The technology market is constantly evolving, with Internet-based technological disruption impacting not only other technology markets, but non-technology sectors as well. Virtual reality is forcing realignments in the mobile app and smartphone markets, as well as forcing realtors to reimagine their marketing strategies. New context-aware applications and AI are contributing to rapid advancements in autonomous vehicle technologies, but are also increasingly contributing to efficiency gains in logistics and manufacturing. In the United States, these technologies are driving a new wave of innovation; but they’ve also driven renewed interest in the antitrust concerns associated with mergers and acquisitions, especially in the context of “Big Tech.”

Firms typically make merger and acquisitions (M&A) centering on their competencies and primary business activities to enhance synergies. That’s why Facebook acquired WhatsApp, Microsoft bought out Linkedin, and Google gobbled up Nest. Tech companies have been eating up startups in order to achieve economies of scale, expand global business reach, or grow their market positions.

The underlying logic of M&A strategies is straightforward. If market dominance is what tech companies care about, focusing on a core ecosystem is always better than dispersing smaller investments across many companies. Holding a fraction of shares in an emerging tech startup whose business is tangential to the company’s value chain involves a high level of risk. Startups are a risky proposition with promises of uncertain returns on investment to larger firms. If a startup dies, investors suffer losses; if it survives, it’s hard to efficiently protect interests as a minority shareholder. When was the last time you saw Apple investing in an individual app developer, or eBay investing in its platform sellers?

It is also worth noting that U.S. tech sector has become one of the primary targets of activist investors in recent years. According to a BCG report, a typical S&P 1500 company has a 13% chance of becoming an activist target, whereas the likelihood rises to 22% for technology companies.

Maybe these strategies are unique to the American technology sector. How do things look in China by comparison?

Baidu, the Chinese variant of Google, possesses similar core competencies to its American counterpart, focusing on advertising services and search traffic. Yet it recently invested in O2O, a food delivery business that operates in a market where physical advertising promotion and logistics operations are the keys to market success. Similarly, Alibaba, China’s Amazon-eBay-Paypal equivalent, spent billions of dollars investing in entertainment. Why have Chinese tech firms been more willing to make investments in markets outside their traditional spheres of market success, while their American counterparts remain more steadfastly committed to core investments?

The fierce oligopolistic competition among Baidu, Alibaba, and Tencent (BAT) in China’s capital market has resulted in various proxy wars, in which new entrants are supported by one of the dominant players to leverage against other BAT firms. Tencent (social media) supported JD.com (e-retail) to counter Alibaba (e-commerce). In America, the equivalent scenario would be Google and Apple leveraging Amazon through equity purchases in eBay. At the same time, Alibaba has been buying stocks in Social Network Service (SNS) firms, such as Weibo, to counter Tencent’s Wechat service, the most widely used social app in China.

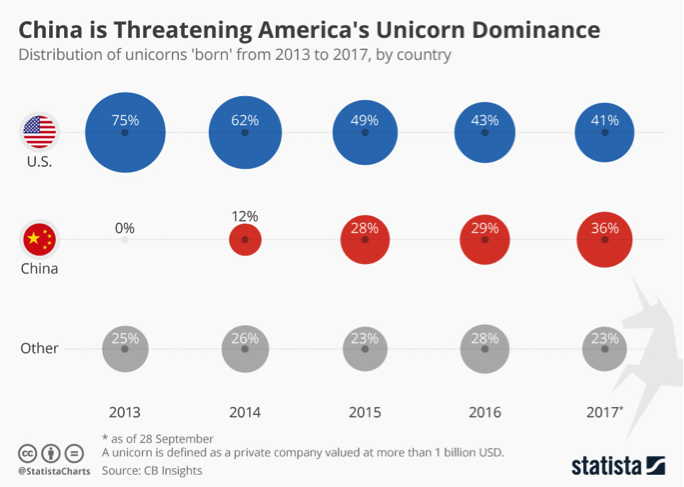

Such proxy battles have resulted in a slew of billion-dollar unicorns emerging in the Chinese tech market, such as Didi, Meituan, Elema, Mobike, and ofo. In each case, these startups experienced exponential growth as a result of the capital support of at least one BAT player. This process provides new players with opportunities to capitalize on such conflict, helping them not only survive, but thrive. Thanks to these dynamics, the birth rate of Chinese unicorn startups has been increasing as well.

The over-diversified investment strategies of Chinese tech giants are made possible by essentially three advantages: Variable Interest Entities (VIE), a policy system favoring industry over capital, and high-yield stocks that make investors happy.

A VIE is an entity in which an investor has a controlling interest, but which does not premise organizational control on a majority of voting rights. VIE has long been a popular structure for foreign parties investing in sectors that are restricted by China’s industrial policy, and has been adopted by many of China’s most well-known offshore-listed companies to attract foreign venture capital financing and complete offshore listings (primarily in the United States and Hong Kong). Even if international hedge funds wanted to exert control over their foreign investment interests, the vague regulations imposed by the Chinese government—without any clear prohibition against, or expressed endorsement of, the VIE structure—makes it very hard for these fund managers to do so.

Second, for tech giants in China, there is rarely pressure from protected investors to force the decision to make changes to a board of directors. And when these firms have an initial public offering, they are simply too big to be threatened, as the restrictions on financing, leverage, and merger further protect their governance role in the board.

Finally, revenue at Baidu, Alibaba, and Tencent has remained steady and growth has been strong. The result has been high-yield stocks distracting investors from other, perhaps more structural, concerns.

All of these issues, in combination, produce a system that tends to favor broader diversification of investments beyond what domestic American tech companies might be willing to tolerate. In comparison, the United States has a capital market where activist investors are empowered by finance regulations to impose pressure on corporations to maximize shareholder value, especially in the short-term. However, the success rate of activists battling against corporate boards has been increasing. The win rate of activists battling for a seat on a company’s board rose from 52 percent in 2012 to 73 percent in 2014. And within 18 months after an activist investor joined their board, 44 percent of companies replaced their CEOs. Examples include the split of eBay and Paypal, the buy-back of Apple, and the post-merger breakup of DuPont and Dow Chemical amid investor unease.

With the presence of activist investors on a board, extra caution is always advised when making investment decisions. Otherwise, uncertain and potentially dramatic battles may lie ahead. Take the eBay-Paypal split for example: after eBay resisted Carl Icahn’s calls for heavy restructuring, including a Paypal spinoff, Icahn launched a proxy fight to control the San Jose company’s board.

It may be time to rethink the role of activist investors and whether they are doing any good for America’s tech industry. As a recent Wall Street Journal op-ed noted, “Activism often improves a company’s operational results—and nearly as often doesn’t.” Given the slowdown of the American unicorn startup community’s growth, the role of activist investors is worth examining.