For decades coal plants were the main baseload power-resource, providing constant streams of power day-to-day, month-to-month, and year-to-year. But fundamental changes in the economics of generating electricity have turned that narrative on its head. Not only are coal plants shutting down at near unprecedented rates, the remaining coal fleet is running much less often than before. New data from the Energy Information Administration reveals that coal plants in the U.S. had a capacity factor of 47.5 percent in 2019,down from 64.2 percent in 2009. That means that total electricity production from all the country’s coal plants last year was less than half of what it could have been if those plants had been run full out.

A number of factors have contributed to the declining capacity factors in the coal industry, the main one being that wholesale power prices are so low that coal plants cannot recover their production costs.

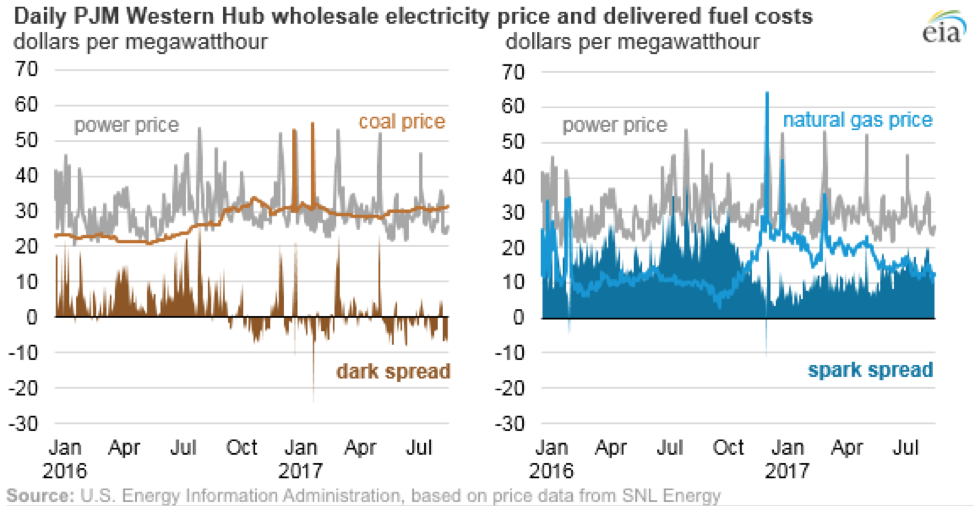

The picture above indicates the relative profitability of coal (dark spread) and natural gas (spark spread). A spread is achieved when the wholesale power price is higher than the fuel’s production costs, and a positive spread is indicative that a plant is generating enough net revenues in wholesale energy markets to cover its fixed costs, and maybe even earn a profit. The panel on the left demonstrates that darks spreads have greatly been reduced, and have even gone negative for sustained periods of time. It’s clear that coal plants cannot compete with extremely cheap natural gas, and zero marginal cost resources like renewables. As operators of coal plants have opted to run them less frequently, natural gas combined-cycle plants have ramped up production, with capacity factors increasing from 43.9 percent in 2009 to around 56.8 percent today. Concurrently, wind power had a capacity factor of 34.8 percent last year, up from 28.1 in 2009.

In reaction to these changing market dynamics and in order to save customers some money, coal plant operators have started switching to seasonal operation, essentially closing the plants for large parts of the year when electricity demand is at its lowest. For example, Xcel Energy in Minnesota claims its decision to run its coal plants seasonally will save customers tens of millions of dollars a year, while also reducing 5 million tons of carbon emissions annually, and utilities across the country are heading in the same direction.

Yet, certain utilities and state regulators are doing everything they can to continue running these inefficient plants. Just this week, lawmakers in Indiana passed a bill that would require utilities to give the state’s Utility Regulatory Commission at least three years notice before retiring a reliable capacity resource of at least 80 megawatts, and they cannot retire this resource without receiving regulatory approval. This bill is essentially trying to beat back the market forces that are paving the way for cheaper and cleaner energy generating sources. This is especially unnecessary considering we have already have enough natural gas electricity generation capacity to make up for lost coal electricity generation in a decarbonizing grid, and renewables can be ramped up significantly before running into reliability concerns.

With a majority of coal plants nearing their useful lifetime, it is essential that utilities seriously take into account the unfavorable economics of coal plants into their resource planning strategies. Coal plants are long-lived assets and continuing to invest in and run these plants would not only lock in emissions for years to come, but could see ratepayers on the hook for poor investment decisions.

Photo by Loïc Manegarium from Pexels