High-risk pools have played a prominent role in the debate over U.S. health care policy, especially on the conservative side. In contrast to liberals, who lean toward a single-payer system or public option, conservatives would like to limit the government’s role to the very sick and the very poor. For the poor, they seem ready (grudgingly) to accepted Medicaid, or something like it, as long as coverage is limited to the “truly needy.” What to do about the very sick is a more complicated problem. High-risk pools, which both HHS Secretary Tom Price and House Speaker Paul Ryan have endorsed, offer one possible solution.

High-risk pools in theory

High-risk pools address the problem that private companies can profitably offer insurance at an affordable premium only if their pool of customers has enough healthy individuals to keep average claims low. If too many sick people join the pool, claims and premiums, begin to rise. Rising premiums cause healthy people to drop out of the pool and take their chances on life without coverage. The dropouts push premiums higher still for those who remain in the pool until, eventually, no one can afford coverage. Economists call this phenomenon adverse selection. It is popularly known as a “death spiral.”

The traditional way of dealing with adverse selection was to practice medical underwriting, which means dividing the population into separate pools according to health status. If medical underwriting is permitted, insurers quote premiums that reflect the actuarial risk of each pool. They may refuse altogether to cover people with pre-existing conditions, cover them only at very high rates, or place caps on annual or lifetime benefits.

Although it keeps premiums affordable for the relatively healthy, medical underwriting inevitably means that some people cannot obtain coverage at an affordable premium, or have exhausted their coverage by reaching their spending caps. Before the Affordable Care Act (ACA or “Obamacare”) limited medical underwriting, many states created high-risk pools to meet their needs. Such pools were not intended to be profitable and were supported by government subsidies.

Described in this way, high-risk pools sound like a good compromise between the comprehensive government health care found in the rest of the developed world, and a purely market-based system that would make health care unaffordable for any but the healthy and the wealthy. What could go wrong? Several things, it turns out.

Problem No. 1: The skewed distribution of health care spending

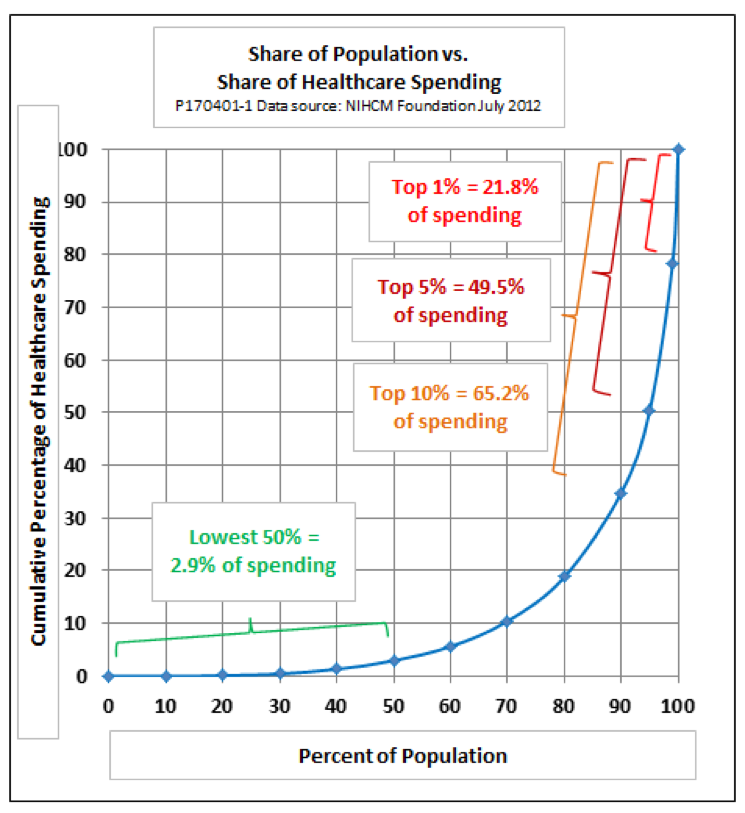

The first problem stems from a nasty reality that proponents of high-risk pools often gloss over. Although such pools would need to cover only a minority of individuals, that small group accounts for the vast majority of health care spending. Consider the following chart, based on data from the National Institute of Health Care Management Foundation:

As the chart shows, the top 1 percent of health care spenders account for almost a quarter of total spending, the top 5 percent for half of all spending, and the top 10 percent for two-thirds of the total. A majority of people in the top spending groups suffer from chronic conditions or functional limitations that put them in the high-spending category year after year. Those near the top of the curve are uninsurable by the standards of conventional medical underwriting. They are the ones who are candidates for a high-risk pool.

People who fall into the eightieth and ninetieth percentiles of spending units account for about 16 percent of total health care spending. Before the ACA, people in this group would have been only marginally insurable. Some would have been able to obtain insurance through a job. If they had high enough incomes, some would have been able to buy individual insurance at higher than average premiums and deductibles. Others would either have been unable to afford the high premiums quoted by private insurers or would have been rejected outright because of pre-existing conditions.

Health care consumers in the lowest two-thirds of spenders account for less than 10 percent of total spending, and those in the lowest half for just three percent of spending. If the highest risk individuals were taken out of the private insurance pool, it is likely that most of these people, except perhaps for the very poor, would be able to buy private individual insurance at premiums they could afford.

