There has been no shortage of proposals from Congress to expand various family tax benefits in recent years. The temporary expansion of the Child Tax Credit (CTC), Earned Income Tax Credit (EITC), and Child and Dependent Care Tax Credit (CDCTC) under the American Rescue Plan Act (ARP) are the most recent examples of this trend.

However, attempts to rationalize this maze of family tax benefits – consolidation of overlapping benefits, streamlined eligibility requirements, and reduced administrative burdens – have been few and far between.

Congressional Republicans made some headway with the Tax Cuts and Jobs Act (TCJA) of 2017. As part of a broader set of reforms, TCJA eliminated personal exemptions in the tax code and shifted their value into a larger standard deduction and CTC. These changes achieved dual goals of expanding and rationalizing family tax benefits.

Building on this momentum, Senators Mitt Romney, Richard Burr, and Steve Daines’ Family Security Act 2.0 (FSA 2.0) is a more ambitious plan to expand and rationalize family tax benefits. It proposes consolidating five benefits – the CTC, EITC, CDCTC, Head of Household (HoH) filing status, and the State and Local Tax (SALT) deduction – into a child benefit and simplified EITC.

Some fans of expansion have criticized the consolidation provisions, casting them as robbing Peter to pay Paul. Such criticisms underestimate the costs associated with complexity and the pay-offs to simplification. The FSA 2.0’s framework for rationalization solves a widely recognized problem by incorporating best practices from other countries.

The American case for rationalization

For decades, a chorus of tax wonks has championed consolidating family tax benefits. Nina Olson was particularly outspoken in her prior role as Taxpayer Advocate. In her very first report to Congress back in 2001, Olson noted:

I realize that many today in the United States believe that there is no constituency or political reward for achieving tax simplification, or, more importantly, tax rationalization. I maintain that this nation can ill afford to ignore the increasing burden (for taxpayers and tax administrators alike) and irrationality of our tax system.

The report listed a litany of complexities that various “family status” provisions create for taxpayers and the IRS. These issues included differing definitions of “qualifying child,” difficulty determining and proving eligibility for the EITC, and delays in refunds stemming from the EITC examination process. Parents struggled to comply with the dizzying array of requirements: The IRS issued 7.6 million “math error” notices in 1999. A whopping 44 percent of those were related to the dependent exemption, CTC, EITC, CDCTC, or HoH filing status.

The annual report’s initial recommendations focused on a series of smaller reforms to each tax benefit, but later reports began to make bolder recommendations. By 2008, the annual report recommended consolidating five distinct family tax benefits into just two.

The first was a Family Credit, which would reflect the cost of raising a family and replace the dependent exemption, CTC, CDCTC, HoH filing status, and child portion of the EITC. The second was a simplified Worker Credit for low-wage earners, based solely on income. The framework is strikingly similar to FSA 2.0.

Olson, who recently retired, reiterated these recommendations in her final (2019) report. Stressing the EITC in particular, she summarized decades of evidence on its shortcomings:

The current credit design may not be the most effective means of increasing labor force participation and reducing poverty among all low-income taxpayers. The current credit is also complicated for taxpayers to comply with, difficult for the IRS to administer, and is associated with a high improper payment rate, especially among taxpayers with qualifying children.

The solution to most of these long-standing problems plaguing the EITC is simply shifting its child portion to the CTC. This is low-hanging fruit that recent proposals have largely neglected. In fact, FSA 2.0 is the only major proposal to address the problem seriously.

The international case for rationalization

The Taxpayer Advocate’s recommendations are also in line with international practices. It has become increasingly common in recent years for American tax experts to look abroad for approaches to family tax benefits that might offer models for reform here. Canada offers the U.S. the best model. The Canada Child Benefit (CCB) and Canada Workers Benefit (CWB) are the results of efforts by both Conservative and Liberal governments to expand and rationalize family tax benefits over the last several decades.

The FSA 2.0 EITC and CWB compared

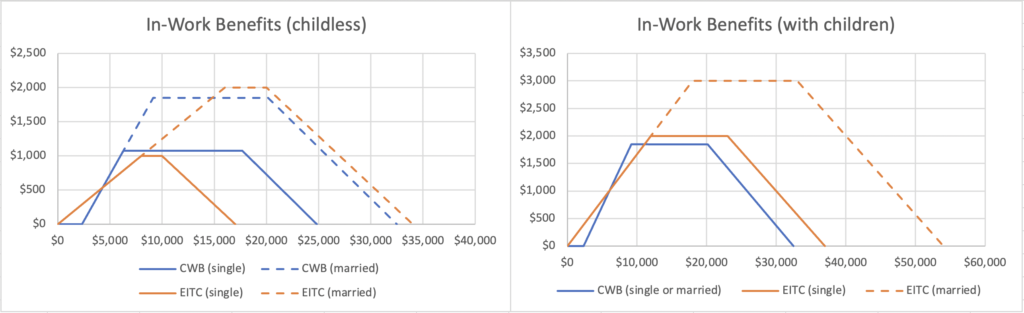

The FSA 2.0’s proposed EITC reforms echo the structure of the CWB in several respects. Figure 1 maps out the benefit structures under several scenarios for a side-by-side comparison.

