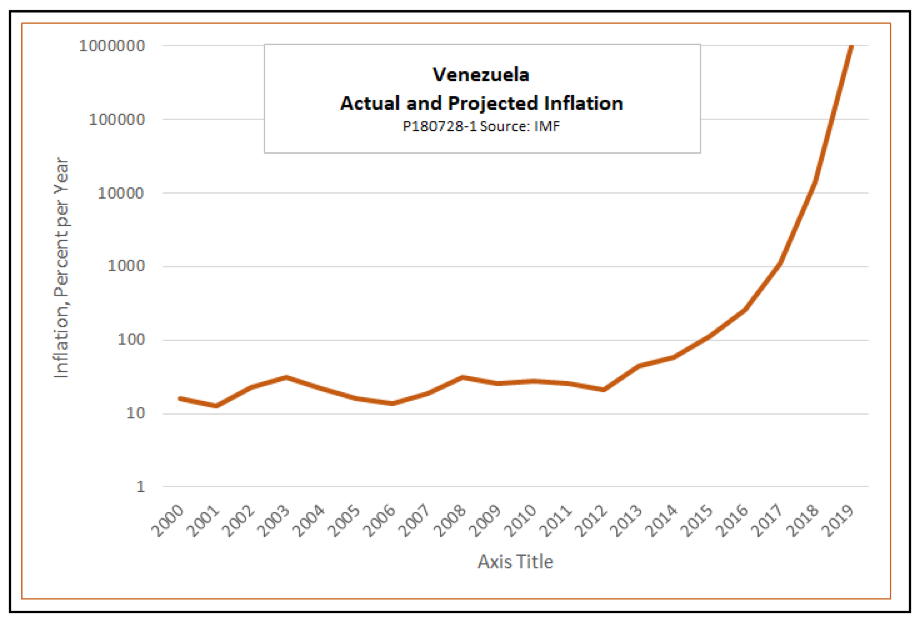

The IMF recently announced that it expects Venezuelan inflation to reach 1 million percent by the beginning of 2019, up from an estimated 13,864 percent this year. Venezuela is no longer just flirting with hyperinflation – it is plunging in all the way.

Hyperinflation is frightening. As they do when they see earthquakes or nuclear meltdowns anywhere in the world, people ask, “Could it happen here?” The Fed wants to keep inflation to about 2 percent. The most widely watched measure, the Consumer Price Index, is already a bit above that, at 2.9 percent, and the New York Fed’s Underlying Inflation Gauge has it a bit higher, hitting an annual rate of 3.3 percent in June. John Williams, who makes a living stoking inflation fears with his blog ShadowStats, claims the true rate is running over 10 percent, and rising. ShadowStats is nonsense, but although there is no panic, it appears that officials at the Fed itself are increasingly recognizing the need to tap the brakes before things get to the point where it has to slam them on hard.

Despite these signs of upward pressure on prices, however, few observers see any danger of hyperinflation here. To see why America will not be the next victim, we need to understand more clearly what is going on in Venezuela. Read on.

What is hyperinflation and where does it come from?

Hyperinflation has a long history, but no official definition. In an influential 1956 paper, Phillip Cagan suggested limiting the term to a rate of inflation of 50 percent per month or more, which is equivalent to an annual compound rate of about 14,000 percent. That would fit extreme cases like Weimar Germany after World War I, Hungary after World War II, or, earlier in this century, Zimbabwe, where inflation reached an immeasurable rate of perhaps as much as septillion percent per year before it ended.

But these are extreme cases. As a practical matter, we can apply the term hyperinflation to any case in which inflation is fast enough to seriously undermine the ability of money to serve its classic functions as a store of value, a unit of account, and a medium of exchange. That can begin to happen at much lower rates of inflation. Such a definition would be applicable in cases like Russia, Argentina, and Bulgaria in the 1990s, even though inflation in those countries reached only the low thousands of percent per year, well short of 50 percent per month. As the following chart shows, Venezuela is just now breaking through into Cagan territory, although it has had many of the symptoms of hyperinflation for several years already.

So, where does hyperinflation come from? We can find the answer in a simple formula called the equation of exchange: MV=PQ. In this equation, M stands for the quantity of money, V for velocity, P for the price level, and Q for the level of real GDP. Velocity is the least familiar term. Intuitively, we can think of it as the rate at which the stock of money circulates through the economy. Formally, it is more accurately defined as the ratio of nominal GDP (that is, P times Q) divided by the money stock, M.

Defining velocity as the ratio of nominal GDP to the money stock makes it clear that the equation of exchange is a simple accounting identity that has no inherent causal interpretation. If we rewrite the equation in the form P=MV/Q, we can see that an increase in the price level can arise from any of several factors: an increase in the money stock; an increase in velocity; a decrease in real GDP; or some combination. I like to call this version of the equation of exchange the inflation accounting equation.

