Key takeaways

- Unemployment insurance taxes are experience rated. When a company lays off workers, the company’s future tax liabilities are increased.

- Experience rating was designed to discourage firms from laying off workers, since they would be paying for unemployment benefits. In practice, experience rating constrains economic dynamism and flexibility and inhibits career growth.

- Experience rating discourages new hires in addition to layoffs. It particularly results in firms being less likely to hire young, entry-level workers, since they are perceived as riskier hires.

- Experience rating further incentivizes firms to limit access to unemployment insurance benefits by hiring contractors instead of employees or by discouraging unemployment insurance applications.

- The United States should eliminate the requirement that states use experience rating to finance unemployment insurance benefits.

Introduction

The United States funds unemployment insurance (UI) in an unusual way.

Most nations fund unemployment insurance through a flat payroll tax — similar to how the United States funds programs like Social Security and Medicare: Every person who works has some fixed percentage taken out of each paycheck1 (up to a certain amount) to fund the unemployment insurance program.

The United States uses a different system called experience rating. Under experience rating, unemployment insurance is paid for by a tax on firms, and the level of that tax depends on each firm’s history (or “experience”) sending laid-off workers into the unemployment insurance system.2 Firms whose employees have frequently drawn on the unemployment insurance program in the past (i.e., firms with high turnover rates due to firing workers) will be assigned to pay a higher tax rate than firms with fewer layoffs and firings.

Conceptually, this is similar to the way that other private-market insurance systems work. For example, when you have a car accident, your insurance pays for the cost of your repairs, but your future premiums go up. Similarly, under experience rating, when someone loses their job, the government pays them unemployment, but the company that laid them off sees their future tax liabilities increase.

Fully implemented, experience rating would mean that unemployment insurance would be effectively paid entirely by the firm that laid off a given worker (in practice, each state uses a complicated formula that only partially approaches this ideal). When the UI system was first designed, it was believed that this would incentivize firms to reduce firings by making each individual firm account for the strains it put on the UI system.3

In practice, this has not been born out. Instead, unique features of the unemployment insurance program result in experience rating causing as many problems as it ostensibly solves. These problems fall into two large categories:

First, UI experience rating is bad for the economy. Experience rating was first designed and implemented during the Great Depression, well before the modern understanding of the causes of business cycles. In the aftermath of the Great Depression, it was widely believed business cycles were the consequence of “overproduction” and that the economy needed to be restrained during boom times to reduce the intensity of business cycles, including with measures that discourage overhiring. This belief has not held up over time. Work by Milton Friedman and Anna Schwartz has suggested that recessions are primarily caused by failed monetary policy,4 not prior overproduction. This implies that, instead of dampening the economic cycle by reducing production peaks, we should use monetary and, if necessary, fiscal policy (including unemployment insurance) to reduce production valleys.

Second, UI experience rating is bad for workers. While experience rating can reduce layoffs, that is not the only margin on which firms shift their behavior. In addition to being less likely to lay off workers, firms reduce their hiring. Moreover, they will specifically look to reduce hiring from higher-risk worker pools, such as entry-level workers. This increases the unemployment rate for young people, making it harder for them to start careers. In addition, experience rating encourages firms to develop ways to make it less likely that their employees qualify for unemployment insurance. They can do this by degrading work conditions (so unwanted employees are more likely to quit), or simply by not providing laid-off workers with resources and information about the UI system. Firms also regularly contest unemployment claims, employing an industry of expert consultants to do so.5 The credit bureau Equifax alone claims to process nearly a quarter of all unemployment claims.6

Eliminating experience rating and replacing it with a simple payroll tax would not only eliminate the problems discussed above but would also unlock other potential reforms. For example, financing unemployment insurance through a tax on individual firms impedes us from implementing effective economic reforms such as creating a UI alternative for “gig workers” (“gig” firms are not currently subject to any UI taxes) or a paid family and medical leave program (which cannot be operated through UI under experience rating, since it would incentive firms to discriminate against new or potential parents and caregivers).7

Even if experience rating itself is maintained, encouraging states to adopt the least damaging among its many variants could allow us to maintain some of the benefits of experience rating while minimizing the costs.

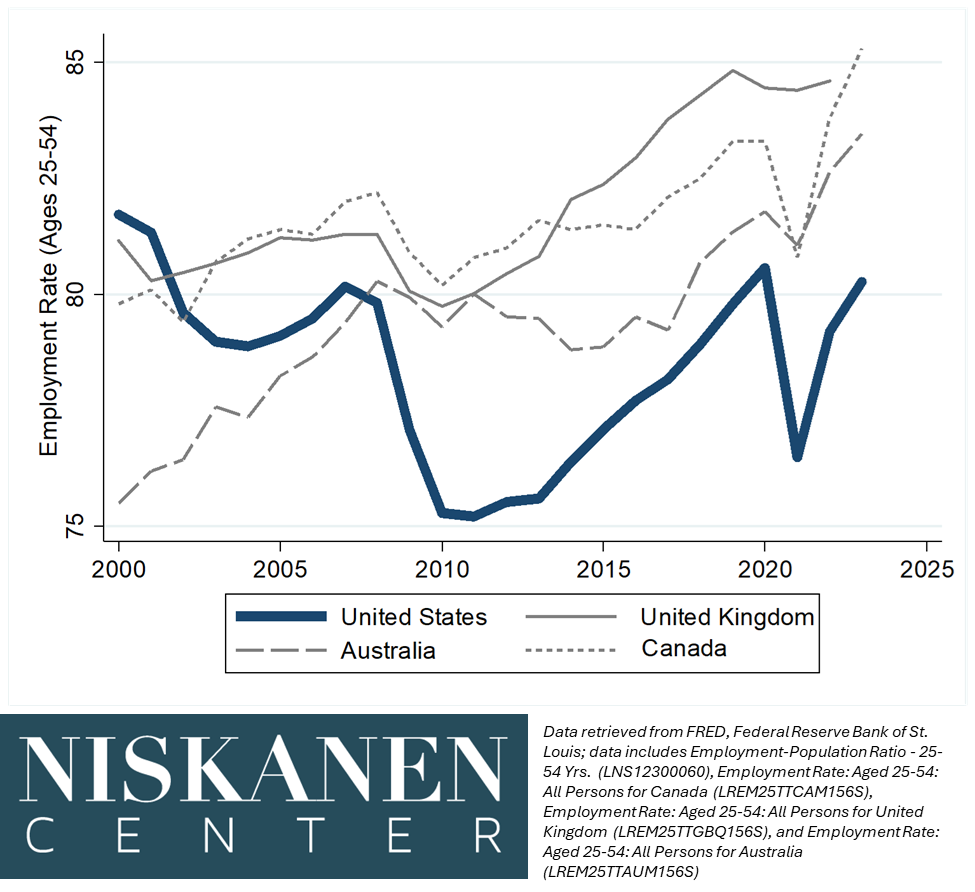

The United States should be the world’s best and most dynamic labor market. Until recently, it was, as shown by Figure 1. In 2000, prime-age (25-54) employment was well above that of peer countries like Australia, Canada, and the United Kingdom. But in recent decades, we have fallen behind. While their employment rates have, on average, increased from 79 percent to 84 percent, ours have slightly declined, from 82 percent to 80 percent.

Figure 1 — The U.S. is no longer the world’s best labor market

Eliminating or reforming experience rating is a crucial step in returning to the front of the pack.

