“No one wants to work anymore.”

“Hyperinflation is going to change everything. It’s happening.“

These complaints are increasingly common, and the vast majority of us recognize them as hyperbolic. But this is emphatically a case of Americans insisting on seeing the glass as half full — and failing to recognize that the glass is actually a giant bucket. We are not struggling with the supply of goods and labor because we are entering an age of scarcity. Rather, crowded ports and “for hire” signs are the growing pains associated with entering an age of abundance.

Somehow we’re in a situation in which a record S&P 500, a rapid labor market recovery, a surge in household wealth, surging demand for consumer goods, rapid wage gains (particularly at the low end), manufacturers working non-stop is being depicted as evidence of a policy mistake.

— Joe Weisenthal (@TheStalwart) October 26, 2021

Abundance in trade

A recent article in The Hill asked, “Are supply chain disruptions the beginning of the end of globalization?” The article suggests that the answer is “yes” and that “American consumers, living in a land of plenty, will have to get used to scarcity.”

Some grocery aisles are indeed oddly empty, and some people are waiting months for some back-ordered goods. But this is not because of scarcity; it’s because of the difficulties in managing abundance.

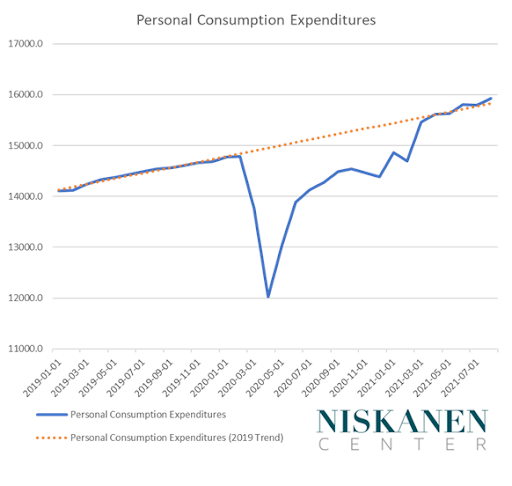

Earlier in the pandemic, many people delayed spending. Now people are more willing to open their wallets. Personal consumption expenditures, a measure of consumer spending, fell dramatically at the beginning of the pandemic but have met or exceeded the pre-pandemic trends since the summer.

And much of that spending has gone to imports.

Overall import volumes at the five largest container ports up 19% from two years ago (comparing Jan-Aug). Up every month of the year relative to the same month in 2019.

— Jason Furman (@jasonfurman) October 15, 2021

Normally volume up about 4% annually.

The ports can’t handle all of the increased demand. pic.twitter.com/Juk2QW1wtn

Our ports are simply struggling to manage a 20 percent increase in volume, forcing ships to wait weeks or months offshore before bringing their goods to market.

This is frustrating. Many of us had come to expect deliveries within days of ordering. I ordered soccer cleats for my daughter at the beginning of her fall season, and it looks like they will not arrive in time for her last game. But it’s important to recognize that we are actually receiving more goods than is typical — even if it’s not as much as we would like.

Abundance in labor

The current problem in the labor market is not that “no one wants to work anymore.” It’s that, by and large, the majority of people who want to work already have jobs. That makes it harder for firms to hire new workers. The economy we’re in right now is not like the economy of the early pandemic or the 2008 financial crisis. It’s roughly the economy we had in 2016.

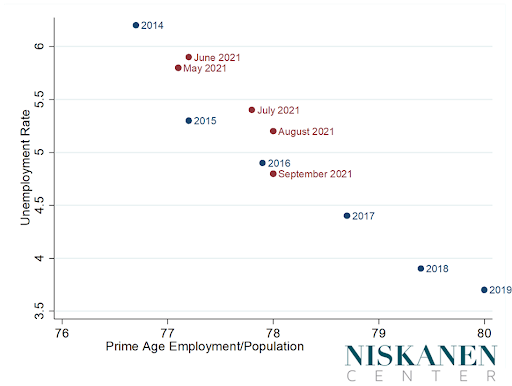

To see why, look at the chart below, which plots the standard unemployment rate on the y-axis and another measure that tracks what percentage of the prime-age working population — people aged 25 to 54 — is actually working. Looking at both measures is helpful because the unemployment rate is difficult to interpret for younger and older Americans, who may be moving in and out of the workforce for reasons including school and early retirement. The lower and further to the right our data lies, the happier the story it tells us about the labor market.

In blue, we see the annual change for both variables in the recovery from the 2008 financial crisis. In red, we see the same variables, but only covering the last four months.

What should be striking about this graph is how fast the labor market is recovering. In June this year, we had an unemployment rate of 5.8 percent and an employment/population ratio of 77.1 percent. In other words, the labor market was in roughly the same condition it was near the end of 2014. But by September, unemployment had dropped to 4.8 percent while the employment/population ratio rose to 78 percent, roughly the position the labor market was in as of 2016.

In other words, the labor market has made as much progress in four months as it previously did in nearly four years. Alan Cole of Full Stack Economics has called this the “warp speed recovery.”

One way I think about our warp speed recovery is by imagining we’re time-traveling through the 2010s, but about 4-12x as fast.

— Alan Cole (@AlanMCole) April 2, 2021

Currently, we are “in 2014.” But we will be in 2015 by, oh, May. And 2016 by August.

Even the 2016 economy still left room for improvement. As the chart shows, the labor market kept expanding through the next three years. But we are far from a crisis in which businesses can’t find workers.As in any strong economy, if you want to hire more workers, you need to lure in people who already have jobs.

Maintaining an abundant economy

A recent article in Bloomberg noted that Domino’s Pizza saw its first-ever decline in earnings last quarter. This was driven, at least in part, by difficulties recruiting enough drivers to deliver pizzas promptly.

Some people will take such news as a sign that workers are unwilling to work right now. This belief has policy implications, such as ending the enhanced unemployment insurance program or providing return-to-work bonuses.But these tools will be ineffective if the cause of the problem is not that people are unmotivated but that so many are already employed elsewhere.

Pizza delivery is the type of industry that may have difficulty adapting to this situation. Before the pandemic, places like Papa John’s were struggling with a 220 percent turnover rate. Few people intend to work in pizza delivery permanently; more often, it’s a job that people take to earn extra money between other opportunities.

As a result, the pizza delivery business depends on a slack labor market to a certain extent. As workers find other opportunities, it gets harder and harder to find delivery drivers. Pizza restaurants can increase their wages and prices, but it may be the case that some pizza restaurants will go out of business because of the thriving economy, not despite it. This may be the case at many similar employers whose business models are built around having low-paid, on-demand workers.

That uneven prosperity—where some companies will have trouble adapting to a thriving economy—can be dangerous. Business models such as pizza delivery are currently organized to expect that there will be people available to perform the labor at fairly low wages. As a result, a set of companies would benefit from keeping the economy below potential. Economist Michael Kalecki argued that as the economy approaches full employment, some business interests will begin to push against the government policies that sustain this growth.

While the economy is doing well now, we need to maintain the political and economic forces that allow it to thrive. That means keeping the Federal Reserve focused on full employment, pursuing sustainable fiscal policy, and reducing costs on the supply side. But it also means recognizing that some people will find full employment disadvantageous, and learning when to ignore their complaints.

Photo Credit: Tryaging via iStock