A new Congress has convened. Soon the battle of the budget will begin. On one side will be the advocates of stimulus, who think the economy needs help to recover fully from the damage done by the pandemic. On the other side will be the deficit hawks, refreshed after their long slumber during the Trump administration.

The case for a sharp turn toward fiscal austerity rests in large part on the idea that we are at the edge of a precipice, poised for a plunge into insolvency, default, hyperinflation, and who knows what other disasters. A new book from the Cato Institute, A Fiscal Cliff conveniently gathers the views of fiscal conservatives into a single volume. This commentary reviews some of the most common arguments for fiscal austerity and explains why they don’t hold up.

How high is the debt ratio, really?

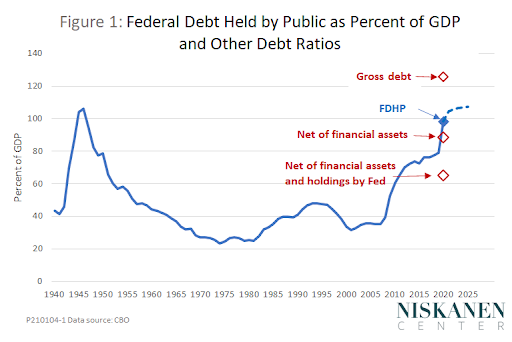

The signature chart of fiscal conservatives, one that appears no fewer than four times in A Fiscal Cliff, shows a soaring ratio of federal debt to GDP. An up-to-date version is shown in Figure 1. The blue line tracks the most widely used measure of federal debt, federal debt held by the public (FDHP), based on historical data and projections from the Congressional Budget Office (CBO).

The historical peak of the debt ratio, 106.1 percent, was reached in 1946. By 1974, a combination of real economic growth and inflation had shrunk the ratio to 23 percent. After that, it moved within a fairly narrow range until 2007, and then began rising rapidly again. The CBO projects that the debt ratio will exceed its wartime high by 2023. Just how alarming is that, really?

In part, the answer depends on which measure of the debt ratio we use. As the bipartisan Committee for a Responsible Federal Budget notes, the version based on federal debt held by the public is widely accepted as “the most economically meaningful measure of debt.” However, a primer on federal debt published by the Congressional Budget Office (CBO) offers several alternatives.

Some fiscal conservatives, including John Merrifield, an editor of A Fiscal Cliff and the author of an overview chapter, prefer to cite the gross debt. That measure, which includes money the federal government owes to itself (for example, in the form of treasury securities held by the Social Security Trust Fund) was about 28 percent higher than the FDHP as of 2020, as shown by a red data point in Figure 1. The reasoning behind a preference for the gross debt appears to be that the Social Security trust fund and similar funds reflect promises to pay benefits in the future, so they should be counted along with other financial obligations of the government.

However, I see problems with that reasoning. For one thing, although the government should, of course, think carefully when making promises, promises to pay future benefits are not analogous to those made when issuing securities. The owner of a security has an actual legal claim against the treasury. A failure to honor that claim would be a default. In contrast, future Social Securities beneficiaries have only an expectation, not a legal claim. They hope that Congress will not change the benefit formulas before their turn comes to collect, but such changes have been made in the past, so they can’t be sure. Ironically, some of the very fiscal conservatives who treat the trust funds as financial obligations are among those who urge Congress to renege on its promises by “reforming” Social Security. Significantly, they do not refer to their proposed reforms as “defaults.”

Furthermore, even if we were to count promises of future benefits as legal obligations of the government, the quantity of securities in the trust funds are not an accurate measure of those obligations. Suppose, for example, that Congress were to change Social Security to a simple pay-as-you-go basis. Instead of placing social security taxes in a trust fund when collected and holding them in the form of securities until they are paid out, those taxes would be deposited in the treasury’s general account at the Fed, along with other revenues. Benefits would not change, but would be paid out of the treasury general account instead of from the trust fund, as they are now. Any securities remaining in the trust fund would be moved to the balance sheet of the treasury, where they would now appear as both assets and liabilities and be canceled out. The whole operation would in no way change the annual federal tax burden, annual government spending, or the deficit. It would have no effect whatsoever on financial markets. But, if applied not just to Social Security but to all similar funds, it would immediately cut the value of the government’s gross debt by 30 percent.

No wonder, then, that the CBO itself warns that “gross federal debt is a poor indicator of the government’s overall financial position.”