A brief introduction to experience rating

When the Social Security Act of 1935 was passed, it allowed the states substantial leeway in determining how they would finance their Unemployment Insurance programs. Most followed the example of the one state that had created an Unemployment Insurance program a few years earlier, Wisconsin.8

Wisconsin’s experience rating system was partially inspired by the “merit rating” that many workman’s compensation programs, developed during the Progressive legislation era of the 1910s, had used for financing benefits for injured employees. Employers that were most likely to draw on the funds had to pay a higher tax rate. This reduced the “moral hazard” of insurance, since accident-prone firms contributed more to the system. The system was intended to incentivize these firms to take measures to reduce injuries.

An employee layoff can be conceptualized similarly to a physical injury, as a harm to that employee that the employer is responsible for. Following that logic, using experience rating to fund unemployment insurance would better frame the firm’s incentives. Firms with a history of firing workers more often would be incentivized to stabilize their business model instead. Some adherents were hopeful that this better alignment of incentives would eliminate the business cycle entirely by deterring firms from hiring workers they would inevitably have to lay off in a downswing.

While there was initially a wide variety of systems throughout the country, this changed in the 1980s. The Tax Equity and Financial Responsibility Act (TEFRA) of 1982 required all states to set a maximum tax rate of at least 5.4%. This effectively forced states to move to some variable formula, because a uniform 5.4% rate would be overly high — it’s possible to fund a fairly generous UI system on a uniform rate of 2%.9 As such, this effectively forced states to move to some variable formula, with experience rating as the obvious choice since other states provided a model. All states switched to experience rating by 1985, with the state of Washington being the final holdout.

While all states have unique experience rating systems,10 there are two primary models:

- Reserve-Ratio Programs maintain a separate UI account for each individual employer in the state. Each firm pays taxes into that account, and any laid off employees have their UI payments drawn from that account. As the account’s funds diminish, the employer must pay a higher tax rate per worker.

- Benefit-Ratio Programs pay UI out of a statewide joint account but track the total cost of UI payments from each firm across the last several years. That number is then compared to the total wage base of the firm to create a “benefit ratio” (i.e., how much are workers from those firms drawing upon benefits, as a ratio of total payroll). Firms that have a higher benefit ratio are subsequently assigned a higher tax rate.

Additionally, three states do not fall into the above categories. Delaware and Oklahoma use a benefit-wage system similar to the benefit-ratio, but using wages as the numerator instead of claims. That is, the firm’s tax liability is a function of laid-off employees’ previous wages, not their total UI payments. Alaska has a unique system, the payroll variation system. It measures payroll stability over the previous three years, and determines the tax rate based on average payroll decrease.

In addition to these differences, three other ways state UI systems differ are their taxable wage base, the maximum tax rate, and the treatment of new firms.

The taxable wage base is how much of each employee’s total wages are subject to the tax. Most states limit the wage base (with a range of $7,000 (Arkansas) to $67,600 (Washington)). 11While employers are the ones that pay the tax, it is based on the salaries of employees. In addition, the employer will generally lower wages of employees to pay for the tax, such that the burden of taxation still primarily falls on employees.12

Employees who make more than the wage base would not have additional taxes levied on their wages once their salary surpasses that range. As most states set the taxable wage base much lower than the average wage, this effectively means that UI taxes are very regressive — they only apply to the first few thousand dollars of earnings, while the tax rate on the marginal dollar for most employees is $0.13

The maximum tax rate is the maximum tax rate for employers. All states have a maximum rate of 5.4% or higher, as required by the 1982 TEFRA reforms. Having a maximum rate reduces an employer’s potential exposure to experience rating — firms that have especially high layoffs in the recent past could otherwise face rates that continue to increase indefinitely, forcing them to go out of business altogether.

Finally, each state must determine how it assigns a tax rate to new firms, where there is no “experience” to “rate.” States typically have a default rate for such firms, either applied universally or depending on their industry.

These and other departures mean that all firms are only partially experience-rated. States with higher taxable wage bases in conjunction with higher maximum taxes will approach a “full” experience rating system in which, over time, any given individual firm would pay the entire effective cost of their laid-off employees. Because of the complexity of the experience rating system, it is hard to calculate exactly how a given layoff will affect a given employer’s future tax liabilities. According to one Department of Labor estimate, under certain assumptions, the average firm pays 29% of the total benefits for each incremental employee that they lay off.14

Experience rating is bad for the economy

“Here is the problem for the social engineer — to make employment constant, and, where constant work is impossible, to place the burden of unemployment on the industry where it belongs.”

–John Commons15

“The curious task of economics is to demonstrate to men how little they really know about what they imagine they can design.”

–FA Hayek16

The misplaced goals of experience rating

As discussed briefly in the previous section, experience rating was designed with the primary goal, not of economic relief, but of using unemployment insurance as a system of economic planning. The first state to implement an unemployment insurance system, Wisconsin, served as the blueprint when a national system was first considered. The architect of the Wisconsin system, the economist John Commons, had previously designed Wisconsin’s worker’s compensation system, in which employees who were injured at work would receive damages paid by the employer.

Notably, worker’s compensation is not merely aimed at providing the injured worker with recompense, but also at encouraging the firm to take measures internally to reduce the likelihood of injury in the first place. Commons designed the unemployment insurance with the same principles in mind — the goal of unemployment insurance was not merely to provide relief to the unemployed, but to encourage firms to limit cases of unemployment altogether.

This approach was hotly contested as policymakers began to design the national UI system. While some economists, like Commons, championed the expansion of the Wisconsin system, others advocated for a system where unemployment insurance was paid out of general funds, without experience rating.

The economist Walter Morton described the debate in the American Economic Review17:

These two types of plans differ in content and method of operation because they reflect two fundamentally divergent economic philosophies. The prevention theory assumes unemployment to be an individual responsibility. Its primary source is traced to faulty management. This theory operates on the assumption that unemployment can be cured by an appeal to the profit motive of the employer…The relief theory, on the other hand, assumes that the individual employer is not responsible for lack of jobs. It traces the source of unemployment to faulty economic institutions. It recognizes relief as a social responsibility and makes provision for it by assessing employer, employee and the public. Assessments under this theory are not considered as a penalty nor as an incentive, but simply as a necessary levy to help the unemployed.

It is worth noting that modern justifications of unemployment insurance almost entirely fall under the second goal of relief. In the subsequent century, we have learned to be cautious about the capacity of economic planners to succeed in lofty goals, such as eliminating unemployment altogether.

Moreover, while the generosity of unemployment benefits and the criteria for eligibility are hotly contested in public dialogue, the mechanisms of financing unemployment insurance have been neglected. Today unemployment insurance is primarily conceptualized as an economic relief program, and relatively few economists believe that economic planning to avoid unemployment altogether is either feasible or desirable.18 As Princeton economists Richard Lester and Charles Kidd said in their 1939 pamphlet “The Case Against Experience Rating”,19

In an interdependent exchange economy governed primarily by market forces, it is not possible to allocate to each individual firm and to individual consumers the responsibility for all unemployment or even for all compensable unemployment. Unemployment is a reflection primarily of the general rate of spending for which society as a whole is responsible.

The original justification used to argue for experience rating has been discarded, but the system has quietly endured. Effectively, experience rating functions to punish firms for laying off employees, even as we now recognize that most layoffs result from larger, whole-market shifts.

Experience rating and business operations

Experience rating results in employers facing a complicated and ever-shifting tax code. Instead of facing a fixed tax rate that they can anticipate when making hiring decisions, they now have to make determinations that factor in a wide variety of different economic conditions, some of which may be about the macroeconomy as a whole instead of their individual firm.

For example, New Jersey changes its experience rate tax schedule as a function of both the individual firm’s use of the UI program and the current condition of the general statewide UI funds balance (New Jersey is a benefit-ratio state, such that UI payments come out of a general fund).20 A firm’s tax rate depends on the current tax schedule (as the UI funds are depleted, taxes are increased) and its unique history of layoffs (which determines its placement within a given tax schedule).

