The Center for American Progress has a new report defending the estate tax on the basis that it incentivizes charitable giving:

Charitable donations gifted upon an individual’s death by their estate, also known as charitable bequests, accounted for 8 percent of charitable contributions in 2016, providing more than $30 billion to a variety of causes. The Congressional Budget Office (CBO) estimates that eliminating the estate tax could reduce charitable giving through wills by between 16 percent and 28 percent—and other studies have found even larger effects. When the estate tax was temporarily repealed in 2010, charitable bequests declined by 37 percent.

There may be many solid arguments for supporting the estate tax, but I think this is a particularly bad one. The definition of an inefficient tax is that it significantly distorts economic behavior through avoidance, or what economist call the “excess burden of taxation.” The paradigmatic example of an excess burden is the “window tax” levied in 18th century England, in which property taxes were tied to the number of windows in a house. As a result, one can still find old homes in which the windows have been closed with bricks in order to avoid property taxation.

Excess burden is an important concept because it underscores how the accounting cost of a tax obscures the full social cost created by distorted economic behavior. The statistics that eliminating the estate tax would reduce charitable giving by 16 to 28 percent are thus a direct measure of its inefficiency.

That the avoidance behavior in this case appears superficially selfless is damning with faint praise. The report’s own statistics reveal that large estates are donated primarily to religious and educational institutions. Of “large gifts” to education, i.e. donations exceeding $10 million, 66 percent go to higher-ed, meaning college endowments, or gifts to build a new library named after the deceased, and so forth. Less than 20 percent of estate tax avoidance finds its way to health or human services, and presumably an even smaller fraction of that goes to charities engaged in anything close to “effective altruism.” Of course, social insurance programs provided by the federal government do much more to help the poor than private charity by a long shot, which makes celebrating dollars lost from the estate tax to avoidance all the more confusing from a progressive perspective.

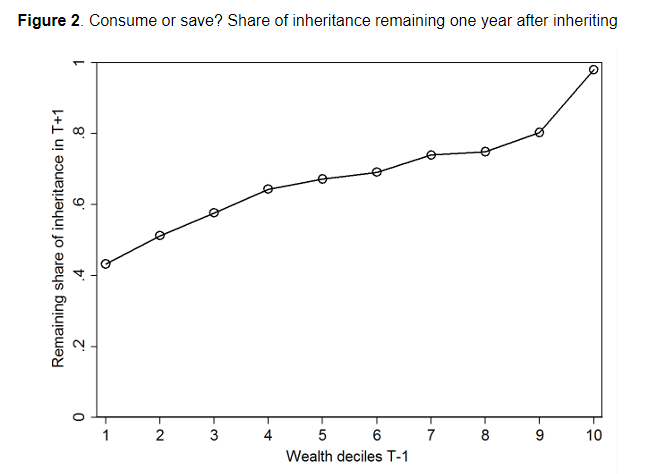

One might object by saying that even a modicum of good from the fraction of a fraction that goes to help the poor is an improvement over the alternative of allowing rich heirs to spend unearned wealth on conspicuous consumption. But that’s not obvious, either. While many smaller estates are consumed within a few years of being inherited due to heirs paying down debts, the largest estates are typically saved and invested, thus channeling funds into productive for-profit investment—the more relevant comparison to charities with dubious social returns. As a result, inheritances may actually reduce relative wealth inequality.

Based on population-wide data from Sweden.

There’s also the simple fact that gifts from parents to their children create a double benefit, assuming the preferences of the deceased count for anything. Indeed, the so-called “strategic bequest motive” for personal savings may be a primary driver of aggregate capital accumulation, as one Lawrence Summers famously argued.

At the end of the day, if you want to subsidize charities it is best to do so directly and transparently. The United States already offers massive tax subsidies to the nonprofit sector through its generous charitable deduction. And while I am a big fan of genuine civil society, it’s not clear that private philanthropy in its current state needs any additional subsidization. Indeed, my perception as a resident of Washington, D.C., the epicenter of foundations and nonprofits, is that a substantial amount of the nonprofit sector is wasted on bureaucracy and salaries that divert human and financial capital from more productive activity.

Present company excepted.