Problem No. 2: Government budgets

Some reformers speak as if it would be easy to offer subsidized high-risk pools to a small sliver of the population — just 5 or 10 percent — and let everyone else pay their own way. Unfortunately, given the distribution of spending, it would not be easy at all.

In a study for the Commonwealth Foundation, Jean P. Hall of the University of Kansas calculates that the net cost to the federal budget of a national high-risk pool would be $178 billion per year. That assumes the pools would cover 13.7 million people with chronic conditions, which is less than 5 percent of the population. Each of them would pay a premium of $7,000 per year and have average medical costs of $20,000 per year, requiring a subsidy of $13,000.

Republican proposals to date do not come close to providing that kind of money. Tom Price, while still a Congressman, suggested a budget of $1 billion per year for subsidies to state high-risk pools. A preliminary proposal endorsed by Rep. Paul Ryan was a little more generous, at $2.5 billion per year.

The American Health Care Act (AHCA) that failed to gain Congressional approval in March treated high-risk pools as an afterthought. Its proposed Patient and State Stability Fund would have allowed states to experiment with high-risk pools (among other options), but it was funded at a level of only $10 billion per year, plus a little start-up money. That would have come to just $728 a year for each of 13.7 million medically eligible individuals, or enough to cover Hall’s estimated $13,000 per year average subsidy for fewer than 750,000 out of 13.7 million medically eligible candidates.

Problem No. 3: Affordability and accessibility

The clash between the real-world expenses of high-risk pools and the amount reformers are willing to budget sets up a tension between affordability and accessibility. GOP reformers promise both — “a step-by-step approach to give every American access to quality, affordable health care,” in the words of a policy brief released by House Republicans in early 2017.

The experience of high-risk pools that existed before the ACA gives an idea of what happens when the goal of affordable, accessible coverage meets budget realities. In an issue brief for the Kaiser Family Foundation, Karen Politz reports that at their peak in 2011, 35 states had some kind of high-risk pool. Total enrollment in the pools, however, was just 223,000 people — fewer than 2 percent of the number of people estimated to be medically eligible today. States discouraged participation in a number of ways that undermined affordability and accessibility:

- Most states charged premiums well above market rate, typically 150 to 200 percent of the prevailing average. Today the cost of an average silver plan for a family of four on the ACA exchanges is $923 per month, according to a Kaiser Family Foundation calculator. Applying the 2011 high-risk markups to that amount would give a range of $16,614 to $22,152 per year, equal to approximately 30 to 40 percent of median household income.

- Deductibles further limited affordability. In 29 states, the deductible was $1,000 or more, and it was $5,000 or more in ten states.

- Most states had lifetime coverage limits, typically $1 million or $2 million. Several states also had annual limits.

- Limits on enrollment were another tool used to control the cost of high-risk pools. Some states closed enrollment altogether when funds ran out. Others had waiting periods or excluded treatment of pre-existing conditions for a period after initial enrollment in the pool.

On balance, then, the high-risk pools of the past fell far short of universal accessibility and affordability. Pools that covered the full needs of all medically eligible individuals at an affordable cost would require much larger budgets than either the federal government or most states seem willing to appropriate.

The High-Risk Dilemma

Taking all of the above into account, high-risk pools, attractive as they are in theory, pose a practical dilemma for conservatives. On the one hand, they offer a possible lifeline to market-based, insurance-driven health care for the majority of households who are neither very poor nor very sick. On the other hand, a full commitment to high-risk pools would not be cheap.

The price tag to combined federal and state budgets of fully-funded high-risk pools would exceed $100 billion per year — $40 billion more than the federal government spends on health care through Veterans Affairs, and an order of magnitude more than envisioned budgeted by any conservative ACA replacement offered to date. To keep the cost close to $100 billion would require that participants in the high-risk pools who had the ability to do so paid premiums and deductibles at or moderately above those prevailing in the individual market.

Introducing high-risk pools without adequate funding would have negative unintended consequences:

- Quantitative limits on admission to the pools or long waiting periods would mean loss of coverage for many people with pre-existing conditions, breaking the promise of universal access.

- Trying to save money by lowering reimbursement rates would discourage providers from accepting high-risk patients, leaving them with coverage on paper, but no actual care—a criticism that conservatives often make regarding Medicaid.

- Moving the threshold for high-risk pool eligibility farther up the cost curve would leave more high-cost households in the individual or employer-based market. That, in turn, would push up premiums at the risk of an adverse selection death spiral.

The next round of conservative health care reform will have to face this dilemma just as the first round did. Unless high-risk pools get a more serious treatment and better funding than the AHCA offered, they will have no future.

Addendum: On April 6, the House Rules Committee approved an amendment to the AHCA in an attempt to revive the measure, however it did not reach the floor for a vote. The amendment authorized an additional $15 billion to fund a federal high risk pools. The effort shows that some conservative House members continue to favor high-risk pools. However, the amount they are willing to spend appears to fall far short of the full costs of a comprehensive program for high-risk individuals.

An earlier version of this post appeared in the Milken Institute Review