Key Takeaways

- The CTC began being paid monthly on July 15th, 2021, reaching nearly 60 million children in 39 million households. Monthly child benefits support investments in children and promote family stability, but are also a powerful stimulant of economic activity given the greater consumption needs of lower income households with children.

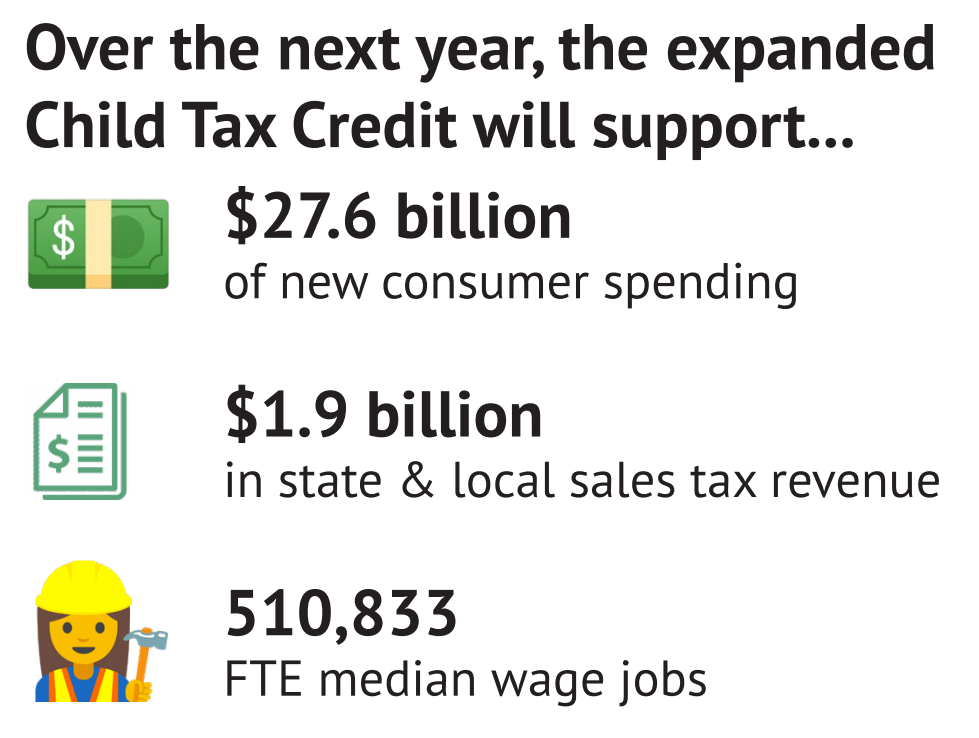

- Across the next 12 months, we estimate that the CTC expansion will boost consumer spending by $27 billion, generate $1.9 billion in revenues from state and local sales taxes, and support over 500,000 thousand full time jobs at the median wage.

