In a promising contribution to the debate over poverty policy, the Institute on Race and Political Economy at the New School has released a major welfare reform proposal that it calls a Guaranteed Income for the 21st Century. Details of the proposal (abbreviated GI21 in what follows) are set out in a report written by Naomi Zewde, Kyle Strickland, Kelly Capatosto, Ari Glogower, and Darrick Hamilton. The proposal makes a full-scale assault on America’s social protection gap. It includes several features that the Niskanen Center has long championed, such as an emphasis on cash assistance, broad eligibility, and payment in monthly installments with appropriate provisions for the unbanked. Although the proposal is not budget-neutral, its estimated cost of $876 billion per year is considerably less than that of several other proposals for a universal basic income.

All proposed reforms of the social safety net face a set of tradeoffs among the goals of income security, affordability, and work incentives. This commentary will examine how GI21 deals with those tradeoffs, beginning with the areas where it is strongest and then turning to aspects of the plan that could benefit from some further thought.

Income security and affordability

The first priority of Guaranteed Income for the 21st Century, clearly, is income security. “Our goal here,” Zewde et al. write, “cannot be to simply reduce poverty, but instead must be to abolish absolute poverty as we know it.” To that end, GI21 calls for a cash grant of $12,500 per year for each adult in a household and $4,500 for each child, payable in monthly installments. For single-parent families, that schedule of payments approximates the 2021 poverty guidelines from the Department of Health and Human Services ($12,880 for a single adult with an allowance of $4,540 for each additional family member, whether child or adult). For two-parent households with children, the GI21 schedule comes in well above the official poverty level.

Not surprisingly, the goal of completely eliminating poverty is costly. The CBO projects that the federal government will spend a total of $812 billion on means-tested poverty programs in 2021, of which about two-thirds will go to healthcare programs and one-third to income support. The $876 billion estimated cost of GI21 would more than double that. However, as Zewde et al. point out, the cost of GI21 is modest compared to that of other basic income proposals, such as that of Andrew Yang ($2.8 to $3 trillion) or one discussed by The Architecture of a Basic Income Miranda Perry Fleischer and Daniel Hemel ($1.8 trillion).

The relative affordability of the GI21 basic income plan comes from the fact that it is structured as a negative income tax rather than a truly universal basic income. As such, the basic grants are subject to a phase-out that begins at $10,000 of earned income for families with one adult and tapers off to zero at $50,000. For two-parent families, the phaseout starts at $15,000 and reaches zero at $70,000. For families whose incomes rise during the year, overpayments are subject to recapture, following a mechanism similar to that used for income-based premium subsidies under the Affordable Care Act. Several safeguards minimize the chance that families with rising incomes will find themselves unexpectedly in debt to a program that was designed to benefit them.

Administratively, GI21 is characterized as “a substantial overhaul and extension” of the Earned Income Tax Credit (EITC) – a program on which the U.S. government currently spends some $88 billion a year. As such, its implementation is assigned to what its authors call “the most powerful fiscal tool” of the U.S. government, namely the tax code. That might raise the eyebrows of some observers, such as Niskanen’s Sam Hammond, who sees the Internal Revenue Service as a “broken home in need of repair” rather than the federal government’s most capable agency. Presumably, though, a sufficiently generous appropriation from Congress could get the IRS up to speed to run such a large new program.

Work incentives

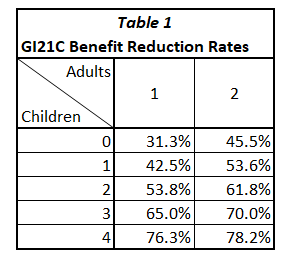

On the whole, I find that the GI21 proposal places less emphasis on work incentives than on income security and affordability, but the topic is not neglected altogether. Work incentives for households with the lowest incomes are protected to the extent that the phaseout of benefits does not begin until earnings rise to a threshold of $10,000 for households with one adult and $15,000 for those with two adults. Once those thresholds are reached, however, households in the phaseout ranges ($10,000 to $50,000 for one adult and $15,000 to $70,000 for two) would lose a significant amount in benefits for each extra dollar earned. Because the phaseout ranges vary only with the number of adults, while the basic grant increases with the number of children, the resulting benefit reduction rates increase with family size. Table 1 shows the amount by which benefits are reduced for each added dollar of earned income within the phaseout range for various family configurations, as I calculate them:

