Last week I had the honor of presenting Toward a Universal Child Benefit at the Brookings Institution as part of an event that explored how a child allowance would work if enacted in the United States. I made the libertarian and conservative case for making the Child Tax Credit fully refundable, and doubling it to $2000 for young kids. You can find video of my remarks here.

The Brookings event also included an excellent talk by Kathryn Edin, who explained how welfare-to-work reforms, whatever their other successes, created a glaring hole in the safety net for single parent households, particularly mothers. Indeed, the echos of the ‘96 welfare reform — from increases in child homelessness, to the debate over work incentives — loomed over the whole event. And in the days since, they have continued online, with the American Enterprise Institute’s (AEI) Angela Rachidi writing a critique of child allowances that uses all the familiar clichés about work as the path out of poverty. Unfortunately — and as was the whole point of Edin’s remarks — child poverty is precisely the area where welfare reform’s familiar formula fell apart so dramatically.

A Significant Omission

I should note that AEI does not take an institutional position on child allowances, and in general encourages robust debate among its scholars. Unfortunately, Rachidi’s post goes a step further by being outright misleading about the state of knowledge around child allowances. She begins by quoting from a paper by the economist Tammy Schirle which looks at the labor market effects of Canada’s Universal Child Care Benefit, a periodic cash payment to families that was introduced in 2006 (it has since been greatly expanded into what is now called the Canada Child Benefit). Here is the excerpt she used from Schirle:

The results suggest large and significant negative income effects on labour supply for lower-educated [married] mothers on both intensive and extensive margins. Significant income effects are found for mothers who have attained education beyond high school as well. The UCCB’s negative effects on father’s labour supply are significant, and align with income effect estimates in the literature.

The careful reader will have immediately noticed that the word “significant” in this excerpt refers to the technical concept of statistical significance, with the one exception of the word “large” applied to the labor supply effect for lower-educated mothers, to which we will return. Of course, all researchers go into a paper understanding the difference between “statistically significant” and “economically significant,” but the difference is often missed by lay-readers — a fact that Rachidi exploits to create the misleading impression that a child allowance would have a dramatic negative effect on female employment more generally. It’s great to know that Schirle’s regression coefficients had low observed standard errors, but for the most part this quote does nothing to indicate the magnitude of the effect; or as Deirdre McCloskey would call it, the oomph.

Effect Size Matters

The truth is that, if anything, it would be surprising to find out that the direction of Schirle’s coefficients were otherwise. As she says herself, they “align with income effect estimates in the literature.” The key question is whether the size of the effect on median female labor supply — one hour of work less per week — is a worthy tradeoff for the benefit of putting a deep dent in child poverty. And yet you won’t find any mention of effect sizes in Rachidi’s post. Instead, she uses statistical significance to move directly to the policy-upshot — “work and work supports are the answer” — which I infer, as a longtime reader of AEI’s policy blog, is a hot-key that comes pre-programmed on AEI’s company-issued keyboards.

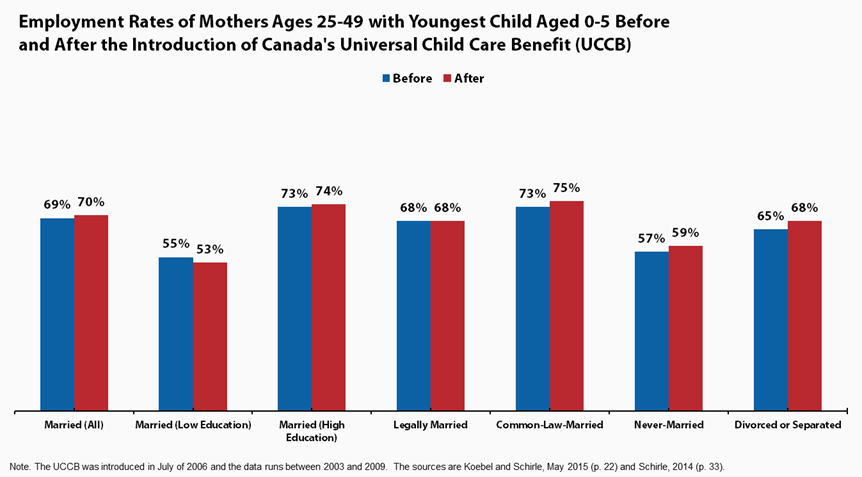

So let’s take a look at the actual before and after of Canada’s child benefit from Schirle’s paper, including results from a follow-up paper she wrote looking at the differential impact on single and married women, starting with mothers of young children:

Image credit: Ben Spielberg, CBPP

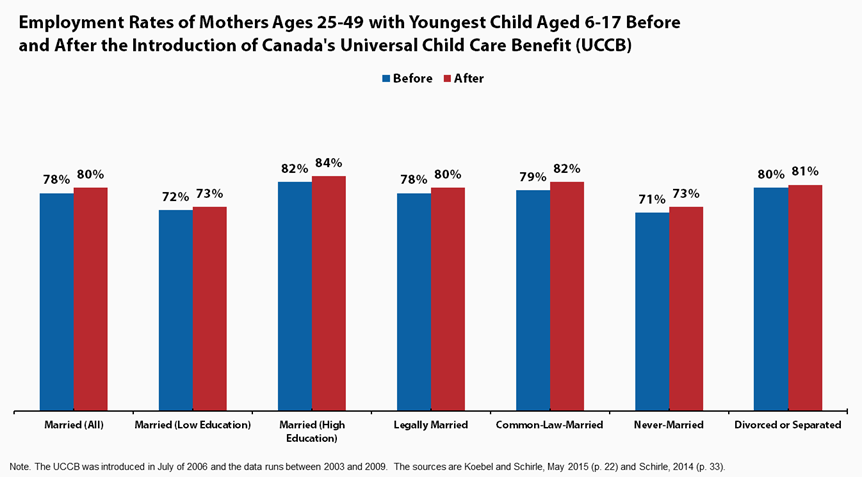

Huh! It turns out the introduction of Canada’s Universal Child Care Benefit (a per month transfer of around $100) was followed by a sizable increase in employment for many mothers, particularly women who were never married, common-law married, or divorced. Employment rates of highly educated married women also increased a point. The before and after for mothers of children aged 6-17 continues the trend:

Of all the categories, the only one that sees an economically significant fall in employment is low education, married mothers of young children. This makes sense. Parents may have an absolute advantage in caring for their own children, but they may not always have a comparative advantage. The decision of whether to be a stay-at-home or working parent is a function of opportunity cost, which is in turn a function of education. Like it or not, it is often the case that parents who have a low level of formal education but who also have the support of a spouse are often the most cost-effective (and highest quality) provider of childcare among the available options. This happened to be the case for me personally. After I was born my mother, a lawyer, worked full time, while my father, a marine engineer in between stints on cargo ships, took nearly five years off work to care for me.

Think about it. Does it make sense to force a new parent into the labor market to earn $10 per hour, only to turn around and pay a babysitter $14 per hour (the current national average wage for babysitters)? Of course not. Subsidizing child care doesn’t change this economic reality. And yet a simple cash transfer is able to split the difference between the needs of diverse cohorts, and let price signals do their work.

The Conservative Labor Theory of Value

A similar differential exists between married and single mothers. As Schirle notes,

the effect of the UCCB on mothers’ participation in the labor force clearly differs across single and married mothers. The estimates in Table 2 suggest that a single mother increases her likelihood of participation in the labor force by 2 percentage points when receiving the UCCB. In contrast, the estimates in Table 3 show that the UCCB reduces the likelihood of married mothers to participate in the labor force by 1.4 percentage points.

This also makes sense, and is devastating for Rachidi’s argument. According to Rachidi,

We should make reducing child poverty a priority, but two concerns remain about a basic child allowance as the policy of choice. First, providing any kind of public benefit that does not require work will likely lead to reduced employment. Without employment, little hope exists to escape poverty and increase upward mobility.

And yet, according to the same author she goes on to cite, a child allowance on the scale of what I’ve proposed caused single mother families — the families where child poverty is most pronounced — to increase their labor force participation by 2 percentage points. Translated to the U.S. population, that would mean 240,000 single mothers entering the labor force — a huge boon for upward mobility on Rachidi’s own terms.

Rachidi’s model — that “any kind of public benefit that does not require work will likely lead to reduced employment” — is simply not what the literature finds. It reflects an extremely limited view of the types of constraints affecting the poor. Being poor, but especially being poor with children, is inherently stressful. Even a small amount of liquidity, about $100 a month in this case, can substantially relieve that stress, mental and financial, and end up being employment enhancing. And that is exactly what the research shows. Recipients of the child benefit in Canada, for example, used the money to purchase so-called “household stability items,” or everyday purchases that helped relieve immediate household stressors, resulting in reduced alcohol and tobacco consumption, and less interpersonal conflict.