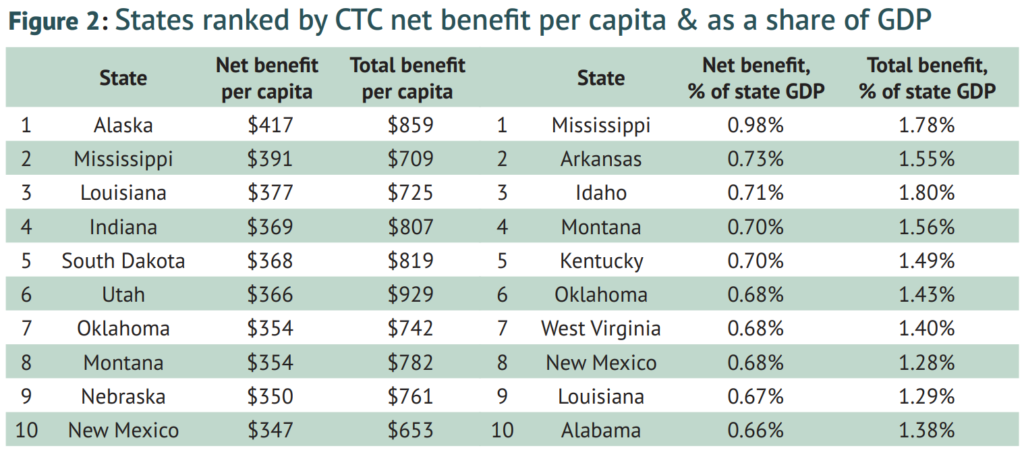

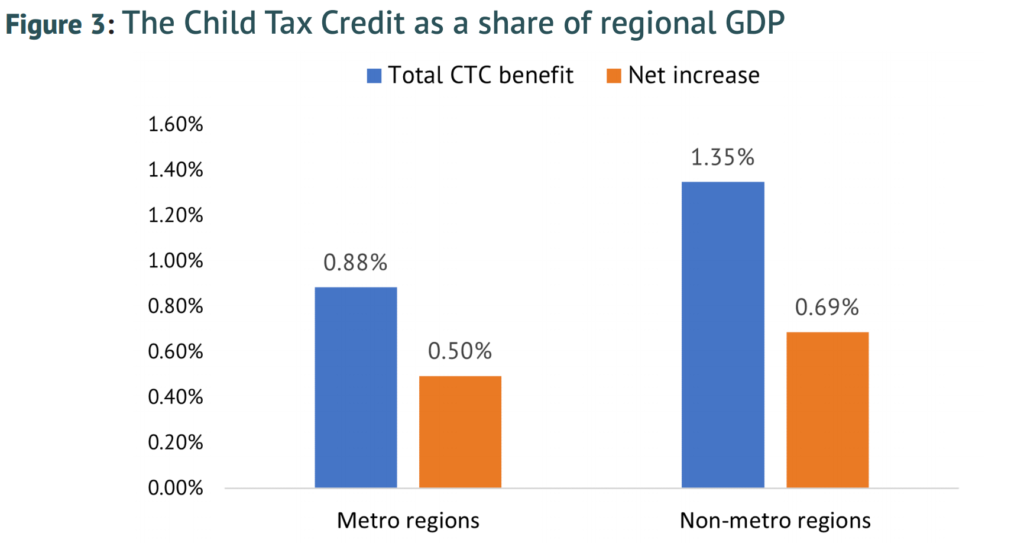

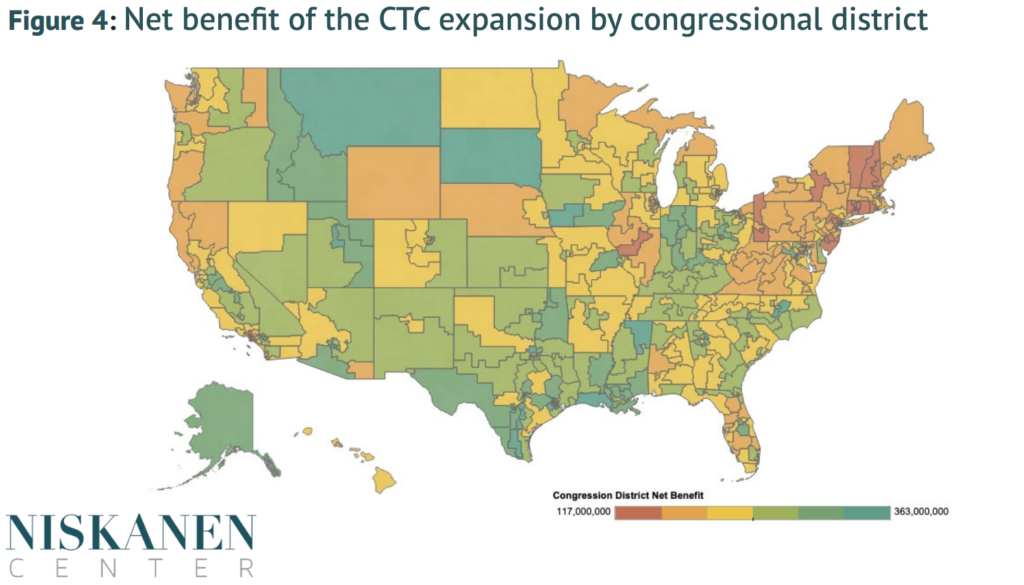

- More populous states will by nature see a larger total benefit from the CTC expansion. In relative terms, however, the CTC expansion provides larger benefits to states with lower average incomes and larger average family sizes, helping support access to community-based child care.

- In particular, rural regions stand to benefit from a substantial injection of relative purchasing power equivalent to 1.35% of non-metro GDP.

Introduction

Since its creation in 1997, the Child Tax Credit (CTC) has grown to become a central pillar of family policy in the United States, providing tax relief and income support to households with dependent children in the form of an annual tax refund. Child benefits like the CTC have strong anti-poverty effects, but can also serve as a powerful stimulant of economic activity. With the recent expansion of the CTC as part of the American Rescue Plan of 2021 (ARP), this report derives novel estimates of the total benefit and likely economic impact of the credit across the fifty states.

