People today remember the Nixon era mainly for the fiasco of Watergate, but there were positive moments, as well. Those included the first moon landing, passage of the Clean Air Act, and a dramatic diplomatic opening to China. There were also some bold policy initiatives that did not immediately bear fruit. This post takes a look at one of them, a proposal for universal catastrophic health insurance from Elliot Richardson’s Department of Health, Education and Welfare. It went nowhere then, but its time may now have come.

Elliot Richardson and the Mega Proposal

The child of a wealthy Boston family, Richardson was seemingly destined for public service. By the time he came to Washington, he had graduated from Harvard, landed at Utah Beach on D-Day, returned to Harvard for a law degree, and served as both Lieutenant Governor and Attorney General of Massachusetts.

Richardson was seen by those who worked under him as a rare combination of policy analyst and practical-minded politician. He had big ideas that went far beyond the clutter of overlapping programs he found when he arrived at HEW in June of 1970. Over the next two years, he put his staff to work on a sweeping plan for reform, known as the Mega Proposal, which covered all of the major areas for which HEW was responsible. The plan for healthcare reform was part of it.

The rationale of the Mega Proposal was explained in its preface:

Every budget season brings us up against past decisions which have mortgaged the future. Potential for control “next year” always appears bleak due to financial and political constraints. In the past, the Department has evaded this dilemma with rhetorical initiatives for the upcoming year or by riding with the political forces, in the end making only minor changes at the margin.

The result is a Federal system out of control. Federal resources are over-committed, results are over -promised, and access to government services is unequal and fragmented. The Federal program structure has become so complex that it is unmanageable. Interdependencies among programs are ignored because they cannot be understood, leaving rational choice difficult, if not impossible.

We propose to tackle the crisis of the Federal system head-on. The Comprehensive HEW Simplification and Reform which we present here is a redesign of the entire Department of Health, Education, and Welfare.

An article written in 1975 by Laurence E. Lynn, Jr., and John M. Seidl, both of whom participated in formulating the Mega Proposal, calls attention to some additional motivating principles: From the beginning, the proposal favored free-market solutions over direct governmental action. It sought to minimize people’s need to depend on public assistance by making them productive in their own right. Yet, at the same time, it vigorously advocated direct services and income support to those who needed help beyond what their own resources could provide.

Maximum Liability Health Insurance

As applied to healthcare, these principles called for a compromise between a single-payer system that would provide complete healthcare coverage to everyone and one that would leave people entirely to fend for themselves in the marketplace. As the proposal put it, “The public’s health concerns are dominated by the fear that they will be overwhelmed by costs catastrophic relative to their income,” with the result that “segments of the population are not receiving the care they should solely because of costs.” The proposed solution, called Maximum Liability Health Insurance (MLHI), was crafted to be relatively simple, to address the problem effectively, and to represent a “legitimate but not an overwhelming” role for the federal government.

To put MLHI in context, it helps to understand the evolution of health insurance in the United States. On the eve of World War II, private health insurance was a rarity, covering just 9 percent of households. Wartime wage controls plus the decision to exempt health fringe-benefits from income taxes spurred the growth of employer-sponsored insurance. Coverage expanded to half the population by 1950. By the early 1970s, nearly 80 percent of the non-elderly population was covered by some form of private insurance, while Medicare and Medicaid were in place for the elderly and the poor.

However, although insurance of some form was widespread, it was not always adequate. The Mega Proposal was especially critical of two problems.

One was the linkage of insurance to employment, which created gaps in coverage for people changing jobs, for the unemployed, and for the self-employed. As the Mega Proposal put it, “It is extremely difficult, even for the average worker, to insure himself when he is healthy and earning a decent income against the possibility that in the future he could face the loss of his job and with it his insurance just at the time he most needs protection against very high cost medical bills.” This problem was to be remedied by severing insurance from employment and making everyone eligible for coverage.

