House Republicans are preparing a tax reform plan that would lower personal income tax rates for many households, increase the standard deduction, and eliminate all itemized deductions — except those for mortgage interest and charitable contributions. Lowering marginal tax rates while tightening loopholes is hard to argue with — but why keep those two?

The charitable contribution as a tax expenditure

Both deductions are examples of tax expenditures. Unlike a simple cut in tax rates, which would leave money in the hands of taxpayers to spend or save as they wish, a tax expenditure is conditional. It leaves money to taxpayers only if they use it in a way the government approves of. The mortgage deduction requires that taxpayers use the money to pay interest on a home mortgage, while the charitable deduction requires them to contribute to tax-qualified organizations.

A tax expenditure is just as real as any other government outlay. Other things equal, eliminating a tax expenditure would bring in more revenue that the government could use to reduce other taxes, buy something else it could not otherwise fit into the budget, or reduce the federal debt.

To decide whether any given tax expenditure is justified, we need to answer two questions: First, does it buy something that is worthy of government support? Second, does it do so more effectively than making a direct expenditure, or than lowering taxes and letting people spend their money however they like?

The mortgage deduction is a relatively easy case. Its ostensible purpose is to subsidize home ownership for the middle class. Not everyone would accept that as a worthy objective, but even if we do, the deduction does not (as I have written elsewhere), accomplish its purpose effectively. The average middle-class household gets less than $200 a year in benefits while those with high incomes get thousands, and renters get nothing at all. If more people understood who actually gets the benefits of this tax break, it would lose much of its popularity.

The charitable deduction is a more complicated case because it benefits not only those who claim the deduction on their tax returns (predominantly upper-income taxpayers), but also the organizations that receive the contributions and the beneficiaries of those organizations. To evaluate the charitable deduction, then, we need to know what it buys.

What does the charitable deduction buy?

Under current law, according to the Tax Policy Center, the charitable deduction is expected to cost the federal budget $51.2 billion in fiscal 2018. Despite the name, however, that money buys less charity than some might think, at least if we use the word in its ordinary meaning of ”generosity and helpfulness, especially toward the needy or suffering” (Merriam-Webster).

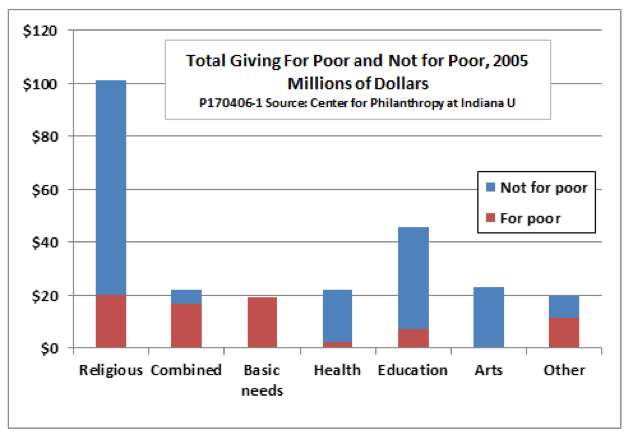

A 2007 study of charitable giving from the Center for Philanthropy at Indiana University estimated the total giving to various categories of organizations and the share for each that was directed toward meeting the needs of the poor. Churches accounted for four-fifths of all giving, of which an estimated 20 percent went to charitable purposes. The remaining 80 percent of church budgets went to support worship activities, salaries and cost of facilities. In contrast, combined purpose charities, such as United Way, and certain other charities specifically focused on basic needs directed nearly all of their contributions to the poor. The study judged that about 10 percent of donations to health care and 15 percent of donations to education went to helping the poor, while the rest went to benefit patients and students of all income levels. Sixty percent of the “other” category of donations were thought to benefit the poor, and only a negligible amount of contributions to the arts. Overall, about 31 percent of donations eligible for the charitable deduction went to truly charitable purposes, as summarized in the following chart:

But charity isn’t everything. Many people consider at least some of the causes supported by the charitable deduction to be worthy of government support, even if they are not strictly focused on the needs of the poor. For example, some people might consider it worthwhile to support “public goods,” which benefit everyone but which are hard to finance because free riders cannot be excluded from benefits even if they do not contribute. Public radio stations are an example.

