Earlier this week, Amazon informed staff at its Staten Island fulfillment center that one of their coworkers had died from COVID-19. The death is tragic reminder of the heighten risk essential workers brave every day they go to work. Policymakers must work equally hard to ensure they are adequately compensated.

A new proposal from Sen. Mitt Romney (R-Utah) aims to do just that. The proposal, dubbed “Patriot Pay,” would create a targeted wage subsidy for essential workers in critical industries. Employers that raise the hourly wages of their eligible workforce would receive rebates offsetting 75 percent of any wage increase, up to a maximum bonus of $12 per hour.

Under the proposal, a grocery store that normally pays its workers $10 per hour could raise wages to $22 per hour — a $12-per-hour bonus — at a private cost of only $3 per hour, with the remaining $9 per hour rebated by the federal government. The maximum allowable credit, according to Romney’s announcement, would be “$1,440 per month, per employee, meaning a full-time worker would receive up to a $1,920 monthly bonus.” The size of the credit would be reduced for workers with annualized wages above $50,000 a year, phasing out completely for incomes above $90,000.

Patriot Pay for essential workers deserves serious consideration in the next phase of relief legislation. In this commentary, we provide an analysis of Patriot Pay’s design, offer suggestions for how it can be improved, and provide preliminary cost estimates based on the details of the plan that are publicly available. According to our analysis,

- Over 42 million workers would be eligible for bonuses under Patriot Pay using an inclusive definition of essential worker, representing roughly one quarter of the full employment workforce.

- After adjusting for recent jobless claims, and assuming a 50 percent aggregate uptake of the maximum credit, we estimate that Patriot Pay would cost roughly $20.7 billion per month in new federal spending.

- The final cost of the program crucially depends on the rate of employer participation and their willingness to contribute to wage increases, which in turn depends on business liquidity. A higher rate of participation could be promoted by allowing eligible employers to access the Employee Retention Credit in exchange for full participation.

- Implementation through the payroll tax system could be significantly automated, while helping to establish the architecture for a more general wage subsidy program to promote broad re-employment in a recovery phase.

The case for “Patriot Pay”

Under normal circumstances, market competition pushes employers to compensate workers in high-risk jobs with higher wages, a concept known as the “wage risk premium” or “hazard pay.” Yet the market may be failing to provide adequate hazard pay during this crisis, and for fairly obvious reasons. First, virtually every job involving interpersonal interaction has become higher risk simultaneously. And second, while some industries have seen an increase in revenue, many if not most have seen revenue declines given the record collapse in consumer spending. These two factors severely constrain the ability of most employers to raise wages, implying that the normal, market-based mechanism for hazard pay has broken down.

As a targeted wage subsidy, Patriot Pay represents by far the most straightforward way to correct for this market failure. By essentially multiplying employer-provided bonuses by four, the subsidy would enable businesses to provide robust hazard pay in spite of revenue constraints. Employers in a critical industry would have to certify that the employees being subsidized faced heightened risk of exposure to coronavirus at work. The final designation of a “critical industry” would be left up to Congress and the Department of Labor, however the proposal gives hospitals, food distributors and processors, and health manufacturers as examples.

The most efficient way to implement Patriot Pay would be through the payroll tax system. Credits could be applied for and quickly disbursed to employers, first through retained payroll-tax withholdings, and second via the same streamlined process recently implemented to advance credits to employers for paid sick leave under the Families First Coronavirus Response Act.

To ensure the subsidy isn’t used to merely reduce worker wages, employers applying for Patriot Pay should have to establish the benchmark wage of each eligible employee using past payroll records. Subsequent payroll reporting periods could then be used to validate that the bonus payment passed through dollar-for-dollar to the employee. As a guardrail, the Department of Labor could also establish minimum benchmark wages for each eligible occupation code based on recent industry averages.

Depending on the rate of employer participation, Patriot Pay may require the Treasury Department to process a much higher volume of advanced credits. Yet that does not mean it is beyond their technical capabilities. As Jon Hartley has suggested, additional resources could be deployed to significantly automate applications and payroll verification by partnering with large payroll processors like ADP, Square Payroll, or Paychex.