The second problem was the “upside down” nature of many policies of the day, which provided first-dollar reimbursement (or very low deductibles) for routine expenditures, while imposing annual or lifetime caps. As a result, people were insured against expenditures that they could easily afford, but not against devastating accidents or illnesses. The proposed solution was to turn insurance “right side up” by making households financially responsible for routine healthcare expenditures, while capping their maximum liability for expenses that would otherwise be financially ruinous.

The resulting plan drew heavily on a proposal that had been published in 1971 by Martin Feldstein of Harvard University. Feldstein, who served as an adviser to the Mega Proposal, knew that there were risks both of underspending and of overspending on care. The risk of underspending was greatest when expenses threatened to become financially ruinous, hence the maximum-liability feature. Overspending, on the other hand, was encouraged by excessively generous first-dollar coverage. To discourage overspending, MLHI called for at least small copayments for all participants, up to the limit of maximum liability. Exceptions were made for certain preventive measures, such as childhood vaccinations, which were to be covered in full.

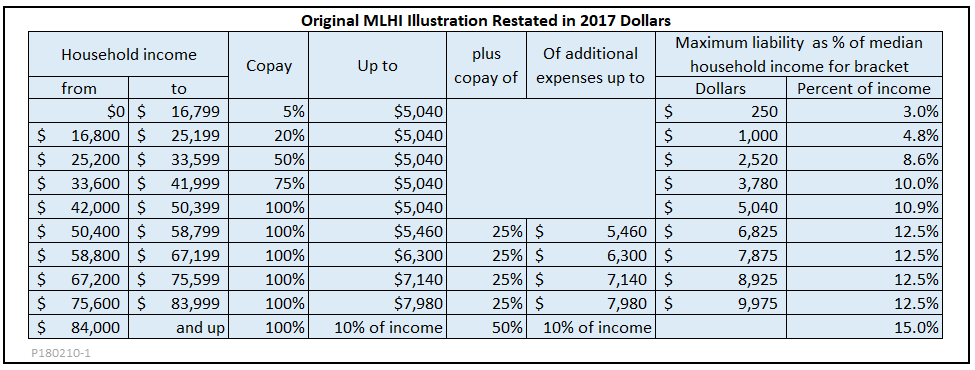

The Mega Proposal did not recommend specific financial parameters, but it did include an illustrative schedule of deductibles and copays to show the general idea. The following table is based on that example, with a few changes to the captions, and with all dollar amounts updated to reflect the increase in median household income since 1972. The result is a schedule of payments that commits even the poorest households to contribute a small amount to their healthcare costs, beginning with the first dollar. Higher income households face a 100 percent copay (that is, a deductible) up to approximately 10 percent of their earnings, and, after that, copays that make them responsible for costs up to 15 percent of their annual earnings.

The Mega Proposal outlined three possible administrative mechanisms. Two of them would be run directly by the federal government, while one would involve private insurers. All of the variants would rely on IRS records for data on household income.

The first federal variant would enroll everyone in the MLHI system, whether they had any claims or not. Patients would present their card to their provider, who would collect the allowed amount from the government, based on the formula for deductibles and copays, and bill the patient for the uncovered balance.

The second variant would take advantage of the fact that many middle- and upper-income households would not meet their deductibles in a given year, and would, hence, have no reason to file claims. The government would encourage them to keep records of health expenses and to file a claim form only if their expenses exceeded 10 percent of income for the year.

The private variant would, instead, give participants a voucher, with a value that varied according to income, that they could spend on an MLHI plan issued by a private insurer. The market for such MLHI policies would be closely regulated at the federal level to assure comprehensive coverage and affordable premiums. Such a system would in many ways resemble the systems used today by countries like the Netherlands and Switzerland.

Whichever the administrative variant, it was considered likely that a market would emerge for private, supplemental policies, which would cover all or part of expenditures up to the limit of maximum liability.