A consequence is that a firm that has not actually laid off any of its workers may find that its taxes have gone up because of higher layoffs in other industries or firms, which have depleted UI funds. Firms typically find out their tax rate in an annual letter from the New Jersey Department of Labor.

A good tax system is one in which households and firms can anticipate and plan for future liabilities. Experience rating results in firms having a schedule that shifts from year to year. While this is partially due to their decisions to lay off workers, it also varies depending on the decisions of other firms and how that affects the state’s total balances.

Firms that attempt to predict their UI tax liability will likely have to invest valuable time and energy to do so. The vast majority will not be able to afford it and resign themselves to apparently random fluctuations most of the time. When they do experience a big lay off, they will see it in their tax rates, and conclude that they should be conservative about hiring when better times return.

This can distract firms from focusing on their core competency of providing goods or services, and instead, track potential tax liabilities. More likely, most firms abandon prediction and resign themselves to a tax rate that vacillates. This can be especially problematic because firms may only recognize that their unemployment insurance taxes are affected the year after they lay off many workers. Experience rating effectively functions as a hidden, “submerged”21 tax on our most dynamic industries — many companies may not even be aware of the incentives they face.

What’s more, firms will be stuck with a bigger bill just as they are struggling financially. An employer that is struggling to make payroll and has to lay off staff will find that their tax liabilities go up the next year. As a result, experience rating makes it so that struggling firms are more likely to go out of business, what the Tax Foundation calls the experience rating “shut down” effect.22

Ironically, policymakers take the opposite tack when the economy itself is facing a downturn. In both the 2008 and 2020 recession, policymakers passed temporary payroll tax cuts, justifying them with the argument that they would make it easier for firms to keep workers employed.23 Experience rating effectively reverses this logic. We are punishing firms for “bad behavior” when they are least able to adapt to the punishment.

Experience rating and macroeconomics

Experience rating also relies on a misconceived understanding of the business cycle. At the time, it was believed that trying to smooth the business cycle by reducing the amplitude of both economic “booms” and “busts” would lead to a better functioning economy. Subsequent research has questioned this understanding.

Macroeconomics has never been an exact science, but with all its faults, we certainly understand it more today than we did in the 1930s. Concepts like “Gross Domestic Product” had not yet been developed, let alone measured. In the 1930s, many people (including economists) had the understanding that economic downturns were caused by seeds that we spread during the “good times.” On the left, Marxist economists would refer to a “crisis of overproduction” where building too much during a boom would cause an economic collapse. For example, if farmers produced too much grain or factories produced too much steel, the price of those would drop precipitously, causing a subsequent downturn. On the right, the “Austrian Business Cycle” theory made similar predictions — that the expanding credit in a boom caused overinvestment and the subsequent bust.24

These theories are both intuitive and appealing. They present what Paul Krugman has called “economics as a morality play.25 Just as in a Greek tragedy, we can think of the Great Depression as the effective nemesis for the hubris of the “Roaring 20s” that preceded it.

But while this view is intuitive, it also does not appear to be true. In the early 1960s, Milton Friedman hypothesized what he called the “plucking model” of the business cycle.26 Instead of the Greek tragedy approach, he suggested that the “boom” is actually the natural state of the economy, and the “bust” is the aberration. The “plucking” in this metaphor references plucking a guitar string. When you play a note on a guitar by pushing down on a string, it will naturally return to its initial state when you let go. Similarly, the economy should be growing most of the time, and recessions should be conceptualized as deviations from that norm — not “corrections” to previously high growth.

He demonstrated this empirically by showing that large “booms” do not predict subsequently large busts (as an overproduction or Austrian Business Cycle model would predict), but instead the reverse — large “busts” effectively predict subsequent “booms” — just as pulling a guitar string down further would increase the speed at which it snaps backs. He then tested this theory again in a second paper released in the 1990s,27 showing that his theory continued to work with data generated after making these predictions. Recent work by Dupraz, Nakamura and Steinsson28 has further demonstrated this using continued advances in econometric methods, as well as more recent data.

The plucking model framework suggests a very different role for policymakers in a recession. Recessions are not the cure for a previous bubble, but a policy mistake. As Kevin Erdmann of the Mercatus Institute has said in reference to the 2008 financial crisis: “The hard truth is that there was no overarching reason why millions of workers in the construction sector had to be thrust into long-term unemployment… We treated the bust as medicine that needed to be taken. That medicine cured nothing and only created disastrous side effects because it was based on false premises”.29

This reconceptualization means that the original premise behind experience rating is fundamentally flawed. Experience rating reduces the incentives to lay off employees but also, as discussed in more detail in the next section, reduces the incentives to hire new employees. Every new employee is now seen as a potential tax liability. Work by the Federal Reserve has shown that a 5% increase in experience rating results in a 2% increase in job “destruction” (ie, the amount of severed job-worker connections) as well as a 1.5% decrease in job “creation” (the amount of new job-worker connections).30 It is not clear if the former is worth the latter.

The questionable virtues of stable employment

It is worth asking ourselves to what extent policy should aim to maximize employees’ tenure with their current employer.

The goal of experience rating is to reduce layoffs. And, despite the concerns raised above, most empirical work suggests that it succeeds in that goal. Researchers have shown that states with stronger experience rating have lower turnover, as well as less seasonal and temporary unemployment.31 But the goal of employment policy writ large is generally not to reduce layoffs, but to improve well-being — primarily through the promotion of policies that increase employment and wages. It is less clear that experience rating has an effect here.

Economic change and flux can be stressful, but can often lead us to a better place. Evidence from the 2008 recession shows that the areas that were hit hardest by the recession were also the areas that saw the most upskilling within firms, as well as reallocation of workers from low-productivity to high-productivity firms.32 The layoff itself is not necessarily going to harm the worker, as much as the lack of income during the period of unemployment. But this is the problem that unemployment insurance benefits are themselves expected to allay. As we have previously argued, UI benefits should be sufficient to cover 75% of workers’ income in order to ensure that they are able to finance normal expenses while they look for a new job.33 Reducing layoffs themselves is simply a step too far.

For a somewhat more intuitive case, consider what happens to someone who is forced to leave their job — not because of a layoff, but because of a natural disaster. A recent paper showed that people who were displaced by the 1973 Iceland Vestmannaeyjar volcano eruption (which the paper argues was an effective ‘natural experiment’, as the lava flows were effectively random) saw dramatically increased incomes afterward — equivalent to an additional $13,000 a year.34 Similarly, another paper shows that workers often badly underestimate the wages that they could earn at other employers, causing overly pessimistic workers to remain stuck in low-pay, dead-end jobs.35 This has even been hypothesized to be a reason for fast-growing wages post-Covid. Because so many people lost work in 2020, there was a broad reallocation to new, better-paid, higher-productivity jobs (in part, aided by the generous unemployment benefits of the CARES Act and American Rescue Plan).36

Conclusion

In effect, experience rating functions the same way as mandating that firms pay laid-off workers a large severance. This reduces the firms’ willingness to hire. Macroeconomically, this leads to a less dynamic labor market. This dynamic is especially bad during recessions: We are effectively raising taxes on labor at precisely the time we want to be lowering them. By designing a system intended to carefully manage incentives at the micro level, we have inadvertently created a system that instead misaligns the macroeconomy writ large.

It used to be that Americans could look across the Atlantic and laugh at the stringent labor regulations that led European firms to be averse to hiring new workers. No wonder their economies lagged ours by so much, with economic systems that discourage firms from hiring in order to increase stability. But today, we have much the same system — we just hide it a bit better.