Furthermore, the full impact of GI21 on work incentives depends not only on the benefit reduction rate, but also on payroll and income taxes. The sum of the benefit reduction rate and the rates of those taxes is known as the effective marginal tax rate (EMTR). For example, a single parent with one child and income between $10,000 and $50,000 would face a benefit reduction rate of 42.5 percent plus a payroll tax of 7.65 percent, for an effective marginal tax rate of 50.15 percent. Households with higher incomes would also potentially be exposed to income taxes. For example, households with two parents and two children, and an income approaching $70,000, would probably face an income tax rate of 12 percent. Their combined EMTR would thus be 61.8 + 7.65 + 12, or 81.45 percent. That means they would keep less than 19 cents in take-home pay for each dollar earned – and less than that if they lived in one of the 42 states that has its own income tax.

The impact of income taxes on work incentives only kicks in at the high end of the phaseout range and could be mitigated by minor changes in tax law that could be included in legislation implementing GI21. However, exempting GI21 beneficiaries from the payroll tax would be more problematic. Doing so would affect the whole structure of the Social Security system, including the financial health of its faltering trust fund and even the eventual eligibility of GI21 participants for retirement benefits. In what follows, I will assume that GI21 beneficiaries are exposed to payroll taxes but not income taxes.

Zewde et al. recognize that high EMTRs can potentially affect work incentives, but their treatment of the issue is dismissive. In a brief text box, they cite a 2006 paper by Nada Eissa and Hilary W. Hoynes, to the effect that “empirical research finds that the EITC phaseout does not significantly reduce the hours worked by taxpayers already participating in the labor market.” However, the conclusions I draw from that paper are not quite so sanguine.

To study the effects of EMTRs on work behavior, Eissa and Hoynes used data from a 1993 expansion of the EITC, which raised the benefit- reduction rate for some EITC recipients from 14 percent to 21 percent. The authors discuss possible reasons why empirical studies of the EITC reforms fail to show the negative effect on hours worked that standard labor market theory would predict. Like Zewde et al., they consider lack of workers’ control over hours to be part of the explanation. However, they also say that “it is not unreasonable to consider [the reduction in hours worked] too small to be identified empirically, especially given the somewhat crude comparison-of-means approach typically used.” In my opinion, the inconclusive results may also be due, at least in part, to “range compression” in the sample, that is, to the narrow range (from the single digits to the low twenties) over which benefit-reduction rates vary under the current version of the EITC. A policy that exposed workers to benefit-reduction rates such as those shown in Table 1 would be much more likely to have measurable negative impacts on hours worked.

But the potential reduction in hours worked by people who already have jobs is not the only issue, or even the most important one. Eissa and Hoynes, like other researchers, emphasize that the labor response to benefit reductions has two components, one being an effect on hours worked and the other an effect on the likelihood of entering the labor market at all. Empirical work shows the latter to be by far the more important of the two. As Eissa and Hoynes put it,

A consistent finding is that labor supply responses are concentrated along the extensive (entry) margin, rather than the intensive (hours worked) margin. This distinction has important implications for the design of tax-transfer programs and for the welfare evaluation of tax reforms.

The entry effect is especially strong as it affects second earners in two-adult households. Consider a household composed of two parents and two children, in which one parent has a full-time job at $15 an hour – enough to bring them above the poverty level, but not fully into the middle class. Suppose now that the other parent wants to take a half-time job at $12 an hour to add a little resilience to a paycheck-to-paycheck family budget. Under GI21 (assuming that the income tax is waived but the payroll tax is not) Parent #2, facing an EMTR of 69.5 percent, would bring home just $3.66 an hour. Costs of commuting and work clothes, let alone child care, would wipe out that $3.66 in a hurry. Why bother?