First, the maximum benefits for childless workers are comparable whether single or married. Second, benefit levels do not vary per-child with either marital status. Instead, there is a family bonus in cases where the worker has a spouse or dependent in the household. Whereas American reformers often envision converting the EITC into a pure worker benefit, it is common in other countries to adjust benefits based on whether the worker is potentially supporting a family. The FSA 2.0 takes this latter approach. Third, the FSA 2.0 EITC and CWB both provide more generous benefits to single parents than to single workers without children.

Figure 1:

There are minor variations in the phase-in/out thresholds and rates, but the big difference between the CWB and the FSA 2.0 EITC relates to marriage penalties. Whereas the CWB’s structure results in substantial marriage penalties, the FSA 2.0 EITC eliminates them. The key difference is how each structures its family adjustment.

The CWB provides a more generous benefit if the worker has a spouse or a dependent but no additional benefit if that worker has a spouse and a dependent. Not providing that additional benefit can result in a single parent losing benefits when they marry. The FSA 2.0 EITC avoids this potential trap by providing a more generous benefit if the worker has a spouse or a dependent and additional benefits if that worker has a spouse and a dependent.

Viewed as a whole, the FSA 2.0 EITC is a marked improvement relative to current policy in the U.S. and Canada.

The FSA 2.0 child benefit and CCB compared

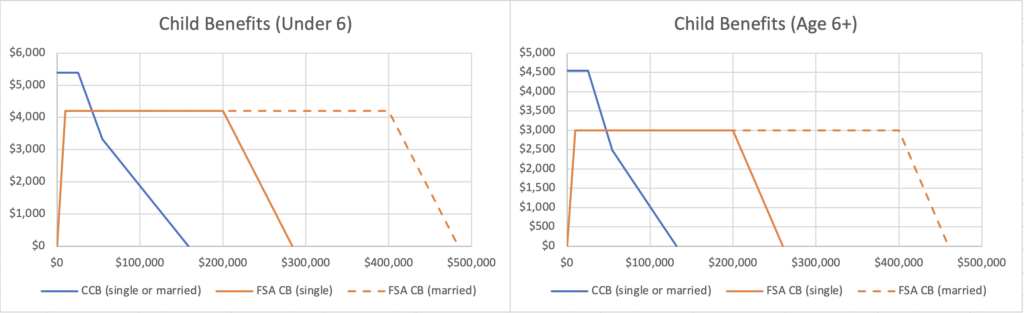

The FSA 2.0’s proposed child benefit aligns it more closely with the CCB, but significant differences remain. Figure 2 maps out the benefit structures under several scenarios for a side-by-side comparison.

The maximum value of the FSA 2.0 child benefit is greater for children under six years old, more in line with the long-standing practice in other countries, including Canada. The temporary expansion of the CTC under ARP had this feature, but it was lost when that program expired. The FSA 2.0 child benefit would permanently bring it back.

The two key differences are related to the distribution of benefits and marriage penalties.

Figure 2:

The relative generosity of the FSA 2.0 child benefit and CCB depends on family income. The CCB is akin to a traditional family allowance, so families with little or no income receive the total benefit. The CCB is also especially generous for these families relative to others. In contrast, the FSA 2.0’s child benefit retains a phase-in (albeit much faster relative to the current CTC) that does not provide full benefits until a family makes $10,000. Even then, Canadian families making $20,000 or $30,000 still receive a more generous benefit.

But that generosity drops off quickly. The CCB has two phase-out thresholds that both kick in before households reach the median income for families with children. As a result, American families making as little as $55,000 (far below the U.S. median for households with children) would receive a more generous benefit than their similarly situated Canadian counterparts. In fact, the FSA’s generosity extends well beyond the median, as it keeps existing phase-out thresholds that do not kick in until families make at least $200,000.

These phase-out thresholds also have implications for marriage penalties. The CCB thresholds are the same regardless of marital status, and this, plus the low income at which they kick in, means that many families will see a marriage penalty. The FSA 2.0’s child benefit keeps existing phase-out thresholds that vary based on marital status ($200,000 for single parents; $400,000 for married parents), eliminating potential marriage penalties.

Overall, the FSA 2.0 child benefit is an enhancement compared to current policy in the U.S. but a mixed bag relative to Canada – falling short in some respects but performing much better in others.

No time like the present

Discussions of family tax benefits tend to be dominated by calls for expansion, but the case for expansion paired with rationalization goes back decades and spans the globe. The Family Security Act 2.0 is a momentous improvement over current policy based on its benefits alone. Still, the fact that it also makes those benefits simpler will compound its impact, helping needy families understand their budgets while advancing the cause of efficient government.

Photo Credit: iStock