Experience rating is bad for workers

Minimum Qualifications of the Mechanical Engineer

- B.S. or M.S. in Mechanical Engineering

- 5+ years of experience in Mechanical Design

- Minimum of 3 years using Solidworks design tools

Seniority Level: Entry Level

–Job Posting (2022)37

By design, experience rating is supposed to reduce employer’s willingness to fire their workers. But, as is often the case, the policymakers who designed the experience rating system did not recognize that the people they sought to regulate could instead adjust their behavior in other ways. Instead of solely reducing the number of workers they fire, companies can reduce the number of workers they hire, shift the type of employees they hire, or simply discourage employees from filing for unemployment insurance benefits in the first place.

In this section, we discuss several of these potential alternatives briefly. We then explore the potential that firms could specifically avoid hiring “entry-level” workers (whom firms may perceive as “riskier” hires because of their lack of experience) by looking at how unemployment for those workers shifted after the state of Washington implemented experience rating in 1985.

Here are some of the ways that firms could respond to experience rating:

- Using “gig” workers instead of hiring new employees.

Contract or “gig” workers are generally not eligible for UI payments, and their employers do not have to pay any UI-related taxes on their wages. This incentivizes employers who are looking to reduce their experience-rated tax liabilities to hire contractors instead of full employees. For example, while it used to be the case that most firms had a mailroom or janitorial staff of employees, most now contract those services out, either to individual 1099 workers (i.e., workers on temporary contracts, as opposed to “W2” workers who are employed by a company) or to agencies that hire out their own 1099 workers.

David Weil (former Administrator of the Wage and Hour Division of the U.S. Department of Labor) has called this phenomenon the “fissured workplace”.38 While it used to be the case that a person could get hired in an entry-level position (sorting envelopes in the mail room) and eventually work themselves up the ladder, this is less and less the case. This results in more people working irregular hours without benefits.

Some people may prefer to work as gig workers for freedom and independence. That is not objectionable. However, experience rating can increase the number of people working “gig” jobs who would actually prefer to work a more traditional job.

- Encourage workers to quit instead of firing them.

Only people facing involuntary unemployment are eligible for unemployment insurance payments (and hence, only they count for determining a firm’s tax schedule). That is to say, you are generally only eligible for unemployment insurance when you have been laid off, not when you have quit.

But the difference between “voluntary” and “involuntary” unemployment is fuzzy at best. Employers who want to reduce headcount without increasing their tax liabilities can look for mechanisms that incentivize their workers to quit. Many aspects of job quality are not contractual, and employers can change them at will. For example, they can change people’s schedules (for example, by making parents work hours that would conflict with school pickup or drop-off). Large, multicity employers can transfer their employees to the other office so that they need to either move or quit. Even small changes — getting rid of free snacks to degrade the work experience generally — could result in some employees quitting and a reduced headcount. Larger changes, for example, the vaccine mandates many employers issued during the Covid-19 pandemic, could also function as mechanism that allowed firms to reduce headcount without increasing their tax liabilities. Many states started to update their UI policies to allow people who quit because of a vaccination mandate to receive UI benefits.39

It’s worth noting that the degradations of work quality, while primarily aimed at inducing some workers to quit, will affect all employees. Workers who are not driven to quit by these measures will still be facing a worse work experience, even if they prefer it to being unemployed without benefits. - Discourage workers from filing for unemployment benefits. In addition to encouraging workers to quit (and become ineligible), employers may take measures to reduce the number of eligible workers who apply for benefits. Employers are more likely to protest UI claims from workers — especially those with low incomes — under an experience rating system.40 They also may not inform laid off workers about their eligibility for UI (or even actively mislead them). As a result, only about 40% of unemployed workers receive the UI benefits to which they are entitled.41

- Reduce the hiring of “risky” workers. Finally, firms may react to experience rating by shifting who they hire. Specifically, firms could reduce the number of people they hire that they may eventually have to lay off. That could include people with spotty or inconsistent work history, people who were incarcerated and have since exited the justice system, or entry-level workers.

The next section looks at the potential for firms to avoid hiring entry-level workers in detail by examining how employment patterns changed in Washington after the state introduced experience rating.42

Washington’s Natural Experiment

The state of Washington started to use experience rating in 1985, a consequence of the 1982 Tax Equity and Financial Responsibility Act changes that incentivized states to use a UI tax that had a variable rate. Before this change, all companies in Washington paid the same rate (though the rate could vary between 3.0% and 3.2% in any given year, based on statewide economic conditions).

This situation creates an opportunity to study the impact of experience rating by comparing Washington to its neighbor, Oregon, which already had an experience rating system in place. This comparison is important because it helps us understand how such policies can affect people’s ability to find jobs, especially younger, entry-level workers, who are just starting their careers.

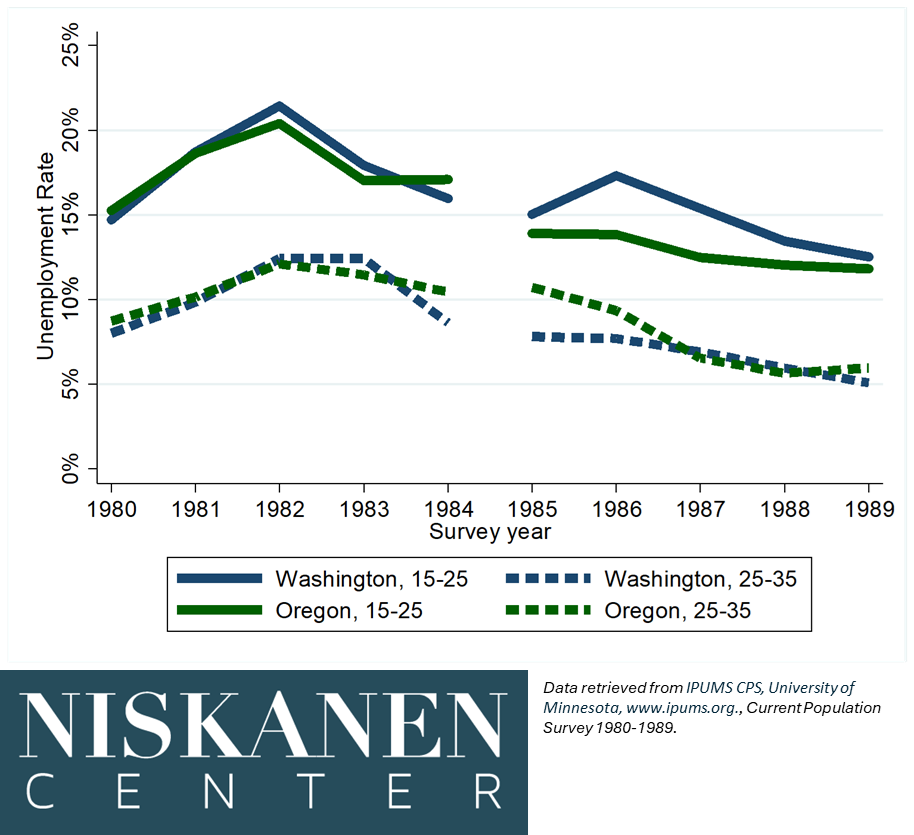

Before Washington introduced experience rating, the unemployment rates for young (15-25), entry-level workers in both Washington and Oregon moved in sync. However, after the policy was implemented, a significant gap appeared. Young workers in Washington started facing much higher unemployment rates than those in Oregon.