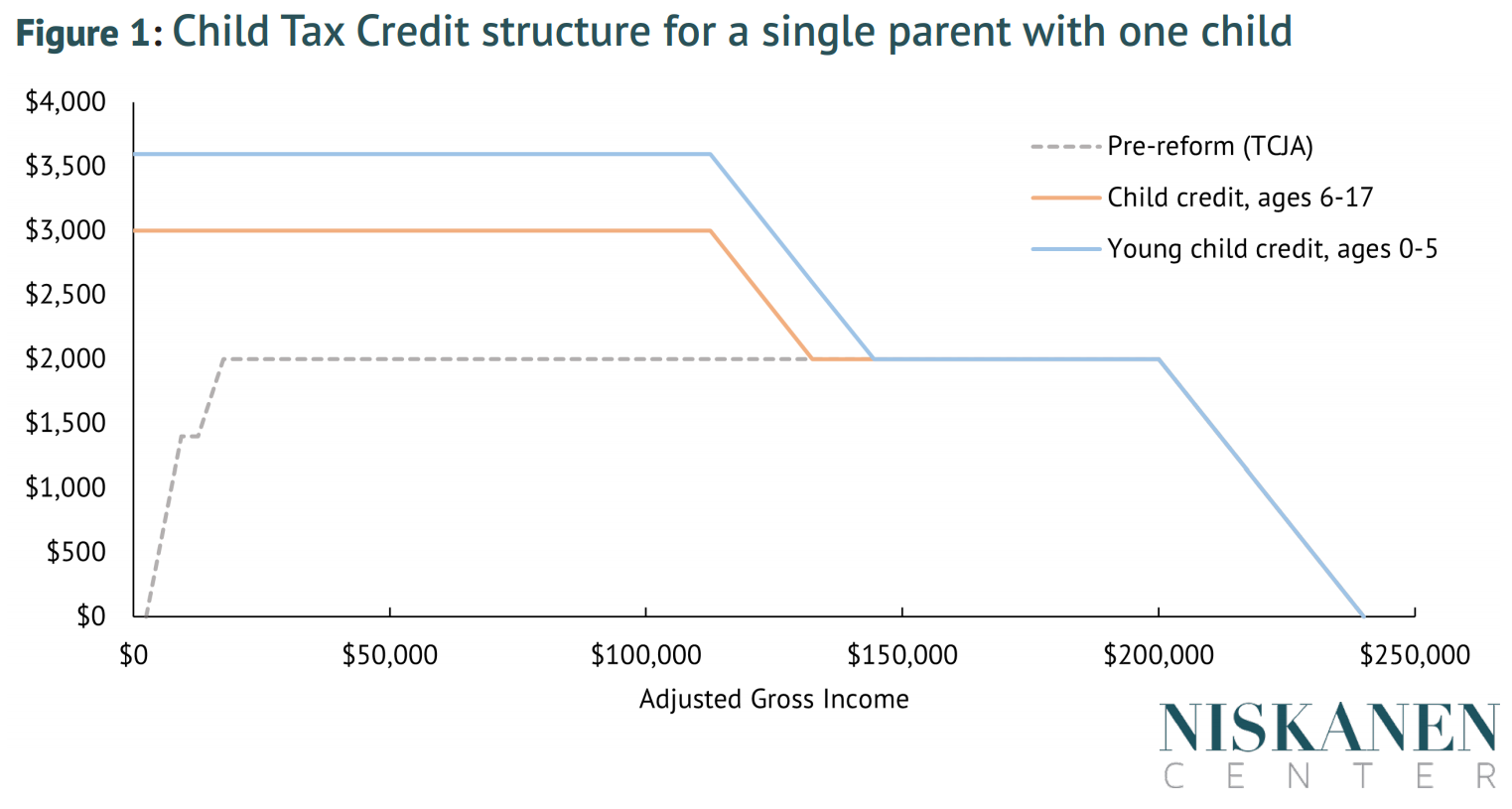

Known for its strong bipartisan pedigree, the maximum CTC was doubled in 2017 to $2,000 per child as part of the Tax Cuts and Jobs Act (TCJA). The ARP built on this expansion in 2021 by increasing the maximum credit to $3,000 for children ages 6 to 17, while creating a larger $3,600 credit for infants and young children. The expanded credit begins to phase out at a rate of 5 percent for married couples with adjusted gross income above $150,000 ($112,500 for single parents) until reaching the TCJA level of up to $2,000 per child. The credit’s value is then further reduced at a rate of 5 percent for married couples with incomes above $400,000 ($200,000 for single parents).

Importantly, the reform also made the CTC “fully refundable” for the first time. This means that the full credit is now available to all low- and middle-income families. The first half of the credit is being advanced as a monthly payment for the remainder of 2021. Monthly payments began on July 15th, reaching roughly 39 million households and 59 million children. While only enacted for one year, if made permanent the reform would bring the CTC in line with the child benefits found in Canada, Australia, the United Kingdom, and most of Europe.

Update (10/19/2021): In light of the recent Axios report that Sen. Manchin’s “red line” on the Child Tax Credit expansion is to have “a firm work requirement and family income cap in the $60,000 range,” we decided to estimate the potential impact this would have on the number of kids receiving the credit by state as well as the credit’s total value. Those estimates have been added to the Google spreadsheet above, and were reported on by Business Insider here.

Figures

Click to enlarge.

Samuel Hammond is the director of poverty and welfare policy at the Niskanen Center.

Robert Orr is a poverty and welfare policy analyst at the Niskanen Center.