The inflation accounting equation does not tell us what sets off any particular episode of hyperinflation. In the case of Venezuela, it seems more likely that the original cause was a drop in GDP, brought on by inept economic policies and aggravated by the collapse of the country’s oil industry. However it starts, though, the explosive character of hyperinflation comes from a set of three feedback pathways that link the variable P, on the left-hand side of the inflation accounting equation, to the variables M, V, and Q on the right-hand side. The feedbacks mean that not only does the rate of inflation depend on the rate of change of M, V, and Q, but that the rates of change of those three themselves depend on the rate of inflation. Let’s look at each of the pathways in turn.

Feedback via velocity

The first feedback pathway, the one that acts through velocity, arises from the function of money as a temporary store of value. If you get your pay on the first Friday of each month, you can put some cash in your pocket and spend the money on gas and groceries at any time during the month as you see fit. Hyperinflation undermines the store-of-value function because it causes money to lose a noticeable amount of purchasing power over even a few days. During a period of hyperinflation, instead of putting your pay in your pocket, it is best to run out and spend it quickly before prices go up. The velocity at which money moves through the economy increases accordingly.

Economists call this behavior asset substitution. You stop using currency or bank balances as a safe temporary store of value and instead, exchange it as quickly as you can for some other asset that will hold its value.

Basic consumer goods are one alternative. I remember seeing a good example when I was living in Russia during its hyperinflation of 1992. One day a fellow economist pointed to a neighbor’s balcony, where we could see a pile of several cases of a popular kind of canned beef called tushonka. “That’s hyperinflation at work,” my colleague said. The neighbor, I could see, was no fool to recognize that tushonka – compact, durable, and hard to counterfeit – was a much better store of value than the rapidly depreciating Russian ruble.

Once people have stocked up on consumer goods to the limit of their storage space, asset substitution turns to foreign currency. People exchange their rubles, bolivars, or whatever for dollars or euros as fast as they can. That happened in Russia in the 1990s and has been happening in Venezuela today, to the extent there are any dollars or euros that people can get their hands on.

The government can slow asset substitution by imposing consumer price controls and foreign exchange controls, and the Venezuelan government uses both. However, doing so has drawbacks. First, such controls tend to be leaky; people find a way to accumulate goods and foreign currency anyway. Second, the controls increase the cost of doing business and slow the growth of the economy (more on this below). Third, even if controls are initially effective, they create repressed inflation, which will break out even more virulently when controls are withdrawn or spontaneously collapse. That is exactly what happened in Russia. During Mikhail Gorbachev’s perestroika, up to the end of 1991, price controls held measured inflation to single digits, but at the cost of ever-growing repressed inflation. When the controls were lifted at the beginning of 1992, inflation jumped to a rate of more than 2,000 percent per year in a matter of days.

Feedback via real GDP

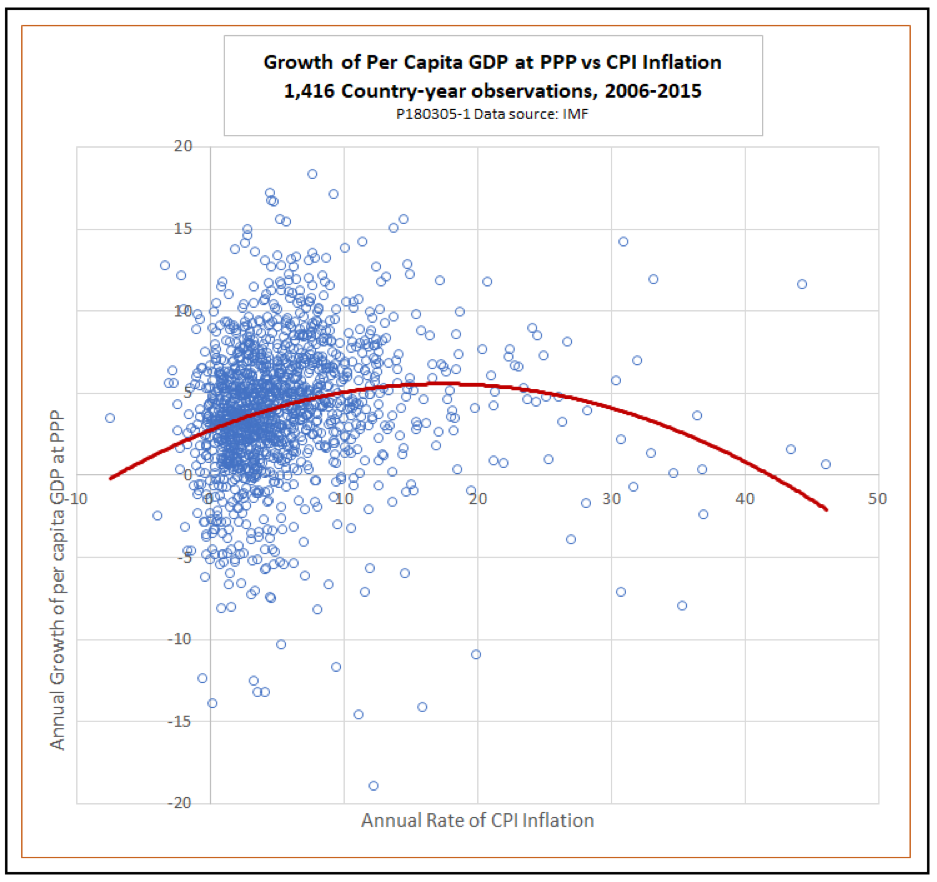

The second feedback pathway that fuels hyperinflation operates through the effect of inflation on the growth of real output. The relationship differs from that implied by the famous Phillips curve, according to which higher inflation is associated with lower unemployment, and thus, other things being equal, with faster growth. It turns out that the positive inflation-growth relationship implied by the Phillips curve applies only to relatively moderate rates of inflation. As suggested by the following chart, based on IMF data, inflation above the mid-teens tends to be associated with slower, not faster, growth of real GDP. In the period covered by this chart, no countries had inflation over 50 percent, but data from the 1990s, when rates of 100 percent or more were more common, suggest that very high rates of inflation are associated with negative GDP growth.