In essence, the same services that already significantly automate the remittance of payroll taxes for millions of businesses can — with a bit of work — be put in reverse. While this would be a new capability for the U.S. Treasury, it would represent a far simpler and more direct pipeline to employers than the Treasury-SBA-lender-business pipeline developed for the Paycheck Protection Program. Indeed, such a capacity would be invaluable for a wide variety of policy purposes, and should arguably be develop independent of Patriot Pay. As Marc Andreessen pointedly put it in his essay, It’s Time to Build,

“A government that collects money from all its citizens and businesses each year has never built a system to distribute money to us when it’s needed most.”

Effects of wage subsidies on employment

The literature on wage subsidies is vast, and points to a range of observed effects that depend on the background economic conditions and how it is implemented. In general, however, research finds that targeted wage subsidies can successfully increase employment and hours worked, at least temporarily.

There is also reason to believe wage subsidies become more effective in an economic crisis when labor demand is otherwise weak. In Germany, for instance, the prior enactment of wage subsidy and work sharing programs has helped to dramatically mitigate employment loss, both in this crisis and the during the Great Recession. A World Bank working paper on Mexico’s 2009 wage subsidy program showed similar success, finding that “the size of the effect [on employment] increased to a statistically significant 24 percent after the program ended and the results indicate that employment after the program recovered faster in eligible industries than in ineligible industries.” Indeed, employment levels in eligible industries returned to pre-crisis levels two years earlier than those not eligible for subsidization.

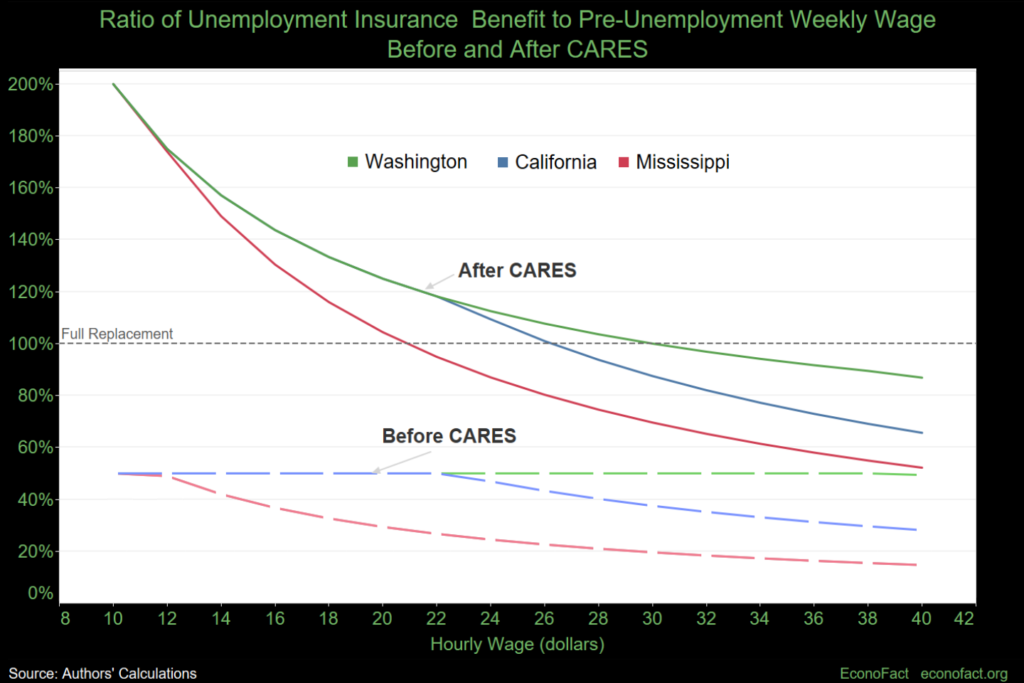

By remaining in effect until July 31, one of the goals of Patriot Pay is to ensure that essential workers remain adequately compensated in the face of the dramatic expansion to unemployment insurance under the CARES Act. The new Federal Pandemic Unemployment Compensation program entitles anyone whose employment was directly affected by COVID-19 to over $600 per week in jobless benefits until the end of July, including workers who quit as a direct result of COVID-19. For some essential workers, these benefits can amount to nearly 200 percent of their prior wages. While it can be disputed whether this benefit structure genuinely disincentivizes work, ensuring that risky employment pays better than safe nonemployment remains important as a matter of equity.

All that said, Patriot Pay is different from a traditional wage subsidy in one key respect. By subsidizing wage increases, Patriot Pay may have much less voluntary uptake compared to a program that allowed businesses to reduce their net employer costs. Participating employers may nonetheless attempt to recoup their contribution by reducing non-wage compensation, or by encouraging increased worker productivity. Worker productivity might even increase on its own through effects on employee morale and motivation. Arguably, however, effective real wages have already effectively fallen by the existence of the epidemic itself.