Others see it as worthwhile to support causes that directly benefit only the members of a limited group (sometimes called club goods), but which indirectly help strengthen civil society or build communities. Churches and service organizations fit this category. The charitable deduction helps such groups in general but leaves it up to individuals to decide which ones to support.

The problem is, though, that a cause one person considers worthy of government support might be considered frivolous by others and positively harmful by still others. Take religious organizations, for example. No doubt followers of any given faith see them as contributing to a strong society, but non-members might see it differently. They might believe government support of religion in general to be inconsistent with the Constitution. They might be put off by doctrines regarding women’s rights or same-sex marriage. Or they might be unbelievers who think construction of elaborate shrines to nonexistent deities is a complete waste of money.

Similarly, some people see support of environmental causes as urgent public purposes, while others see environmentalists as enemies of progress. Some people think the government should put animal rights on a par with human rights, where others might see any government action in this area as a violation of the rights of chicken farmers or ranchers. For that matter, there are plenty of people who think helping the poor should be a strictly private duty, not a matter for government.

The point here is that almost no one endorses the full list of causes supported by tax-exempt donations. If I had to guess, I would say the average taxpayer probably finds no more than half of those causes as worthy of public support.

How Much Does the Charitable Deduction Increase Giving?

If the charitable deduction dramatically increased total giving, it might be possible to justify its budgetary cost of $50-odd billion per year, even if only half of the giving went to truly worthy causes. Let’s refer to the amount of added donations to worthy causes (however defined) per dollar of cost to the budget as the charitable efficiency of the deduction. For example, if it generated $2 in new giving to worthy causes for each $1 of cost, we could say that its charitable efficiency is 100 percent. However, the available evidence suggests that the charitable efficiency of the deduction is far less than that.

Charitable efficiency, in this sense, depends on three variables: The share of tax-qualified donations that go to purposes counted as worthy, tax rates themselves, and the elasticity of giving, that is, the percentage by which donations increase for each 1 percent decrease in the cost to donors of making contributions.

An example will show how these three variables interact to determine charitable efficiency. Suppose you are in a 40 percent tax bracket. Suppose that even without a tax deduction, you would make $1,000 in annual donations, half of which go to causes judged worthy by a consensus of your fellow taxpayers. Then suppose that the elasticity of giving is 0.2, a value found to be reasonable in a review of the academic literature by Daniel Hungerman and Mark Otoni-Wilhelm. If donations were instead deductible, the out-of-pocket cost of each dollar you give falls to 60 cents (a 40 percent decrease). Applying an elasticity of 0.2 to that 40 percent decrease would produce an 8 percent increase in your total giving. Instead of giving $1,000, you now give $1,080 of which $540 rather than $500 goes to worthy causes. The cost to the Treasury is 40 percent of the full amount you give, or $432. If that $432 “buys” an increase of just $40 in worthy donations, the charitable efficiency of the deduction is just 9.25 percent.

Do my numbers appear too conservative? Put your own numbers in and see what you get. For example, try keeping the tax rate at 40 percent but raising the elasticity of giving to 0.5 and the share of worthy donations to 80 percent. The tax deduction would then generate $160 in new worthy donations at a cost to the budget of $464. The charitable efficiency would still be just 34 percent.

In reality, these examples overstate charitable efficiency, since the 40 percent tax rate they use is unrealistically high. According to the Center for Philanthropy, a third of all giving comes from households with incomes under $100,000. None of these face a tax rate of more than 25 percent, and only 39 percent of them itemize. High-income taxpayers with tax rates of 35 to 40 percent account for at most another third of donations.

In short, whether you think that charitable efficiency is 9.25 percent, or 34 percent, or even an unrealistic 50 percent, the charitable deduction is an expensive way to fund scholarships, soup kitchens, and animal shelters.

