Cash transfers are without a doubt the most efficient means of providing individuals and households with basic economic security. Cash is cost-effective, and spares us of added bureaucracy. Beyond that, it helps preserve individual choice. Yet for many, freedom of choice is a double-edge sword.

On the one hand, the fungibility and flexibility of cash lets the recipient harness their local knowledge and channel resources into the goods or services they need the most. On the other hand, freedom comes with the possibility of making choices that deviate from public policy goals, including using the cash to engage in vices like tobacco and alcohol.

The concern that the poor will misuse income support on vices like tobacco or alcohol has been a strong force in the shaping of the U.S. welfare state. Rather than simply transfer poor people cash, for instance, we provide vouchers towards groceries or rent, and then attach additional strings to ensure that the poor buy the right groceries and live in the right housing.

But what if this concern is completely unfounded? What if the poor consume tobacco and alcohol no more than their richer counterparts? And what if cash transfers, rather than enabling bad behavior, can actually help to cure it by reducing economic insecurity and the demand for so-called temptation goods?

This is the main takeaway from newly published research by David Evans and Anna Popova in Economic Development and Cultural Change (click here for an earlier ungated version). The authors review 19 studies quantifying the impact of cash transfers on temptation good expenditure in developing countries, along with another 11 studies surveying respondents about whether they used transfers to purchase temptation goods, and then construct a meta-analysis. Their findings are clear:

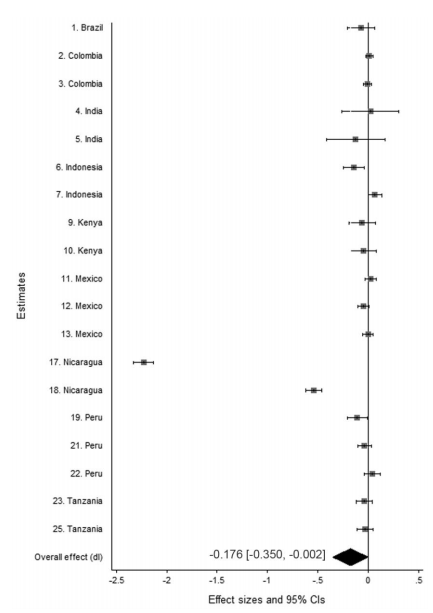

Across 44 estimates from 19 studies, we find that almost without exception, studies find either no significant impact or a significant negative impact of transfers on expenditures on alcohol and tobacco. This finding is similar whether the analysis includes experimental and quasi-experimental designs or if it is restricted to randomized trials alone. Likewise, studies that have tried to quantify the proportion of beneficiaries who spend transfers on temptation goods find negligible effects. This result is consistent across the world, supported by data from Latin America, Africa, and Asia. It is also consistent across conditional and unconditional cash transfer programs. The evidence suggests that cash transfers are not used for alcohol and tobacco at any significant levels.

While the majority (24) of the 44 estimates showed zero or insignificant effects of cash on temptation good spending, 12 showed statistically significant negative effects. Only 2 estimates indicated a significant positive effect.

Results of a meta-analysis on cash transfer’s impact on “temptation good” expenditure. Source: Evans and Popova, 2016.

How can this be? The authors offer a couple of potential explanations. First, products like tobacco are inferior goods, meaning the average person will expend less on tobacco as their income increases. When cash is conditional on work or schooling, it can potentially induce substitution away from temptation goods as well. Second, cash transfer programs often come with social messaging campaigns that actually work to shape the recipient’s spending decisions, a phenomena known as the flypaper effect. Lastly, the authors consider whether cash is spent more responsibly when it’s received by the female heads of households, but those results are mixed.

This is all consistent with the research I cite in my paper making the case for a Universal Child Benefit to replace the federal childcare bureaucracy. As I wrote then, when researchers looked at expenditure surveys of families receiving Canada’s Universal Child Care Benefit they found:

outcomes for children improved through two distinct channels: by increasing direct expenditures on inputs like education and health (“the resource channel”), and by helping pay for general household items that reduced stress and improved family stability—what the authors refer to as “household stability items.” For every dollar the child benefit increased, the average household spent 13 cents more on education inputs like computers and school supplies, but also 17 cents more on rent, 8 cents more on food, and 6.5 cents on transportation. Perhaps the most surprising result is that increases in the child benefit caused a significant drop in the consumption of tobacco and alcohol products. It’s hard to say why an extra dollar would lead households to spend 6 and 7 cents less on cigarettes and booze, but one obvious possibility is that reducing a household’s financial stress reduces its need for stress relief.

So why do we continue to craft public policy as if the opposite were true? It’s time to shed our cynicism about cash transfers and accept the mountain of evidence that cash works.