Figure 2 – Experience rating increased unemployment for younger workers

This effect was limited to entry-level workers; we do not observe a similar effect when looking at somewhat older workers, those between the ages of 25 and 35. Their unemployment rates continue to move mostly in parallel, and we actually see somewhat higher unemployment rates for these older workers in Oregon. That suggests that something in 1985 specifically affected young, entry-level workers, but not older workers. This is consistent with our theory that experience rating specifically causes employers to discriminate against younger, riskier workers and suggests it is not a change that happened because of broad economic shifts that would affect workers of all ages.

This increase in unemployment among young workers in Washington raises concerns about the broader effects of such policies. While designed to reduce layoffs by making companies more cautious about firing, the experience rating system may inadvertently lead companies to be more hesitant to hire, especially when it comes to less experienced workers who are perceived as riskier. This can delay or disrupt the early career paths of young individuals, affecting not just their immediate job prospects but potentially their long-term career development and even non-economic aspects of their lives, like family planning.

While the goal of reducing layoffs is commendable, the broader implications on the job market, especially for young and inexperienced workers, must be taken into account. We need solutions that balance the need to discourage unnecessary layoffs with the equally important goal of not discouraging companies from hiring and providing opportunities for the next generation of workers.

Conclusion

Experience rating, while designed to stabilize employment by discouraging layoffs, has had negative unintended consequences for workers. Employers are incentivized to shift their hiring strategies in order to reduce future tax liabilities, increasingly relying on gig workers and creating barriers to discourage unemployment claims. This shift not only undermines the stability of traditional employment but also disproportionately affects younger, less experienced workers, who find themselves edged out of opportunities for stable, long-term employment.

This rise in entry-level unemployment in Washington after a shift to experience rating highlights the broader, often overlooked, ramifications of experience rating on the labor market. Policymakers should consider its far-reaching impact on employment patterns and seek out solutions that truly bolster job security and fairness in the workforce.

Policy recommendations

There are several proposed solutions to the various issues with experience rating cataloged above.

One idea comes from a broad range of left-leaning think tanks, including the Center for American Progress, Center for Popular Democracy, Economic Policy Institute, Groundwork Collaborative, National Employment Law Project, National Women’s Law Center, and the Washington Center for Equitable Growth. Recognizing how experience rating has decreased take-up of unemployment insurance benefits, this approach would have states move their experience rating system to something closer to Alaska’s payroll-based system.43 Specifically, these analysts recommend moving to a system where tax liabilities are a function of the total payroll hours in one quarter, as compared to the previous 12 quarters (with a weighting factor such that decreasing payroll hours affects the rating more than increasing them). This conceptually maintains the financial penalty of layoffs, but no longer rewards firms for limiting unemployment insurance take-up, as taxes are driven by total payroll and not by the number of former employees claiming UI. This system would maintain the ostensible benefit of experience rating while addressing one of its unintended consequences.

Another proposal comes from the Tax Policy Center.44 Recognizing that experience rating encourages firms to avoid hiring high layoff-risk workers, they recommend adjusting experience rating so it supports hiring more workers with higher ex-ante layoff risks. They suggest giving firms an effective tax credit for hiring from these groups, specifically suggesting a tax credit for hiring workers without a college degree.

Both of these solutions have advantages over the current framework. But they introduce their own undesirable complexities into the tax code, what Niskanen Senior Fellow Steven Teles calls “kludges”.45 They take a complicated and burdensome system and try to fix problems with additional complications.

Rather than continuing to attempt to fine-tune the economy through complicated tax schemes, our preferred reform is to simply get rid of the experience rating mandate altogether. This could be pursued at either the state or the federal level. If done at the state level, Congress would need to re-write the relevant sections of the TEFRA bill so that states could choose to operate using a flat payroll tax or similar system. Alternatively, it is worth considering a more ambitious federal approach that seeks to overhaul the UI financial administration system as a whole.

What should the tax rate be? One option would be to have a payroll tax applied to all income. A recent UI reform proposal from Brookings estimated that a 2% payroll tax would sufficiently cover its benefits (which are substantially more generous than current UI schemes).46 Another option would be to create something like the pre-1985 Washington tax — a tax rate of 3% on a particular wage base, potentially going up incrementally to 3.3% when the UI reserves are low. The wage base would need to be adjusted to increase over time with incomes. Our preference would generally be to have a broader wage base and a lower tax rate when possible.

One concern about leaving an experience rating system is that it would make employers less likely to participate in the employment verification process. Right now employers are incentivized to monitor any UI claims, since spotting fraudulent claims could reduce their future tax liabilities. But the employer verification process is becoming increasingly irrelevant in fraud prevention. During the Covid-19 pandemic, fraudsters were able to effectively short-circuit the employer verification process altogether by using tactics such as identity theft, synthetic identities, and forged documents.47 For example, in Colorado, over 7,000 fictitious employers were registered as new businesses during the pandemic and used for unemployment insurance applications.48 Managing fraud risk is increasingly not about verifying past employment but verifying identity in the first place. This requires administrative and technical capacities at state Departments of Labor, regardless of whether UI is experience rated or not.

Conclusion

The experience rating system for unemployment insurance in the United States, while well-intentioned, has proven to be detrimental both to the economy and to workers. The attempt to reduce layoffs by penalizing firms with higher taxes has inadvertently led to a more stagnant labor market, discouraging layoffs with one hand and discouraging hiring with the other. This has contributed to a less dynamic and adaptable economy, especially during downturns, when flexibility and resilience are most needed.

Moreover, the experience rating system has had unintended consequences for worker welfare. Firms do not react to experience rating merely by reducing layoffs, but by pursuing ways to avoid layoff risk, including hiring contractors instead of employees, encouraging voluntary quits, and discouraging claims for unemployment benefits. Most concerning, the system pushes firms to avoid young and inexperienced workers, who are just establishing their careers. The experience rating system has led to degraded job quality and stability.

Moving towards a simpler, more straightforward payroll tax system, similar to the pre-1985 system in Washington, would likely alleviate many of these issues. It would encourage a healthier labor market, reduce the complexity and unpredictability of the tax code for businesses, and better support workers, especially those at the entry level or from marginalized groups.

A reformed unemployment insurance financing program can foster a more vibrant and equitable labor market — not only benefiting workers and businesses but also contributing to a more robust and resilient economy.

Appendix

Washington Natural Experiment — Details

The state of Washington did not use experience rating between the years 1972 and 1984. Instead, all employers were charged a single tax rate (which could be either 3.0% or 3.3%, depending on statewide economic and budget conditions). After 1985, Oregon switched to an experience rating system, incentivized by the Tax Equity and Financial Responsibility Act (TEFRA) reforms. This gives us a “natural experiment” where we can compare the unemployment rate of entry-level workers who were affected by this change in policy to that of similarly situated workers in neighboring states.

Previous research using this natural experiment has shown that the imposition of experience rating decreased turnover and UI claims,49 as intended by the policy. However, it did not examine the effects on the unemployment rates of entry-level workers. In this section, we demonstrate that the shift to experience rating caused a dramatic increase in the unemployment rate for entry-level workers by comparing unemployment rates in Washington and the neighboring state of Oregon.

Our data for this analysis comes from the Bureau of Labor’s “Current Population Survey” (CPS), which conducts a rotating monthly panel of 60,000 Americans. Each month, approximately 2,000 Washingtonians and Oregon residents were included in this panel. We define “entry-level” workers as those between the ages of 15 and 24, and compare their unemployment rate to that of people between the ages of 25 and 34. “Unemployment” in this context refers to the population that is actively looking for work but unable to find a job. Our analysis examines the period five years before and five years after Washington introduced experience rating. This provides enough time for experience rating to have an effect while also limiting any divergence in the Washington and Oregon economies.