As the CBO explains, if we want a measure of the debt that is more economically accurate than the FDHP, we would end up with a lower, not a higher number. One such alternative nets out government financial assets, such as the outstanding balances on student loans. As of 2020, that lowers the debt ratio by about 10 percent, as shown in Figure 1. A further adjustment recognizes that the Federal Reserve is de facto a part of the federal government, and thus excludes its large holdings of treasury securities from “debt held by the public.” Adjusting for both government assets and the Fed’s securities holdings reduces the 2020 value of the federal debt to 65 percent of GDP. Figure 1 shows only the 2020 values of the alternative debt measures, but because both student loans and the Fed’s portfolio of securities have grown rapidly in recent years, showing full historical values would reduce the apparent rate of growth of the debt ratio as well as its current value.

Do we even care about the debt ratio?

Rather than quibbling over whether debt held by the public overstates or understates the government’s financial liabilities, perhaps we should ask the more fundamental question of whether the debt ratio is a meaningful measure of fiscal sustainability in the first place. In a recent paper, economists Jason Furman and Lawrence Summers argue that it is not. The problem with the debt ratio, say Furman and Summers, is that it compares the stock of debt with the flow of GDP. But that is not how we normally think about our finances either as borrowers or as lenders.

Suppose you are a young person on the first rung of a promising career, and you are looking to buy your first home. Of course, you are not going to pay cash – you will take out a mortgage. Accordingly, what you want to consider in deciding how much house you can afford is not the ratio of the mortgage principal to your current annual income (a stock-to-flow comparison), but rather, the ratio of your monthly payments to your monthly income (a flow-to-flow comparison).

The payment-to-income ratio is also what the bank will look at. The 28/36 rule is a widely-used flow-to-flow formula that says monthly mortgage payments should not exceed 28 percent of a borrower’s income, and that total debt service, including car loans and credit cards, should not exceed 36 percent of income.

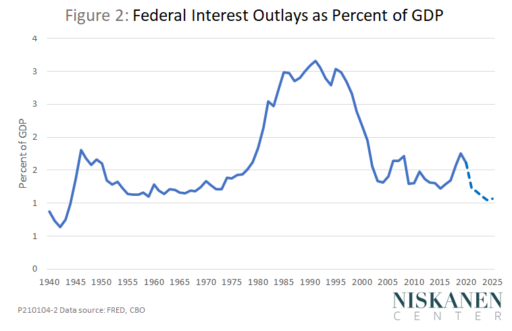

Figure 2 shows what a flow-to-flow comparison looks like for the federal government. The peak of federal interest outlays as a share of GDP came in the 1980s and early 1990s, at a time when the debt ratio was less than half what it is today. The trend from 2007, projected forward to 2020 and beyond, shows not a further increase in the ratio, but a return to normal, or even a little below what was normal for the post-WWII period. There is no sign of an impending fiscal cliff like the one that looks so alarming in Figure 1.

“Every family in America has to balance their budget. Washington should, too,” John Boehner liked to say when he was Speaker of the House, a sentiment often echoed by fiscal conservatives. By that standard, the debt service burden of the federal budget looks pretty modest in comparison to the 28/36 rule that is considered prudent for households. Federal interest outlays, which the CBO now pegs at about 2 percent of GDP and expects to decline toward 1 percent, figures out to just 5 to 10 percent of federal receipts. Furman and Summers consider 2 percent of GDP to be a reasonable standard for the long run. The budget in the twenty-first century is comfortably within that range so far.

What are the risks?

But, warn fiscal conservatives, what would happen if interest rates rose? If we combined the high interest rates of the 1980s with today’s higher debt ratios, debt service costs would soar. Can we take that chance? The response has several parts.

First, the smart money says that is not going to happen. What pushed the interest rate so high in the 1980s was high expected inflation. Market-based data – not the estimates of some government economist but the real market bets of people who are putting their own money on the line – show that investors don’t expect inflation even to reach the Fed’s target rate of 2 percent over the next ten years. Wall Street is behaving as if 1980s-style interest rates are about as big a worry as an asteroid strike.

Second, there are sound structural reasons to justify market expectations of low inflation and low interest rates. Furman and Summers point to increased saving driven by lengthening life expectancy and rising inequality, and also to decreased private-sector borrowing demand driven by changes in technology and corporate behavior. In fact, they consider a further decline in interest rates to be as likely as even a modest increase.