The empirical results reported by Eissa and Hoynes confirm the impact of increased benefit-reduction rates on labor force participation by second earners. Specifically, they estimate that the EITC expansion of 1993 lowered the rate of labor market participation of married women by 1 percentage point. That may not sound like much, but keep in mind that the 1993 expansion increased the EITC benefit-reduction rate by just 7 percentage points. GI21, in contrast, would increase the benefit reduction rate for married women with two children from 21 percent under today’s EITC to 61.8 percent. The impact of GI21 on the labor force participation of second earners would presumably be significantly greater than in 1993.

Interaction with other poverty programs

So far, we have looked at the work-incentive effects of GI21 in isolation. However, the analysis is incomplete without recognizing that GI21 intends not to replace other poverty programs, but to supplement them. As Zewde et al. write,

This program is designed to supplement and bolster the existing social safety net and should not be thought of as a replacement for other in-kind government support programs. While many of our existing social supports help to address specific essential needs, unconditional cash grants provide families with the opportunity to take care of urgent needs or emergencies of any kind, or to invest in their careers or their families. This maintenance of other social safety net programs helps to ensure that our program enables individual progress and wealth building, and bolsters support for those in need and who have historically been excluded from economic opportunity.

On the face of it, this appears to mean that people who receive GI21 benefits could use them flexibly to meet any urgent needs or to build wealth while continuing to receive in-kind benefits such as Supplemental Nutrition Assistance Program (SNAP) funds for food needs, Medicaid for health care needs, housing vouchers for shelter, and so on, and perhaps other forms of cash benefits as well, such as Temporary Assistance for Needy Families (TANF). Insofar as the intent is to further strengthen the effects of GI21 on income security, that is all well and good, but it is also important to consider the effects on affordability and work incentives. Those effects, in turn, depend on exactly how the supplementary nature of GI21 would actually be implemented – a point on which the report by Zewde et al. sheds little light.

I see two possibilities. One is that existing programs would not be eliminated to make way for GI21, but guaranteed-income payments would affect eligibility and benefits for those programs in the same way as earned income does now. Another is that the enabling legislation would direct that GI21 benefits be disregarded when calculating eligibility and benefits for other programs. Either option raises potential problems.

First suppose that there is no disregard, so that GI21 benefits are counted the same as earned income. In that case, given that GI21 benefits alone equal or exceed the federal poverty level, it seems that few people would actually qualify for SNAP, housing vouchers, and other programs, and that those who did would receive only minimal benefits. Furthermore, to the extent that GI21 succeeded in its intended goal of facilitating wealth building, some beneficiaries would also fail the asset tests for Medicaid and other programs that had them.

From the point of view of affordability, a reduction in the number of beneficiaries of existing programs is a plus. Obviously, however, a no-disregard rule would reduce the degree to which GI21 enhanced beneficiaries’ financial security. In that sense, the no-disregard option seems inconsistent with the language of the paragraph quoted above.

On the other hand, disregarding GI21 benefits for purposes of other poverty programs would raise a different set of problems. The most serious would be the impact on work incentives for households that qualified simultaneously for GI21, SNAP, TANF, and other programs that each have their own benefit reduction rates.

Consider SNAP, a program that is available to almost all households with low incomes. The typical benefit-reduction rate for SNAP is 24 percent of income, after considering a standard deduction from earned income. If that rate were added to the rates shown in Table 1, and if payroll taxes were also counted, a single person eligible for both SNAP and GI21 would face a EMTR of 62.95 percent once they reached the phaseout range for GI21 ($10,000 of earned income). A couple with two children in the phaseout range (over $15,000 of earned income) would face a combined benefit-reduction rate of 93.45 percent.