Figure 1A below shows the annual unemployment rate for the five years before and five years after the implementation of Washington’s experience rating program. We can see that the unemployment rates of entry-level workers (again, defined as workers between 15 and 24) in Washington and Oregon are tightly linked before Washington introduced experience rating in 1985. In 1986, we see a large gap open up as the unemployment rate for entry level workers in Washington increases by 3.5 percentage points. There is no change in the entry-level unemployment level in Oregon during this period. The size of this gap diminished over time, and the unemployment rates approached parity in 1989 (though this does not necessarily indicate that the effect was temporary).50

Looking at workers between 25 and 34, we again see a close link between state unemployment rates through 1983. In 1984 and 1985, the unemployment rate for mid-career workers in Washington declines, but it stays stable in Oregon until 1987. After 1987 the unemployment rates for experienced workers in Washington and Oregon again move in parallel.

Figure A1 – Experience Rating Increased Unemployment for Younger Workers

We can test whether experience rating increased unemployment for entry-level workers using a “triple differences” analysis.51 Using this method allows us to control for any changes to the economies of Oregon or Washington generally. For example, if Washington experienced a localized economic boom (or bust) we would expect that to affect both entry-level and experienced workers, but not the relative difference between the two. On the other side, if there was a general shift in the relative unemployment rates between entry and experienced workers (for example, if more younger people chose to enter college) we would expect to see similar trends in Washington and Oregon. Conceptually, we are assuming that in the absence of the shift to experience rating, the difference between unemployment rates for entry-level and experienced workers in Washington would have followed the same pattern as the difference between entry-level and experienced workers in Oregon. This allows us to estimate the effect of experience rating on the unemployment rate of entry-level workers in Washington.

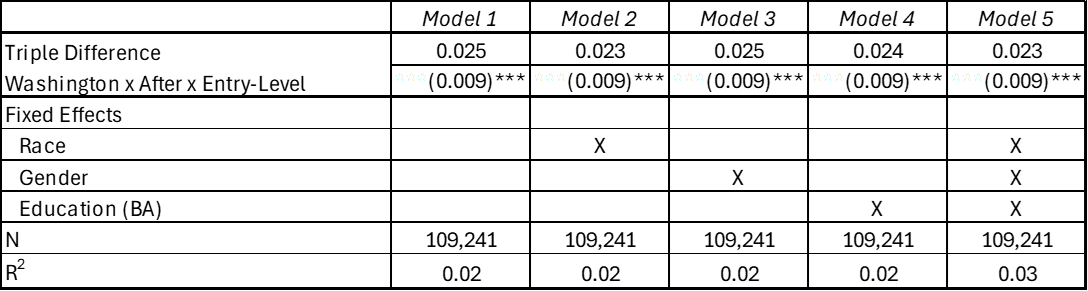

Formal statistical testing in Table 1 shows that across all years being examined, the effect of experience rating is large and statistically significant. We observe a 2.5 percentage point increase in the unemployment rate for entry-level workers after experience rating is implemented when compared to the counterfactual. This finding is robust, with little variation as we add fixed effects for race, gender, and education. Across all models, including a fully saturated model with all fixed effects, the p-value is less than 0.01%.

Table 1 – The effects of experience rating on entry-level workers

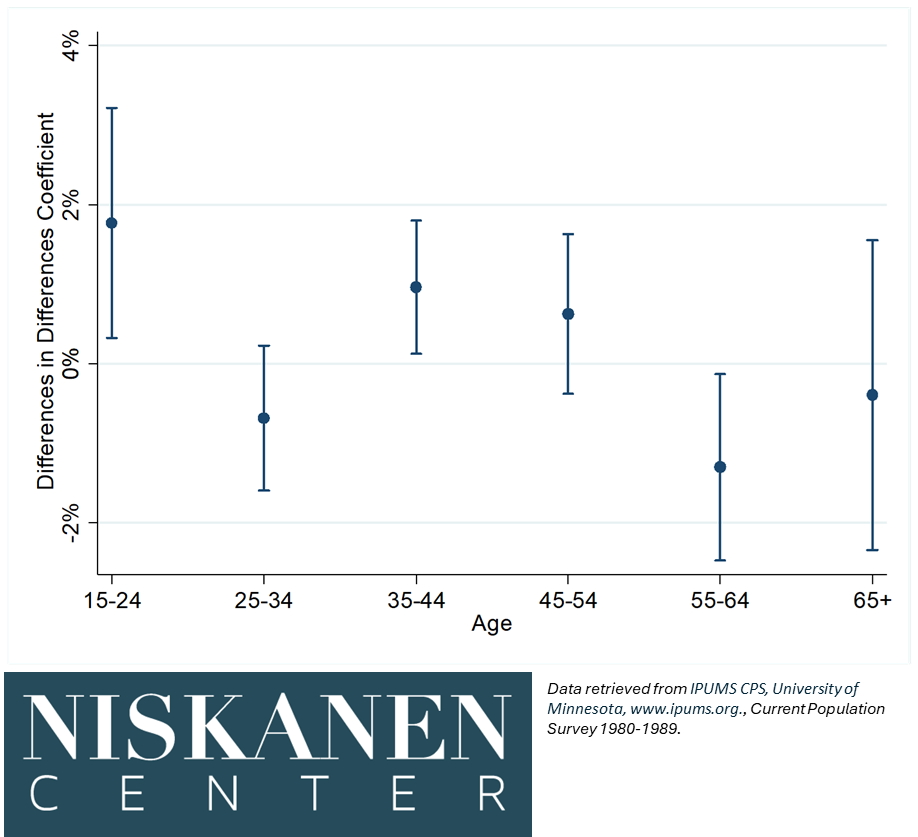

Figure A2 shows the difference-in-difference between Washington and Oregon for each age group. The dot shows the estimated value, while the lines show the 95 percent confidence interval. Note that we are no longer conducting the “triple difference” analysis discussed above, but simply looking at the “differences in differences” between workers in Washington and Oregon before and after Washinton implemented experience rating, by age group. In addition to the 15-24 and 25-34 groups analyzed earlier, we also look at the changes for the 35-44, 45-54, 55-64, and 65+ age groups. The largest difference in unemployment rates across groups is the 15-24 age group, as expected. We also observe a smaller, but statistically significant, increase in the unemployment rate for the 35-44 group and a negative effect on the 55-64 group.

Figure A2 – The Effects of Experience Rating on Unemployment, by Age

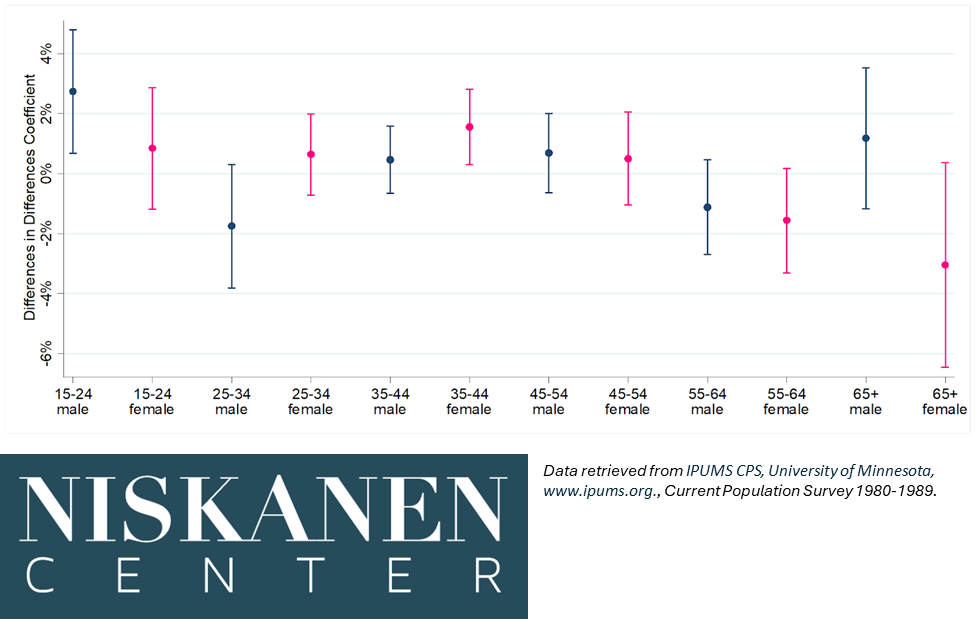

In exploratory data analysis, we observed that the increased unemployment rate for entry level workers is focused almost entirely on men. Table 2 shows the effect by gender in the raw data and a saturated model. If we limit the analysis to men, the unemployment rate increase caused by experience rating is a staggering 4.5 percentage points. For women, the effect is negligible.

