The Niskanen Center is proud to announce the launch of our new fiscal policy initiative to study the political economy of debt and deficits. Thanks to the generous support of the Peterson Foundation, in the coming weeks and months we will publish fresh insights into the nature and causes of America’s national debt, with a special focus on the prospective cost-drivers of America’s fiscal imbalance over the long-run.

Understanding the Political Economy of Debt and Deficits

Our fiscal policy initiative takes inspiration from the Center’s namesake, William Niskanen. Niskanen was known from his time in the Reagan administration onward for bluntly rejecting the “starve the beast” theory of spending cuts. Cutting taxes, Niskanen argued, does not automatically lead to spending reductions down the road. On the contrary: in the short term, deficit-financing reduces the cost of government programs as experienced by the public, creating a “fiscal illusion” that increases the demand for greater spending down the road — a conjecture Niskanen went on to test empirically.

The failure of the “starve the beast” strategy is now well known, but that did not stop Congress from passing a deficit-financed tax cut in 2017, with the promise of it being paid for by future entitlement reforms. As a result, before the pandemic hit, the CBO forecasted that the federal deficit would surpass a trillion dollars in FY 2020. Several mammoth Covid-19 relief bills later, the deficit this fiscal year could easily surpass $4 trillion. This historically unprecedented level of peace-time deficit spending may be critical to support the economy through this crisis. Yet as a broader political indicator, it illustrates the equally unprecedented ebb in the clout of budget hawks on either side of the aisle.

In some sense, fiscal conservatives have only themselves to blame for their waning influence. The argument for budget sustainability has always been forward-looking; as Herbert Stein famously said, “a trend that can’t go on forever won’t.” And yet fiscal hawks have tended to fight the last battle, either by seeking politically untenable cuts to popular programs, or by insisting on procedural gimmicks that “hold the line” on new spending in ways that are routinely waived or easily gamed. Both the starve the beast strategy and these procedural approaches ultimately fall victim to what economists call the “time inconsistency” problem, which is just a fancy way of saying “today’s actions, tomorrow’s regrets.” Put another way, addressing prospective fiscal risks requires adopting an equally forward-looking strategic orientation.

“It’s the Costs, Stupid.”

We believe the issue is not merely that the potential ruinousness of large deficits lacks persuasiveness. It is, more fundamentally, that the underlying levers determining long-term fiscal balances are not purely budgetary. Instead, they are often regulatory in nature, embodied in the cost of programs that do not yet exist but for which there is building, potentially irrepressible political momentum.

The economist William Baumol famously observed that differences in labor productivity growth cause the cost of goods and services in labor-intensive sectors to balloon over time. Symphony orchestras are no more productive than they were in 1900, for example — one violin part still requires one violinist — and yet the cost of assembling a symphony requires paying would-be violinists on par with the myriad higher-wage, higher-productivity jobs they could be doing in the year 2020.

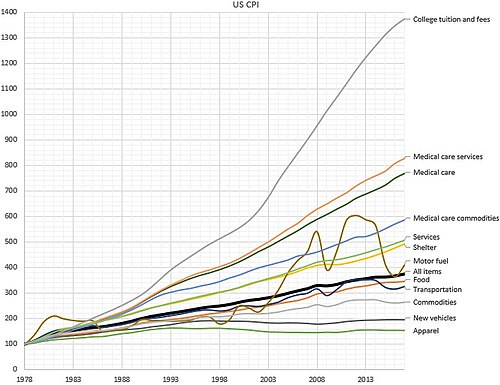

Baumol’s cost disease, as it has come to be known, is the curse of any highly productive economy. The United States is no exception. Chart a graph of cost inflation over time, and labor-intensive services like health care, child care, and education all rise up and to the right. Not coincidentally, these are also some of the most highly regulated sectors of the economy. Faced with pressure to make such services more affordable, policymakers tend to favor regulations and subsidies that socialize costs from a household’s point of view, rather than address the underlying dynamics, from nationalized day care to “Medicare For All.” At best, these proposals are designed to merely shift private costs onto public budgets. At worst, they can exacerbate cost disease by stimulating greater demand for the affected service while reducing the market incentive to discover lower-cost alternatives.

Baumol’s original framing is somewhat misleading, as if cost disease were a mechanical fact of the service economy over which we have no control. The cost of housing in lucrative metro areas, for example, is driven not by conventional cost disease, but by land-use regulations that restrict supply, sustained by the political economy of the property owners who ultimately capture those rents. With better market design, we know how to reduce the cost of housing, and thus the demand for a national fiscal program like a renter’s tax credit. Labor-intensive services are not so different. With new technologies and better market design, labor-intensive, non-tradable services have the potential to become our single greatest source of opportunity for future productivity growth. Socializing such services thus represents a double threat to long-run fiscal balance, since it both grows the numerator (spending) while shrinking the denominator (GDP growth).

The Fiscal Case for Regulatory Reform

The captured economy of cost disease illustrates how related microeconomic and political dynamics combine to drive long-term debt. Indeed, Baumol’s theory cannot explain the scale of cost increases in sectors like health care and education without a complementary theory of the political construction of such markets, and thus their susceptibility to regulation and socialization. The traditional focus of fiscal conservatives on entitlement reform is thus fighting the last battle. In addition to being unpopular, cuts to existing programs are likely to be vain if rising household costs in areas like health care, higher education, child care, and housing lead to the creation of new national programs, and thus new spending commitments, down the road.

If working politicians cannot be expected to ignore these spiraling cost-of-living issues, there are only two directions that the political demand can go in. The first is simply to socialize all of these increasing costs. The second approach is to directly address the fundamentally broken market design in health care, higher education, child care, and housing—areas that are all subject to an absence of effective competition and a great deal of regulatory capture.

Overcoming America’s fiscal impasse will thus require addressing escalating costs in these sectors head-on. That means implementing structural market reforms, eliminating regulatory capture, and exposing cost-diseased sectors to robust innovation and competition. Stay tuned for future commentaries where we will apply this insight to concrete case studies, including in health care, higher education, child care, housing, and beyond.

Samuel Hammond it the Niskanen Center’s Director of Poverty and Welfare Policy.