The fate of the Mega Proposal

In the end, neither MLHI nor the other parts of the Mega Proposal went anywhere, politically. Disagreements within the Nixon administration played an important role. Caspar Weinberger, who served as head of the Office of Management and Budget while Richardson was running HEW, was decidedly unenthusiastic. He was not persuaded by assurances that, although the proposal might put additional demands on the budget in the short run, it would save the federal government money in the long run.

Timing also played a role in the plan’s political failure. As it turned out, Nixon decided to move Richardson to the Defense Department in January 1973, two weeks before he finally had a chance to make a formal presentation of the Mega Proposal to the White House. The presentation did take place, but Weinberger, who participated in it, recommended further consideration before moving forward. Weinberger’s subsequent replacement of Richardson at HEW marked the end of active consideration of the Mega Proposal.

The basic concept of universal catastrophic coverage did have some backing on Capitol Hill, especially from Sen. Russell Long, chairman of the powerful Senate Finance Committee. However, catastrophic-only coverage was not enough for Senator Ted Kennedy, who was pushing for something much more comprehensive. Long was not able to advance his own plan without Kennedy’s support.

As the Watergate scandal deepened Nixon’s political and ethical difficulties, it seemed there might be one last opening for healthcare reform. In article written for the Huffington Post at the time of Kennedy’s death, Sam Stein explains that Nixon, in his last months in office, was desperate to show that the government still worked. With that in mind, he was open to a plan that would have combined a robust employer mandate with subsidized private coverage for the self-employed, unemployed, and others not covered through their jobs—something not unlike Obamacare.

In pursuit of that plan, Nixon entered into secret negotiations with Kennedy, who had come to realize that even the backing of organized labor was not enough to ensure passage of a single-payer system. Meanwhile, Rep. Wilbur Mills, chairman of the House Ways and Means Committee, joined the negotiations with a plan of his own. However, after Nixon resigned and Mills was disgraced by the exposure of his drunken escapades with a stripper, the three-way negotiations collapsed. Sporadic efforts at healthcare reform continued through the Ford and Carter administrations, but without result.

What can we learn?

What can today’s reformers learn from the MLHI proposal and its failure to advance beyond the talking stage?

First, we learn that a necessary, but not sufficient, requirement for political success is a willingness to compromise. The MLHI proposal of the Nixon era, and similar proposals for universal catastrophic coverage today, offer a plausible version of such a compromise, which makes individuals responsible for routine care, within affordable limits, while protecting everyone against financially ruinous medical expenses. Within that broad framework, other compromises could be crafted regarding administration, competition, pricing, and so on.

Second, conditions for universal catastrophic coverage may be more favorable now than they were then. The U.S. healthcare system has evolved in ways that ease some of barriers faced by MLHI in the 1970s. For one thing, the “upside down” model of first-dollar coverage combined with caps on spending for the seriously ill has largely disappeared. As high deductible coverage has become widespread, the idea that middle- and upper-income households can and should assume routine health costs has become more widely accepted, so long as premiums for the high-deductible policies themselves are not unaffordably high. At the same time, the disadvantages of employer-sponsored insurance, which was seen as the main alternative in the 1970s, have now become more apparent. Even without policy changes, the employer-sponsored segment of the market is shrinking slowly but steadily. It is likely that employers could now be persuaded to join a coalition favoring an updated MLHI.

Third, although the current administration has produced no Mega Proposal, independent efforts have produced some well-crafted, detailed, and modernized versions of universal catastrophic coverage. One of the best is that promoted by Kip Hagopian and Dana Goldman, first introduced in 2012 in an article in National Affairs and updated several times since then. Their proposal has recently been the subject of rigorous modeling and cost analysis by Jodi Liu of the RAND Corporation.

In short, the 45 year-old idea of Maximum Liability Health Insurance has not gone away. Now may well be the time to bring it back to life as universal catastrophic coverage.

Hat tip to Carlos Mucha for links to key sources.