Repeal or reform?

On the basis of low charitable efficiency alone, not even considering philosophical objections, we can make a case for abolishing the charitable deduction altogether. Part of the $50 billion increase in federal revenue could be added to the budget of public programs for poverty relief, education, or whatever, in recognition of lost contributions. The remainder could be returned to taxpayers through cuts in other taxes. Instead, the entire $50 billion dividend from abolishing the charitable deduction could be folded into a universal basic income, as I have suggested elsewhere.

Alternatively, those who are not persuaded that the deduction should be abolished might want to consider reforms that would raise its charitable efficiency.

One way to do that would be to replace the existing charitable deduction with a tax credit that would available at a fixed rate to all households, regardless of income and regardless of whether they itemize. For example, a 20 percent tax credit would mean that any person who gave $100 to charity would get a reduction of $20 in the amount of income tax they owed. That differs from the current deduction, under which a person giving $100 gets a $35 reduction in taxes owed if they are in a 35 percent tax bracket; a $15 reduction in taxes if they are in a 15 percent bracket; and no reduction if they do not itemize deductions.

A 2011 report from the Congressional Budget Office discusses several tax credit scenarios, with rates ranging from 15 to 25 percent, and with or without minimum required donations. Depending on the structure of the credit and on the assumed elasticity of giving, the CBO found that such a reform might increase or decrease total donations and might increase or decrease the total cost to the budget, but in almost all cases, would increase charitable efficiency.

A different kind of reform would narrow the range of organizations eligible for tax-preferred giving. As it stands, the IRS seems willing to allow deductions for donations to any not-for-profit organization that offers the slightest fig leaf of charitable purpose. Instead, it could require that any organization wanting to qualify for the tax preference submit an application showing the percentage of its activities that directly benefit approved causes, along with other relevant information of the type currently supplied by organizations like give.org. Based on appropriately audited information, it might turn out that, say, $60 of a $100 donation to the United Way might qualify for the tax credit, but only $10 of a $100 unrestricted donation to a university endowment.

Such reforms could be implemented individually or in combination. For example, converting the deduction to a flat credit would be beneficial even if the list of approved causes were left as broad as it is now. Similarly, restrictions on eligibility could be implemented within the framework of the existing tax deduction, or could be combined with the conversion of the deduction into a credit. Together, almost any combination of these reforms could increase charitable efficiency while reducing its cost to the federal budget.

Finally, although this post has focused only on the deductibility of charitable contributions from individual income taxes, it is worth noting that not-for-profit organizations are also exempt from corporate income taxes and several kinds of state and local taxes. The points discussed here suggest that consideration might be given to narrowing the scope of these other tax preferences, as well.

Conclusions

I think it is fair to say that the popularity of the existing charitable deduction rests on a set of false premises. As things stand, only around a third of tax-qualified giving goes to meet basic needs of the poor. The remainder goes to causes ranging from religious worship to arts to environmental causes that some people consider worthy of government subsidy but others do not. Overall, the charitable efficiency of the deduction is low. On reasonable assumptions, each dollar of cost to the budget may bring in less than a dime in new money for worthy causes.

Personally, I would not be sorry to see the charitable deduction eliminated altogether as part of a broad tax reform that reduced rates and eliminated preferences. If some kind of tax preference for charitable giving is retained, then the existing itemized deduction should be replaced with a flat tax credit available to all households, and the range of organizations and causes eligible to receive tax-preferred contributions should be narrowed.

Some might fear that such a reform would doom the not-for-profit sector, a key buttress of civil society. However, as an editorial in Nonprofit Quarterly points out, such warnings have often been issued, but have proved unfounded when major tax reforms were made in the past. The introduction of the standard deduction in 1944 and the huge cut in the top tax rate in 1981 had even greater effects on incentives to donate, but in the end, had little effect on giving. I am convinced that organizations doing good work for worthy causes, whether they focus their efforts on the poor, the environment, universities, or the arts, would survive elimination or reform of the charitable deduction in good shape.