It is not hard to understand why inflation is harmful to the real economy. It makes business planning difficult, especially since inflation is usually variable and unpredictable when it is high. Hyperinflation also disrupts financial intermediation, as banks become reluctant to lend for more than very short periods. It undermines the payments system because it strengthens incentives to pay late. It leads to labor strife, social disruption, and political instability. All of the above promote capital flight. If the government uses price controls and currency controls to combat inflation, those measures further disrupt normal market processes.

Venezuela is already showing negative growth. The IMF expects real output to fall by about 18 percent this year. Since the rate of economic growth, Q, appears in the denominator on the right-hand side of the inflation accounting equation, any slowdown in growth, or negative growth, causes inflation to accelerate, thus completing the second feedback pathway.

Feedback via fiscal policy

The third feedback mechanism operates through the effect of inflation on fiscal policy. The mechanism is less direct than that for velocity or GDP growth, but under conditions of hyperinflation, it can be quite powerful.

This third feedback pathway begins with the effect of inflation on real tax revenue. No government has yet figured out a way to collect taxes instantly. The tax revenues a government receives are always based on economic activity (income, retail sales, property values or whatever) in some previous period. If there is no inflation, the delay in receiving tax revenue does not affect its real value. However, when there is inflation, the real purchasing power of the tax revenue falls between the base period for which taxes are calculated and the time the government receives the tax payments. If expenditures are constant in real terms, the reduction in the real value of revenues means a larger budget deficit. Economists call the tendency of inflation to increase the real budget deficit the Tanzi effect.

One result of the Tanzi effect is an increase in the rate of growth of the money stock. When governments spend money on current purchases or transfer payments, the money stock increases, but that increase is normally offset by reductions of the money stock that take place when the government collects taxes. During hyperinflation, however, the Tanzi effect reduces the real value of tax revenues. In extreme cases of war or revolution the government may not be able to collect any taxes at all, so that the entire budget deficit is monetized.

According to our inflation accounting equation, the increased rate of money growth would be enough by itself to cause an increase in the rate of inflation. However, as proponents of the fiscal theory of the price level point out, loss of control over the budget deficit can also affect the rate of inflation in another way, via its effect on expectations. The idea is that as long as people are confident that fiscal authorities will respond to any emerging inflation by raising taxes or cutting expenditures, they will be willing to hold money as a means of exchange and store of value. As accelerating inflation triggers the Tanzi effect, their confidence in the ability of the government to contain the deficit is shaken. In response, they try to reduce their holdings of real money balances, which raises velocity.

It makes little practical difference whether we view the higher deficits induced by the Tanzi effect as acting on inflation via the money stock, via velocity, or both. Ultimately, hyperinflation brings all three right-side variables of the inflation accounting equation into play as both velocity and the money stock rise while real output falls.

What lies ahead?

All the links in the feedback chain of hyperinflation are now in operation in Venezuela. What lies ahead?

If history is any guide, Venezuela’s hyperinflation will continue until it abandons its present currency, the bolivar, and replaces it with a stable foreign currency like the dollar, as Ecuador did in 2000, or a new version of its own currency linked to a foreign currency, as Argentina did in 1991. Those actions did not resolve all of Ecuador’s or Argentina’s economic problems, but they did end hyperinflation.

Meanwhile, the United States remains immune, at least for the time being. The main safeguard against hyperinflation in this country is the expectation that the government will behave responsibly. As long as expectations are well anchored, velocity cannot increase explosively. The experience of Venezuela and other countries is that velocity is the main driver of hyperinflation, especially in its initial stages. In Venezuela, real GDP is falling at a rate of less than 20 percent per year, and the money stock is estimated to be rising at a rate of “only” 2,000 percent, so by far the greatest part of this year’s estimated 13,000 percent inflation, and almost all of the faster inflation expected next year, is due to rising velocity.

The only thing that could destabilize velocity enough to cause hyperinflation in the United States would be a collapse of confidence in both our fiscal and monetary authorities. Can we imagine that Congress would double down on tax cuts, despite rising deficits? Can we imagine that a global trade war would lead to a sharp downturn in GDP? Can we imagine that the White House would pack the Federal Reserve Board of Governors with less responsible candidates than the most recent nominees? As blogger Billy Mitchell once wrote in reference to hyperinflation in Zimbabwe, “Bad Governments will wreck any economy if they want to.”

But that won’t happen here, surely.