Table 2 – The effects of experience rating on entry-level workers, by gender

Figure 3 shows the difference-in-differences effects by both age and gender. Again, we can see that the increase in the unemployment rate for entry-level workers is driven by men. Overall, men appear to have a “W-shaped” change in unemployment rates. Entry-level (15-24) workers saw their unemployment rate increase, especially relative to the decline for men between 25 and 34. There is no effect for men between 35 and 55. Men between 55 and 64 have an unemployment rate under experience rating that is 1 percentage point lower, while men 65 and above have an unemployment rate that is 1 percentage point higher. While neither effect is significant on its own, it suggests the possibility that experience rating may also cause firms to limit the hiring of older workers.

We see a very different pattern for women. Under experience rating, we see somewhat elevated unemployment rates for women from ages 15 to 54 (only the finding for the 35-44 group was statistically significant). However, we see declines for the 55-64 and 65+ groups. This is consistent with employers statistically discriminating against women who are most likely to have children and/or caregiving responsibilities.52

Figure A2 – The Effects of Experience Rating on Unemployment, by Age and Gender

We can speculate about the potential effects these shifts may have on people, though such long-run effects are outside the empirical scope of this paper. Higher unemployment rates for entry-level workers do not just affect men at the beginning of their careers but can push their whole career trajectory back. Higher unemployment rates for women who have caregiving responsibilities can make it harder for parents to transition back into the labor force when desired. In both cases, people experiencing important career and life transitions are effectively penalized. They do not get the career experience they can use to get better jobs, or the stable finances a job affords. This can then have knock-on effects on important non-economic factors like marriage or starting a family.

Footnotes:

- Typically, both the employer and employee pay some of this tax.

Antonia Asenjo and Clemente Pignatti, “Unemployment Insurance Schemes around the World: Evidence and Policy Options,” Research Department Working Paper No. 49 (International Labour Office, October 2019). ↩︎ - United States, Department of Labor, “Conformity Requirements for State UC Laws,” accessed January 17, 2023, https://oui.doleta.gov/unemploy/pdf/uilaws_exper_rating.pdf.

↩︎ - Daniel Nelson, “The Origins of Unemployment Insurance in Wisconsin,” The Wisconsin Magazine of History 51, no. 2 (Winter 1967-1968): 109-121, https://www.jstor.org/stable/4634308. ↩︎

- Milton Friedman and Anna Jacobson Schwartz, A Monetary History of the United States, 1867–1960 (Princeton: Princeton University Press, 1963). ↩︎

- Jason DeParle, “Contesting Jobless Claims Becomes a Boom Industry,” The New York Times, April 3, 2010, https://www.nytimes.com/2010/04/04/us/04talx.html. ↩︎

- Equifax, “Unemployment Cost Management,” brochure, 2021, https://assets.equifax.com/assets/usis/unemployment_Cost_Management_brochure_UCM_by_Equifax.pdf. ↩︎

- Joshua McCabe, “Supporting Families, Supporting States: A Framework for Expanding Paid Family Leave,” issue brief, Niskanen Center, October 2022, https://www.niskanencenter.org/supporting-families-supporting-states-a-framework-for-expanding-paid-family-leave/. ↩︎

- The history in this section is adapted from Guo and Johnson (2021) and Baicker, Katz, Goldin (1992).

Audrey Guo and Andrew C. Johnston, “The Finance of Unemployment Compensation and Its Consequences,” Public Finance Review 49, no. 3 (2021).

Katherine Baicker, Claudia Goldin, and Lawrence F. Katz, “A Distinctive System: Origins and Impact of U.S. Unemployment Compensation,” in The Defining Moment: The Great Depression and the American Economy in the Twentieth Century, 227-264 (National Bureau of Economic Research, Inc., 1998). ↩︎ - Arindrajit Dube, A Plan to Reform the Unemployment Insurance System in the United States (Washington, D.C.: The Hamilton Project, 2021). ↩︎

- Office of Unemployment Insurance, Division of Legislation, preface to Comparison of State Unemployment Insurance Laws, January 1, 2023, https://oui.doleta.gov/unemploy/pdf/uilawcompar/2023/complete.pdf. ↩︎

- ibid ↩︎

- Dorian Carloni, “Revisiting the Extent to Which Payroll Taxes Are Passed Through to Employees,” Congressional Budget Office Working Paper 2021-06 (Washington, D.C.: Congressional Budget Office, June 2021). ↩︎

- For a detail discussion of the effects of the low taxable wage base, see Po-Chun Huang, “Employment Effects of the Unemployment Insurance Tax Base,” Journal of Human Resources 59, no. 1 (January 2024): published online March 9, 2022, doi:10.3368/jhr.0719-10316R2. ↩︎

- Robert Pavosevich, “The Cost of Layoffs in Unemployment Insurance Taxes,” Monthly Labor Review, U.S. Bureau of Labor Statistics, April 2020, https://doi.org/10.21916/mlr.2020.4. ↩︎

- John Commons to William Leiserson, March 20th, 1912, in the John R. Commons Papers, Archives-Manuscripts Division, State Historical Society of Wisconsin. ↩︎

- Friedrich A. Hayek, The Fatal Conceit: The Errors of Socialism (Chicago: University of Chicago Press, 1988). ↩︎

- Walter A. Morton, “The Aims of Unemployment Insurance with Special Reference to the Wisconsin Act,” The American Economic Review 23, no. 3 (Sep. 1933): 395-412. ↩︎

- Ryan Bourne, “A Jobs Guaranteed Economic Disaster,” Cato At Liberty (blog), April 24, 2018, https://www.cato.org/blog/jobs-guaranteed-economic-disaster.

“A Jobs Guarantee is a Flawed Idea,” The Economist, May 10, 2018, https://www.economist.com/united-states/2018/05/10/a-jobs-guarantee-is-a-flawed-idea. ↩︎ - Richard A. Lester and Charles V. Kidd, The Case Against Experience Rating in Unemployment Compensation, Industrial Relations Monographs no. 2 (New York: Industrial Relations Counselors, Incorporated, 1939). ↩︎

- New Jersey Department of Labor and Workforce Development, “Rate Information, Contributions, and Due Dates,” Division of Employer Accounts, https://www.nj.gov/labor/ea/employer-services/rate-info/. ↩︎

- Suzanne Mettler, The Submerged State: How Invisible Government Policies Undermine American Democracy (Chicago: University of Chicago Press, 2011). ↩︎

- Jared Walczak, Andrey Vishnevskiy, and Katherine Loughead, “2024 State Business Tax Climate Index,” Tax Foundation, 2023, https://taxfoundation.org/research/all/state/2024-state-business-tax-climate-index/. ↩︎

- Congressional Research Service. “Payroll Taxes: An Overview of Taxes Imposed and Past Payroll Tax Relief.” April 4, 2022. https://crsreports.congress.gov/product/pdf/R/R4706. ↩︎

- Brian Snowden and Howard R. Vane, Modern Macroeconomics: Its Origins, Development and Current State (Cheltenham: Edward Elgar Publishing, 2005). ↩︎

- Paul Krugman, “Economics in the Crisis,” The New York Times, March 5, 2012, https://archive.nytimes.com/krugman.blogs.nytimes.com/2012/03/05/economics-in-the-crisis/.