Ultimately, this is the tradeoff that comes from asking employers to cover 25 percent of the full Patriot Pay bonus. Cost-sharing keeps employer’s skin in the game, and allows for bonuses to adjust differentially across critical industries in line with relative risk and labor demand. On the other hand, many low margin employers may be too liquidity constrained to participate at all. Providing eligible businesses with a new source of liquidity would therefore raise the probability of their full participation. This could be achieved through a more general payroll support program of the kind proposed by Senator Josh Hawley (R-Mo.), or by allowing participating employers to claim the Employee Retention Credit.

The Employee Retention Credit under the CARES Act provides a refundable tax credit for 50 percent of employee payroll costs, up to $10,000 in wages paid by an eligible employer. To date, only businesses that have been financially impacted by COVID-19 and which did not benefit from the PPP are eligible for the credit, which potentially excludes many essential employers. Broadening eligibility to employers that participate in Patriot Pay would thus ensure critical industries have the liquidity needed to afford a full contribution.

Cost Estimation

The cost of a wage subsidy program like Patriot Pay will depend on a number of dynamic variables, including the rate at which employers participate, the average wage increase, and the effect on employment. Some jobs would likely see larger bonuses than others, and higher wages could draw many of the unemployed back into work. Greater employer participation would require more spending, but also tend to promote employment growth and retention, increasing personal incomes and reducing reliance on unemployment-related programs.