TANF is less widely available than SNAP. Only about 23 percent of all poor families receive aid from that program. However, for those families that are eligible, TANF interacts with SNAP in complex ways that produce much higher benefit-reduction rates than either program alone. A report from the Agriculture Department estimates that the typical combined benefit-reduction rate for families eligible for both TANF and SNAP is 70 percent. Without a disregard of GI21 benefits, all families who were eligible for all three programs (GI21, TANF, and SNAP) and who had incomes in the phaseout range would face combined benefit-reduction rates in excess of 100 percent, even without considering payroll taxes.

Although TANF is available only to a minority of families, its interaction with GI21 is particularly problematic. The whole rationale of TANF in the first place was based on the principle of welfare-to-work. To that end, TANF subjects its beneficiaries to strict work requirements. But if you combine work requirements with a mix of income-support programs that have an effective marginal tax rate of 100 percent or more, you get the absurdity that people are required to work, but are paid nothing for doing so.

Poverty experts caution against exaggerating the effects of additive benefit-reduction rates, noting that some of the highest combined rates quoted by welfare critics involve improbable combinations of programs. For example, a report titled “It Pays to Work” from the Center on Budget and Policy Priorities (CBPP) estimates that “only about 3 percent of single mothers with two children and earnings below 150 percent of the poverty line receive the EITC, SNAP, and either TANF or housing aid (or both) and are in the earnings range where these benefits all phase down simultaneously — and consequently face marginal tax rates above 80 percent.”

For more realistic combinations of earnings and benefits, the CBPP report argues, work incentives are higher. It uses the example of a single mother of two children who is eligible for the EITC, the Child Tax Credit, and SNAP. Based on 2016 benefit levels, such a person would have an income of $6,132 if not working, $16,786 if working half-time at a minimum-wage job for $7.25 per hour, and $25,882 if working full-time at a minimum-wage job. The figures include the effect of payroll taxes. The result is that the family’s total income including benefits actually rises 40 percent faster than earned income for half-time work and 20 percent faster than earned income for the transition from half-time to full-time work. For such a household, it truly would pay to work.

But there is a catch: The favorable work incentives in the CBPP example arise largely from the fact that the household in question is in the phase-in range of the EITC. If we replace the existing version of the EITC with GI21, which has no phase-in bonus, a lower phaseout threshold, and higher phaseout rates, the picture changes dramatically. Now, even if GI21 benefits are disregarded in calculating SNAP, the single mother of two used in the CBPP example has a total disposable income of $27,632 if she does not work, $34,595 if she works half-time at a minimum wage job, and $37,322 if she works full-time. The incentive for half-time work is still there; she would keep 92 percent of her income from the first 1,000 hours of work. However, moving to full-time work would put her in the phaseout bracket of GI21, so she would keep just $2,727, or 34 percent, of the extra $7,540 she earned. If her wage were $10 per hour, instead of the minimum wage, then the full increase in wages when moving from half-time to full-time work would be subject to the GI21 phaseout. In that case she would keep just 12 percent of her added earnings. (All of these numbers could vary from state to state, according to local SNAP rules.)

In short, whether or not GI21 benefits are disregarded, and even for favorable cases, such as the one suggested by the CBPP, effective marginal tax rates would be far higher and work incentives far lower under GI21 than under common existing combinations of EITC with other programs.

Suggested modifications

None of the problems identified above should be considered fatal to the aims of GI21. It is my impression that the version of that program outlined in Zewde et al. is not meant as a complete blueprint, but rather, a catalyst for further thought. Here are my suggestions for possible modifications as the concept of a Guaranteed Income for the 21st Century is developed further.

First, more thought needs to be given to the way GI21 would interact with current tax law and existing poverty programs. Among other things, the program should include some mechanism to make sure that people who are subject to the GI21 phaseout are not also subject to income taxes. Also, the degree to which GI21 benefits would count as earned income for existing means-tested programs needs to be clarified. That is the case not only for programs aimed at the poor, such as SNAP, TANF, and Medicaid, but also for middle-class benefits such as premium subsidies under the ACA.

