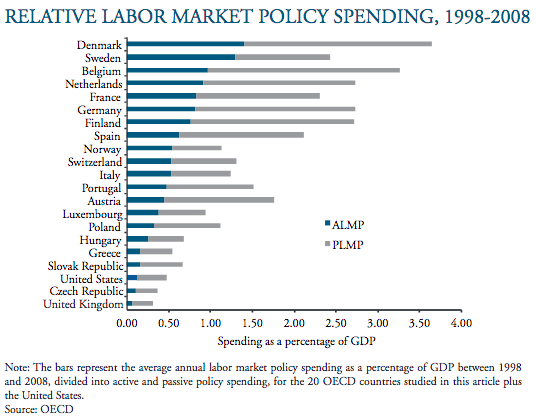

That said, even a strong economy will leave some marginalized or discouraged workers behind. Providing subsidies to private sector employers for hiring hard-to-employ groups, from the long-term unemployed to individuals with disabilities, is a realistic strategy for closing the last mile of involuntary unemployment. As I’ve noted before, the United States trails the developed world in spending on active labor market policies. Researchers at the Georgetown Center on Poverty and Inequality have published a review of the evidence from 40 years of U.S. employment subsidy programs and experiments, with many lessons for how a program with dedicated federal funding could work.

Indeed, within the OECD “direct job creation” is one of the least favored forms of “active labor market policy,” and for obvious reasons. The goal of ALMP is largely to ease the adjustment costs of economic shocks, like through job-search support and wage subsidies. “A large-scale, permanent program of public employment,” in contrast, does nothing to transition workers into newly productive sectors. On the contrary, it risks making the public sector its own source of labor market hysteresis, locking more potentially productive labor into non-market employment with each economic shock.