Editor’s note—our guest blogger today is Danny Cullenward. Danny is a Research Associate with the Near Zero program at the Carnegie Institution for Science in Stanford, CA.

In May, California’s quarterly cap-and-trade auction imploded, with 90% of available allowances failing to find a buyer. Had these allowances sold at the minimum auction price, they would have brought in more than $990 million in total revenue—$550 million of which was due to be delivered to the Greenhouse Gas Reduction Fund to support high-speed rail and other state projects. The state now faces an enormous shortfall of carbon revenue.

California’s cap-and-trade policy is widely seen as the leading example of state carbon pricing. So what happened?

As my co-author Andy Coghlan and I explain in a new article in The Electricity Journal, California’s market suffers from a structural oversupply of allowances and a lack of long-term policy credibility. These problems illuminate how emissions trading systems work in practice and should inform the next generation of climate policies.

Let’s begin with the structural oversupply issue.

Perhaps the most important factor behind May’s auction is the state’s reliance on sector-specific programs and regulations to meet its goal of returning to 1990 greenhouse gas emissions levels by 2020. In local policy circles, these instruments are called complementary policies, implying that they exist to support a comprehensive cap-and-trade system that covers 85% of statewide greenhouse gas emissions.

In practice, however, the terminology is backwards: complementary policies do most of the work, as Stanford Law Professor Michael Wara has observed. The California Air Resources Board (CARB), which implements state climate policy, calculated that complementary policies are expected to deliver about 70% of the total mitigation required to meet the state’s 2020 target. As a result, the carbon market only prices residual mitigation not otherwise required by regulation. The bulk of mitigation occurs via other policies, whose implicit carbon prices are often much higher than in the market.

Additional CARB reforms further weakened the carbon market. Just before the market officially launched in November 2012, CARB quietly issued an informal guidance document that enabled electricity importers to freely swap power contracts across the state border. By engaging in this practice—known as resource shuffling—electricity importers are able to preferentially replace high-emitting coal power imports with lower-emitting natural gas and renewable energy sources.

The result? Leakage. Although companies that engage in resource shuffling book a reduction in their reported emissions—and demand fewer carbon market allowances as a result—their actions merely shift responsibility for emissions to neighboring states that lack climate policy.

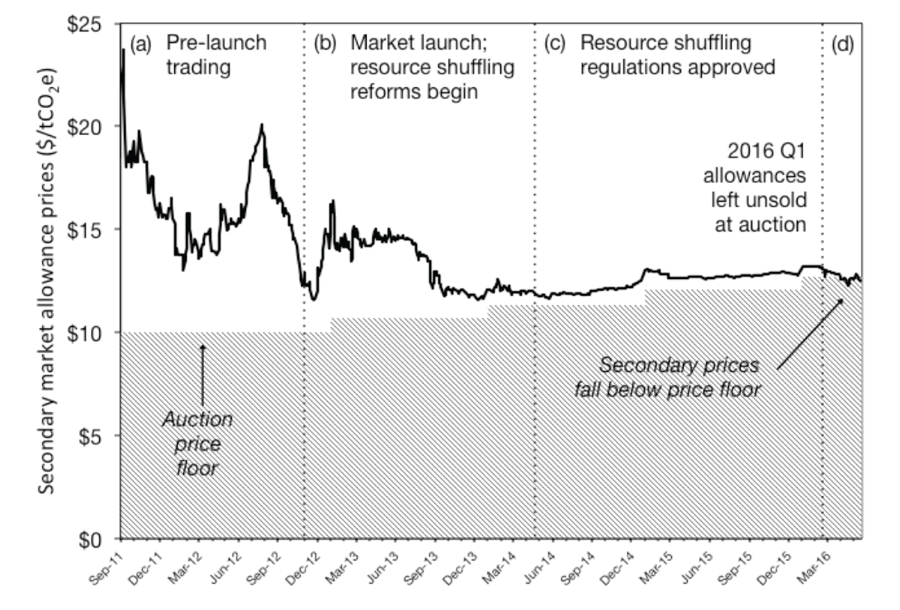

As CARB formalized its resource shuffling rules in July 2013, secondary carbon market prices fell to the minimum auction price floor, where they remained stable for several years. A few months ago, however, secondary prices suddenly fell below the price floor and government-sponsored auctions failed to sell out—first with a minor wobble in the February 2016 auction, and then a spectacular failure in May.

Developments in the auctions and secondary markets are, of course, related: if regulated companies do not wish to purchase allowances at the auction price floor, it makes sense that these instruments would trade at a lower price on the secondary market. Similarly, if the secondary market clears below the auction price floor, we should expect companies to buy allowances on the secondary market, not from the government.

Source: (Cullenward & Coghlan, 2016)

It’s now clear that the carbon market is seriously oversupplied. But that aspect of policy design is only part of the problem. Long-term credibility matters, too.

The most pressing legal issue is the lack of a credible post-2020 future for state climate policy. The legal authority for California’s carbon market is set to expire at the end of 2020 (see Cal. Health & Safety Code § 38562(c)), which helps explain why the market is leaving $13/tCO2e compliance options on the table despite Governor Brown’s ambitious goal of reducing statewide emissions 40% below 1990 levels by 2030. If companies believed today’s allowances could be used to meet tomorrow’s climate target, allowances would be a steal at $13.

Even as the May auction demonstrated the need for post-2020 policy, its failure sent jitters throughout the world of state climate politics. Money is, as always, at the heart of the conflict. Governor Jerry Brown proposed a $3.1B cap-and-trade spending plan in January, drawing on an expected $2.0B in carbon market revenue in the 2016-17 fiscal year. After the failed May auction, however, the final state budget eliminated any mention of projected revenues, promising instead that “[t]he Administration will work with the Legislature to appropriate additional Cap and Trade funding later in the legislative session.”

Meanwhile, a variety of efforts are underway to extend the cap-and-trade program beyond its current expiration date in 2020. The most obvious solution would be to pass new enabling legislation (SB 32), but any extension that includes government-run auctions—a critical element in political terms—would likely require a 2/3 legislative supermajority under Proposition 26. Likely as a result, the current version of SB 32 does not extend CARB’s explicit authority to continue the carbon market.

Not all stakeholders are convinced that new legislative authority is required, however. Chief among this group is the market regulator, CARB. On Friday afternoon before the July 4 holiday weekend, CARB announced it will release draft regulations for the post-2020 period on July 12. But whether CARB has the legal authority to do so is hotly disputed. If CARB proceeds with a post-2020 regulatory strategy, it will surely face a difficult and high profile lawsuit—one with the potential to damage California’s reputation as a climate policy leader.

With carbon market revenue drying up and legal tensions rising, all eyes are now on the upcoming August auction, where the state will offer 96 million allowances. Compare that with the May auction, when 78 million were offered but only 8 million sold.

The billion-dollar question: is CARB’s regulatory assertion legally credible enough to calm the market?

Image by Gerald from Pixabay.