↩︎ - Milton Friedman, “Monetary Studies of the National Bureau,” in The National Bureau Enters Its 45th Year: 44th Annual Report (1964): 7-25. ↩︎

- Milton Friedman, “The ‘Plucking Model’ of Business Fluctuations Revisited,” Economic Inquiry, April 1993, https://doi.org/10.1111/j.1465-7295.1993.tb00874.x. ↩︎

- Stéphane Dupraz, Emi Nakamura, and Jón Steinsson, “A Plucking Model of Business Cycles,” NBER Working Paper No. 26351, October 2019, revised June 2021, https://doi.org/10.3386/w26351. ↩︎

- Kevin Erdmann, Building from the Ground Up: Reclaiming the American Housing Boom (Post Hill Press, Kindle ed.), 26. ↩︎

- David D. Ratner, “Unemployment Insurance Experience Rating and Labor Market Dynamics,” Finance and Economics Discussion Series, Divisions of Research & Statistics and Monetary Affairs, Federal Reserve Board, Washington, D.C., 2013, 1-69, https://www.federalreserve.gov/pubs/feds/2013/201386/201386pap.pdf. ↩︎

- David Card and Phillip B. Levine, “Unemployment Insurance Taxes and the Cyclical and Seasonal Properties of Unemployment,” Journal of Public Economics 53, no. 1 (1994): 1-29.

Robert H. Topel, “Experience Rating of Unemployment Insurance and the Incidence of Unemployment,” The Journal of Law and Economics 27, no. 1 (April 1984): 61-90. ↩︎ - Brad Hershbein and Lisa B. Kahn, “Do Recessions Accelerate Routine-Biased Technological Change? Evidence from Vacancy Postings,” American Economic Review 108, no. 7 (July 2018): 1737-72.

Lucia Foster, Cheryl Grim, and John Haltiwanger, “Reallocation in the Great Recession: Cleansing or Not?” Journal of Labor Economics 34, no. S1 (S74-S99). Chicago: University of Chicago Press. ↩︎ - Matthew Darling and Will Raderman, An Unemployment Insurance System That Works (Washington, D.C.: Niskanen Center, September 2023). ↩︎

- Emi Nakamura, Jósef Sigurdsson, and Jón Steinsson, “The Gift of Moving: Intergenerational Consequences of a Mobility Shock,” The Review of Economic Studies 89, no. 3 (May 2022): 1557-1592, https://doi.org/10.1093/restud/rdab062. ↩︎

- Simon Jäger, Christopher Roth, Nina Roussille, and Benjamin Schoefer, “Worker Beliefs About Outside Options,” NBER Working Paper No. 29623, National Bureau of Economic Research, December 2021, revised April 2023, http://www.nber.org/papers/w29623. ↩︎

- David Autor, Arindrajit Dube, and Annie McGrew, “The Unexpected Compression: Competition at Work in the Low Wage Labor Market,” NBER Working Paper No. 31010, March 2023, revised November 2023, https://doi.org/10.3386/w31010. ↩︎

- Budgetbunker07, “Why do all ‘entry level’ jobs require like 3-5 years of experience? bs,” Reddit, 2022, https://www.reddit.com/r/MechanicalEngineering/comments/ysuul4/why_do_all_entry_level_jobs_require_like_35_years/?rdt=61783. ↩︎

- David Weil, The Fissured Workplace: Why Work Became So Bad for So Many and What Can Be Done to Improve It (Cambridge, MA: Harvard University Press, 2014). ↩︎

- Matthew Darling, “Rethinking Unemployment Benefits Under Vaccine Mandates,” Milken Institute Review, February 10, 2022, https://milkenreview.org/articles/rethinking-unemployment-benefits-under-vaccine-mandates. ↩︎

- Marta Lachowska, Isaac Sorkin, and Stephen A. Woodbury, “Firms and Unemployment Insurance Take-Up,” NBER Working Paper No. 30266 (National Bureau of Economic Research, 2022). ↩︎

- Christopher J. O’Leary, William E. Spriggs, and Stephen A. Wandner, “Equity in Unemployment Insurance Benefit Access,” presentation, W.E. Upjohn Institute for Employment Research, January 11, 2022. ↩︎

- This section is also expanded as an appendix at the end of the paper. ↩︎

- Josh Bivens, Melissa Boteach, Rachel Deutsch, Francisco Diez, Rebecca Dixon, Brian Galle, Alix Gould-Werth, Nicole Marquez, Lily Roberts, Heidi Shierholz, and William Spriggs, “Reforming Unemployment Insurance: Stabilizing a System in Crisis and Laying the Foundation for Equity,” in “Section 2, Financing: Reform Financing of UI to Eliminate Incentives for States and Employers to Exclude Workers and Reduce Benefits,” a joint report of the Center for American Progress, Center for Popular Democracy, Economic Policy Institute, Groundwork Collaborative, National Employment Law Project, National Women’s Law Center, and Washington Center for Equitable Growth, https://www.epi.org/publication/section-2-financing-reform-financing-of-ui-to-eliminate-incentives-for-states-and-employers-to-exclude-workers-and-reduce-benefits/. ↩︎

- Ryan Nunn and David Ratner, “Rethinking Unemployment Insurance Taxes and Benefits,” Tax Policy Center, Urban Institute & Brookings Institution, October 28, 2019, https://www.urban.org/sites/default/files/publication/. ↩︎

- Steven M. Teles, “Kludgeocracy in America,” National Affairs, no. 58, https://www.nationalaffairs.com/publications/detail/kludgeocracy-in-america. ↩︎

- Arindrajit Dube, A Plan to Reform the Unemployment Insurance System in the United States (Washington, D.C.: The Hamilton Project, 2021). ↩︎

- Matt Weidinger and Amy Simon, “Pandemic Unemployment Fraud in Context: Causes, Costs, and Solutions,” American Enterprise Institute, January 2024, PDF file, https://www.aei.org/wp-content/uploads/2024/01/Pandemic-Unemployment-Fraud-in-Context.pdf?x91208. ↩︎

- Phillip Spesshardt, Director Division of Unemployment Insurance, Colorado Department of Labor and Unemployment, conversation with the author, April 18, 2024. ↩︎

- Patricia M. Anderson and Bruce D. Meyer, “The Effects of the Unemployment Insurance Payroll Tax on Wages, Employment, Claims and Denials,” Economic and Industrial Democracy 21, no. 4 (2000): 491-517. ↩︎

- Note that this does not necessarily indicate a diminished effect of experience rating over time. Our approach is best able to measure the effect of experience rating near the time of the policy change itself. Over longer periods of time, we do not necessarily expect that trends in Washington and Oregon would be consistently parallel – other policy and business shifts will affect both economies, not just experience rating. In our primary results, presented in Table 1, we compare at the 5 year bins before and after the 1985 introduction of experience rating. ↩︎

- Andreas Olden and Jarle Moen, “The Triple Difference Estimator,” The Econometrics Journal 25, no. 3 (September 2022): 531-553, https://doi.org/10.1093/ectj/utac010. ↩︎

- Goldin, Claudia. “A Grand Gender Convergence: Its Last Chapter.” American Economic Review 104, no. 4 (2014): 1091-1119. ↩︎