A second, more far-reaching possibility would be to make GI21 an outright substitute for most existing cash and in-kind poverty programs, rather than an add-on. The concept of allowing GI21 to cover urgent spending needs while SNAP, housing vouchers, and other in-kind programs provide a backup sounds nice, but in practice, it would be unworkable. If GI21 benefits were not disregarded, so few people would qualify for the other programs that it would not be worth the administrative expense of maintaining them. If GI21 benefits were disregarded, then the combined benefit-reduction rates of multiple programs would be extremely injurious to work incentives. However, programs that address needs that are not best addressed through cash grants, such as access to affordable health care, substance abuse, and domestic violence, would still be needed.

Third, since GI21 is framed as a reform of the existing EITC, consideration should be given to retaining some key features of the EITC that the current version of GI21 proposes to eliminate.

- Benefit reduction rates during the phaseout should be held closer to rates under the existing EITC than to those in Table 1. One partial step toward doing that would be to allow the upper limit of the phaseout range to rise as the number of children in a family increases. In that way, the benefit-reduction rates would not rise, or not rise so sharply, as family size increases.

- Consideration should be given to retaining a phase-in range with a positive wage bonus, as with the current EITC. However, unlike the current EITC, the phase-in bonus should start from a substantial basic benefit that would be received even by households with no earned income.

- To further smooth the transition from nonemployment to work, the phase-in and phaseout ranges could (optionally) be connected by a plateau rather than a single benefit peak, as is the case under the current EITC. The higher the eventual phaseout rate, the more important it would be to have the flat segment.

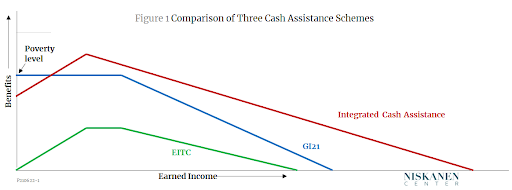

A version of GI21 with all of these features would look very much like an approach that I call Integrated Cash Assistance (ICA). Figure 1 provides a schematic comparison of a hypothetical ICA with GI21 as described by Zewde et al. and with the existing version of the EITC.

The three programs shown in Figure 1 balance the basic tradeoffs of poverty policy in different ways:

- The EITC by itself scores well for work incentives and affordability, but it falls short on income security in that it offers little or no assistance to either childless or nonworking parents. If rated in combination with other existing programs, it offers better income support, but it is less affordable and, because of additive benefit reductions, it has weaker work incentives.

- GI21 does excellently in terms of income support. It is more affordable than truly universal basic income programs that have no phaseout. However, with no phase-in and a steep phaseout, it rates poorly for work incentives, especially if it supplements rather than replaces other programs.

- ICA, with a positive phase-in and a gradual phaseout, has strong work incentives, especially if it replaces existing income support programs rather than being added on top of them. The version of ICA in Figure 1 is drawn to have approximately the same affordability as the combination of GI21 plus the other existing forms of income support that would continue. On static scoring, it would offer somewhat weaker income support than GI21 to households with very low earned incomes, but it would still do better than the existing combination of poverty programs. If scored dynamically, including the effect of work incentives, it could well provide more total earned-plus-unearned income to the target low-income population as a whole than GI21 would do.

Conclusions

As a long-time supporter of cash assistance to poor families without work requirements, I welcome the addition of Guaranteed Income for the 21st Century to the menu of policies offered as improvements over today’s broken safety net. It is clear that GI21 would provide better income support than what we have now, and its budgetary cost, while far from negligible, would plausibly be less than that of competing proposals for universal basic income or universal guaranteed jobs.

In my opinion, the initial version of GI21, as presented in the report by Zewde et al., does have some weaknesses. I see the two most serious as the inadequate consideration given to the program’s interaction with existing tax policies and welfare programs, and its less-than-thorough consideration of work incentives. I am sure that further thought will be given to those issues as GI21 is fleshed out more fully. I look forward to more from the team at the Institute for Race and Political Economy.