In response to the introduction of the MARKET CHOICE Act (MCA), the first Republican-sponsored carbon pricing bill to be introduced in Congress since 2009, several commentators have argued that the economic harms from the carbon tax portion of that bill should make it a nonstarter and, more generally, that carbon taxes are akin to tariffs and should be opposed with equal vigor by free-marketers. While carbon taxes and tariffs superficially resemble each other, they are different in important ways — and those differences explain the case for carbon taxes and the case against tariffs.

Both a tariff on imports and a tax on greenhouse gas emissions will affect consumer prices and raise revenue. With a carbon tax, redistribution is used to bolster the policy. In the case of the MCA, revenue goes to funding other tax cuts and to infrastructure spending, both of which offset the costs of the new carbon tax to the poor. MCA revenue also funds research to decrease the long-term costs of transitioning to low-carbon energy. Those are transfers, and would lead to increased government spending, but they are aimed at reducing the burden of carbon pricing and investing in economically productive projects.

Of course, new government spending does not come for free. A carbon price, though levied on producers and emitters, will increase the prices to households of energy and consumer goods whose production leads to carbon emissions. Those increased costs will be real, but small in aggregate. The most comprehensive analysis of the MCA indicates that the negative effect on GDP will be small, reducing annual output in the first decade by a steady 0.1—0.2 percent against current policy.

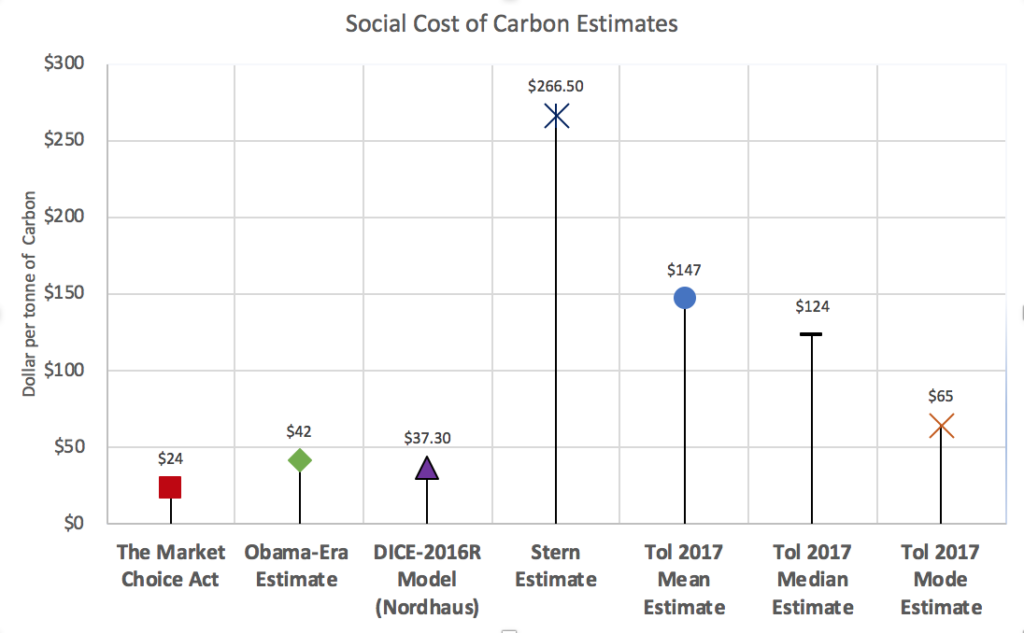

That small burden will be worth it in the long term because a carbon tax corrects for a market failure, by creating an artificial price signal to represent the damages expected from today’s carbon emissions that will add up over the next few centuries. While estimates of the future damages from CO2 emissions vary widely, it is hard to argue they are zero and credible estimates reach much higher than the carbon prices imposed by the Market Choice Act (see chart below). By pricing carbon emissions at or below expected damages, thereby reducing emissions at a lower cost than the economy would suffer in the future, we can expect overall welfare to go up in the long term. That is one of the key insights of climate economics.

Estimated climate damages of CO2 emissions from numerous models as reported in Nordhaus 2017 and Tol 2018, from the 2013 Interagency Working Group Report on the Social Cost of Carbon (green dot), and the carbon tax in the MCA (red dot).

Tariffs work backward to this in almost every meaningful way. A tariff creates a market failure by building an artificial barrier to entry into the marketplace. That causes prices to go up for goods that depend on imports, while some particular industries accumulate short-term gains from the price protection. But while domestic producers get some temporary advantage, overall GDP goes down as trade barriers shift investment to less productive sectors. Unlike the carbon tax, the long-term effect of tariffs is to make overall wealth go down.

And as we’ve seen thus far, rather than being thought out and aiming to work toward broader policy goals with new revenue, imposing tariffs in a trade war builds errors on top of errors. President Trump plans to spend $12 billion on emergency aid to farmers, who are enjoying fewer sales because of tariffs imposed on their products by China and other countries. The Washington Post reports that the President is facing increasing pressure to extend bailouts to other industries that face international tariffs. Those tariffs were raised in response to the earlier imposition of tariffs, by the United States, on a variety of imported goods. So far from being a planned measure to offset the impacts of a larger policy with productive expenditures, the new emergency aid is a reactionary move to bolster a group harmed by the tariffs raised by our antagonists in a trade war with nebulous long-term goals.

That is not to say that carbon tax policies don’t have trade implications. The MCA imposes a border adjustment for greenhouse-gas-intensive products, allowing rebates for the cost of the carbon tax on exports and levies on imports. These adjustments have two principle effects: to limit emissions leakage into other countries and maintain the competitiveness of American producers in global markets that do not yet have carbon pricing. Preventing leakage is important to ensuring that emissions reductions in the United States create climate benefits, which would be lessened if production of industrial goods shifted to countries with high emissions. The size of these adjustments will likely go down in tandem with the carbon intensity of U.S. industry, which would fall under a carbon tax.

The case for the free market is that it efficiently allocates resources to where they can be put to use creating wealth. Trade tariffs get in the way of that growth and hurt in the long run. So do carbon emissions.

Image by Gerd Altmann from Pixabay.