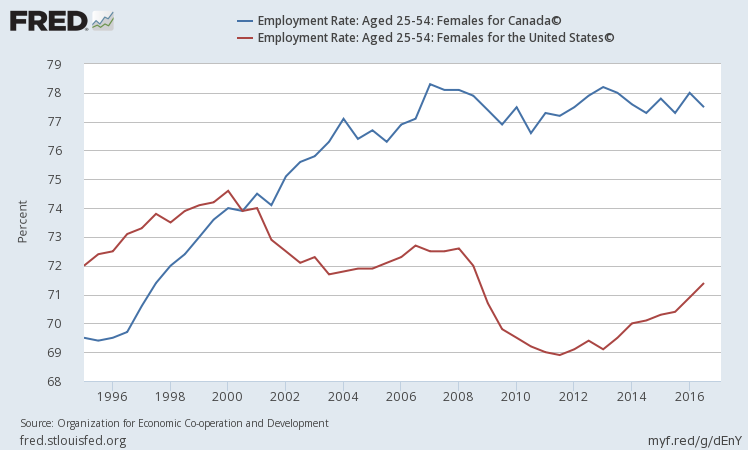

More generally, and as I noted to AEI’s Robert Doar during the Brookings Q&A, opposition to a child allowance based on employment concerns seems to posit a “thin-skinned” view of labor markets. Prick the labor market even slightly, like with a $2,000 credit for young kids, and jobs will hemorrhage. It should go without saying that this is not supported by the data, but sometimes a picture is worth one thousand words:

H/T @inclusionist

Of course, many policy and cultural factors go into explaining labor force participation, including things the U.S.’s trillion dollar gap in active labor market policy — but that is kind of the point. The intense focus on cash transfers is a red-herring, a hangover of the welfare reform debate from the 1990s. Consider that under Canada’s current child benefit, a family with two young children would receive unconditional payments of $12,800 each year, dropping to $10,800 when the kids turn school age. And yet as you can see, the floor has not dropped out of their labor market. If that doesn’t move Doar and Rachidi’s priors on the insignificance of income effects for robust labor force participation, I don’t know what will.

What Happened To All the Pro-Family Conservatives?

So to refresh, the group with the greatest child poverty (single mothers) is also the group most likely to use the money from a child allowance to increase their labor force participation. But what about legally married mothers? This gets to the power of a universal child allowance, and why it has historically appealed to family minded conservatives.

We know that a child allowance is an extremely powerful force for reducing child poverty and promoting labor force participation among single mothers. But for married mothers, the marginal effect is what you would expect from a benefit that doesn’t discriminate against the division of household labor in traditional families. As it stands now, more than 40% of preschool aged children are primarily cared for by a relative, including stay-at-home parents and grandparents. A cash-based child benefit can help families afford external child care, but since it can also be used to compensate the costs of familial child care arrangements, it thus shows respect to more conservative lifestyle choices. That a per-child tax credit could also reduce abortion and family break-ups doesn’t hurt, either.

Reihan Salam made the case that conservatives should pick up the cause of stay-at-home parenthood in a recent piece for Slate. Pointing to work done by the sociologist Catherine Hakim, Salam noted that

women’s attitudes toward work and family life can be divided into three broad clusters. At the extremes you have home-centered women, for whom family life and children are always the first priority, and work-centered women, for whom work or other commitments outside the home take precedence. In between are adaptive women, who tend to greatly outnumber women in the other two categories.

Salam likes the idea of a refundable child tax credit because home-centered women tend to be more socially conservative than other women, and he’d like to see conservatives become more “attuned to their material interests.” Indeed, there is nothing conservative about Rashidi’s desire to convert new mothers into wage earners — quite the opposite. Long before AEI made labor force participation the measure of all things, illiberal reformers within the progressive movement sought to break up traditional family structures by pushing women into formal employment so that, among other things, their work would be taxed and recorded in the national accounts. This found its pinnacle in calls for all children to be raised by strangers in government daycares, a policy that, as I’ve written before, took a disturbing turn in the Canadian province of Quebec. How did we reach the point where the “conservative” child care alternative is indistinguishable from a voucherized version of the old progressive ideal?

But regardless of one’s own views on traditional families — and I am personally not a social conservative — any member of a liberal society should feel trepidation when one group attempts to use political power to impose their values on another. The imperative of liberal neutrality lies at the core of my support for dismantling the child administrative state in favor of a simple per-child tax credit. Federal child care policy must come to recognize that there isn’t one formula for supporting families, and no one right way to raise a child. A refundable child tax credit would be a great place to start, as long as bad arguments don’t lead us astray.