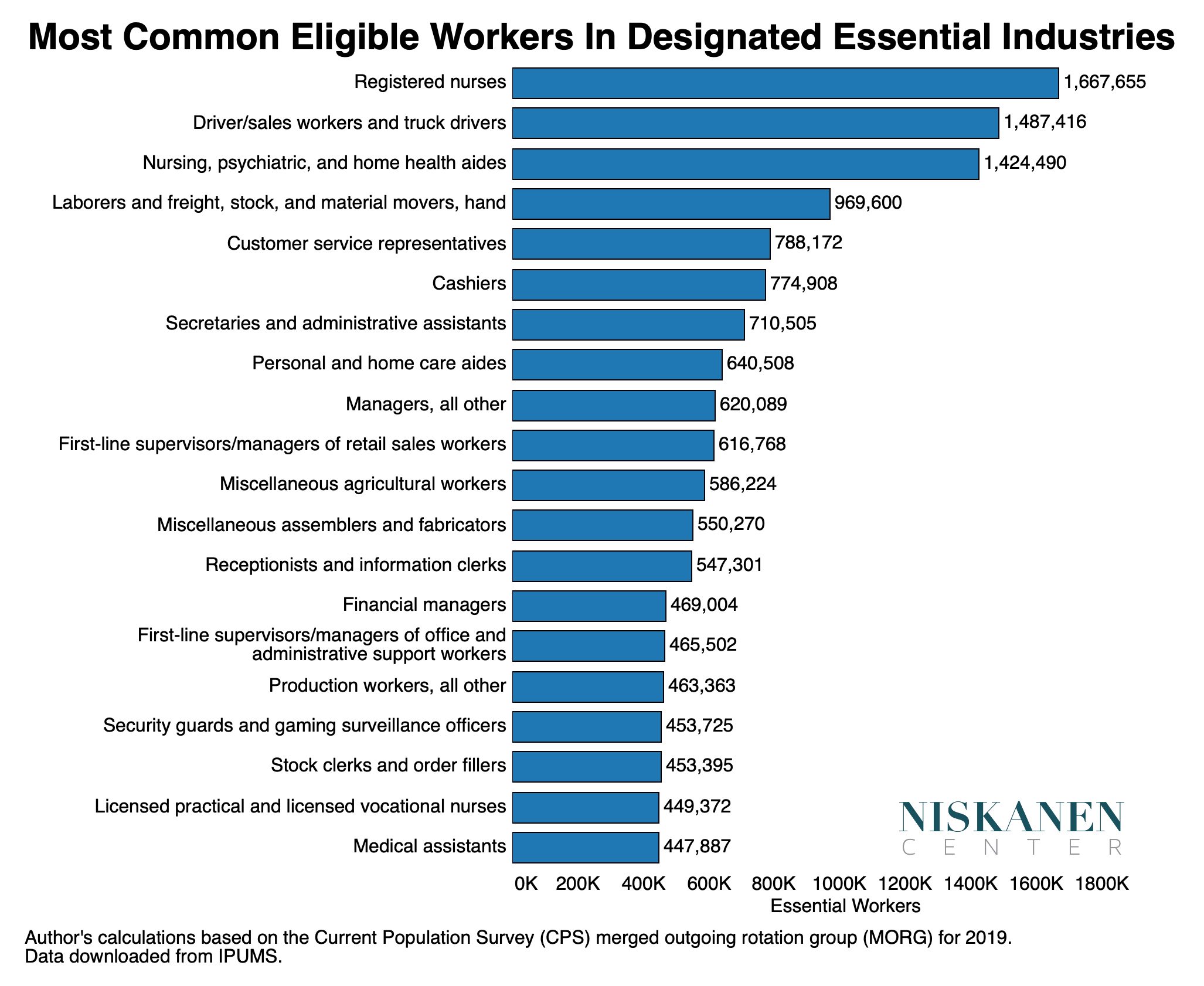

We make no attempt to model these or other dynamic factors. Instead, our cost estimation strategy relies on an estimate of the number of essential workers in the U.S. and their pre-crisis hourly wage. Given that Patriot Pay does not offer a concrete definition of an essential worker, we borrowed the inclusive definition provided in the DHS’s “Guidance On The Essential Critical Infrastructure Workforce.” We then match these to IPUMS-CPS industry codes, while hewing closely to the Brooking Institution’s interpretation of which industries are most relevant in the context of the contemporary crisis. Our analysis is further restricted to employees in the private non-profit and for-profit sectors, and omits government employees, the self-employed, and employees who works less than 25 hours a week. The full technical details of our estimation strategy are available here.

Under our eligibility definition, the most common categories of essential work include registered nurses, truck drivers, home health aides, manual laborers, and various kinds of retail occupations. The total eligible population covers approximately 42 million workers, representing roughly one quarter of the United States labor force. Importantly, these estimates rely on surveys conducted before the unprecedented collapse in employment that began in March of this year. While some essential occupations have been spared of mass layoffs, or even seen employment growth, essential industries have undoubtedly cut back on staffing and hours in aggregate.

To adjust for recent employment loss, we use initial claims data matched to industry codes to derive a crude estimate of the employment contraction within essential industries. While millions of jobs have been lost across construction, manufacturing, retail trade, and even health care and social assistance, we find most essential industries are still near 95 percent of their pre-crisis employment levels. Our final cost estimate is thus reduced proportionately.

With an estimate of the eligible essential worker population, we are able to derive an estimate of Patriot Pay credit eligibility based on surveyed wage levels and a range of assumptions for maximum credit uptake. Assuming 100 percent employer participation, and with every employer contributing the maximum $3 per hour, per employee raise, we estimate Patriot Pay would cost roughly $43.6 billion per month. This uptake rate is unlikely, however, given tight revenue constraints. Indeed, the full $3 per hour employer contribution (and thus $12 per hour employee bonus) would likely only be seen in the sectors with the most serious worker shortages — a feature of requiring employers to share 25 of the cost.

While admittedly subjective, our preferred estimate is based on a 50 percent rate of total credit uptake, adjusted for employment loss. This reduces the estimated monthly cost to $$20.7 billion. A narrower definition of essential worker would reduce this cost further. We therefore take this estimate to be an upper bound, particularly after accounting for cost savings elsewhere.

Conclusion

The coronavirus epidemic has exposed millions of low-wage workers in essential industries to infection and potential loss of life. America’s largest food and retail union, the United Food and Commercial Workers, recently reported that at least 72 of its members had died from COVID-19, while thousands more have tested positive. Twenty of these deaths occurred within the meatpacking and food processing sector, contributing to the closure of 22 meatpacking plants and the first major epidemic-related disruption to America’s food supply chain.

Under Patriot Pay, employers in critical industries would be empowered to leverage federal tax credits toward the provision of generous hazard pay, magnifying a $3 per hour raise into a $12 per hour bonus. Wage subsidies are an efficient way to encourage employment growth and retention, and can be implemented in a straightforward way.

We have the tools. It’s now up to policymakers to make compensating these front-line workers a top priority, both for its own sake and to ensure essential goods and services continue to be produced for the benefit of us all.

Samuel Hammond is the director of poverty and welfare policy at the Niskanen Center.

Robert Orr is a poverty and welfare policy associate at the Niskanen Center.