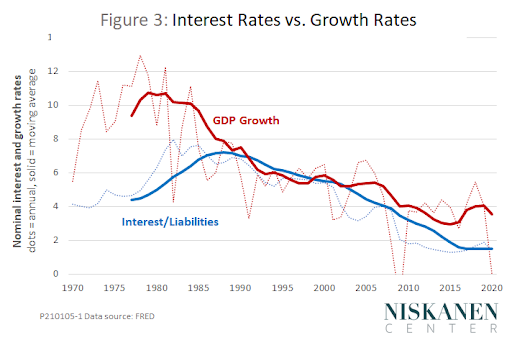

Third, we need to consider economic growth. Just as your home mortgage becomes more manageable as your income grows over your career, growth of GDP makes government debt management easier. Without getting too technical about it, as long as the rate of growth of GDP is higher than the rate of interest (either adjusting both variables for inflation, or adjusting neither), the debt is not going to explode. And, as Figure 3 shows, that has been the case for most of the past half-century. (See here for the detailed mathematics of deficits and debts.)

Fiscal conservatives warn of inflation and a debt crisis, but the very measures they propose to avoid those risks – capping spending and balancing the budget — have risks of their own. Economic policy, now as always, is a matter of balancing one set of risks against another.

In the short run, the obvious risk is that of undertaking austerity prematurely, when aggregate demand is weak and the economy is still operating well below its potential. It is especially important to maintain an expansionary fiscal stance in periods when the Fed’s interest rate target is at its lower bound of 0 or close to it. Failure of fiscal policy to support aggregate demand at a time when zero interest rates render conventional monetary policy impotent virtually guarantees a slower recovery. A slow recovery, in turn, is more likely to widen than to narrow the budget deficit.

That is just where we are, entering 2021. After its December 2020 meeting, the Federal Open Market Committee announced its intention “to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time.” A commentary from the Cleveland Fed notes that the FOMC expects inflation to remain at or below 2 percent at least through the end of 2021. A survey of private securities dealers in New York shows even lower inflation expectations, in the range of 1.7 to 1.8 percent, through 2022.

Eventually, the economy will recover from the current pandemic-induced recession. At that point, the balance of risks will change. The biggest risk will then come not from inadequate fiscal stimulus, but from an inappropriate way of achieving the appropriate deficit target.

That risk comes from another side to fiscal conservatism, one that often hides behind all the noise about the size of the deficit and the national debt. That is an insistence that the desired deficit target always be achieved through cuts on the spending side of the budget, not through adjustments to revenues. Such a one-sided view of budget balance risks undermining the state capacity that is essential to support healthy, long-run economic growth. My Niskanen colleagues Brink Lindsey and Samuel Hammond put it this way in a recent manifesto, “Faster Growth, Fairer Growth:”

[T]he private sector functions at its best when it is enabled and supported by a strong, capable, effective public sector. It needs government to write and enforce the rules that align private profit-seeking with the public welfare. It needs government to fund or supply the public goods — education, infrastructure, research and development — that enable people to participate in the marketplace at a high level and push the whole system to new heights by advancing the frontiers of knowledge and technology. It needs government to provide social insurance against various hazards of life — poverty, sickness, and joblessness — and thus protect well-being against downside risks, prevent the mass waste of human potential that would otherwise occur, and sustain support for economic dynamism even in the face of its incessant disruptions of people’s plans and expectations.

Fiscal conservatives’ goal of shrinking the government until it is “small enough to drown in a bathtub” completely misunderstands the role of the state in a modern economy. As I have detailed elsewhere, the evidence is overwhelming that quality of government, not size of government, is the key to freedom and prosperity. Around the world, high quality governments tend on the whole to be somewhat larger rather than smaller.

Do we need fiscal rules? Absolutely. In a dissenting chapter included in A Fiscal Cliff, I outline a set of rules that would guarantee long-run fiscal sustainability while leaving room for cyclical stimulus or restraint as needed, and permitting a government whose size is determined by the country’s actual needs rather than driven by ideology. (An updated version of the chapter is available on the Niskanen Center website.)

For far too long, successive presidential administrations and Congresses have made tax and spending decisions with little regard for either appropriate short-term demand management or long-term growth and fairness. But naïve calls for fiscal austerity are not the answer. We do not face a fiscal cliff – we face a deficit of clear thinking about the proper size of government in a liberal democracy and the proper way to achieve the sustainable prosperity that we all want and deserve.